MAJR News 083

Crypto markets get hammered, Bitcoin finds some stability around $35k as other digital assets fall further, Fed officials begin discussions for March moves, Inflation hits different across the US

@cristiangodoy_nft

MAJR NEWS BRIEF

Videos

Polymath and crypto maximalist, Balaji Srinivasan joins Robert Breedlove on the What is Money Show for a multi-episode series exploring sovereignty in The Digital Age, geopolitical game theory, the future of statism, and how Bitcoin/crypto fits into the picture.

Top Stories

BITCOINFirst Mover Asia: Bitcoin Stabilizes Above $36K as Investors Await Next Fed Meeting

Bitcoin gained 8% in the past 24hrs after briefly trading below $34k. The market is in a waiting pattern for the Fed to reveal their plans on Wednesday for a potential rate hike in March. Bitcoin’s Relative Strength Index (RSI) was hovering around the 50 market after recovering from previous oversold levels under 30, which indicates that bitcoin was trading below its fundamental value.

Bitcoin Dominance Rate Rallies, Leaving Altcoins Behind

Bitcoin’s market dominance has been trending around 40% or below since May’21, but its a seen a strong bounce given the market correction and is approaching resistance levels around 43%-44%. On the longer term charts, both the MACD and RSI are showing considerable bullish divergence and could suggest a strong upward move. This would make sense given the flight to safety now that the market has corrected and is in oversold territory.

More on Bitcoin

No regrets for NYC mayor receiving his first Bitcoin paycheck during dip

MicroStrategy Share Prices Fall 15% Following SEC Accounting Ruling

CRYPTOCrypto Sell-Off Wipes $700B From Industry Market Cap So Far in 2022

The past month has been extremely painful for the crypto market which as seen it’s total market cap lose over $700 billion going from $2.3 trillion to $1.6 trillion. Bitcoin is down 28% year to date, while Ethereum and other top tokens are down 40% or more since the beginning of 2022. The market hit a high in November 2021 with over $3.1 trillion in total value. The term “crypto winter” is being through around, as the timing and volatile price action feels like previous corrections. In 2013 bitcoin suffered a 70% drawdown from $230 to $68 and in 2018, the crypto market plummeted from $850 billion $130 billion. It took almost three years to recover, which was definitely a crypto winter. So, people are wondering if we’re in the same scenario right now.

MAJR Take: I would argue that this time is completely different than previous cycles when coins were trading on complete speculation. Bitcoin was still a hobbyist and fringe concept and Ethereum was in a primitive state, while tokens were mainly vaporware hype driven off whitepapers. Billions of institutional dollars are flowing into space and real use cases and products are live. Not to mention, the growth opportunity that crypto provides in an investment landscape that presents little opportunities for yield. We’re in a decade long bull market and right now we’re seeing the effects from macro-chop and portfolio reconstruction due to record inflation and emotional central banks. Be cautious, but patience is key.

Metaverse, Layer 1 Cryptocurrencies Jump as Grayscale Updates 'Assets Under Consideration'

Grayscale, the largest digital asset manager is exploring a laundry list of tokens to create a new investment product. The list includes many alternative layer 1s, metaverse and gaming tokens, along with some broader utility tokens. They did mention that the list is not indicative of coins that will 100% be listed, but only under consideration, and there may be some tokens that they’re exploring that aren’t on the list as well.

MAJR Take: These are the types of alpha opportunities that are so apparent in the crypto space. If you’ve been reading this newsletter and doing your research, you should be able to see a pattern with top token projects that are de-risked for the next year or so, especially as large institutional players like Grayscale and Coinbase are telling you which tokens they’re thinking about listing.

Solana User Experience 'Not What It Should Be', Says Co-Founder as Network Struggles

The Solana network has seen multiple issues over the last 6 months and even network outages slowing down or completely preventing transactions. Censorship resistance and being unstoppable are two of the main reasons for blockchains to exist and Solana is losing user confidence down 42% in the last week. The CEO Anatoly Yakovenko is chalking it up to growing pains as it scales to meet demand from users. In January, the blockchain has seen a partial outage for almost 9 days as some transactions were stalled or failed.

More on Crypto

Ethereum Foundation Kills 'ETH 2.0' in Favor of 'Consensus Layer' Rebrand

OpenSea Exploit Sees Bored Ape Yacht Club NFT Sell For $1,700 in Ethereum

MACROFed Steps Up Deliberations on Shrinking Its $9 Trillion Asset Portfolio

Today, Federal Reserve officials begin their conversations about trimming their asset monthly asset purchases. Their target is to end by March, and it’s forecasted that they will make at least one rate hike. The Fed’s portfolio, also referred to as their balance sheet has doubled since the start of 2020 and now sits around $9 trillion or almost 50% of US GDP. Fed Chair Jerome Powell said their tapering will be months not years, which is historically aggressive. Fed officials have also stated that moving forward that would like to rely on adjusting the federal funds rate vs. the scale of their asset purchases and size of the balance sheet. However, there’s not much room to maneuver when rates are near 0%, and therefore could suggest several rate hikes going forward.

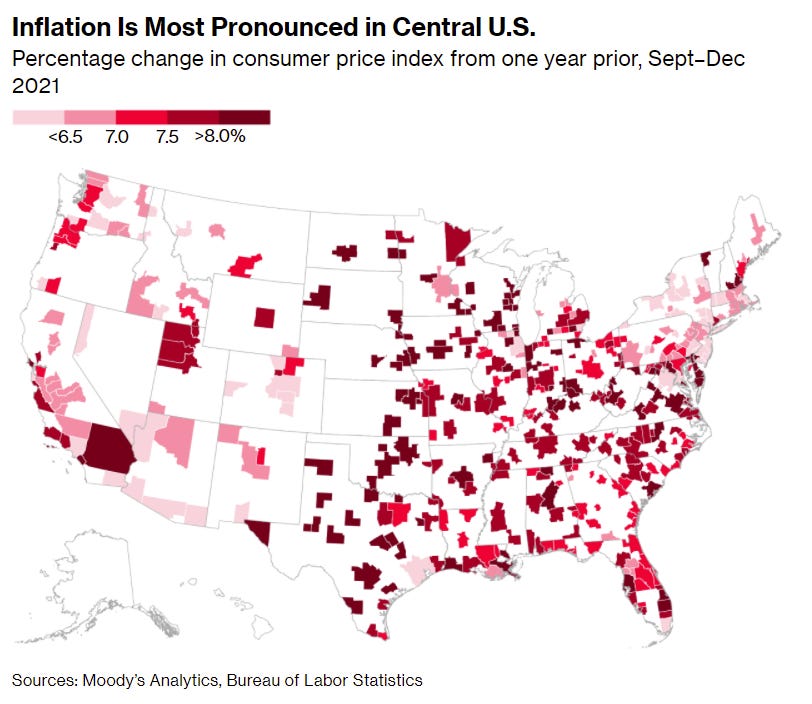

Red-Hot Inflation Grips Pockets of U.S. Midwest and South With Rates Over 9%

America’s heartland and southern states in the Midwest and south are seeing higher price inflation than the national average in CPI, 7% in December compared to their 9%. Smaller towns and cities with lower population sizes have been seeing higher prices. Given the fact that inflation is different for everyone, especially across income classes, it will be very difficult for the Federal Reserve to get inflation under control without running the risk of extreme tightening throwing the economy into recession.

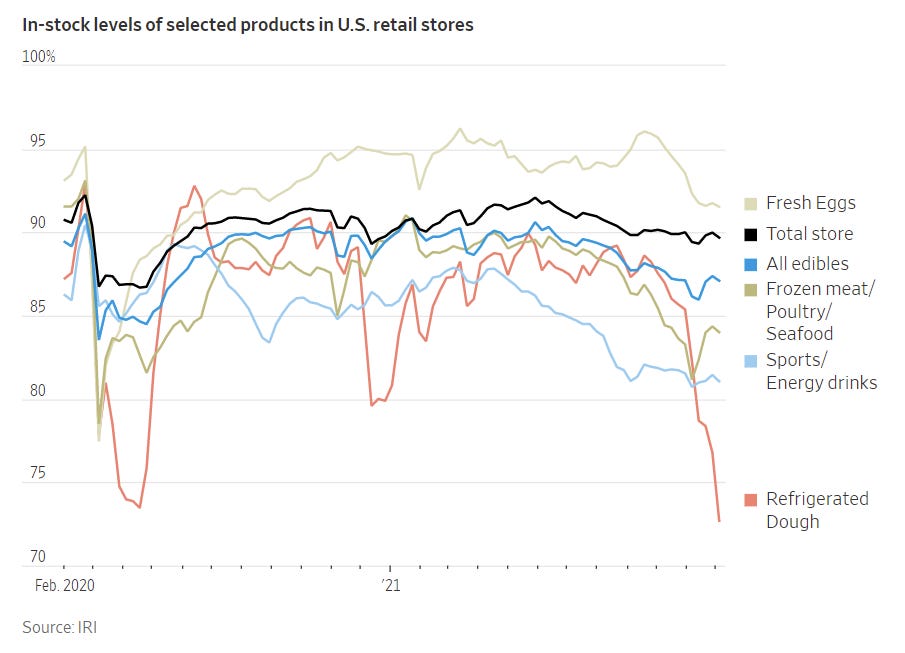

U.S. Food Supply Is Under Pressure, From Plants to Store Shelves

The pandemic and the recent spread of Omicron has been causing stress within the US food system as workers are calling in sick leaving gaps within the processing plants and supermarkets. US retailers hit 86% for in-stock levels for food products which is lower than last summer and pre-pandemic levels of 90%. The same situation persists with packaged food and meatpacking plants as shortages linger and staffing is tight causing lower production across meat and chicken processing, down between 4%-9% from a year earlier.

Omicron Slows the Global Economy, Hitting the U.S. Particularly Hard

More on Macro

China’s ‘Little Giants’ Are Its Latest Weapon in the U.S. Tech War

U.S. Puts 8,500 Troops on Alert to Bolster NATO Near Ukraine

Google Deceived Users About Location Tracking, States Allege

MEDIASovereignty in the 21st Century | The Balaji Series | Episode 1 (WiM115)

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.