MAJR News 074

Crypto market rally despite tightening, NYDIG raises $1B to expand operations, Avalanche (AVAX) pumps with banks as target customers, Central banks slam breaks, Pelosi backs congress insider trading

MAJR NEWS BRIEF

GM - What’s the market really thinking right now?

You have to imagine that the smart money is asking this very question and positioning themselves accordingly for the next 6 months - year. If the Fed is going to hard pivot to accelerated tapering and rate hikes in 2022, it confirms our intuitions - inflation is very bad and most likely going to get worse.

So, where do you allocate capital?

Apple is about the hit $3 trillion, probably not much upside here, but Apple is a strong company, so there stock is most likely better than cash. Why else would anyone be buying such an expensive stock where more fundamental upside is dependent on smooth supply chains…?

Equities are near all-time highs and more levered than ever and with a slow down in the economy + more variants presenting unknown risk + more expensive for companies borrow, perhaps I trim these positions given what happened in March 2020. Lots of downside risk here with little upside.

So, should I cash up? Wait for steep discounts across asset classes? If inflation is that serious and the Fed just confirmed it…what’s the best inflation hedge?

Real estate - all-time highs and dependent on low rates…Commodities - stretched, but probably a good bet due to supply chains and pivot to green energy (copper, uranium, etc.)…bonds - guaranteed to lose money with negative real rates…Where to allocate?

What happens if the fed and central banks move too fast and crash markets? Will they allow an extreme correction in asset prices without stepping in? Definitely not, but is this time different? Or will they reload the MMT stimulus bazooka? IDK.

In times of uncertainty, investors tend to run to what’s scarce. We’ve already seen this play out with the real estate market and bitcoin, but if real estate is already too hot, then that leaves bitcoin.

I have no doubt that bitcoin will see a deep pullback with other risk assets if there’s a deep market correction, there’s now large players on the sidelines ready to buy the dip and its new narrative as the potential hedge on the current system and as gold 2.0 - presents a lot of upside at its $900 billion market cap.

So, it’s most likely the best bet to cash up or even better yet use stablecoins that yield 4%-20% APY and load-up on bitcoin and be ready for dips.

At least that’s my completely biased thought process of trying to make sense of markets right now. Not financial advice.

Videos

Dan Held and Preston Pysh have a conversation around the most common Fear, Uncertainty, and Doubt (FUD) in the Bitcoin community. This episode is a good one to share with family members that are new to Bitcoin.

Top Stories

BITCOINFormer South Carolina Governor Candidate is Mining Bitcoin

Multimillionaire, John Warren formed GEM Mining and raised $200 million from institutional players (banks, hedge funds, endowments and pension funds) to go all in on mining bitcoin. The company has apparently mined over 400 BTC ($20M) in the last nine months and as over 9,000 machines that are fully operational. November revenue amounted to $7.8 million with 92% carbon neutral footprint. They’re targeting 32k machines after the raise.

Bitcoin Company NYDIG Raises $1B at $7B Valuation

The vertically integrated institutional bitcoin trading and custody firm raised an impressive $1 billion led by WestCap and is now valued over $7 billion. Other investors include Affirm, FIS, Fiserv, MassMutual, Morgan Stanley and New York Life. The funds will further develop their bitcoin platform with upgrades for the Lightning Network, new product lines and expanding it’s operational headcount. NYDIG is becoming an institutional centerpiece for onboarding traditional finance players like regional banks, pension funds and even professional sports teams such as Houston Rockets into the digital asset class.

MAJR Take: The wall of institutional money coming into bitcoin will be enormous. Don’t be late :)

More on Bitcoin

CRYPTONexo Will Soon Let Users Borrow Cash Against CryptoPunks, Bored Apes NFTs

The financialization of everything is upon us. Nexo announced that they will soon allow users to borrow cash using their high valued CryptoPunks and Bored Ape NFTs as collateral. Nexo is teaming up with crypto hedge fund and venture firm Three Arrows Capital to provide this new and unique crypto credit service.

Avalanche Up 16% After Network Launch of USDC Stablecoin

Avalanche (AVAX) pumped yesterday, up over 22% in the last 24hrs. Increased price action can be attributed to it’s platform integration with leading stablecoin USDC. AVAX hit all-time highs in November - $144.96 before topping and dropping to $70s, it’s now $107.43 at press. Avalanche is one of the leading Ethereum competitors focused on DeFi using a unique consensus method across it’s subnets - separate and privacy-enabled blockchains. USDC brings Avalanche DeFi applications and users increased liquidity. Bank of America also praised the platform for it’s subnets, flexibility and transaction speed. Avalanche market cap is $26 billion and the sky is the limit.

Crypto Custodian BitGo Adds AVAX Support as Institutions Eye Avalanche

Gaming, Esports Stars Join Ethereum Game Ember Sword After $203M Metaverse Land Sale

Ember Sword, an Ethereum based Play-to-Earn fantasy game sold more than $200 million in virtual land for their game in July. The firm’s chief creative officer, Rob Pardo was formerly at Blizzard Entertainment and lead design for the popular game World of Warcraft. Ember Sword is a MMORPG (massive multiplayer online role-playing game) and will also feature competitive gameplay for eSports. Bright Star Studio, the company developing Ember Sword raised a new round for an undisclosed amount for it’s P2E game. Applications to buy land are closed.

MAJR Take: Lots of metaverse property popping up across new games. This feels like a mini-bubble inside a larger NFT bubble. NFTs and virtual land are definitely here to stay, but getting liquidity for single parcel of virtual land or unique collectibles is a major risk. Who will be the winning games / blockchains? I think the more open and freely traded games / chains with most traffic will be the winners, but it’s very early.

More on Crypto

Solana Block Explorer Solscan Raises $4 Million in Seed Round

'The Next Billie Eilish Will Emerge on Web3': NFT Startup Sound Offers Musicians a New Model

ConsenSys Collaborates With Mastercard on New Ethereum Scaling Solution

MACROFed Doubles Taper, Signals Three 2022 Hikes in Inflation Pivot

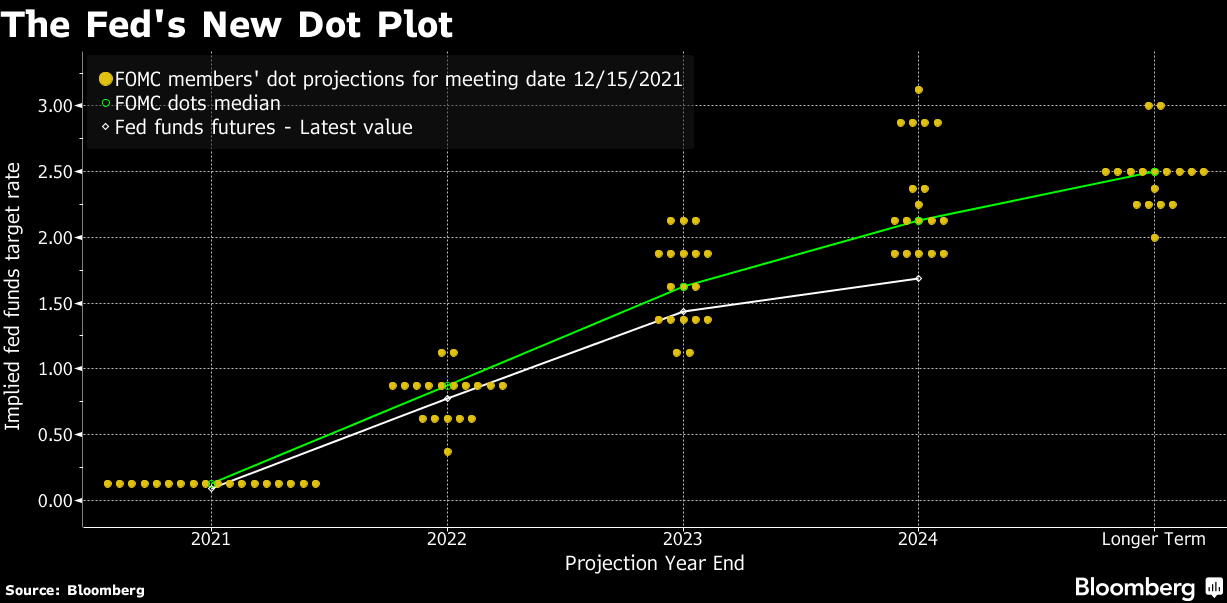

Going down as one of the fastest monetary policy pivots in history. In a matter of two months time, the Fed has gone from “inflation is transitory and not even anticipating rate hikes until 2023” to “we need to stop using the word transitory” to possibly 3 rate hikes in 2022. On Wednesday, Fed Chair Powell said they plan to accelerate tapering their monthly bond purchase program from $105 billion to $30 billion with target end date in March (seems extremely aggressive). They also project 3 25 BPS rate hikes in 2022, which they “estimated” will happen after they taper. With 3 more rate hikes in 2023 and 4 in 2024 bringing the fed funds rate to 2.1% by the end 2024.

MAJR Take: I look at monetary and fiscal policy through the lens of the second law of thermodynamics.

The second law of thermodynamics states that “in all energy exchanges if no energy enters or leaves the system, the potential energy of the state will always be less than that of the initial state.”

The market is chaotic and in a constant state of change (high energy - high entropy) and rather than use a framework or policy to manage the economy that’s simple and unchanging (low energy - low entropy), central banks and lawmakers knowingly add or subtract energy from the system without full knowing of how their actions will ultimately affect the system, the economy (more potential energy - more entropy - more chaos). Add a pandemic (another high energy variable) and we’re now in an very unstable environment playing with fire and using gas. But that’s just me…they probably know what they’re doing…

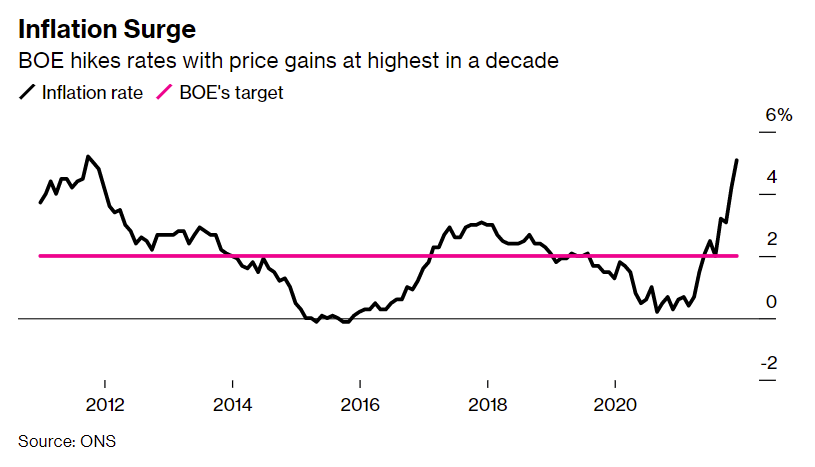

BOE Surprises With First Hike in Crisis to Curb Inflation

The Bank of England just surprised markets that they too will be increasing interest rates due to increased “worries” about inflation as the country is facing record CPI clocking in at 5.1% in November. The BOE is raising rates for the first time in 3 years, lifting borrowing costs by 15 BPS to 0.25%. Markets are pricing in another rate hike to 0.5% in February.

MAJR Take: Economics is not an exact science, but central banks who have scientists and Ph.Ds. informing monetary policy are now flipping positions on a dime and it’s due to new found "worries” (human emotion) about inflation. It’s low tide for institutions and they’re clearly a façade. The central bankers and lawmakers have no clothes…well besides their…expensive clothes…

Pelosi defends lawmaker stock trades, citing 'free market'

House Speaker Nancy Pelosi said lawmakers should be able to trade the markets because its a “free market economy.” Congress has come under recent scrutiny due an increase in seemingly well timed trades highlighted during the pandemic. Pelosi’s husbands has tens of millions of dollars in the capital markets and she claims not to know about his investment decisions. The Stock Plan was a law passed in 2012 which bars members from using inside information to make investment decisions and requires all trades to be reported within 45 days. Since the law, no one has been prosecuted, however 49 members have violated the law with penalties as low as $200.

MAJR Take: Yes, definitely nothing to see here. The average salary for Congress is $174k, yet they’re all millionaires. If we have such a free market economy, why aren’t retail and average investors allowed to participate in startup / venture investing without being an accredited investor? Are you fed up with this crap yet?

More on Macro

MEDIABTC056: Bitcoin Fear, Uncertainty, & Doubt (FUD) w/ Dan Held

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.