MAJR News: $1.02 trillion in new US Consumer Debt in 2021

Russia to treat bitcoin & crypto like foreign currencies, BlackRock entering crypto trading, Terra blockchain sponsors MLB Washington Nationals, Gucci buys digital land, Jan'22 CPI hits record 7.5%

@gasta

MAJR NEWS BRIEF

Videos

In this interview, Jack Mallers, CEO of Strike discusses his interactions with the IMF, Facebook, Jeff Bezos, and Argentina, and the global implications of the Bitcoin network.

Top Stories

BITCOINRussia Expected to Regulate Crypto Like Foreign Currencies

According to a report published on an official Russian government website, the Russian government and the central bank came to an agreement to regulate digital assets like foreign currencies. It was only a month ago, when the central bank proposed a full ban of digital assets, but now it appears that the government is attempting to bring crypto trading and services under government oversight.

MAJR Take: Russia’s sudden change to accept bitcoin and digital assets makes sense given the US government’s use of monetary sanctions that cut off Russia from the SWIFT network, which is the main banking network for sending dollars all over the world. It also makes sense due to Russia’s wealth in energy that could be used to mine Bitcoin. Regardless, this is Bitcoin’s global game theory playing out.

$10 Trillion Asset Management Firm Blackrock To Add Bitcoin Trading To Its Services

The world’s largest asset manager is preparing to offer cryptocurrency trading services to its investor clients. Clients will be able to trade crypto and even borrow from BlackRock’s credit facility for leverage trading by collateralizing their digital assets. BlackRock has been telegraphing their intentions - they own more than 16% of MicroStrategy, hired a blockchain strategist, been trading in CME bitcoin futures and has plans to launch an iShares Blockchain and Tech ETF.

MAJR Take: If crypto dips again in March after the Fed tightens, I think it’s safe to say everyone including BlackRock is buying the dip hard. This will most likely be the last time bitcoin stays correlated to equity markets.

More on Bitcoin

Russia’s Move to Regulate Cryptocurrency Puts Other Countries on Notice

JPMorgan Analysts Predict $150K Bitcoin, Investors Ignore Coming Rate Hikes

CRYPTOTerra Signs 5-Year, $40M Sponsorship Deal With MLB Team Washington Nationals

Terra (LUNA) the smart contract protocol that has a native algorithmic stablecoin, UST just signed a 5-year $40M sponsorship deal with MLB team the Washington Nationals. Terra joins other infamous crypto projects sponsoring professionals sports teams - Grayscale and the Giants, FTX and the LA Staples Center, and Crypto.com and the UFC. Terra’s sponsorship is a little more unique since it’s stablecoin will be accepted throughout the ballpark.

Bill Ackman Calls on New York to Remove Crypto Barriers

Billionaire hedge fund manager, Pershing Square Capital Management founder Bill Ackman sends a tweet to the governor of New York and the mayor of New York City requesting them to fix the state’s strict crypto laws before they loose any more New Yorkers. New York has some of the strictest crypto laws in the US that prevents innovation with its BitLicense and prevents users from opening accounts on some exchanges, yet its the financial capital of the world…for now at least.

CFTC Wants Larger Role in Crypto Regulation—And Sam Bankman-Fried Agrees

Rostin Behnam, the Commodity Futures Trading Commission (CFTC) thinks his agency is the best suited to regulated digital assets and made his case for expanding their authority in a letter to the House and Senate Agriculture Committees on Tuesday. In January, the Biden Administration announced that they will make an executive order on how and who will regulate digital assets like Bitcoin, Ether, stablecoins and NFTs. Crypto is increasingly becoming a political issue with different opinions across the isle and different agencies vying for power.

Gucci buys virtual land on The Sandbox as part of metaverse experience bid

Luxury fashion brand, Gucci bought digital land in The Sandbox, one of the most popular metaverse blockchain games and digital worlds. Gucci says the move is to create digital fashion experiences and place to hold conversations about the future of fashion. In May 2021, Gucci was the first luxury brand to introduce an NFT auction via Christie’s.

MAJR Take: It’s becoming increasing clear that being early to crypto is amazing for marketing. It speaks to your brand being forward thinking and reaches new audiences that have a monetary stake in continued crypto adoption. Powerful.

More on Crypto

Investment firm KKR to up Animoca Brands’ newest funding to $500 million

Crypto infrastructure startup Qredo closes $80 million raise led by Dan Tapiero’s 10T Holdings

NFT prices misfire as OpenSea daily active user volume drops 30% in a week

MACROU.S. Households Took On $1 Trillion in New Debt in 2021

US households levered up in 2021 and borrowed more than $1.02 trillion in debt, the most since 2007 ($1.07 trillion). The increase in debt was driven by low interest rates and increased prices for homes and cars. Total consumer debt now stands at $15.6 trillion in 2022 compared to $14.6 trillion compared to the start of 2021. In Q4’21, Americans tacked on $52 billion in credit-card debt, the largest quarterly jump on record.

MAJR Take: The article goes on to say that the Fed isn’t worried about this type of leverage because it wasn’t driven by sub-prime (2% of mortgages), but homes that can appreciate in time and overall wealth increased across all income levels, but mostly for the rich. This doesn’t make sense since the homes were purchased at all-time highs and inflation is running at record levels, therefore it’s money illusion and American's’ overall buying power has been damaged. All of this coincides with the general expectation of interest rate hikes this year which will shock the housing market and make everyone’s ability to service debt much more difficult as the economy slows down with less spending. This has bubble written all over it if the Fed tightens too much or at all. The only way this works out is if inflation runs hot and interest rates remain low melting-up asset prices.

Fed’s Mester Supports Moves to Accelerate Balance-Sheet Wind-Down

Federal Reserve Bank of Cleveland President, Loretta Mester said she’s in favor of shrinking the Fed’s $9 trillion balance sheet faster by not reinvesting the principle payments from the bonds and cash back into the economy. She thinks this should be done, while also raising interest rates by 0.25 BPS in March. She sees inflation as bigger risk and believes it should start to cool down with tighter policy and a recovery in supply chains, but still remain higher than their 2% target. Ms. Mester believes that the Fed can increase rates and shrink the balance sheet at the same time and at an accelerate pace, barring “any unexpected turn in the economy.”

MAJR Take: Fed officials are most likely using hawkish rhetoric to push the market to correct for them by leaving outs like “unexpected turn in the economy.” It’s general consensus that the entire economy is going to dramatically slow down with tighter policy, especially with higher rates and running off the balance sheet. A turn in the economy is expected, that’s the whole point of tight monetary policy.

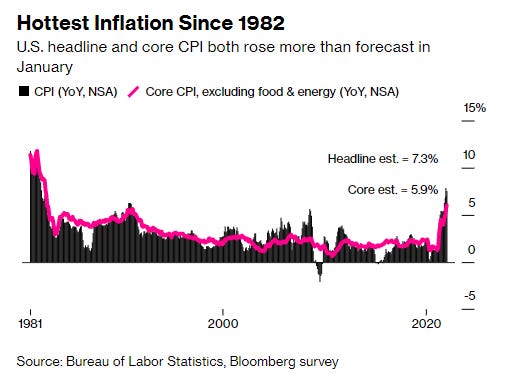

U.S. Inflation Charges Higher With Larger-Than-Forecast Gain

The US consumer price index (CPI) jumped to 7.5% in January from a year earlier, up from 7% in December. This is the largest price increase since 1982 and now puts the Fed in a position where they may need to increase rates by 0.5% vs. 0.25% in March. Economists have underestimated the monthly surge of inflation 8 of the last 10 months. The CPI print will likely stall Biden’s trillion dollar Build Back Better spending bill. Inflation in CPI could be much sticker than economists predict given the tight labor market and increases in wages.

MAJR Take: Beware of the pundits trying to use the term “core CPI” which increased 6%. “Core CPI” is a deceiving language game used to hide the real costs as it excludes prices for food and energy, literally the things that everyone needs most. Remember, these are the inflation numbers being quoted, when real inflation is in the double digits given what you’re buying - financial assets, homes, rent, food, etc. This is an average basket tailored weighed for easy monetary policy and it’s still at record highs.

More on Macro

Bank of Canada Gov. Macklem: Current Rate of Inflation ‘Too High’

Top Forecaster Now Sees Japan Inflation Running Higher All Year

Stock-Trading Ban for Congress Hits Pushback From Right and Left

The Next Supply Chain Mess Is Coming for Your Morning Coffee

MEDIAJack Mallers Orange Pilling the IMF with Bitcoin

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.