MAJR News 087

Bitcoin & crypto prices rebound in early February rally, Big accounting firm - KPMG Canada put BTC and ETH on their balance sheet, Polygon raised $450m, Aave to launch web3 social media platform, Lens

@gasta

MAJR NEWS BRIEF

Videos

Preston Pysh and Jeff Ross talk about a potential economic tightening event in 2022 and how investors need to think about their positioning. They discuss the impacts it might have on Bitcoin and many other equities and sectors.

Top Stories

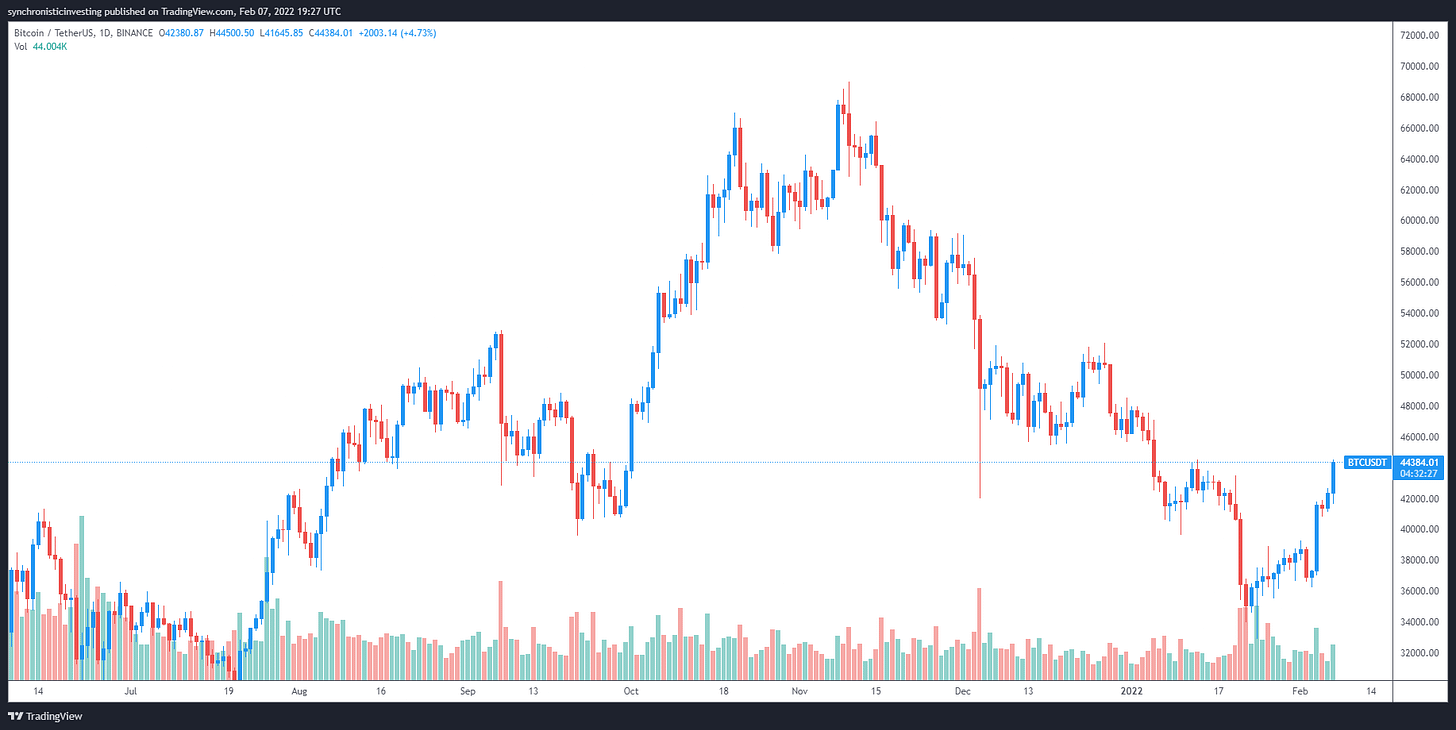

BITCOINBitcoin bulls look to push price above $45K to validate bullish trend reversal

Bitcoin breaks $40k price levels and pushes higher, but sees resistance at $45k. Traders are still bearish overall as negative funding rates increased to cover short positions, while $71 million in bitcoin shorts were liquidated. If bitcoin breaks $45k, resistance could flip to support as this level has historically held strong and could mean a possible trend reversal from a technical analysis standpoint.

MAJR Take: At the end of the day, bitcoin hasn’t changed and continues to stack blocks every 10 minutes. It’s value prop remains the same; sound money that can’t be debased by centralized authority and is the best hedge against inflation. It’s still insanely undervalued for where it’s ultimately going. However, it’s volatile and relatively correlated to risk assets in the short term and the Fed hasn’t tightened yet. We’ve got until March to see what they do. In the meantime, it’s it’s probably best to keep layering in vs. chasing big green candles.

Valkyrie Capital Bitcoin Mining ETF to Debut on Nasdaq

Valkyrie Capital is getting at least one type of Bitcoin ETF approved, their Bitcoin Mining ETF focused on renewable energy miners, ticker symbol “WGMI” which is crypto slang for “we’re gonna make it.” The ETF is focused on mining companies that use at least 77% renewable energy and that earn at least 50% of their profits from mining bitcoin. Included are Argo Blockchain, Bitfarms, Cleanspark, Hive Blockchain and Stronghold Digital Mining.

KPMG Canada Adds Bitcoin and Ethereum to Its Balance Sheet

Accounting giant, KPMG Canada puts bitcoin and ether on the company’s balance sheet. They are the latest publicly traded company to acquire and hold the two market leading digital assets, others include MicroStrategy, Tesla and Square. KPMG is part of the “big four” accounting firms with PricewaterhouseCoopers, Deloitte and Ernst & Young.

The investment reflected their "belief that institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix…"Cryptoassets are a maturing asset class…Investors such as hedge funds and family offices to large insurers and pension funds are increasingly gaining exposure to cryptoassets, and traditional financial services such as banks, financial advisors and brokerages are exploring offering products and services involving cryptoassets…We've invested in a strong cryptoassets practice and we will continue to enhance and build on our capabilities across Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs) and the Metaverse, to name a few…We expect to see a lot of growth in these areas in the years to come.”

Bitcoin Will Reach $200K in Second Half of 2022, FSInsight Says

FSInsight investment report says bitcoin is still king and could reach $200k by the end of 2022 with ether reaching $12k, saying its undervalued compared to cloud platforms. DeFi, NFTs and other web3 applications are what’s driving the momentum and growth.

More on Bitcoin

Jack Dorsey’s Cash App Integrates Bitcoin’s Lightning Network

Tesla held $2B of Bitcoin as of late 2021, SEC filing reveals

Canadian Trucker Protest Bypasses Fundraising Restrictions with Bitcoin

CRYPTOInvestors pour $450M into Ethereum scaling platform Polygon

Polygon (MATIC) raised $450m in a new venture round, led by Sequoia Capital India, Tiger Global, Soft Bank, Galaxy Digital, Republic Capital, Alameda Research, Alan Howard and many other crypto VC giants. Polygon is a side chain or layer 2 solution that helps Ethereum scale the number of transactions on the network by using a variety of technologies (plasma, optimistic rollups, zero knowledge (zk) roll ups) that batch data off-chain and then settle back on mainchain Ethereum. Over 7k applications are deployed on Polygon, including big names like Aave, Curve, Sushiswap, Pool, Uniswap, Decentraland and OpenSea. Polygon’s (MATIC) token market cap is up 23% in the last week, sitting at $13B.

Crypto Fund Inflows Follow Pickup in Market Sentiment

Investor inflows going into crypto funds last week quadrupled and helped push the price of bitcoin over $40k, which pumped the rest of the altcoin market. The majority the new funds came from the America’s, with 88% coming from Brazil and Canada. Bitcoin received the lion share of investment and layer 1 alternatives saw an increase in investor funds specifically - Solana, Polkadot, Terra and Cardano.

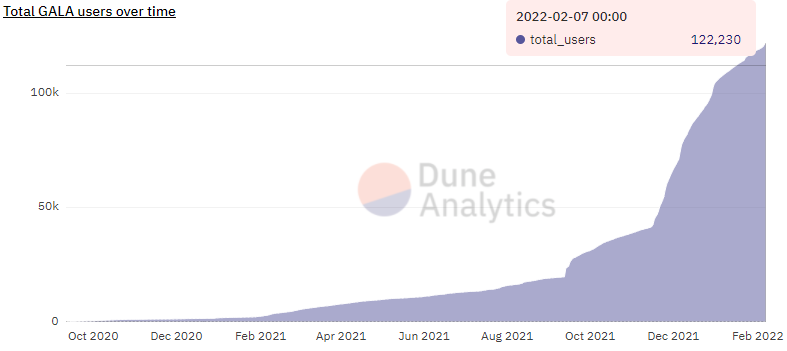

GALA gains 117% in February as P2E crypto gaming goes mainstream

Gala (GALA), a “play-to-earn” protocol focused on the gaming sector saw massive price action over the last week, jumping 117% in price. The increase can be attributed to new games that they’re rolling out to users and a strong increase in the amount of users holding GALA tokens (chart above). Users can earn GALA from playing their games but also from staking their GALA and running network nodes. The company also partnered with popular NFT communities 888innercircle on Twitter with more than 205k members.

DeFi’s Aave Launches Web 3 Social Media Platform ‘Lens’

Stani Kulechov, the founder of DeFi lending protocol Aave announced that their team will be launching a web3 social media platform called “Lens.” Interoperability and composability will be key features of the new platform. Users will be able to create NFT based profiles that store posts, publications and follower history, revenue sharing features for content hosted on IPFS and have built-in governance. The protocol will be built on Polygon.

“The cool part is that every app will expand the social graph, essentially there is less need for developers to growth hack for users, instead the focus can be shifted towards better and more humane user experience,” said Kulechov.

More on Crypto

BuzzFeed Outs Bored Ape Yacht Club Founders: Doxxing or Journalism?

AssangeDAO raises $38M in donations to help free WikiLeaks founder

Axie Infinity Making Big Changes to Fix Its Ailing Play-to-Earn NFT Economy

Minting Your First NFT: A Beginner’s Guide to Creating an NFT

MACRONY Fed: Stablecoins Are Not the Future of Payments

New York Fed researches put out another paper arguing for tokenizing deposits over stablecoins claiming that they’re less risky and would work better with legacy payment infrastructures. They compared stablecoins the free banking era where different banks could issue they’re own dollars or currency, a time when currencies weren’t fungible. This comes shortly after Fed researchers put out a lengthy analysis on possible stablecoin scenarios. The researchers argued that tokenized deposits are better from a liquidity standpoint. They reduce risk by allowing banks to use the deposits as needed in order cover other shortages or risks taken by the bank, essentially fractional reserve banking. For this reason, they argued for the continued need of centralized banks controlling the payment system.

MAJR Take: Of course the Federal Reserve is going to argue for control and centralization, but their points don’t change any of the problems or offer any solutions. The whole point of stablecoins, is the liquidity backing the stablecoin issuance is collateralized and there, and not being rehypothecated. Banks over extending themselves with tax payer money offering no yield in return for increased risk is what got us into this mess in the first place. And, we don’t stop technology innovation to serve legacy infrastructure, legacy infrastructure changes to keep up with technology.

In Covid-19 Housing Market, the Middle Class Is Getting Priced Out

Over the past two years, the pandemic and it’s related issues around supply chains, super low mortgage rates and mass migration have driven increased demand for a dwindling supply of homes, especially the middle class. For the households earning between $75k-$100k, there’s only 1 out of 24 listings that’s affordable. There were about 411k fewer homes considered affordable on the market last year prior to 2020. For two-person households, Pew Research Center considered household income between $43,399-$130,198. The number of homes listed for sale or under contract fell to 910k at the end of December, the lowest on record since 1999.

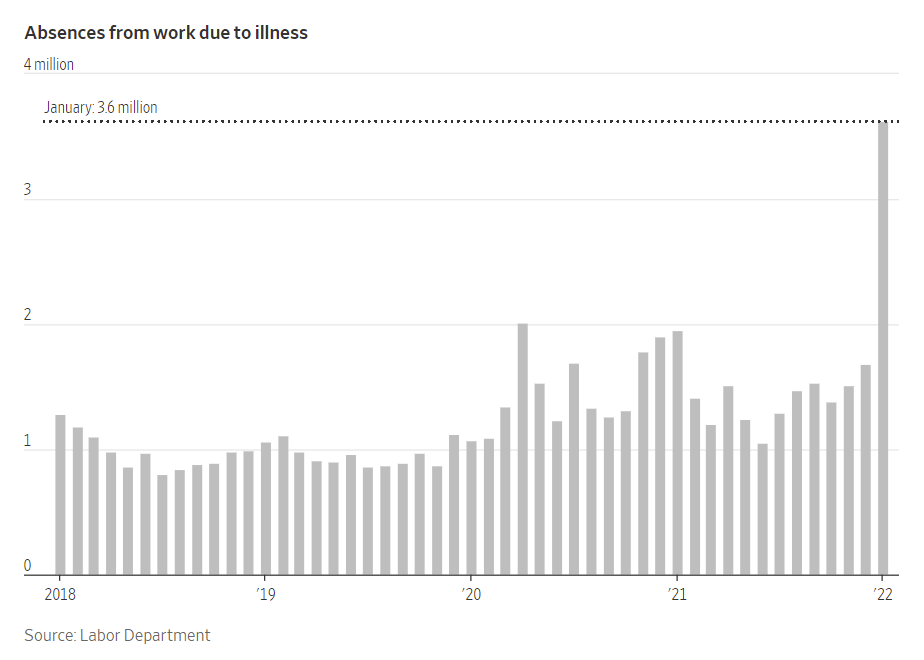

Omicron Absences Fail to Dent Job Growth

January job data looks strong as employers added 467k jobs, however many people were out of work or working less due to being sick or Omicron related issues. These numbers increased by 3.6 million people not working, up from 1.7 million in December. January 15 was the peak for the number of cases being reported in the US. Weekly hours dropped by .02 hours. Retail was worker lost 1 hour on average per week.

More on Macro

MEDIABTC063: Economic Tightening & Bitcoin w/ Dr. Jeff Ross

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.