MAJR News 081

Rio gives 10% discount on taxes paid in bitcoin, More NBA Stars take part of their salary in bitcoin, Digital land prices surge, Bond yields spike, China's economy slows down and eases monetary policy

@patternbase

MAJR NEWS BRIEF

Videos

In this episode of On The Margin, Mike is joined by guest Danielle DiMartino Booth, CEO & Chief Strategist for Quill Intelligence. As a former advisor at the Federal Reserve Bank of Dallas, Danielle provides a unique insight into the Fed's policy decisions throughout 2022. Danielle shares her thoughts on the dilemma's the Fed faces going into 2022, how the Fed exacerbated wealth inequality in America, Modern Monetary Theory, Universal Basic Income, her outlook for the U.S Dollar & so much more.

Top Stories

BITCOINRio de Janeiro Eyes Treasury Investment in Crypto and Discounts for Taxes Paid in Bitcoin

Eduardo Paes, the mayor of Brazilian city Rio de Janeiro pledged to invest 1% of the city’s treasury into cryptocurrencies with plans to transform Rio into a crypto hub. They also announced a 10% discount on taxes for anyone paying in bitcoin.

NBA Stars Buy Bitcoin

NBA stars Andrew Iguodala and Golden Warriors teammate Klay Thompson announced that they are taking part of their salaries in bitcoin via the mobile payment service, Cash app. They join other professional athletes adopting bitcoin such as Aaron Rodgers, Odell Beckham Jr., Russel Okung, Trevor Lawrence, Tom Brady and Sean Culkin.

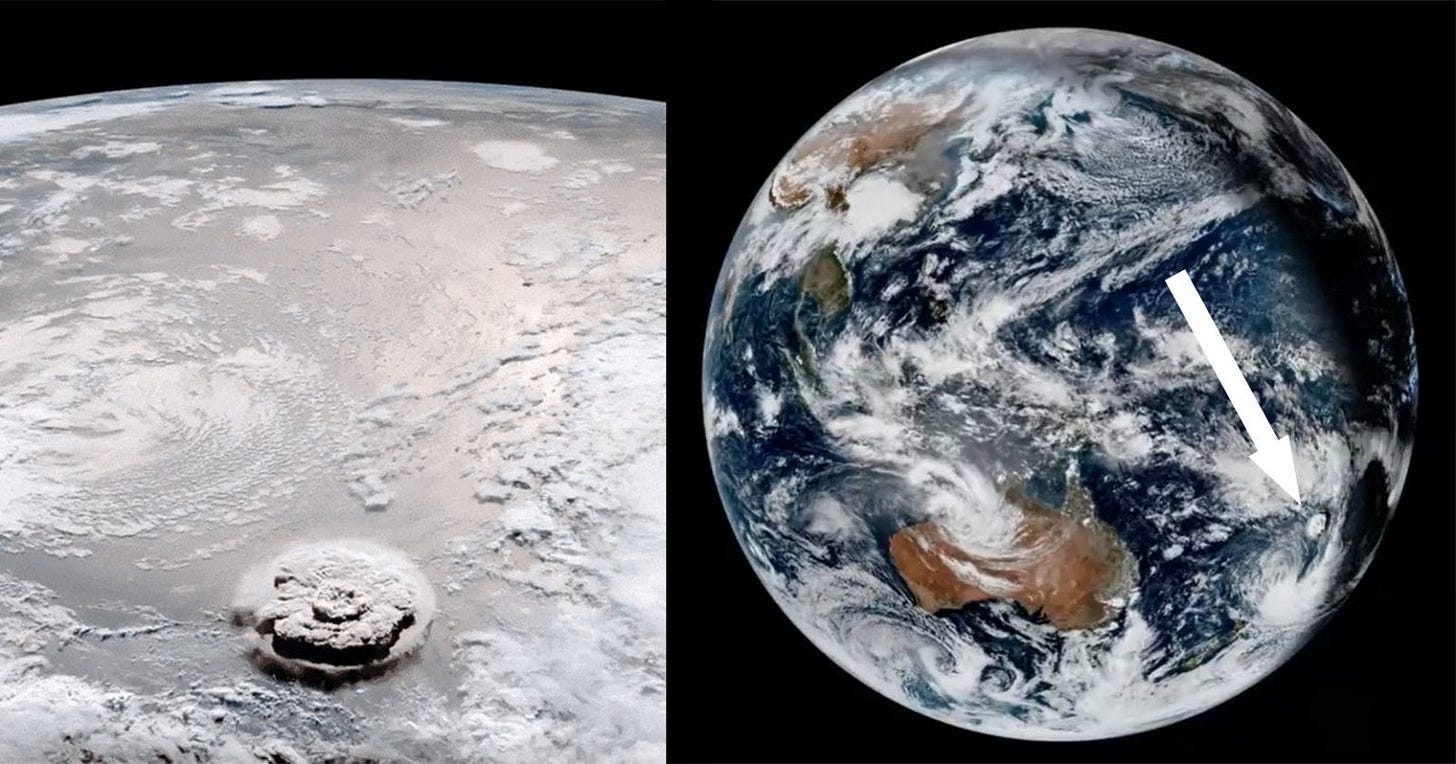

Tonga accepts Bitcoin donations amid tsunami onslaught

Tonga was hit by a devastating underwater volcanic eruption causing chaos and tsunami waves in the region. Tongan lawmaker set up a bitcoin wallet address where people can donate bitcoin for relief funds. The Kingdom of Tonga is surrounded by 21 volcanos and the lawmaker added that they plan on using the geothermal energy to mine bitcoin in the near future.

More on Bitcoin

Jack Dorsey Says Block, Formerly Square, Is Getting Into Bitcoin Mining

$500,000 Bitcoin Donation Prompts Renewed Investigation Into Capitol Hill Riot

Arkansas to Lure Remote Tech Workers With ‘Bitcoin and a Bike’ Sweetener

Credit Rating Agency Moody’s Sounds Alarm on El Salvador’s Bitcoin Policy

CRYPTOLand Prices Surge on Cardano Metaverse Project Pavia

Pavia, the first virtual world built on Cardano’s smart contract blockchain has sold nearly 60% of its 100k virtual plots. Pavia’s native token was airdropped to the 8,300 NFT landowners. Pavia’s token price is just over $0.20 with a market cap of $107M. The project comes during a time when virtual land is booming across blockchains and being sold for millions of dollars. Individuals can buy the virtual land on Cardano’s NFT marketplace CNFT.

FTX Launches $2 Billion Web3 Venture Fund Led by Lightspeed’s Amy Wu

The cryptocurrency exchange FTX will launch a $2 billion venture fund for FTX Ventures to invest in variety of web3 businesses. The fund is being led by Amy Wu, previously a General Partner at Lightspeed Ventures, who led their gaming division. FTX Ventures will largely focus on web3 gaming, consumer and social applications. This fund will be the 3rd largest crypto focused VC fund, after a16z and Paradigms $2B+ funds.

Ethereum EIP-1559 upgrade launches on Polygon to burn MATIC

Ethereum’s EIP-1559 burns a portion of the ETH transaction fees creating deflationary pressures on the price of ETH by ultimately making it more scarce. The same proposal launched on Polygon’s layer two scaling network. The upgrade went live on Monday and now portions of the their native token MATIC will be burned. Since going live on Ethereum in August, Ethereum as burned 1.54 million ETH or $5 billion.

More on Crypto

Animoca Brands Valuation More Than Doubles to $5.5B in Three Months

NFT Platform OpenSea Hits Record $3.5B in Monthly Ethereum Volume

World of Women Ethereum NFTs Follow Bored Apes to Hollywood, Prices Surge

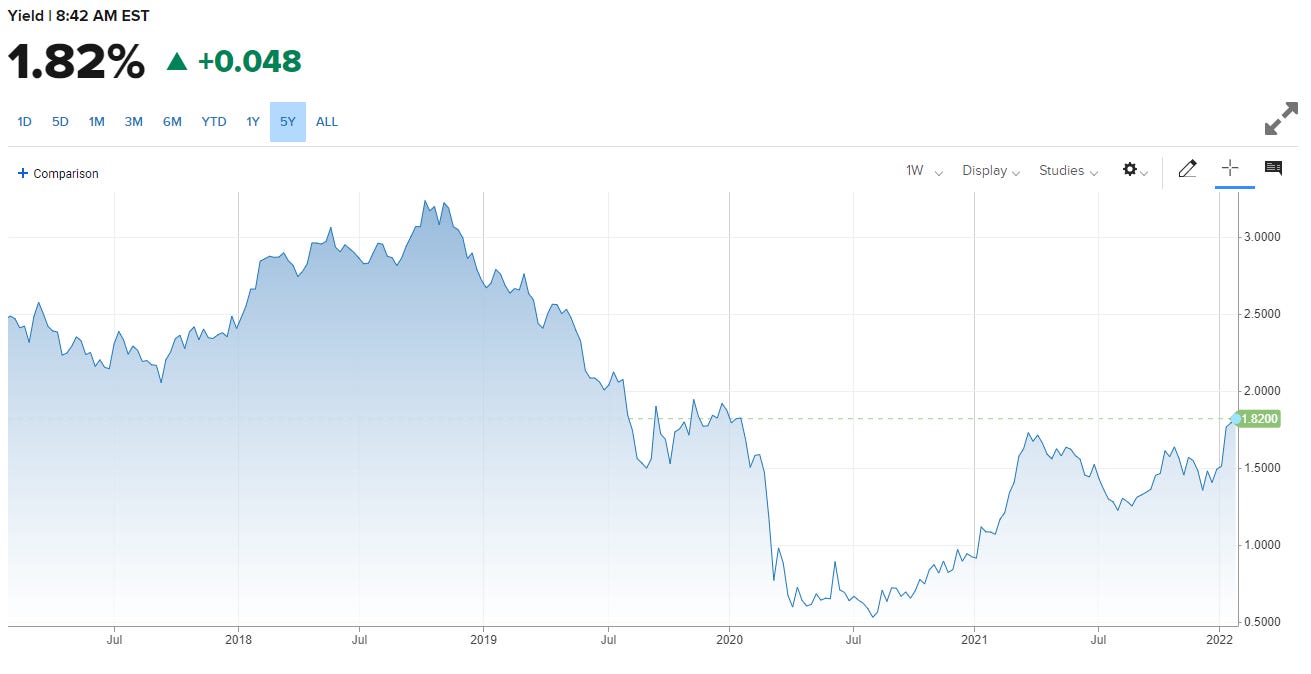

MACROBond Yields Hit Two-Year High as Stock Futures Fall

Bond yields hit a two-year high. The benchmark US-10Y Treasury yield ticked 1.818%. Prices fell internationally as yields for 10Y German bunds traded as high as -0.05% up from -0.061%. Futures for tech stocks pulled back as well, the S&P500 was down 1.2% and the Nasdaq declined 1.8%. It was only in October when investors were under the opinion that perhaps one rate hike was in the near future for 2022, but now we have 4 possible rate hikes this year, record inflation with CPI at 7% in December and a tight labor market (more jobs than workers, therefore higher wages).

MAJR Take: These are nominal rates and even nominal rates in Germany and parts of Europe are negative. Every bond on the planet is underwater with investors guaranteed to lose purchasing power with 7% CPI. That’s only the number that authorities are sharing, when the real cost of inflation is much higher, probably double given the expansion of the money supply and the rise prices for housing, rents, food, energy, financial assets, etc. Bitcoin should perform very well in this environment once investors have repositioned themselves and there’s no where else to go. Cash is trash, equities are overvalued and let’s face it - the economy is not as hot as everyone thinks.

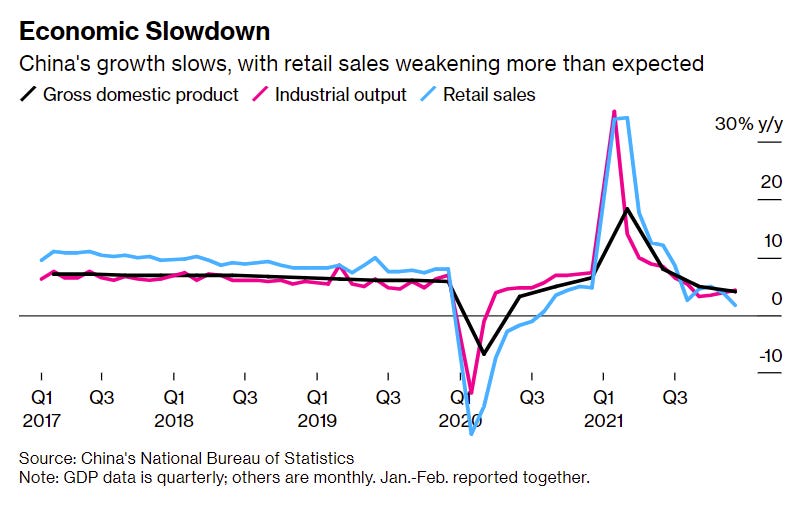

China Seeks to Cushion Blow of Economic Pain as Momentum Slows

China’s economy is slowing down and only expanded 4% in Q4’21, the slowest since Q2’20 at the start of Covid. Authorities are reversing their tight monetary policy to put a floor under the economy, cutting its key interest rate for the first time in 2 years, lowering the rate at which the PBOC lends to banks by 10 BPS. The PBOC also lowered its 7 day reverse repo rate from 2.2% to 2.1% and injected $110B more of liquidity into its financial sector in the form of one-year loans. Economists expect a continued slowdown and more policy changes including their tough stance on Covid restrictions as retail sales are down, they’re expecting less demand from exports and the real estate sector continues to struggle.

MAJR Take: While the world is tightening in the face of inflation with possibly a weak Q4’21 earnings season, China is bracing for as slow down with more accommodative policy. If China, the world’s largest economic trading partner is slowing down, it’s most likely that the world is going to slow down, yet the western world is tightening policy. Generally, tight policy is meant for a booming economy.

Full Recovery in Global Labor Market Could Take Years

The pandemic shocked global economies and the recovery is uneven globally. While western economies are approaching full employment, other parts of the world are still largely set back with high unemployment. Globally, the number of unemployed workers fell from 214M to 207M and is expected to fall to 203M in 2023, but its still well above the 186M recorded in 2019. Returning to pre-pandemic levels could take an additional two years.

MAJR Take: Overlay the affects of high inflation across the globe, especially in developing countries, then these numbers look a lot worse and will drag on the economy as less workers have less means with less purchasing power in the face of higher costs and a stronger dollar.

Omicron, Inflation Drive Down U.S. Growth Outlook

Economists are trimming their forecasts for GDP growth in the first quarter and for the year from 4.2% to 3.3% due to high inflation, continued supply chain constraints, the surge in Omicron and now tighter monetary policy. While, the US labor participation rate is picking up, there’s still a shortage of workers putting upward pressure on wages to incentivize job creation, an estimate 4% increase in wages. However, economists seem to expect inflation to cool off by years end, but still high at 4.5%. The biggest worry is the Fed chasing inflation, which they haven’t in decades, which could result in a recession. In Oct’21, only 5% of economists expected a rate hike in March and over 40% expected no rate increases in 2022 at all. Jaime Dimon, CEO of JPMorgan thinks we could see 7 rate hikes to combat inflation.

More on Macro

BOJ Raises Inflation Expectations Amid Pandemic-Related Supply Shortages

U.S. Retail Spending, Manufacturing Drop as Omicron and Inflation Surge

MEDIAWhat Will Happen if the Fed Raises Rates with Danielle DiMartino Booth

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.