MAJR News 080

BTC longs get liquidated - $340M, Billionaire investor Bill Miller has 50% of his assets in BTC, PayPal is exploring their own stablecoin, Fed Vice Chair Resigns, China's CBDC digital wallet is live

@doodles

MAJR NEWS BRIEF

Videos

Nic Carter talks about the global macro situation for Bitcoin, Web 3.0, Bitcoin mining, and much more. Nic is a venture capitalist and prominent thought leader in the Bitcoin community. He has contributed some of the most noteworthy and highly shared articles and essays on Bitcoin over the past five years.

Top Stories

BITCOINBillionaire Investor Bill Miller Now Has 50% of His Personal Wealth in Bitcoin

The billionaire investor Bill Miller known for beating the S&P 500 15 years in a row revealed that 50% of his personal wealth is in bitcoin. Thinking of bitcoin as “digital gold” was the framework that helped him become a bitcoin bull. He thinks the average investor should have at least 1% of their net worth in bitcoin given the asymmetric upside and for protection if the financial system collapses.

Crypto Traders See $343M of Liquidations as Bitcoin Dips Below $40K

More than 109k bitcoin bulls going long at $40k on margin were liquidated, with over $340M lost in the last 24hrs as the price briefly dropped below $40k. Traders making leveraged bets on ETH saw $89M in liquidations. Liquidations are very common in crypto because of the fast and volatile nature of the markets and some foreign exchanges allow traders to use 100x leverage. Traders are liquidated because they have insufficient funds to cover their margin call.

Single inactive volcano has 90% chance of powering El Salvador's Bitcoin City, according to president

The president of El Salvador Nayib Bukele stated that they’ll be using the Conchagua volcano located on the eastern boarder to provide electricity to their Bitcoin City project. The inactive volcano will provide 100% clean geothermal energy. In November, the president announced that the Bitcoin City will be funded with $1 billion in BTC bonds provided by Blockstream, a bitcoin infrastructure company. Residents of the Bitcoin City will apparently pay no capital gains, income, property or payroll taxes.

More on Bitcoin

CRYPTOPayPal Says It Is 'Exploring a Stablecoin' After Dev Discovers It in Code

PayPal is exploring their own stablecoin. The company first jumped into crypto by enabling bitcoin purchases, before allowing users to buy and hold other digital assets such as Ethereum and now users can buy crypto using their Venmo app. Launching their own stablecoin seems like a natural fit for the company that was initially started to disrupt money with digital tech. PayPal has a market cap of $220 billion and could see big bump if they rollout a stablecoin. The stablecoin market caps are huge and growing fast - Tether (USDT - $80B), USD Coin (USDC - $44B) and Binance USD (BUSD - $14B).

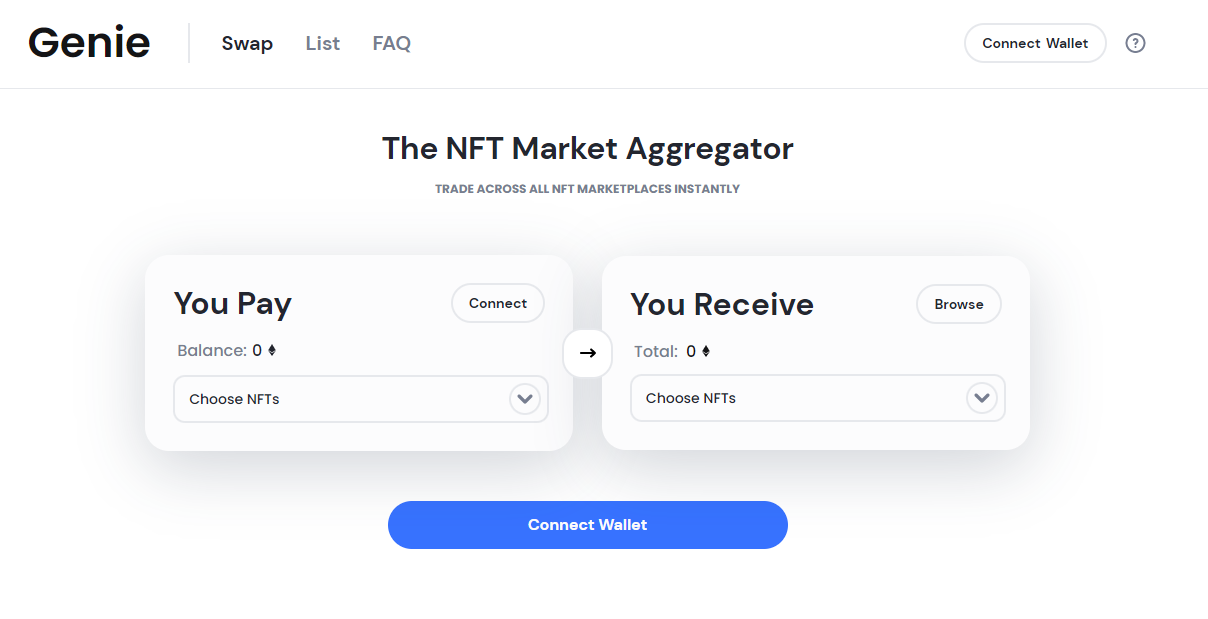

How Genie Is Driving Ethereum NFT Bulk Buying and 'Floor Sweeps'

The NFT market has not slowed down compared the other markets. The largest decentralized marketplace for NFTs, OpenSea has already seen $1.4B in trading volume in the first week of 2022 and volumes could increase with Genie. Genie is an Ethereum marketplace aggregation tool that lets users buy NFTs in bulk to help save on gas. Users can buy up to 60 NFTs at once from multiple marketplaces - OpenSea, Rarible and NFTX in a single transaction. The app is starting to pick up steam and has already increased its trading volume by 50% in one week from $25M in ETH. This app is great for big collectors and digital artists by allowing them to collect many items at once and raises the price floor.

CBDC wallet tops mobile app store charts in China

China’s digital wallet for their centralized digital yuan is the most downloaded app in the Chinese app store. Developed by the Digital Currency Research Institutes of the People’s Bank of China was released on Android and Apple devices last Tuesday. The app is available in select cities, but country started rolling out pilots for the digital currency back in April 2020 and plans to enable CBDC payments for the 2022 Winter Olympic Games in Beijing scheduled for next month.

Grand Theft Auto Maker Take-Two Eyes 'Web3 Opportunities' With Zynga Acquisition

Take-Two Interactive, the game developer behind the Grand Theft Auto franchise bought mobile game developer Zynga for $12.7 billion. Zynga is known for hits like FarmVille and Words with Friends, but prior to the acquisition the company pivoted into blockchain gaming and NFTs. They planned on integrating NFTs into existing IP and creating new blockchain games from scratch. The CEO of Take-Two Interactive said the acquisition will allow their company to pursue new web3 opportunities.

More on Crypto

Developer of 'The One' California Mega-Mansion Wants to Tokenize the Property

New NFT marketplace LooksRare allows traders to earn rewards

MACROFed Vice Chairman Richard Clarida to Resign

Fed Vice Chairman Richard Clarida reigned from the central bank this past Friday, which was two weeks before his term was set to end. Mr. Clarida was one of the Fed officials in question for his trading activities throughout the pandemic. The former Fed official was selling shares of specific stocks on February 27th 2020, which was one day before Fed Chair Jerome Powell announced that the Fed will immediately cut rates if the pandemic worsened in the US. Then the market crashed on March 12th 2020. Clarida’s financial transactions weren’t disclosed until May 2021. These transactions flew under the radar until two other Fed officials, Boston Fed President Eric Rosengren and Dallas Fed President Robert Kaplan put in their resignations after questionable trades came to light. These incidents have caused reputational issues for the Federal Reserve who’s supposed to be acting as independent party, but seems to working in tandem with the Treasury and White House, and now has ethical issues with insider trading allegations.

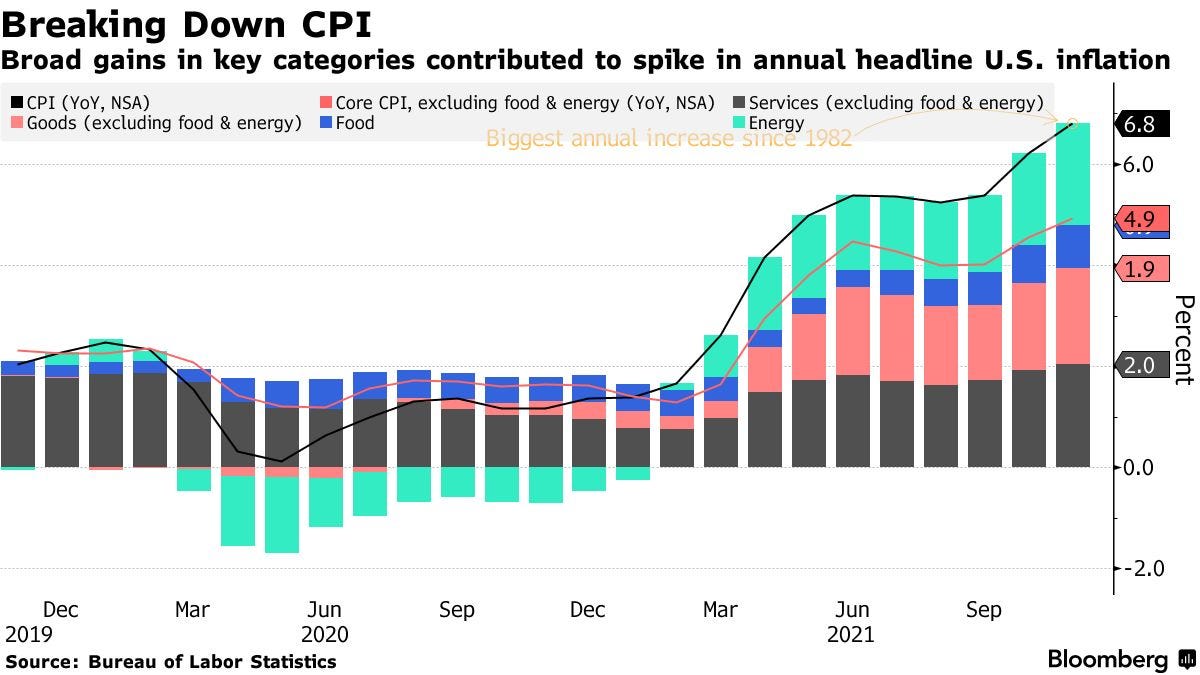

MAJR Take: Money and power is a confidence game and it’s no different for the Federal Reserve. Their confidence has been in question since the first US central bank was established in 1791 before it was abolished in 1811. The current Fed is the America’s 3rd attempt at a central bank formed in 1913. The Fed has been losing faith with the public for decades as corporate and banking bailouts have become more regular and most recently calling inflation “transitory” before reversing in November when CPI spiked to 6.8%. These recent events and optics could be one of the reasons why we’re seeing such an aggressive hawkish tone from Fed. A desperate act to win back public support so they can get back to printing…because they have to and need to print.

Fed Unites Left and Right in Warning It’s Behind Inflation Curve

The Fed is on a marketing campaign to get politicians to believe that they’re on top of the inflation worries in the US. December CPI numbers come out Wednesday this week and are expected to show CPI above 7%. Not all economists, politicians and public pundits are on the same page or believe the Fed has it under control. Some are under the opinion that Fed is acting too aggressive and tighter policy won’t solve the supply chain issues. Others are of the opinion that rate hikes and tapering, won’t be enough to slow down inflation and suspect treasury yields to continue to rise.

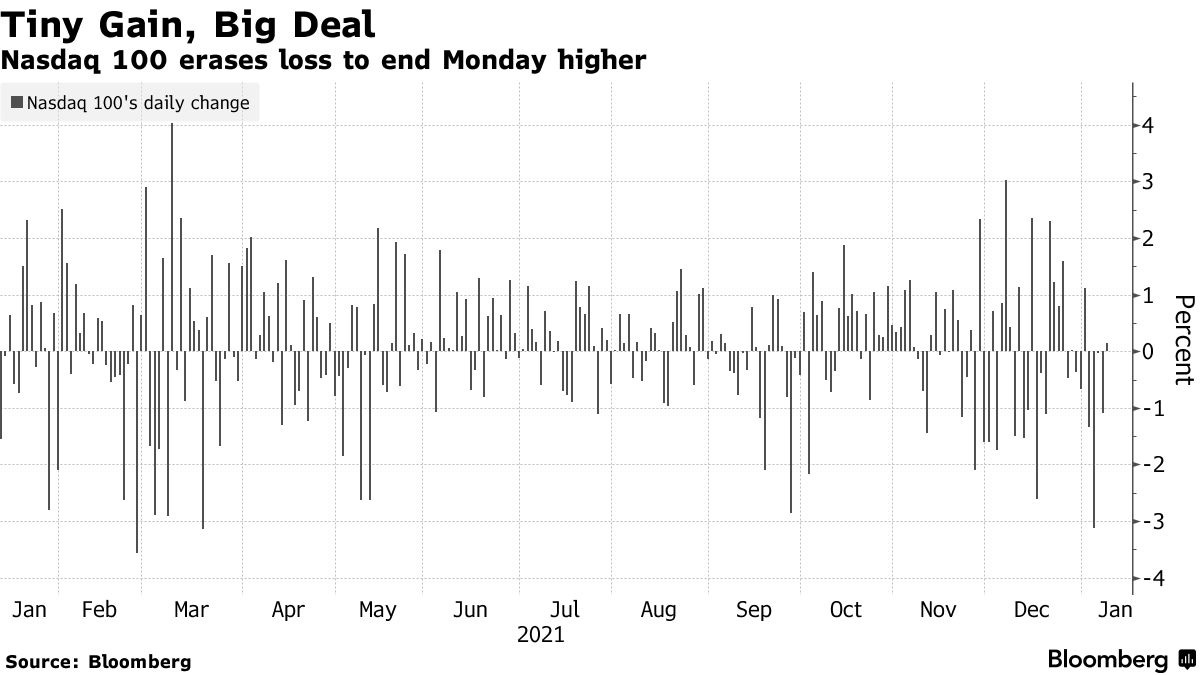

Furious Rally Sends Nasdaq to Biggest Rebound Since March 2020

The Nasdaq 100 which is the exchange behind some of the biggest tech names saw a huge bounce from yesterday’s lows. Dip buyers rescued the index from what would have been their fifth straight down day.

MAJR Take: For anyone wondering if we’re in a bear market, this may be a sign of hope. There’s huge demand from both retail and institutional buyers to take advantage of these discount opportunities. It’s essentially the market calling the Fed’s bluff on tight policy and multiple interest rate hikes this year.

More on Macro

Dimon Sees ‘Huge Pressure’ on Wages for First Time in His Life

U.S. reports at least 1.1 million COVID cases in a day, shattering global record

North Korea Fires Second Ballistic Missile in Less Than a Week

Calls for China to Cut Rates Grow Louder as Economic Risks Grow

MEDIABTC059: Bitcoin is Freedom w/ Nic Carter

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.