MAJR News 079

Bitcoin, crypto & all markets correct based on December Fed minutes, The Fed signals faster taper, faster rate hikes and faster plans to shrink balance sheet, Corporates rush to land in the Metaverse

@dualvoidanima

MAJR NEWS BRIEF

Videos

Pomp interviews Jason Lowery who graduated from MIT and now researching Bitcoin for the US National Defense Space Force division. One of the most interesting interviews that provides a new perspective on bitcoin as a weapon for defense. We highly recommend watching.

The Doggfather himself Snoop Dogg has been all over the NFT game acquiring a number of CryptoPunks, Bored Apes and land in the metaverse. We’ve included a video clip showcasing what Snoop has been building in the blockchain enabled Sandbox metaverse. Check it out. It’s pretty awesome.

Top Stories

BITCOINBitcoin, Ethereum and Stock Prices Fall as Fed Readies Interest Rate Hike

Bitcoin is down more than 6% in the last 24hrs after Fed December minutes confirmed intentions to raise interest rates, as early as mid-March. The overall crypto market is down by 9.4% at $2.2 trillion. Equities also took a hit after hearing that it’s going to be more expensive to borrow. Fed officials also discussed whether to start shrinking their balance sheet which has swollen to $8.3 trillion.

MAJR Take: We’re buyers at these price levels and will be buying all the way down and back up. Lots of institutional capital moved in at $30k-$45k prices levels, so the bottom isn’t too deep from here. A tighter financial system and an economic slowdown is bearish for all markets, however, central banks are bearish because of inflation and bitcoin was built for inflationary environments. Regardless it’s not a bad time to cash up and be cautious.

Bitcoin Market Dominance Hits Lowest Level Since 2018

Bitcoin market dominance within the overall crypto market is the lowest it’s been in years reaching 37%. The last time it was this low was in the 2018 bear market. Ethereum market dominance is at 19% and has been slowly increasing over the years. These numbers make sense as adoption grows and more investors are looking for smaller cap coins for performance, especially as strong token projects emerge.

MAJR Take: Bitcoin’s market dominance has been in a downtrend since July’20 after peaking at 73%. However, this tells us that bitcoin may be closer to a reversal as the rest of the market may seem overvalued compared to the core asset.

More on Bitcoin

Bitcoin Falls to 1-Month Low as Fed Minutes Reveal Talks to Shrink Balance Sheet

Bitcoin Falls Below $43K, Leads to $800M in Crypto Liquidations

CRYPTOThe Sandbox Announces Multiple Hong Kong Partnerships to Create Mega City in the Metaverse

The Sandbox (SAND), which has become the leading decentralized gaming virtual metaverse, overtaking Decentraland’s market cap. Announced multiple partnerships with businesses in Hong Kong from the film, music, entertainment, acting, professional services, finance, real estate and gaming sectors to create a Mega City in their metaverse. The Sandbox announced that they will be doing a new land sale on January 13th to purchase choice spots near the new partners.

Real-world and virtual-world home auctioned

ONE Sotheby’s International Realty and Voxel Architects are partnering to create a “MetaReal” mansion that will be auctioned off that includes both real-world property and digital property in the metaverse. The home will live in the Sandbox metaverse. The buyer will own the NFT that will acquire ownership rights to the physical home in Miami and it’s metaverse counterpart which will mirror the real world home and environment. ONE Sotheby’s has purchased the equivalent amount of 40 acres in the metaverse for future projects.

NFT sales top $530 million in 7 days

NFT sales are not slowing down with the rest of the market like many people feared. Last year, over $23 billion of NFTs were sold and in just the first 7 days of 2022, sales have topped $530 million.

MAJR Take: This doesn’t make NFT investment less risky just because there’s demand for NFTs. When you buy an NFT, you’re still buying a unique digital item that can really pump due to it’s scarcity, but on the flip side it could be extremely hard or impossible to find liquidity. NFT investment requires research and strategy just like any other type of investment. However, there is an NFT Index Set token, NFTI which tracks price performance of core NFT projects like MATIC, MANA, SAND, AXS, ENJ, and others. We need to do more research here, but it’s an interesting way to get broad exposure to the space.

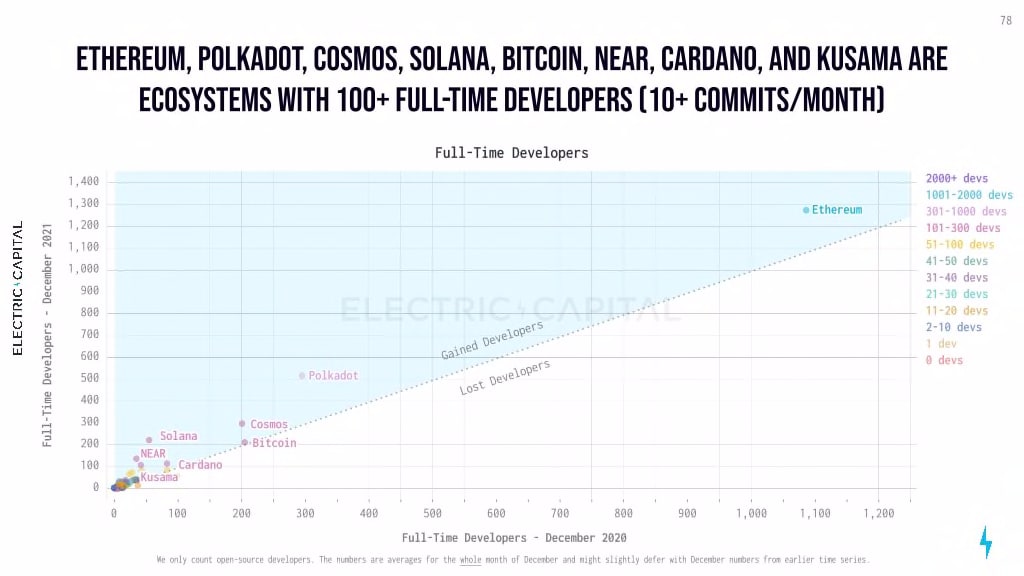

Solana, Terra and Polkadot Are Growing Faster Than Ethereum Did

According to Electric Capital, the alternative layer 1 blockchains are growing faster than market leader Ethereum did at this point in their life cycle. The other top blockchains for full-time development are Polkadot, Cosmos, Solana, Near, Avalanche, Terra and Binance Smart Chain. Metrics used to determine growth are the number of days since their first code commits and changes to the code and the number of developers since launch. These ecosystems have more developers than Ethereum did at similar stages. Ethereum still draws the lion share of builders, 20%-25% of the new developers per month. There are now 18,416 monthly active developers in Web3. Bitcoin still remains one of the largest ecosystems for development.

MAJR Take: We recommend reading the full report linked above. Understanding the development happening across chains is probably the best fundamental metric to use for smart investment strategy.

More on Crypto

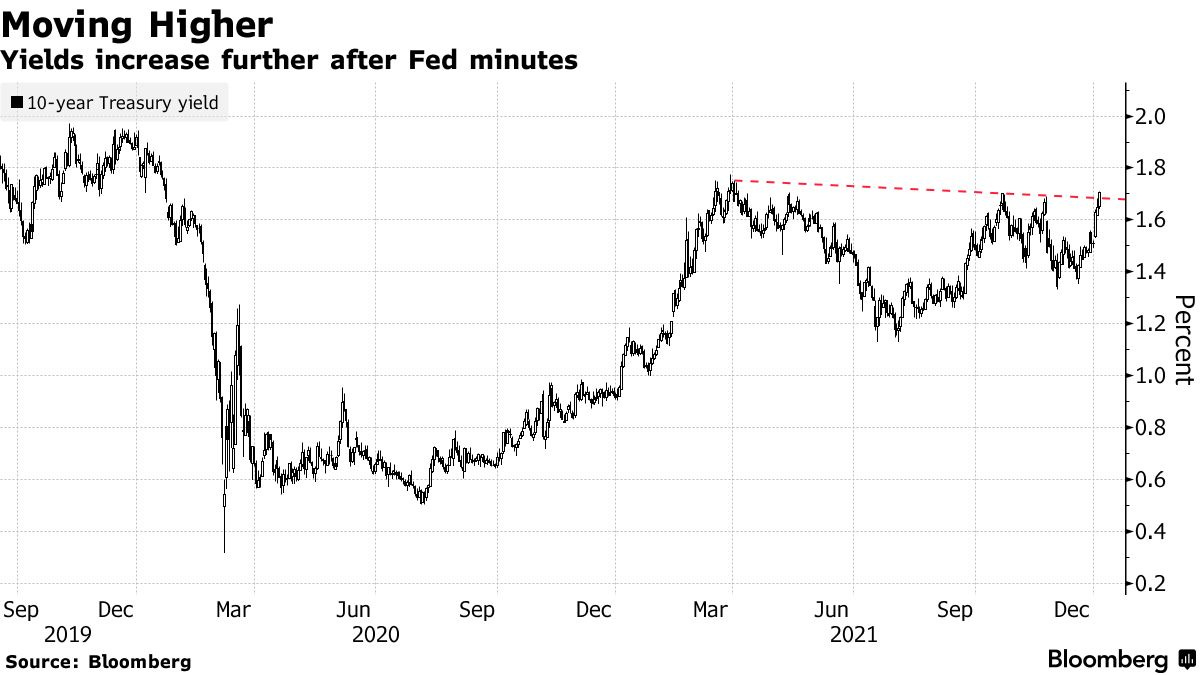

MACROFed Minutes Point to Possible Rate Increase in March

December Fed minutes were released yesterday shocking the market as discussions for interest rate hikes accelerated with a potential hike as early as March instead of June. Most central bank officials think there will be at least 3 quarter-percentage point increases in 2022. The minutes highlight a newfound urgency from Fed officials worried about inflation risk. The minutes also detailed plans for scaling back monthly asset purchases by March instead of June. While, inflation is now top of mind at the Fed, they said that inflation will ease later this year along with supply chain constraints, but will be higher than originally expected.

MAJR Take: Keep in mind that this is forward guidance. The Fed hasn’t done anything yet. Another way to interpret this rhetoric and the abrupt change in policy is through optics. The Fed needs tools and public support to respond to market conditions. If they look like they’re acting responsibly to higher inflation, they gain support, aggressively tighten policy, spook the market sending asset prices lower, but now they would have the public’s support to act and room to lower rates again. Rates ultimately need to stay low given the amount of debt in the system.

Treasury Selloff Deepens as Fed Opens Door to Faster Rate Hikes

Bond yields spiked as a selloff ensues post December Fed minutes detailing faster rate hikes, faster tapering and shrinking their balance sheet due to inflation risks. Yields on US 10-year notes climbed to 1.73%, almost reaching 2021 highs of 1.77%. Bond yields move opposite to price, so investors are leaving risk off assets to protect purchasing power from inflation.

MAJR Take: Bond holders are guaranteed to lose purchasing power across duration, TIPs and high yield instruments if CPI is at 6.8%. The question is - where are bond investors going to allocate their capital in an inflationary environment combined with possible an economic slowdown?

ECB Will Act If Inflation Outlook Picks Up

The ECB is approaching inflation worries with a more dovish tone than the BOE and the Fed, saying they’re standing by ready to act if inflation were to become a bigger risk, but they don’t plan on raising rates in 2022. The ECB expects prices to increase 3.2% on average this year.

Supermarkets Limit Purchases as Australian Supply Chains Hobbled

Australian supply chain issues are causing hundreds of supermarkets to limit consumer purchases. For example, the second largest supermarket operator has a temporary two-package buying limit on sausages, chicken thighs, breasts and mince. Supermarkets are struggling to keep their shelves stocked with limited supply combined with shoppers hoarding goods. They are also short on staff due to Covid.

More on Macro

MEDIAThis Bitcoin Interview Will Blow Your Mind: Jason Lowery

Snoop Dogg Enters The Sandbox Metaverse

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.