MAJR News 085

Bitcoin adoption continues across US states, BTC price could be bottoming, FTX crypto exchange valued at $32B, Fed's change in monetary policy puts pressure on housing market, Solana & altcoins pump

@gasta

MAJR NEWS BRIEF

Videos

In this episode of On The Margin Mike is joined by Andreas Steno Larsen Director & Lead Economist of Heimstaden. After spending 10+ years as a Chief Global Strategist, FX Analyst & Researcher at Nordea, Andreas provides a unique insight into the current macro factors driving markets. Andreas shares his global macro outlook for 2022, his thoughts on the effect tapering will have on markets, the slowing credit impulse as a leading indicator for growth, the rise of China vs the U.S & if we are in a period of secular inflation.

Top Stories

BITCOINBitcoin And Arizona: State Senator Aims To Make The Crypto Legal Currency

Bitcoin adoption is spreading across US states. It’s popping in large metro areas like NYC, Miami and other states including Arkansas, Colorado, and now Arizona and possibly Mississippi. Wendy Rogers, State Senator for Arizona introduced a bill that would make bitcoin legal tender in her state. The bill has a slim chance of passing, it wouldn’t require merchants to accept it and it wouldn’t have any influence on taxes.

MAJR Take: Whether the bill passes or not, doesn’t matter, it’s a glimpse into Bitcoin’s game theory playing out. There’s only so many bitcoin (21 million), there’s 50 millionaires in the world and 8.2 billion people on the planet. Do the math. Bitcoin has entered the mainstream and the narrative is no longer tulips, it’s a digital store of value with military grade encryption. A full fledged monetary good with 24 / 7 / 365 liquidity. The next decade will be about securing real estate on Bitcoin’s blockchain. Pay attention.

JP Morgan: Bitcoin, Ethereum Continue to Face 'Significant Challenges'

JPMorgan analysts continue to push the same FUD for crypto markets. A recent letter to investors says digital assets will continue to struggle to gain institutional adoption due to volatility and networks like Ethereum will face increased competition from rival chains like Solana.

MAJR Take: First, they’re not wrong, digital assets are volatile and network competition is underway. It’s just the constant FUD (fear, uncertainty, doubt) and headlines used to scare readers. In July, JPMorgan opened up crypto trading services beyond select clients to their wealth management division. They’re working behind the scenes with government officials, senators, the SEC, the Treasury and the White House to make sure they get their “share” of the upside and don’t loose full control of things like stablecoins. This is not a conspiracy (read this article) and it makes total sense - we have a broken financial system built on debt that’s run by banks. The new blockchain system is built on equity and run by the users. Why do you we have a Bitcoin Futures ETF approved and the Bitcoin Spot ETF keep getting rejected in the name of “investor protections?” The answer - to suppress BTC price and leave an opening for let’s say, BlackRock’s Bitcoin ETF. Plus, institutional adoption is underway - the oldest bank in the country, BNY Mellon is jumping into the space and asking for more regulatory clarity. Watch what they do, not what they say.

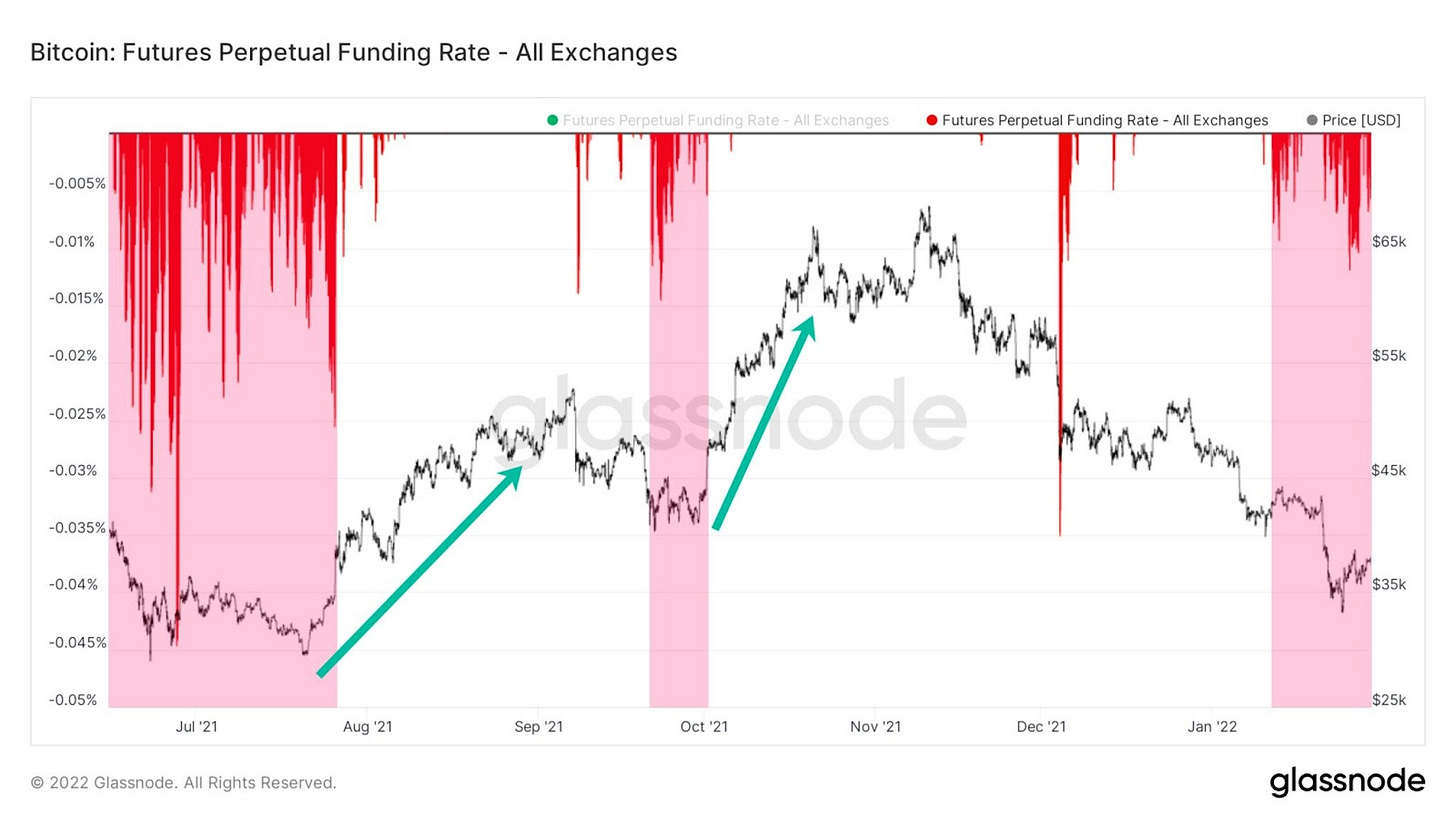

BTC On-Chain Analysis: Negative Funding Rates and Declining Open Interest

For the last three months, Bitcoin has been in a downtrend from $69k highs to $34k lows, it’s now trading around $39k. More than a 50% correction. Open interest in the bitcoin futures market is falling, which means there are less contracts being traded for the asset, which is a bearish signal when the price is falling. However, the open interest across multiple exchanges has reached multi-month lows as bitcoin’s price is stabilizing around $35k-$36k price levels. In addition, we’ve seen negative funding rates (funds flowing into to maintain short positions) increase as the price has increased from lows. While this indicates that many traders have short positions on, it could also suggest that bitcoin could be forming a bottom showing signs of bullish divergence.

More on Bitcoin

Dormancy Flow Gives Buy Signal for Sixth Time in History: Bitcoin (BTC) On-Chain Analysis

BTC On-Chain Analysis: 99% of Short-Term Holders Reporting Losses – Bullish Signal?

Anchorage Closes In on FDIC Crypto Custodian Deal, Documents Show

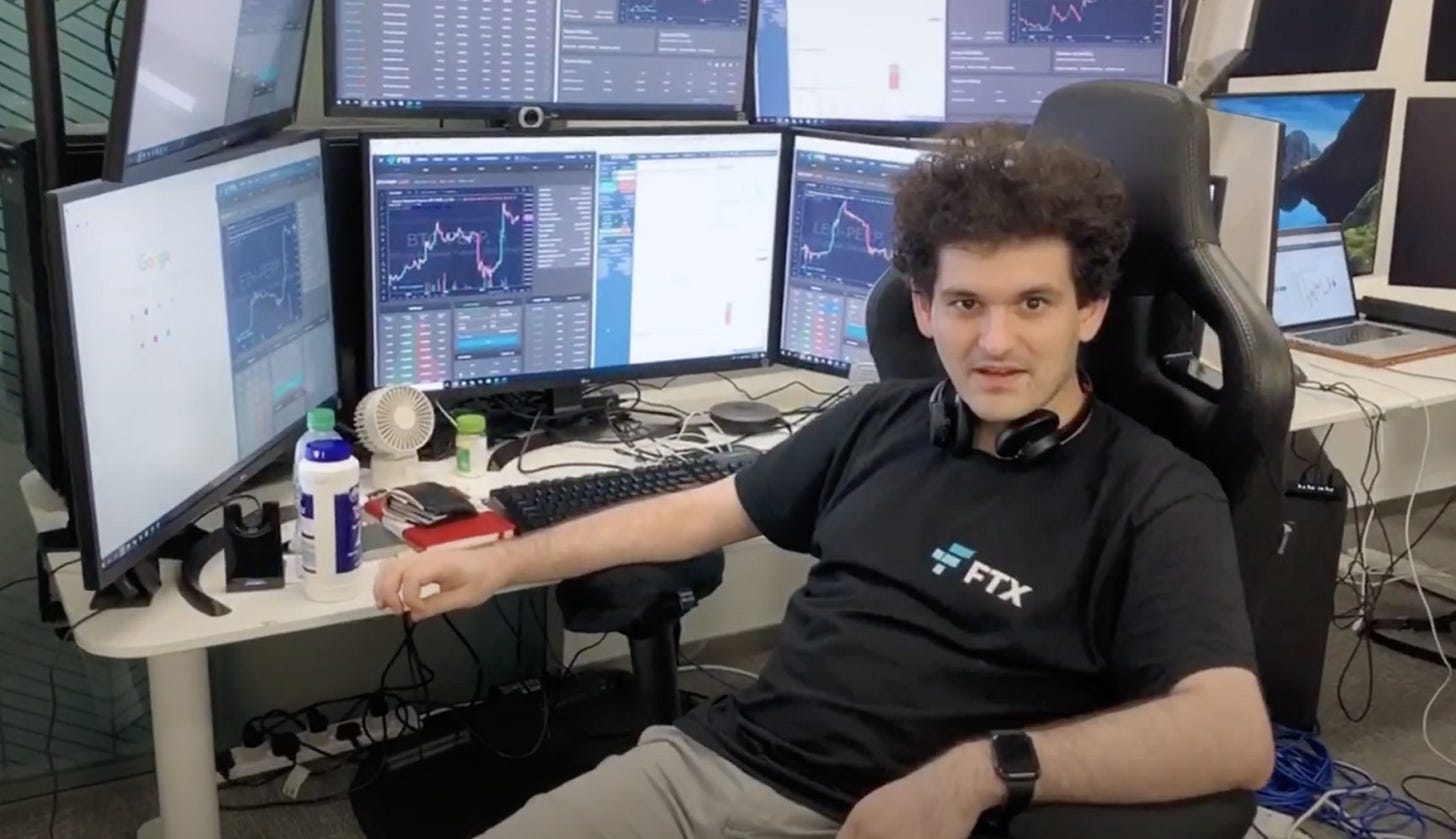

CRYPTOCrypto Exchange FTX Now Valued at $32 Billion With $400 Million Raise

In the last six months, FTX has been on a fundraising spree raising $1.5 billion for its parent company and US businesses, now valuing FTX at $32 billion. FTX is a crypto exchange led by 30 year billionaire Sam Bankman-Fried. The company also launched FTX Ventures, a $2 billion fund focused on investing web 3 applications in the social and gaming sector. It should be noted that the CEO, Sam Bankman-Fried plans to give all of his money to charity through his earning to give approach to Effective Altruism.

'Cryptoization' Poses Risks for Emerging Markets: IMF Counsellor

The International Monetary Fund is concerned that crypto adoption, or “cryptoization” is going to destabilize financial markets, especially in developing countries. Tobias Adrian, the IMF’s financial counselor said that traditional methods of maintaining international capital flows is very challenging with crypto as capital can flow across other global rails. He believes that capital is flowing out of countries that he would deem as “unstable.”

Solana Wallet Phantom Raises $109 Million, Bringing Valuation to $1.2 Billion

Solana (SOL), the leading Ethereum competitor known for faster and cheaper transaction times has had some positive updates with regard to listings on Coinbase, a rebound in price action and it’s leading digital wallet, Phantom with a huge raise, making it another crypto unicorn. Phantom raised $109 million valuing the company at $1.2 billion. The round was lead by Paradigm, a leading crypto firm who just launched a $2.5 billion fund. The Phantom wallet can be compared to the popular Metamask wallet used for Ethereum.

MAJR Take: Solana has seen a dramatic drop in price crashing from $260 in November to $89 in January. The bearish price action was was correlated to the overall market however, the Solana network encountered outages halting or slowing transactions for hours. This is very concerning for any blockchain, however, it hasn’t stopped developers or capital from flowing into the Solana ecosystem. Solana is currently valued at $34B market cap compared to Ethereum’s $334B. Regardless, it’s still so early and both of the protocols have such a lead that they’re extremely undervalued in the long-run.

LooksRare Has Reportedly Generated $8B in Ethereum NFT Wash Trading

LooksRare the new NFT marketplace and competitor to OpenSea, the largest NFT trading platform has apparently been ripe with wash trading from users taking advantage of the platforms rewards structure. Analytics firm, CryptoSlam identified more than $8.3 billion worth of wash trading from LooksRare. Wash trading is when users buy and sell NFTs between owned wallets to manipulate rewards and tax consequences. The platform issues rewards in their LOOKS token to users who buy and sell on the platform.

More on Crypto

SOL Surges 17% After Coinbase Lists Two Solana Ecosystem Tokens

India Proposes 30% Tax on Crypto Income, Announces Digital Rupee Launch

Indian parliament's agenda includes crypto training session, leaves out bill banning digital assets

MACROHow the Fed’s Policy Shift Is Rippling Through the Housing Market

The US central bank has been the largest buyer of home loans since the start of the pandemic, stockpiling $2.7 trillion of mortgage backed securities on it’s balance sheet. Now, they’re exiting the market and winding down it’s monthly asset purchases by March. Mortgage-backed assets are starting to sell-off given there’s no buyer of last resort. This will most likely slow down the housing market as lenders tighten and there’s less liquidity overall, especially if they increase interest rates.

Teachers Are Quitting, and Companies Are Hot to Hire Them

Teachers are burned out from the pandemic and are leaving the educational industry in droves. People quitting educational services rose more than any other industry in 2021. Teachers started to quit back in 2020, as the private education sector recorded a high of 550k resignations between January and November, and more than 800k resignations occurred during the same period for state and local education services. Educational quit rates rose 148% and according to LinkedIn, teachers left who left their career increased by 62% last year. While, this isn’t good for children or the educational system, teachers are being hired quickly for their skillset - easily absorb new information and apply it to their new role, finding jobs in sales, coaching, behavioral health technicians and software engineers.

EV Sales Reach 'Inflection Point’ With Fast Growth in China and Europe

Automakers providing electric vehicles never really saw growth in sales until now. China and Europe auto markets appear to be at an inflection point over the last two years. EV sales for new cars was about 4% of the overall volume and last year EV sales as a percentage of new cars sales jumped to 15% in China and 20% in Europe. Korea passed the 10% mark last year and the US saw an increase of 8%, and still growing.

More on Macro

MEDIAHow Fed Tightening Will Impact Markets | Andreas Steno Larsen

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.