MAJR News: 8.3% CPI in April - higher than estimates, but lower than March data

Crypto market crashes further, TerraUST and LUNA's stablecoin lost it's peg and increases regulatory focus on stablecoins, Flow blockchain raises $725M, Inflation in China & across the globe increases

@jonjon2000

MAJR NEWS BRIEF

Videos

Preston Pysh talks with Eric Weiss about Bitcoin. They discuss why it's important for Bitcoin to be considered property relative to many other digital asset projects.

Top Stories

BITCOINEl Salvador buys the bitcoin dip, adding 500 coins to its balance sheet

El Salvador spends $15.5M and adds 500 BTC to their country’s balance sheet at an average price of $30,744. Bitcoin is down 17% in the last week and down over 50% from it’s $69k highs in November. The country has 2,301 BTC or $71.7 million at current prices. The country has been in hot water with the IMF due to their bitcoin legal tender law and $1 billion bitcoin bond raise to build it’s bitcoin volcano mining power plant and bitcoin city.

Coinbase Stock Plummets as Crypto Exchange Posts $430 Million Loss

Coinbase (COIN) shares dropped 12% after missing Q1’22 revenue estimates, with $1.17B in revenue. The stock is down with the broader market, but the company’s leadership has never been more confident in the future of the company and crypto market adoption. Coinbase has 9.2M monthly active users and did $309B in Q1’22 trading volume, which was a 44% decrease from Q4’21 during the height of the bull market. Coinbase makes revenue from subscription fees, trading fees, institutional services (prime brokerage, derivatives, futures, lending) and recently launched an NFT marketplace where Coinbase will collect trading fees trading NFTs.

Bitcoin Is Tanking—Here's What Institutions and Whales Are Doing

The recent market downturn across crypto and traditional markets have sent asset prices crashing including BTC and ETH, along with many top altcoins. On-chain analysis is showing that whales (long-term holders and institutional investors) are taking advantage of the discounted prices and loading up on BTC and ETH. Crypto investment products saw net inflows of $40M and Bitcoin saw $45M of inflows alone. Regardless, there’s still negative sentiment and not mass buying as the crypto market seems to be tied to capital markets and still acts as leading indicator of what’s to come. Bitcoin and crypto are down 50% from its highs, but in previous cycles the markets have crashed 54% in 2015, and 77% and 86% in 2018 and 2020.

MAJR Take: Be patient, make a plan and be ready to execute. Bear markets is when you make all your profits from discounted prices.

More on Bitcoin

Nearly Half of Global Bitcoin Holders Out of the Money Today

New York digital media company the latest to add Bitcoin to balance sheet

CRYPTOMeta Trials NFT Display Feature for Instagram Creators and Collectors

NFTs are coming to Instagram and will start testing features with specific creators and collectors on the platform. They will begin by sharing NFTs in feeds, stories and direct messages, which was revealed by head of social media, Adam Mosseri via Twitter. Mosseri said they’re embracing web3 technology to support creators, but will begin testing the technology before going all in. They will test features with NFTs on Ethereum, Polygon, Flow, Solana blockchains.

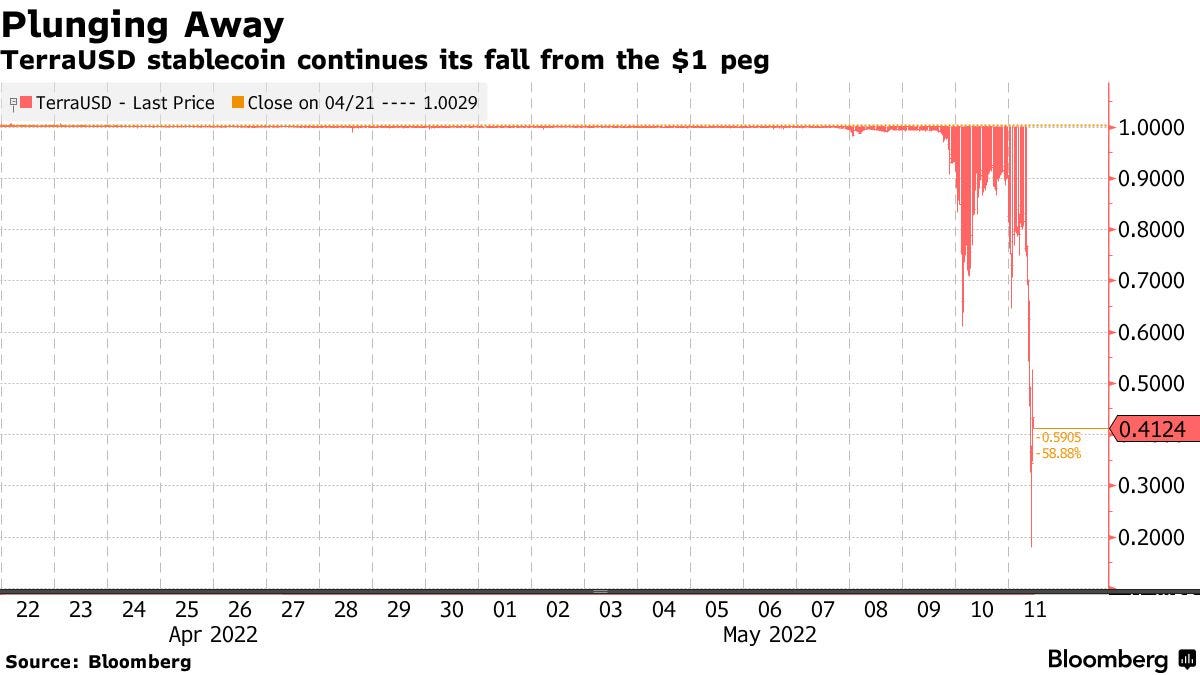

UST Stablecoin Falls To $0.30 Overnight as Terra’s Market Woes Continue

Terra’s (LUNA) UST stablecoin continued to plunge overnight touching $0.30. TerraUSD is struggling during this bear market predominately due to algorithmic stabilization mechanism between UST and LUNA and its volatile basket of digital assets used as collateral - it’s native token LUNA, BTC and some AVAX.

MAJR Take: Having an algorithmic stablecoin is the goal for the decentralized ecosystem. A decentralized system shouldn’t have a unit of account tied to a deteriorating fiat dollar. While this is terrible for the protocol, it’s most likely a learning experience for the space about how to improve. A big problem is that regulators have been watching stables like hawks, and this breakdown only helps their case for strict regulation.

What Terra's Meltdown Means for Centralized Stablecoins Tether and USDC

USD Coin from Circle and the Tether stablecoins use asset backed collateral to maintain the $1 peg, which means $1 fiat dollar in and $1 crypto dollar out. This is different than the algorithm peg run by the Terra protocol which used volatile digital assets like it’s native token LUNA, BTC and even AVAX to help back it’s peg. This past week, UST’s peg dropped and then continued to plummet as users withdrew and sold their LUNA, bringing the price down to $0.33. Stablecoin pegs have been known veer couple cents, but nothing like this. Regardless, all pegs are vulnerable as fiat based collateral can deteriorate as well. Terra’s team and analysts are confident that they restore their peg, but this incident will no doubt impact how regulators view the market.

Secretary Yellen: Stablecoins Pose Significant Risk to Financial Stability

Congress needs to pass stablecoin legislation before the end of the year, and UST’s (Terra’s algorithmic stablecoin) recent 70% crash doesn’t help crypto’s case for loose regulation. US Secretary of Treasury, Janet Yellen has come out and said, stablecoins pose significant threat to financial stability, particularly “run risk” on liquidity, similar to a bank run. The total value of the stablecoin market was more than $180 billion in March’22 and UST lost it’s peg this week, seeing its stablecoin value drop to $0.65 on Monday, before plummeting to $0.30.

More on Crypto

NBA Top Shot Creator Raises $725M Fund To Grow Flow Blockchain Usage

Trading Volumes Spike on Azuki NFTs After Creator Admits to Failed Projects

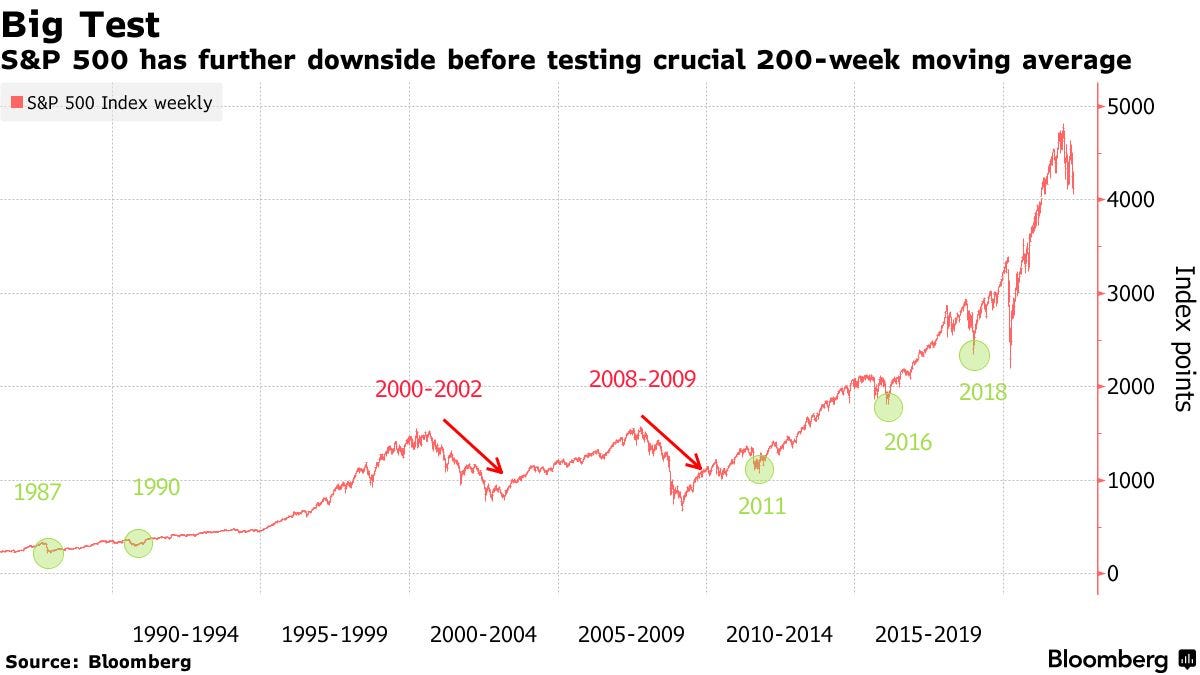

MACROSelloff in Stocks Isn’t Over Yet

Wall Street thinks stocks are still mispriced and have room for more downside as earnings continue to slow down and the Fed tightens against continued high inflation numbers. While, the 5-week downturn in stocks has left some buying opportunities, investors should shift towards defensive positions in cash, cash equivalents, healthcare, utilities and real estate stocks. The S&P 500 is still off it’s 200 day moving average, and the market could see the index hit 3,600 from 4,000, a 10% move down before reaching support.

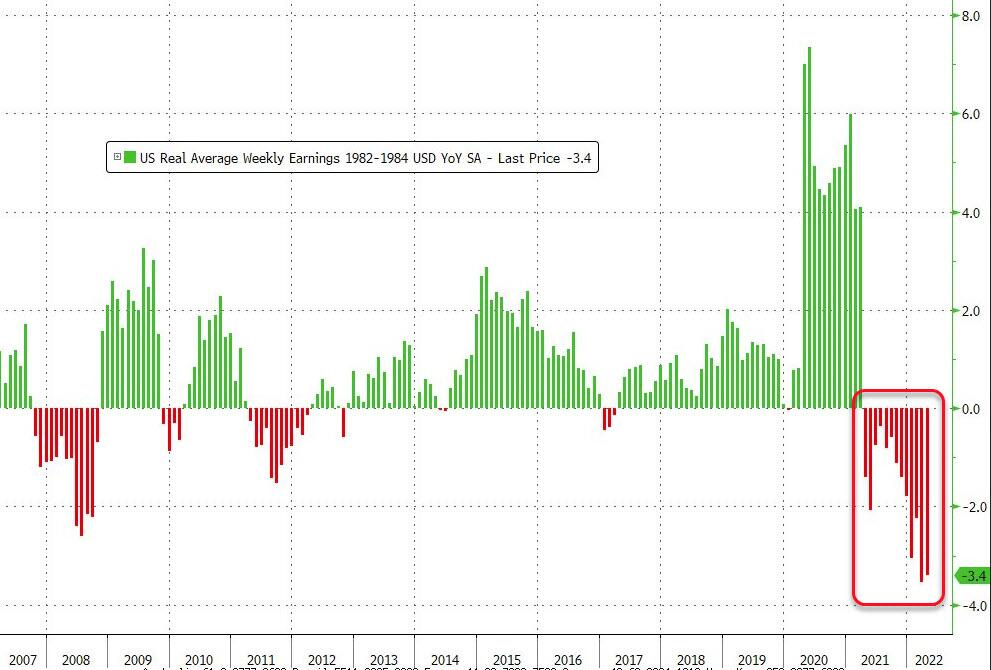

U.S. Inflation Eased in April to 8.3% Annual Rate

April CPI was 8.3% down from March’s 8.5%, but still incredibly high and hotter than the 8.1% analyst estimates. This is the first time CPI has retreated in 8 months. The Fed recently raised interest rates 50 bps in May, which was the largest increase since 2000. This is their second rate hike total 75 bps to ~1% from near zero to start the year.

Price inflation may be moving away from goods and services to labor as the supply of job openings outstrips the available labor force, creating incentives for higher wages, and ultimately putting more pressure on prices. Real wages continue to fall as inflation spikes causing workers to look for higher paying jobs. There were 11.5M job openings available this spring, the highest since 2000, while the number of people quitting hit new highs in March, at 4.5M.

Lagarde Joins ECB Officials Signaling July as Rate Liftoff

The European Central Bank has been slow to tighten compared to the rest of the world, however ECB President Lagarde has signaled a rate hike starting in July. While inflation is high across Europe and the war in Ukraine rages, the ECB is still buying assets and performing quantitative easing out of fear of stagflation - low growth and high inflation.

China Inflation Exceeds Forecasts as Lockdowns Roil Supplies

The producer price (index PPI) and consumer price index (CPI) in China rose steadily over the last year as inflation and strict lockdowns make materials, goods and services more expensive. PPI is up 8% in April and the CPI is 2.1% up 1.5% compared to March. A surge of Omicron in China has forced authorities to lock people in their homes for over a month now, which as caused panic buying, further supply chain disruptions and social unrest. Food prices have spiked - fresh vegetables are up 24% YOY while fuel has also seen a 28% increase.

More on Macro

House Approves $40 Billion Ukraine Aid Bill, Sends to Senate

German Production Flags, Hit by Ukraine War and China Lockdowns

MEDIABTC074: Bitcoin is Property w/ Eric Weiss

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.