MAJR News 078

BTC & ETH trade sideways while alternative layer 1s pump, MicroStrategy buys more bitcoin, OpenSea starts strong in 2022, Bond yields increase, China is short on cash with $708B in maturing debt

@bigbadbarth

MAJR NEWS BRIEF

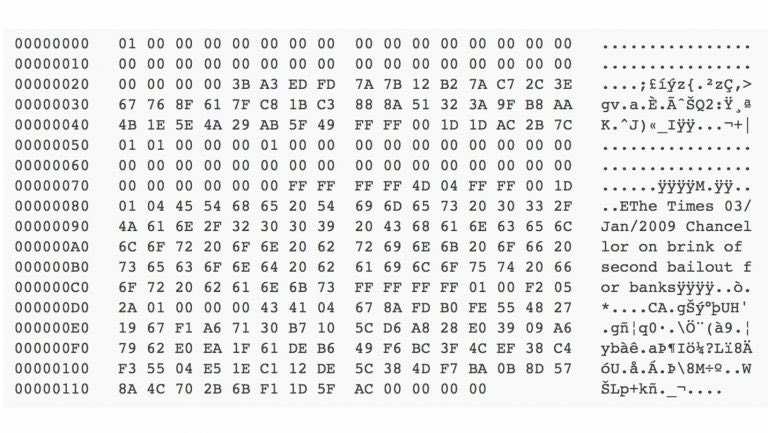

Bitcoin Turned 13 Yesterday

The anonymous creator of Bitcoin, Satoshi Nakamoto mined the genesis block on January 3rd 2009. That day will be remembered as the beginning of the digital revolution.

Videos

Ray Dalio is an investor, author, and founder of Bridgewater Associates. Ray joins Lex Fridman to discuss the dynamics of power and the changing world order.

Audio

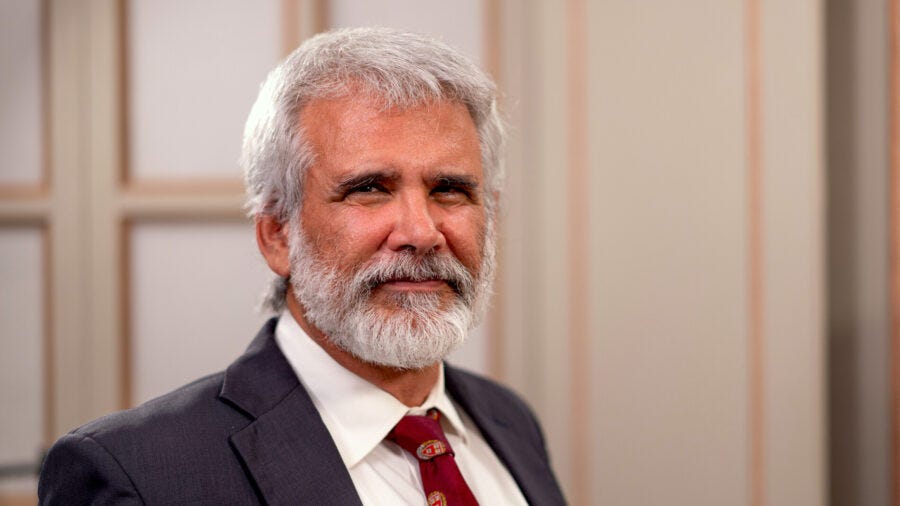

Joe Rogan’s Interview with Dr. Robert Malone, MD - inventor of the mRNA vaccine technology. He was recently banned from Twitter for raising awareness to suppressed information about vaccines, their side effects and alternative preventative treatments. The interview can be found in the Macro section.

Top Stories

BITCOINBitcoin dips below $47K as US dollar surge dampens BTC price performance

Since December, Bitcoin has been trading sideways between $45k - $52k with basically no movement between $40k-$60k since February. This could be for multiple reasons - altcoins tend to attract capital when bitcoin goes sideways as liquidity tries it’s luck with smaller caps, end of the year profit-taking and tax-harvesting, and the overall bearish tone coming from the macro environment - tapering central banks, inflation and Omicron surge. On-chain analysts see long-term holders continue to accumulate (bullish for Q1) and a possible short squeeze in January as capital returns to markets to start the year and bitcoin’s available float shrinks.

MAJR Take: We’d be surprised if bitcoin broke below $42k given the amount of institutional capital that bought at $35k-$40k price levels. Anything below $40k is a buying opportunity, however the macro environment is sketchy with emotional monetary and fiscal leadership. There was a surge of insiders trading and selling off at the end of 2021, which is similar to the end of 2019 and beginning of 2020 before the March 12 market crash. Be cautious.

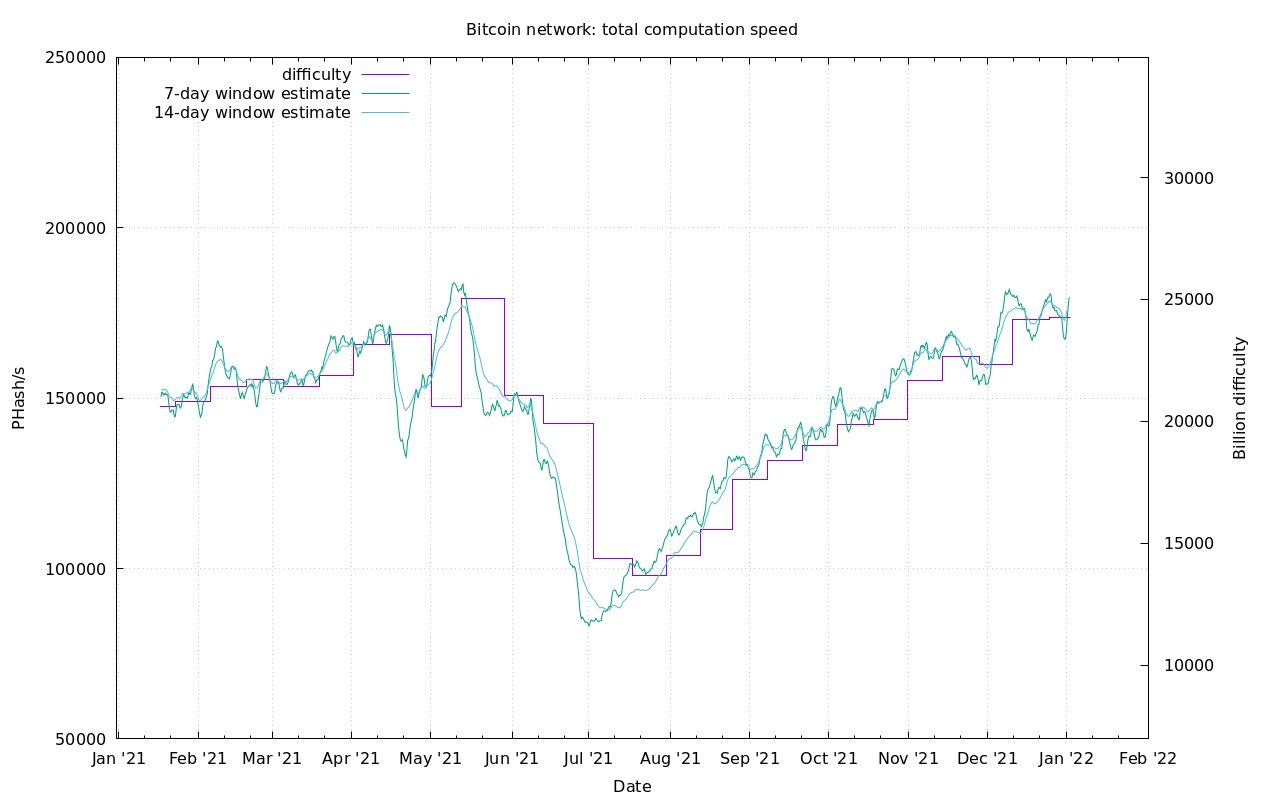

Bitcoin Hashrate Mints New All-Time Highs

The amount of computational power used by miners to process transactions for the 6.25 BTC block reward, known has hashrate has fully recovered from the Chinese government mining ban in June’21. Higher hashrate means a stronger and more secure network. The network made a new high on Sunday night crossing 201 exahashes.

Bitfarms and Marathon Digital Both Mined Over 3K BTC in 2021

Bitfarms (BITF) and Marathon Digital (MARA), two of the largest publicly traded mining companies each mined over 3k BTC in 2021 and kept nearly all of them. Historically, miners need to sell their coins in order to pay down their capital expenditures, however, given the rise of financial services for crypto companies, miners switched to a hodling business model using cheap fiat debt to pay down expenses keeping their mined BTC for the long-term. A business decision that comes with popular shareholder support. This ultimately means less available supply for buyers, increasing the price floor for the market. There’s only 10% of the total 21 million coins left to mine over the next 120 years.

MicroStrategy Buys 1,900 More Bitcoins

MicroStrategy (MSTR) bought more bitcoin at the end of the year, 1,914 BTC equivalent to $94 million at an average price of $49,200. The firm has the largest amount of bitcoin compared to any other publicly traded company with over 124,391 BTC or $3.8 billion. The company is hodling close to 1% of the total supply of bitcoin and they seem to be buying multiple times a quarter at different prices - $27k, $49k, $59k, etc. Their average purchase price is $30,160. CEO, Michael Saylor has obviously made a huge bet on bitcoin and thinks bitcoin’s price will be 1000x higher in the future.

More on Bitcoin

CRYPTOEthereum NFT Market Soars in First Days of 2022 After OpenSea Marks Another $3B Month

The NFT boom doesn’t seem to be slowing down or trading sideways like other sectors in the space. OpenSea, the decentralized marketplace for unique digital items or non-fungible tokens (NFTs) had $3 billion in record trading volume for the month of December and then proceeded to make huge daily strides starting 2022 - $124M on Dec’31, $170M on Jan’1 and then $243M on Jan’2. The trading volume has been predominately on Ethereum however, Polygon (MATIC) an Ethereum sidechain is seeing volume increase for lower fees and faster transactions.

Pantera Capital CEO: Terra is ‘One of the Most Promising Coins for the Coming Year’

Dan Morehead, CEO of Pantera Capital and long-time digital asset investor with a superior traditional macro trading background is hot for Terra (LUNA) and Polkadot (DOT). He was quoted saying that Terra is one of the most promising alternative coins for 2022. Pantera Capital is solely focused on trading and investing in the digital asset ecosystem.

Cosmos-Based Exchange Osmosis Crosses $1B in Locked Value

Cosmos Network (ATOM) built using Tendermint’s Inter-Blockchain Communication protocol and is self-identified as the “internet of blockchains” has it’s first decentralized exchange (DEX) Osmosis (OSMO) cross $1B in total value locked on chain (TVL). Cosmos is an alternative layer one blockchain and the 18th largest blockchain by market cap. Osmosis raised $21 million in Oct’21 in a round lead by Paradigm.

MAJR Take: As more applications built on top of alternative layer 1s (AL1s) like Cosmos attract capital like Osmosis, the more liquidity will find it’s way into Cosmos’s token ATOM which has a market cap of $11B, one of the lowest for AL1s.

Near Hits All-Time High as Layer-1 Blockchain Competition Heats Up

Near Protocol (NEAR) another AL1 that’s seeing higher prices while market leaders trade sideways. It’s token made new highs on Tuesday crossing $17.28, up 15% in 24 hours. Near has announced multiple new partnerships with other DeFi projects and bridges bringing Ethereum developers into the Near ecosystem. The biggest was an integration with Terra’s stablecoin UST. Other AL1s with similar market caps have been performing such as Harmony, Fantom and Tezos.

MAJR Take: Timing these markets can be very difficult, however, alternative layer 1s are a big theme and the next market cap milestone set for similar projects is $30B with Ethereum leading at $450B. While, Bitcoin and Ethereum are sleeping giants and can pull liquidity from projects like Near, these AL1s have growing ecosystems, capital and momentum to survive and thrive as more adoption continues.

More on Crypto

BlockbusterDAO Wants to Raise $5 Million in NFT Sales to Buy the Defunct Video Brand

LinksDAO NFT Sale Books First $10M Toward Buying an Actual Golf Course

MACROTwitter Suspends MRNA Vaccine Inventor Robert Malone's Account Over Pfizer Shot Concerns

Dr. Robert Malone is one of the inventors for the mRNA vaccines used by Pfizer and Moderna. He was recently banned from Twitter for posting a video that explained some of the harms from the Pfizer vaccine. Mainstream media has labelled him an “anti-vaxxer” even though he’s spent his entire life researching and creating vaccines. This comes at a time when the Biden Administration and public health authorities are pushing vaccines for children between the ages of 5-11 in the face of the Omicron surge, a different variant that vaccines weren’t created to necessarily treat.

MAJR Take: We’ve been living in a world where the mainstream media across traditional outlets and social media are censoring content that they deem to be harmful. We believe in free speech and encourage an open dialogue for readers to come to their own conclusions. We highly recommend listening to the most recent Joe Rogan interview with Dr. Malone. If the man who invented the vaccine can’t openly speak about the pros and cons of vaccines, we have a huge and dangerous problem.

New Year Sends Treasury Yields Higher

The yield on the benchmark 10-year Treasury reached its highest level since November to start 2022 touching 1.628%. Bond yields move inversely to bond prices which may indicate that investors are worried about inflation and seeking higher risk investments for higher yields. As investors move out of bonds, they are theoretically calling the Fed’s rate hike bluff. Low rates historically mean that the economy is weak and therefore the Fed will have a hard time raising rates if the economy isn’t ready for tight financial conditions. This also may indicate that the market doesn’t see Omicron has a big worry given that it seems to be less harmful, but much more virulent.

MAJR Take: Omicron has an R0 (pronounced R-naught) of 7-10 (meaning if I’m infected with Omicron I’m likely to infect 7-10 people - super high and means most of the world will contract Omicron).

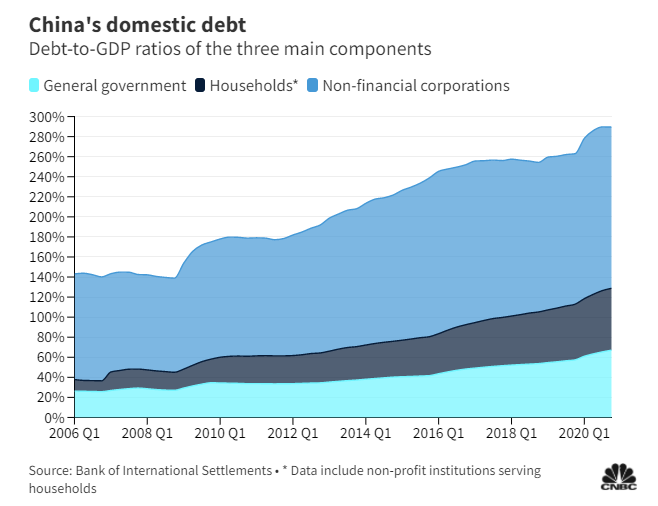

China’s $708 Billion Race for Cash Adds Pressure for Easing

China is strapped for cash and the demand for liquidity comes at time when the economy is grappling with a failing real estate sector and the fallout from Evergrande. Evergrande has lead to a wave of defaults with six developers failing to pay debt in time. The Chinese financial markets have about $708 billion in maturing debt, 18% more than last year which may only be solved by easy monetary conditions and liquidity injections from the People’s Bank of China. This is something that President Xi has been trying to avoid in order to decrease the existing asset bubble and stand out from other developed nations debasing their currency.

MAJR Take: China’s overall goal is to become the world’s reserve currency. It’s already the world’s largest trading partner and has a large amount hard assets in the country. However, the country has brought a huge percentage of it’s population out of poverty that demand continued growth. This puts Chinese central planners in an awkward situation. They want to reduce leverage in the system, incentivize capital to flow into the country, however, they can’t afford a liquidity crisis that could potentially crash the economy and undermine / upset their new middleclass. The balance between power, freedom and economic success in China’s is something to keep a close eye on.

More on Macro

Dr. McCollough Says Outpatient Treatments For COVID-19 Have Been Suppressed

India Jobless Rate Rises to Four-Month High Amid Covid Uptick

MEDIARay Dalio: Money, Power, and the Collapse of Empires | Lex Fridman Podcast #251

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_btcWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.