MAJR News 084

Fed signals tightening, but with no certainty, IMF doesn't like El Salvador's BTC legal tender law, Putin - "Russia has an edge in BTC mining," YouTube suggest NFT tech, Sandbox launches $50M fund

@starfury

MAJR NEWS BRIEF

Videos

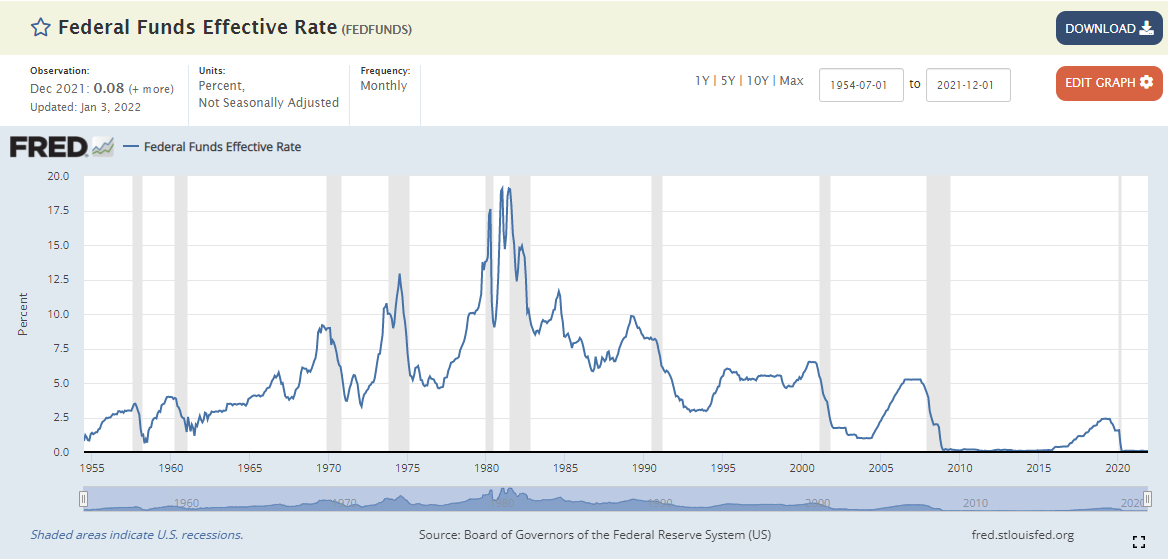

Federal Reserve Chairman Jerome Powell holds a news conference following a meeting of the Federal Open Market Committee on Wednesday 1/26/21. In short, the Fed Chair stated that they will taper their monthly bond purchases by early March, currently at $105B per month. He sited a rate hike post taper to curtail inflation prompted by the pandemic, supply chain imbalances, a tight labor market and increased wages. Powell confirmed that they will shrink the Fed’s $9 trillion balance sheet after they increase the federal funds rate.

Please Watch to Understand Why This is Crazy and Not Good Enough

MAJR Take: No specifics were given on timing and percentages. The main takeaway is that the trillion dollar piggy bank is in full reaction mode. There is no real plan. The Fed will be reacting to a chaotic economy that they’re helping to create. How are households, businesses and countries supposed to plan with that? The above bitcoin GIF is one of my favorites because it represents the times we’re living in. Bitcoin’s price might seem crazy and volatile because it’s being priced in dollars, but remember, 1 bitcoin = 1 bitcoin.

Top Stories

BITCOINBitcoin Briefly Spikes on Fed Announcement—Before Traders Realize Nothing Changed

The Federal Reserve announced that rates will remain near 0% until March, when they intend to increase the federal funds rate. The price of bitcoin briefly popped to $39,200 from $37,700 before dropping down to the $35k-$36k range. The federal funds rate is the rate at which banks can borrow money from each other’s reserves overnight. Increasing the federal funds rates effects the economy by increasing credit card interest rates and mortgages rates for consumers. Essentially, tighter rates mean less lending and less spending.

Putin Says Russia Has 'Competitive Advantages' in Bitcoin Mining

Russian leadership is torn regarding bitcoin and digital assets. The Finance Ministry believes they should allow the technologies to develop, while the central bank believes they should be banned. President Putin stated that he believes that the government needs to come to consensus on the issue, and believes Russia would have an advantage in mining bitcoin given their excess supply of energy and operators. Russia currently has 10% of the global Bitcoin hashrate compared to the US who’s leading with 35%. Tensions have grown between the US and Russia as of late due to the rising crisis in Ukraine. The US has threatened to cut Russia off from the US dollar payment system, called SWIFT. This type of sanction would only push Russia into Bitcoin’s open monetary network in order to move money around the world.

IMF Again Calls for El Salvador to Drop Bitcoin as Legal Tender

El Salvador’s population is 6.5 million with a GDP of $24 billion, quite small and the International Monetary Fund (IMF) has now warned the country at least 3 times to remove their Bitcoin legal tender laws. El Salvador has approximately 1,800 BTC in their country’s treasury and bought 410 BTC more this week.

MAJR Take: The IMF is in the business of loaning harder currencies to developing countries all over the world, including El Salvador. This may seem like a good thing at first, but in reality it’s a double-edged sword. The developing nation economies are now indebted with a harder currency than their own, so if they can generate enough growth internally they have to print or inflate their softer currencies in order to service their debts. This gets even worse when developed country’s central banks course correct both directions. When the Fed tightens, the indebted countries just owe more local fiat to pay down debt which is now in a stronger currency. When the Fed loosens, the indebted countries don’t see the benefits of the inflation such as governments hand outs or monetary stimulus, but rather the countries need to stay competitive in global trade and weaken their currencies even more. Don’t get it confused, the IMF is in the business of control and their power comes from usury. Bitcoin removes the IMF controls via exiting the system, this is why government entities like the IMF and WEF are worried about bitcoin and crypto. They lose their power.

"The adoption of a cryptocurrency as legal tender, however, entails large risks for financial and market integrity, financial stability, and consumer protection. It also can create contingent liabilities."

"Crypto assets can pose significant risks and effective regulatory measures are very important when dealing with them."

Ex-Goldman CEO Lloyd Blankfein says ‘crypto is happening’ despite plunge in digital assets

Ex-Goldman CEO, Lloyd Blankfein came out on CNBC this week to reverse course on his previously bearish statements on bitcoin and digital assets, stating that they’re here to stay and the multi-trillion dollar asset class is something you can no longer ignore. Goldman and other traditional financial institutions have begun offering their selective clients opportunities to trade and custody digital assets like bitcoin.

In the past, Blankfein has criticized bitcoin as a store of value and said that regulators should be “hyperventilating” over its rise.

“I may be skeptical, but I’m also pragmatic about it,” Blankfein said Monday. “And so guess what? I would certainly want to have an oar in that water.”

More on Bitcoin

Gibraltar Could Launch the World’s First Crypto Stock Exchange

How Bitcoin Contributions Funded a $1.4M Solar Installation in Zimbabwe

CRYPTOEthereum NFT Game The Sandbox Launches $50M Metaverse Accelerator

The Sandbox (SAND), the leading gaming and virtual property metaverse blockchain is launching a $50M accelerator program to invest in 100 startups to help build their ecosystem over the next three years. The program is backed by Sandbox investors Animoca Brands and Brinc. The equity investment in each startup will be between $150k to $250k, plus $150k worth of SAND tokens. It will also make in-game land plots or LAND, their in-game NFTs.

YouTube CEO Hints at NFT Integration in Letter to Creators

YouTube CEO, Susan Wojcicki wrote her annual letter to creators that the video behemoth is considering non-fungible tokens to help creators capitalize on the emerging technologies. She didn’t mention any specifics except “that NFTs and DAOs (decentralized autonomous organizations) present a previously unimaginable opportunity to grow connections between creators and their fans.” YouTube’s head of gaming recently left to go to Polygon Network (MATIC), an Ethereum side-chain focused on crypto gaming.

MAJR Take: I’m proud to say we’ve been WAY ahead of this trend and MAJR Inc is building technology that does exactly this using NFTs and DAOs. Excited to share with everyone this year.

Diem Reportedly Trying to Sell Assets—Is This the End of Facebook’s Stablecoin Ambitions?

Facebook’s (Meta) crypto ambitions never had the chance due to regulatory oversight. The company’s stablecoin project drew enough bad attention that US government agencies prevented them from even launching. It probably didn’t help that Zuckerberg and his company aren’t known for keeping their word or protecting their customers. Regardless, they’re shutting down the project called Diem and selling their assets. It’s been reported that they’re selling their assets to crypto centric bank, Silvergate Bank for $200 million.

More on Crypto

Polygon (MATIC) sees a strong oversold bounce after $250B crypto market rebound

OpenSea Is Adding Solana NFTs, Phantom Wallet Support: Leaked Images

Superdao Raises $10.5 Million to Build an 'All-in-One' DAO Platform

MACROFed Interest-Rate Decision Tees Up March Increase

Fed Chair, Jerome Powell issued their monthly FOMC statement addressing the nation on the status of the economy and their path forward. For the last two months, the Fed has pivoted from being extremely dovish to aggressively hawkish, however it’s only been verbal, nothing has changed yet from an operations standpoint. In the meantime, markets across the board - crypto, stocks and bonds have all corrected embracing for tight monetary conditions. In summary, the Fed wants to taper their $105 billion monthly asset purchases by March, and after they want to increase the federal funds rate by 0.25 BPS, with possibly another hike in May. After the hikes, they’d like to begin running off their $9 trillion balance sheet. BUT, Powell left the door wide open to not do anything at all if economic conditions worsen.

MAJR Take: It’s very important that people actually watch the video of Powell addressing questions from reporters (below). It doesn’t take an economist to know when someone doesn’t have the answers or actual control. The Fed wants to tighten but knows they’re stuck and can’t have markets crash with a slowing economy. Honestly, this is where a central bank digital currency would come in handy. They could tighten from a monetary standpoint, and send relief funds to the ones most affected by inflation. Don’t hold your breath.

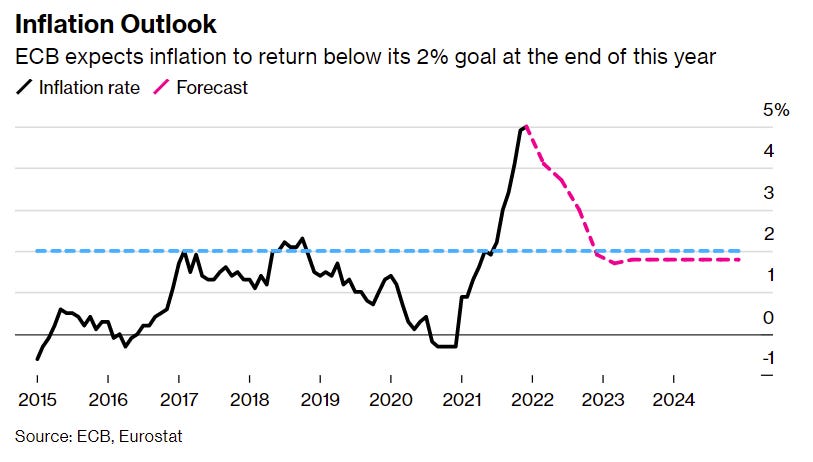

Inflation Outlook No Reason for ECB to Change Track, Simkus Says

The European Central Bank seems to be the only central bank sticking to the plan and not following the Fed’s lead regarding rate hikes. The ECB expects inflation to be transitory and plans to keep rates low to support the uncertain economy. However, markets are pricing in hikes this year starting in October, while economist think rates won’t move until 2023. European inflation is still at record highs with 5% CPI in December.

Bank of Canada Says Rate Increases Are Coming

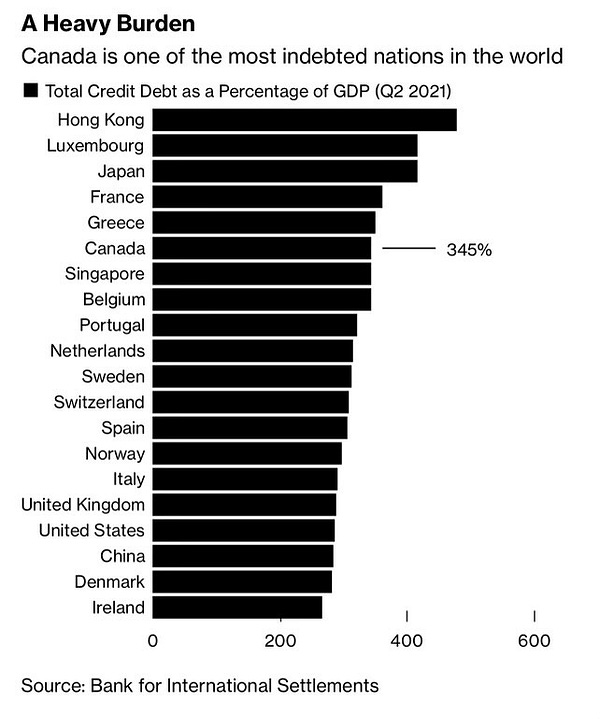

The Bank of Canada expects inflation to remain close to 5% for the first half of the year before coming down to 3% later in 2022. The Bank of Canada ended their large scale asset purchases this past fall, putting an end to QE and are preparing to tighten interest rates starting in mid-March. Authorities believe the economy is much healthier and expanding at rapid rate, however, it’s estimated that Canada is one of the most indebted nations on the planet with an estimated 345% debt to GDP. We will see how raising interest rates will effect the economy and ability to service debt payments.

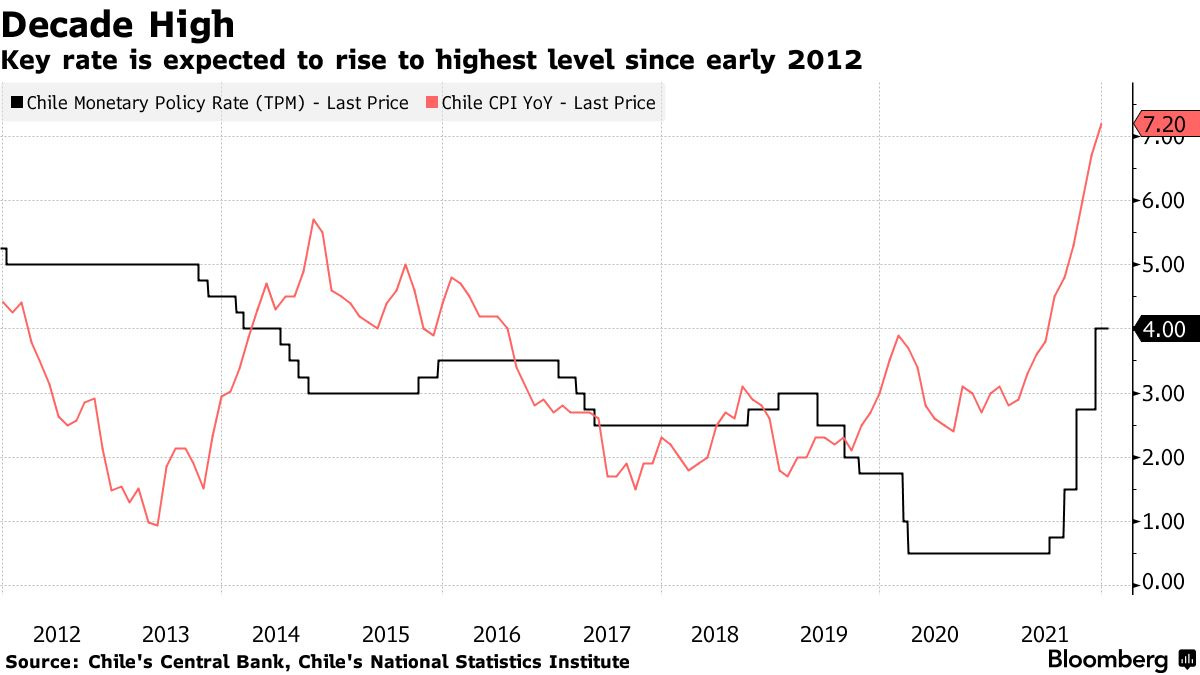

Chile to Lift Key Interest Rate to Decade High: Decision Guide

The central bank of Chile is raising rates to record highs to help curtail the 7% inflation. This will be the country’s third straight rate hike of 125 BPS to 5.25%. Economists expect steeper hikes to damper inflation, 150 BPS. Inflation has gone past their 3% target after putting billions of dollars of fiscal support into the economy during the pandemic.

More on Macro

IMF Sees Supply-Chain Bottlenecks Slowing Global Growth in 2022

Stocks shed gains, Treasury yields jump as Fed signals rate hikes could come 'soon'

U.S. responds to Russia security demands as Ukraine tensions mount

MEDIAFed Chair Jerome Powell holds news conference after rate decision — 1/26/22

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.