MAJR News 082

Intel is creating bitcoin mining chips, BTC outflows continue - however we could be nearing the bottom, There's a digital real estate boom & the Sandbox is leading, Gold finally moves due to inflation

@pislices

MAJR NEWS BRIEF

Videos

Luke Gromen talks with Preston Pysh about all the important macro trends for the 1st Quarter of 2022.

Top Stories

BITCOINIntel Closes Sale for Its Upcoming Bitcoin Mining Chip

Intel, the worlds biggest chip manufacture is developing bitcoin mining ASIC (application-specific integrated circuit) hardware, technology designed specifically for mining bitcoin. They already have one buyer, a bitcoin miner GRIID. GRIID’s deal with Intel is for their BZM2 ASICs and entitles them to purchase at least one quarter of all qualified Intel designed chips through 2025. GRIID plans to go public through a SPAC merger and is valued at over $3 billion.

MiamiCoin has now raised $24.7 million... but who will benefit?

New York City and Miami are paving the way for bitcoin adoption at the local level in the US. They are both working with the project CityCoins that uses the Stacks blockchain to pay citizens holding the STX token a dividend in bitcoin. MiamiCoin has raised over $24.7M worth of STX and NYCCoin has raised $30.8M in STX, which sits in their treasuries. It has yet to be determined how the dividend will be allocated, but one can expect more cities to follow suit as an additional benefits to provide to constituents.

MAJR Take: We will be doing a deep dive on the Stacks (STX) blockchain and token to provide a better understand how their protocol works with bitcoin.

Bearish sentiment may soon abate according to Coinshares and Bitcoin metrics

Institutional outflows from bitcoin products (Grayscale, ProShares, CoinsXBT) has been negative 4 out of the last 5 weeks totaling $55M. This comes at a time when the “Fear and Greed Index” has been at extreme fear for the last two months and spot buying has hit a six-month low. These subdued markets have a pattern in bitcoin and the last time the real bitcoin trading volume was this low was back in July 2021 at the end of the mini 2021 bear market, which was followed by an aggressive pump to new all-time highs during the fall, peaking in November at $69k.

MAJR Take: We’re going through an unprecedented period in time in global markets. So many moving pieces coming together at once. Investors have never been through something like this - the end of a long term debt cycle and possibly the busting of a sovereign debt bubble, a global pandemic that happens every 50-80 years, and a Fed that’s aggressively tightening into a soft recovering market with decade high price inflation as the largest generation is leaving the workforce. All happening in parallel with the emergence of a highly disruptive technology for money and value. Needless to say, everyone is flying blind.

More on Bitcoin

Bitcoin Holding Support Above $40K; Faces Resistance at $43K-$45K

Block’s Cash App adopts Lightning Network for free bitcoin payments

CRYPTOLAND Rush: Why Crypto Whales Are Buying Up Virtual Real Estate

The digital real estate boom is happening right now in the world of crypto and the action is happening on Animoca Brands’ The Sandbox (SAND) blockchain based game. The Sandbox has partnered across industries providing LAND sales for parcels of digital property (NFTs) and Binance and NFT Collector WhaleShark are emerging as the new land barons. While, the crypto market seems to trending sideways, digital real estate acquisition is speeding up as more players become aware of the space and network effects start to secure value in different metaverse projects. All LAND and SAND owners stand benefits from the economic incentives happening within the Minecraft like world.

Secret Network offers $400M in funding to bring others in on the secret

Secret Network is a privacy focused smart contract blockchain and is looking to increase adoption for its ecosystem with a new $400 million incentive fund. The network has four components called Secret Tokens, Secret Bridges, Secret Finance and Secret NFTs. The accelerator fund is backed by prominent VCs / players in the space - BlockTower Capital, Arrington Capital, Figment, and Spartan Group. The fund will be focused on privacy enabled web3 applications, network infrastructure and tooling. Top-tier investment firms such as Alameda Research, Defiance Capital, CoinFund and Hashkey have all taken positions in SCRT tokens.

'It’s Time': NBA Top Shot Maker Dapper Labs Set to Launch NFT Platform for UFC

Dapper Labs and the UFC are partnering to bring NFTs to the ultimate fighter and replicate the success that was seen with the NBA Top Shot NFT product running on the Flow blockchain. The first pack will feature NFT moments from fighters such as Francis Ngannou, Amanda Nunes, Kamaru Usman, Rose Namajunas, Derrick Lewis, and Justin Gaethje. Dapper Labs also signed deals with the NFL and LaLiga.

More on Crypto

Tom Brady’s Autograph NFT Platform Raises $170M From Andreessen, Others

Dogecoin-Friendly AMC Rewards 580K Shareholders With Free NFTs

MACROFed Will Likely Hike Eight Times to Curb Inflation, Marathon Asset CEO Says

CEO and co-founder of Marathon Asset Management said that the Fed would probably need to increase interest rates 8 times to curtail inflation and would most likely cause a recession. He expects US economic growth to slow with tighter monetary conditions, but doesn’t expect a wave of defaults since most of the companies have increased their prices to to buffer a downturn and decreased consumer spending.

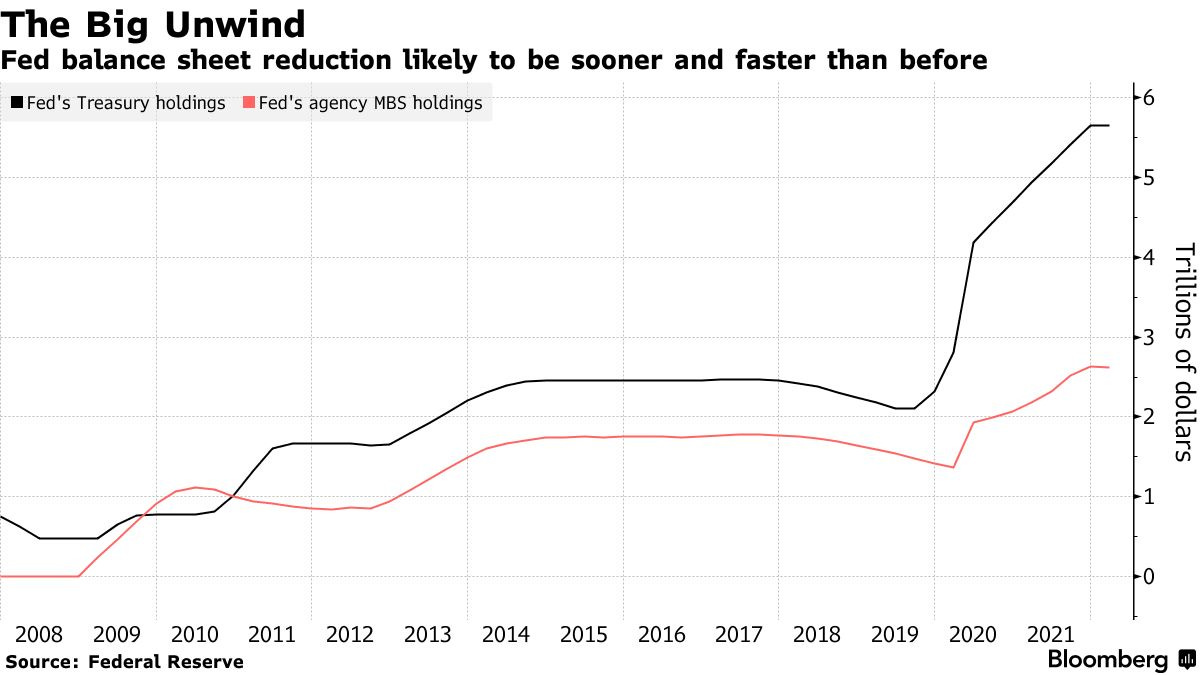

Markets Tremble at Fed’s Unprecedented Double-Edged Tightening

The Federal Reserve has been telegraphing their moves in hopes that the market will tighten for them. Their aggressive approach has spooked investors because they’re talking about raising raising rates, tapering their monthly asset purchases and shrinking their balance sheet all at the same time. Something that hasn’t been done before. No actions have been taken yet, but that’s the point. If asset prices come down, then the wealth effect goes down, causing people and companies to be more careful with their spending and investment in hopes to damper inflation. The Fed will need to be more careful and cautious with their actions vs. their rhetoric to prevent a recession, but its safe to assume that agenda is set for the near term and tighter policy will be implemented.

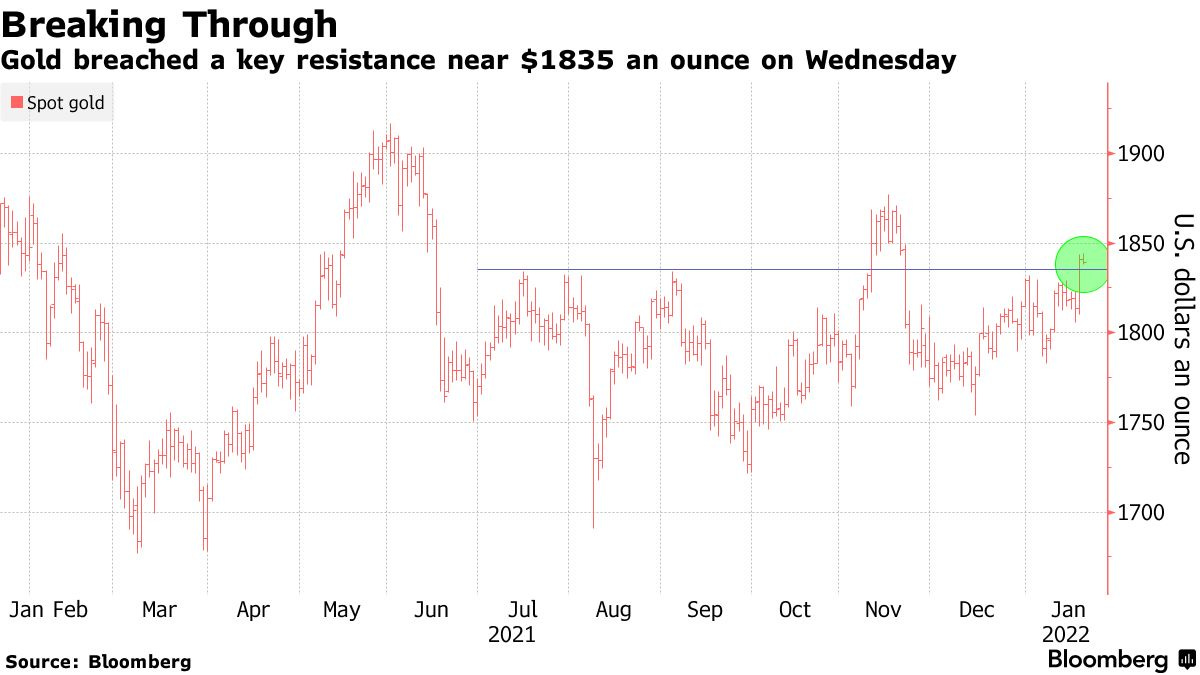

Gold at Highest Since November as Traders Seek Inflation Hedge

Gold is finally responding to the inflation worries and broke through a key resistance level of $1,835 per ounce. Volatility in stocks and risk assets are driving investors to safe havens such as as commodities. Bullion backed ETFs saw their biggest inflows since November.

China Central Bank Cuts Benchmark Lending Rates

Chinese monetary authorities are responding to the slow down and economic worries in their country by cutting key interest rates, which has been welcomed by investors as Chinese stocks rallied across the board. The PBOC cut it’s benchmark lending rates for the second straight month in a row. On Thursday it cut the one-year loan prime rate to 3.70%, dropping it by 10 BPS and the five-year loan prime rate was lowered by 5 BPS to 4.60%. It’s the first time in 21 months that China has cut the two rates in the same month.

More on Macro

Canada Inflation Reaches 30-Year High, Placing Spotlight on Central Bank

German Benchmark Bond Yield Briefly Turns Positive for First Time Since 2019

SEC Under Pressure to Implement Agenda in 2022, While Democrats Control Congress

MEDIABTC061: tGlobal Macro 1Q 2022 w/ Luke Gromen

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.