MAJR News: Biden's crypto executive order lacks details, but acknowledges the benefits of digital assets.

US inflation hits new high - 7.9%, LimeWire is back with music NFTs, Credit Suisse - there's a new monetary world order, War in Ukraine increases the price of everything, Recession incoming

@unknown

MAJR NEWS BRIEF

Stats

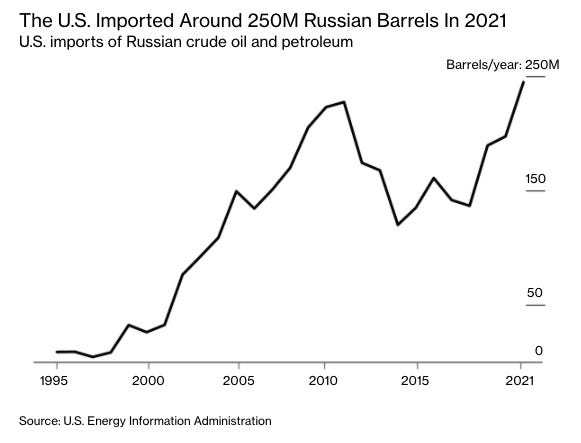

The US sits on the largest natural energy reserves in the world and has been a net importer of energy since the 1950s. Russia accounted for 3% of all crude shipments and 8% of all oil and gas imports to the US in 2021.

Videos

Historian Yuval Noah Harari provides important context on the Russian invasion, including Ukraine's long history of resistance, the specter of nuclear war and his view of why, even if Putin wins all the military battles, he's already lost the war.

Top Stories

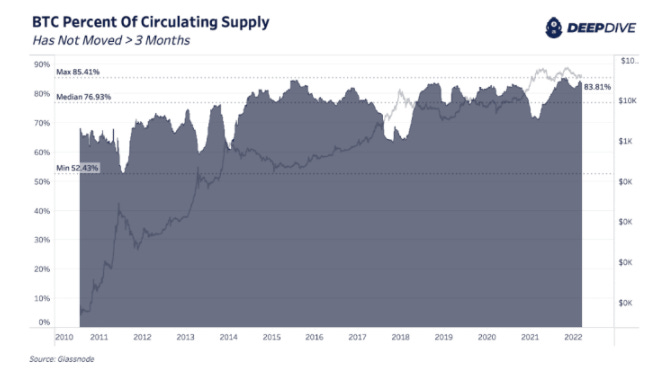

BITCOINDespite Macroeconomic Turmoil, Bitcoin Holders Remain Unfazed

Data shows that 83.81% of the bitcoin supply has not moved in last three months, near all-time highs despite global market uncertainty. The previous all-time high was in October 2021 with 84.41%, prior to the November move to $69k.

MAJR Take: While, illiquid supply is bullish indicator for potential strong price action, it should be taken with a grain of salt given the macro environment and upcoming FOMC meeting. There’s plenty of reasons to be cautious as a credit crunch could be around the corner and cause forced liquidations.

Credit Suisse Strategist Says We're Witnessing Birth of a New World Monetary Order

"This crisis is not like anything we have seen since President Richard Nixon took the U.S. dollar off gold in 1971," wrote Pozsar.

Former Federal Reserve and U.S. Treasury Department official, and now Credit Suisse strategist, Zoltan Pozsar stated that the US is in the middle of a commodity crisis that will give rise to a new monetary world order that ultimately weakens the dollar-system and creates mass inflation for western countries. He marked the end of the current system last week when G7 countries seized Russian foreign reserve assets, putting China and other countries on high alert. He goes on to mention that the monetary sea-change will most likely benefit bitcoin.

MAJR Take: Every 80-100 years, the world goes through dramatic geo-political cycles or changes that result in war and a new monetary system. History doesn’t lie. We highly recommend reading The Fourth Turning. A book written in 1997 that describes the events unfolding today.

Crypto Miners to Benefit From Biden’s Executive Order: Jefferies

A Jefferies investment bank analyst wrote that President Biden’s executive order was sign of a maturity in crypto regulation and a buy signal for bitcoin miners. An event similar to China’s Bitcoin ban that pushed miners out of the country and into the US, making the US the world leader in Bitcoin mining.

More on Bitcoin

CRYPTOBiden Issues Long-Awaited US Executive Order on Crypto

President Biden’s signed executive order regarding bitcoin and crypto officially make digital assets part of the White House agenda. Not many details were provided outside of directing federal agencies to coordinate efforts for appropriate regulation. It ordered the Treasury Department to provide a report on the future of money and how the current system doesn’t meet consumer needs. The order tasked the Fed and other relevant agencies to continue to pursue the issuance of a central bank digital currency (CBDC).

MAJR Take: No news is good news for crypto and a neutral stance taken by the highest office acknowledging the benefits of digital assets is a positive for the industry. Roughly 40 million or 16% of Americans are invested in or trading digital assets…we’re so early.

Ukraine Has Received Close to $100M in Crypto Donations

Ukraine's president "shares our vision" that the use of crypto could be an "economic breakthrough," according to the country's deputy minister at the Ministry of Digital Transformation.

Ukraine has received close to $100 million in crypto donations from all over the world. At the start of the war, the Ukrainian government tweeted a bitcoin and ethereum address, and since they’ve received donations in TRON, Polkadot, Dogecoin and Solana. The funds have been spent on non-lethal equipment such as fuel, food, and bulletproof vests.

Music Sharing Service LimeWire Is Back—As an NFT Marketplace

“LimeWire is returning as a platform for artists, not against them,” the co-CEOs said. “On LimeWire, the majority of the revenue will go directly to the artist, and we will be working with creators to allow full flexibility, ownership, and control when it comes to their content.”

Millennials favorite music sharing service, LimeWire is relaunching as a music NFT and digital goods marketplace for musicians. The LimeWire brand was purchased by tech entrepreneurs and brothers Paul and Julian Zehetmayr. The marketplace will try to attract both web2 and web3 customers who will be able to pay with credit cards, bank transfers and fiat. It will have KYC (know-your-customer) compliance and won’t require a wallet. They plan on launching their governance token later this year, but has yet to announce which blockchain it will be using.

MAJR Take: Music NFTs will be one of the next big trends in crypto.

More on Crypto

MACROWhat to Know as U.S., Allies Put Sanctions on Russia

Last week the US and its allies removed Russia from international financial messaging system SWIFT, essentially cutting Russia off from the global banking system. In addition, the US banned imports of Russian oil and energy products and blocked Russia’s central bank from selling dollars, euros and other foreign currencies. Other sanctions include restrictions on large Russian banks, freezing assets of Russian oligarchs, restricting technology exports into the country and preventing corporations from doing business with Russia.

MAJR Take: These are crippling economic sanctions and will have negative effects for Russia’s trade partners. Removing the 11th largest economy and one the largest energy and commodity producers creates dislocations in global markets, and sets up another global recession similar to the pandemic in 2020.

Ukraine War Impact Reverberates Through World’s Factory Floor

We’ve entered a commodity crisis and everything is expensive now. Energy prices effect all markets and the effects are hitting Asian manufactures that provide 41% of the world’s exports. Prices for raw materials are soaring and hitting new highs, which effects every day goods - copper used in appliances and wiring, nickel used in batteries, along with aluminum (transportation, construction, consumer goods, electrical) and palladium (automotive, technology, jewelry, surgical instruments).

MAJR Take: It’s probably good idea to stock up on essentials - food, gas and other important goods. No matter what the Fed does, prices are going to rip all year. This is why buying power is so important and why holding cash is a liability. Your dollars are only as good as how much they can buy, which is why you own assets. Outside of owning commodities directly, you need assets that will outperform the prices of the things you want / need. If you don’t own any bitcoin, now is the time to rethink that strategy.

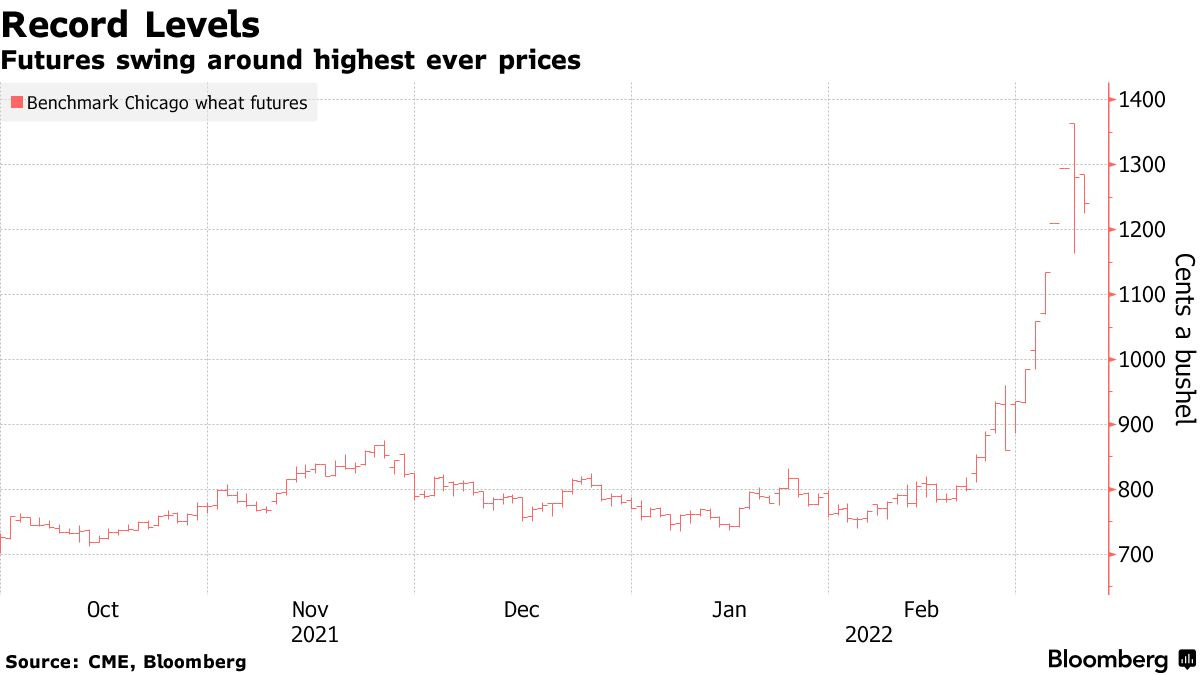

As War Spurs Race for Wheat, World Has Limited Room to Grow More

Outside of energy prices, the war in Ukraine has a massive effect on the market for wheat. Russia produces about 25% of the worlds supply of grain that’s used in everything from bread to noodles. Goldman Sachs stated the global wheat producers were already at max capacity before the conflict and it’s unlikely that one country will be able to step in to fill the gap.

House Passes $1.5 Trillion Omnibus Package That Includes Aid for Ukraine

The US House of Representatives passed a $1.5 trillion spending bill that’s 2,700 pages long, provides economic aid to Ukraine and Baltic allies ($13.6B) and provides funding for the US government for the rest of the fiscal year. In order to get the bill passed, Democrats had to remove $15.6B allocated for additional covid funding. Defense spending increased by $46B, the largest increase in 4 years ($782B). The International Revenue Service saw a budget increase of $675M totaling $12.6B to collect taxes from Americans.

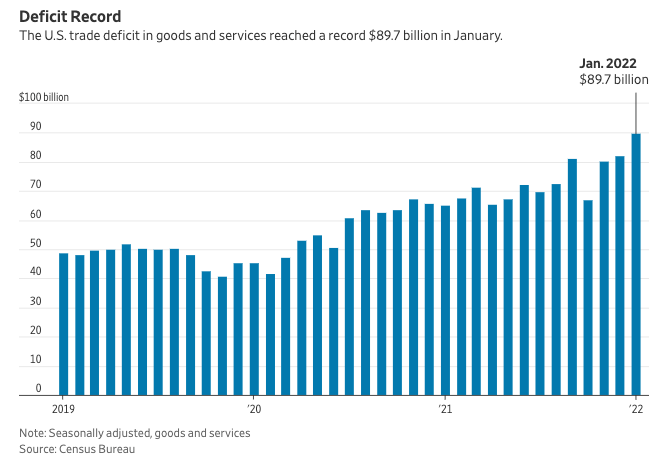

Higher Vehicle, Energy Imports Push January U.S. Trade Deficit to New Record

The US trade deficit hit a new record high of $89.7 billion, up 9.7% over the previous month as energy and vehicles imports increased. An increase in US imports can be interpreted as a strong dollar and a strong US consumer, but another way of viewing the data is that the US is spending more than we’re making.

More on Macro

Job Openings Near Record as Labor Market Emerges From Omicron Disruptions

Will Inflation Stay High for Decades? One Influential Economist Says Yes

Ukraine accuses Russia of genocide after bombing of children's hospital

MEDIAThe War in Ukraine Could Change Everything | Yuval Noah Harari | TED

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.