MAJR News 073

Bitcoin & crypto markets continue downtrend, 90% of all BTC has been mined, Nike buys NFT clothing studio RTFKT, Fed & central banks are the biggest question marks for the global economy

@danheld

MAJR NEWS BRIEF

Videos

In this interview, Peter McCormack talks with Mayor Francis Suarez about leading the City of Miami. They discuss the political system, the role of a Mayor, and how Bitcoin re-energizes capitalist systems.

Top Stories

BITCOINBitcoin, Ethereum Down 6% as Uncertainty Around Fed Taper Lingers

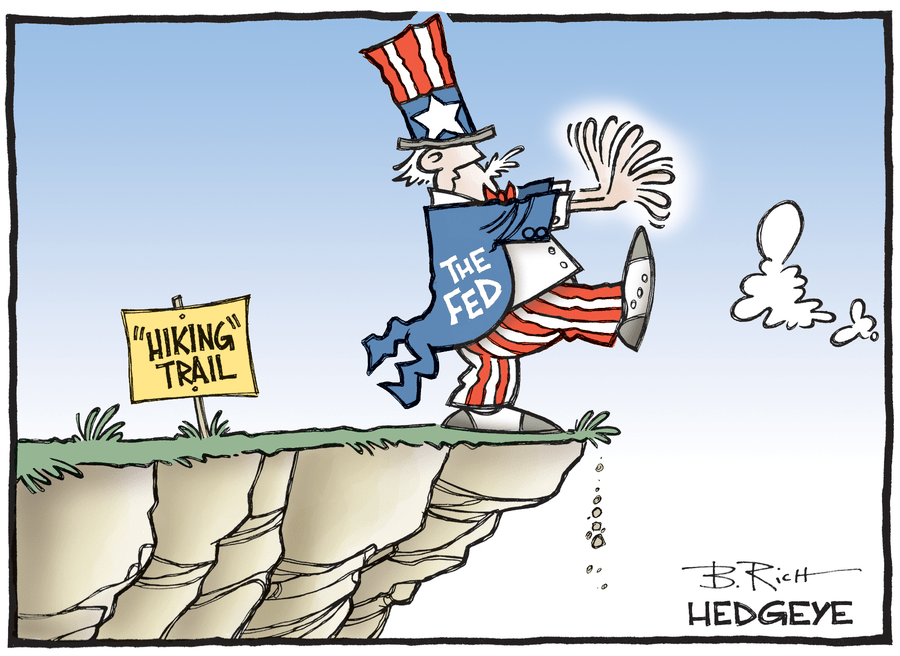

Crypto prices have been in a month long downtrend. Top assets are down more than 30% over the last 30 days. While, overall bullish fundamentals remain strong, the market is most likely clearing for a number of reasons- taxes (harvesting, wash sales, and locking in profits), performance fees, bonuses and audits. However, the Fed’s quick reversal on monetary policy has spooked the entire market. Will they really accelerate tapering their $105 billion monthly asset purchases by June of this year and raise rates at the same time? While, this is overall bearish, the bigger worry is if the Fed is going to move too fast and make a mistake causing markets to crash. This would cause all risk asset to move lower given that the Fed’s has primed the market that rates weren’t changing until 2023.

Bitcoin Dips Below $50,000 as Nearly 90% of All Coins Mined

Bitcoin drops below $50k as 90% of all 21 million bitcoin have been mined and the last 10% will be mined over the next 120 years. Bitcoin differs from other “commodities” due to it’s pre-programmed and automated difficulty adjustment. Normally, when prices for natural resources increase like gold, silver, oil, etc - companies tend to mine more of the material to capture the demand. However, bitcoin’s difficulty adjustment adapts every two weeks to the amount of miners mining the network to keep it’s 10 minute issuance schedule. If more miners are mining the network, the adjustment makes it more difficult to mine the block reward. The difficulty adjustment combined with the 4 year halving schedule and fixed supply makes bitcoin extremely deflationary, so bitcoin under $50k = fire sale.

Bank of England Again Warns Crypto Could Pose Threat to Financial System

The Bank of England warned that crypto could disrupt the current financial system and the existing financial players. Sir Jon Cunliffe, the deputy bank governor has voiced his worries a few times, siting that bitcoin could trigger financial instability in October. He stated the $2.3 trillion crypto industry is not yet big enough to destabilize the $250 trillion financial market, but they need to prepare and create standards and regulations to mitigate risks.

MAJR Take: Bitcoin and crypto were designed to be a completely different and separate systems from the banking system. This makes the people at the top of the existing system nervous because crypto serves everyone and not just the banks and privileged few. Regulators, bankers and lawmakers realize their monopoly on money is in trouble and when the average UK citizen has $400 in crypto, they see this as a risk because it’s the start of money crossing the bridge out of their system. To me, “investor protections,” “accredited investor rules” and crypto trading services offered by banks to their wealthy clients, while their CEOs say bitcoin is a fraud is all a front - financial incumbents see the change happening and they just want to make sure they get their first.

More on Bitcoin

Fidelity Digital Assets Europe Head: Bitcoin Will Play Prominent Role in Investment Portfolios

German Savings Banks Weigh Vote to Launch Bitcoin, Ethereum Trading Services

CRYPTONike Steps Further Into Metaverse by Buying NFT Sneaker Studio

Big brands are moving quickly into the metaverse. Nike launched NIKELAND collaborating with Roblox for an immersive 3D world and just bought NFT AR clothing studio RTFKT Studios. Adidas was one of the early movers as well buying land in Sandbox, purchasing a Bored Ape for $156k and collaborating with BAYC creators Yuga Labs and others on metaverse games and initiatives.

Bored Ape Yacht Club to Launch Play-to-Earn NFT Game

BAYC creators Yuga Labs will co-develop a play-to-earn game with metaverse early mover Animoca Brands (The Sandbox, Axie Infinity and NBA Top Shot). BAYC has generated over $1.4 billion of secondary market trading activity and hast attracted numerous celebrities sporting their digital collectibles including - Steph Curry, Post Malone, Snoop Dogg, Jimmy Fallon, etc. It’s unclear if the game will only be available to BAYC NFT holders like most NFT P2E games.

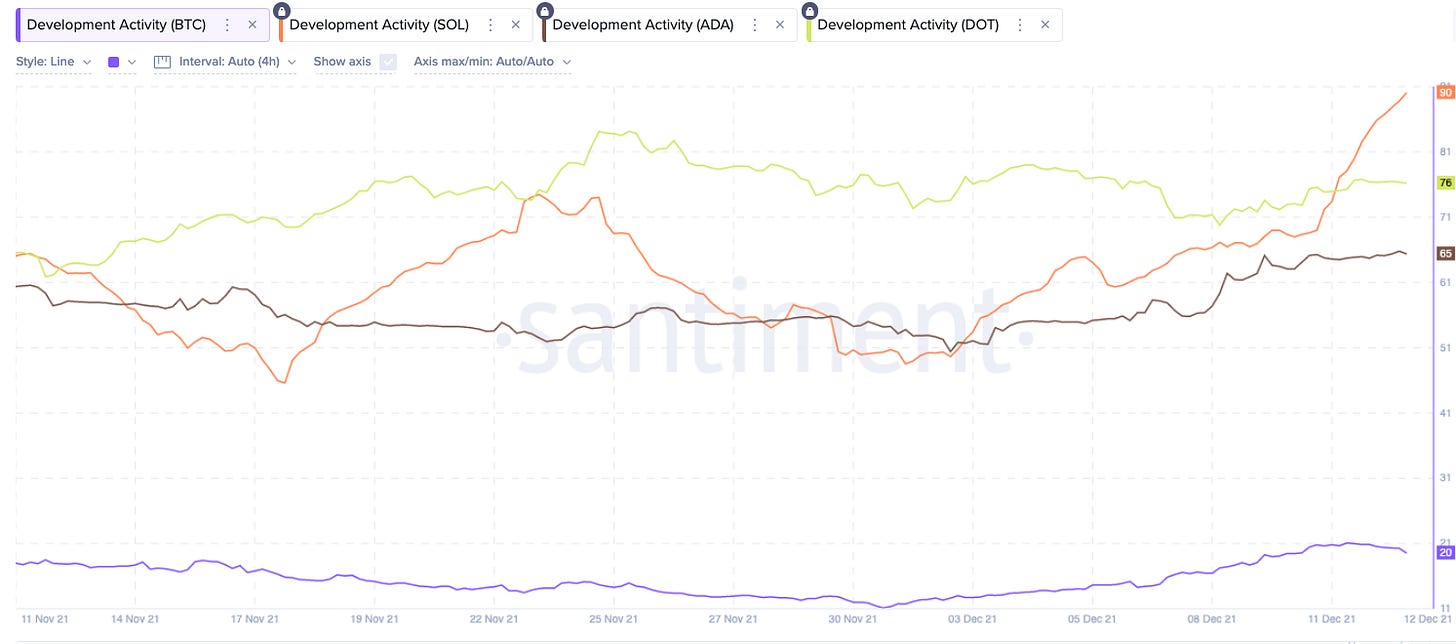

Solana on-chain development increases after a recent DDoS attack

Solana (SOL) experienced yet another DDoS (distributed denial-of-service) attack from coordinated bot traffic aimed to slow down the network to a point of failure. This attack happened last Thursday and slowed down the network, but did not shut it down like the one this fall. While, these attacks have showed vulnerability in Solana, the 5th largest blockchain, the developer activity has resumed its uptrend, seeing more GitHub commits than other blockchains. Solana uses a newer and a less tested consensus algorithm called Proof of History which has allowed faster transaction times and a better UX, but could be less secure given how these attack’s affect the network.

MAJR Take: Solana is the second leading blockchain after Ethereum with a much better user experience. It has the developer activity, brand awareness and a solid working product, but these DDoS attacks on the network make me nervous. Blockchains shouldn’t be able to shut down, that’s the whole point. It’s good to see Solana stay running and still attract the developers needed to be successful.

More on Crypto

National Unity Government of Myanmar Recognizes Stablecoin Tether as Official Currency

Brazil Stock Exchange B3 Plans to Enter Crypto Market in 2022

SEC chair's regulatory agenda fails to include clarity on crypto, says Hester Peirce

MACROWhy U.S. Job Gains Are So Hard to Count During Covid-19

The monthly US jobs report moves trillions of dollars in market trades and influences key policy decisions such as the Fed’s interest rate plans, yet we don’t even have a clear understanding of the real data. Economists and government officials have had to make big revisions throughout the pandemic. For example, the median economist was off by 363k jobs added for the November jobs report forecasting 573k new jobs, but the actuals came in at 210k. Economists are blaming stimulus payments, lockdowns, vaccine mandates, and variants. The economists claim they aren’t getting replies from struggling business for reporting purposes - so they’ve guessing…

MAJR Take: Is this really the best we have in 2021? Why do we pay so much in taxes? Where does the money go? We don’t have quality data to make trillion dollars decisions. This should be a priority. We literally have human beings guessing on job reports that dictate policy decisions. We have the technology for better reporting, better voting and better policy, but lawmakers have chosen to squander the money without any accountability. Where are the adults?

Global Central Banks Diverge as Omicron Clouds Growth, Inflation Outlook

Global central banks have differing views for the first time since the pandemic. Despite inflation in Europe reaching a record 4.9%, the ECB has signaled that they won’t raise rates next year and will continue with their asset purchase program. The Bank of England was expected to raise rates, but the recent spread of Omicron has led the government to reimpose restrictions which may delay their policy changes. The Chinese central bank is dealing with the Evergrande and housing market fallout and had to inject billions into the economy last week and may also need to drop rates. While, the US seems confused. Tighten and raise rates? But, what about that $2 trillion stimulus bill, the debt ceiling and a new variant…If the US chooses to tighten too fast they risk of crashing the US economy, strengthening the dollar and causing a global market slowdown and crippling emerging markets.

MAJR Take: The US is in a pickle and their decisions in the short term could cause immense damage, but is another global financial crisis a bad thing for the Fed and lawmakers? IMO - the Fed and lawmakers don’t worry about being held accountable and if they cause a massive correction in markets, they have all the excuses in the world to pass the buck and come-in guns blazing with an even bigger stimulus package than before because in the end, they know the market needs it, it’s all about how they can frame it to look like the heroes.

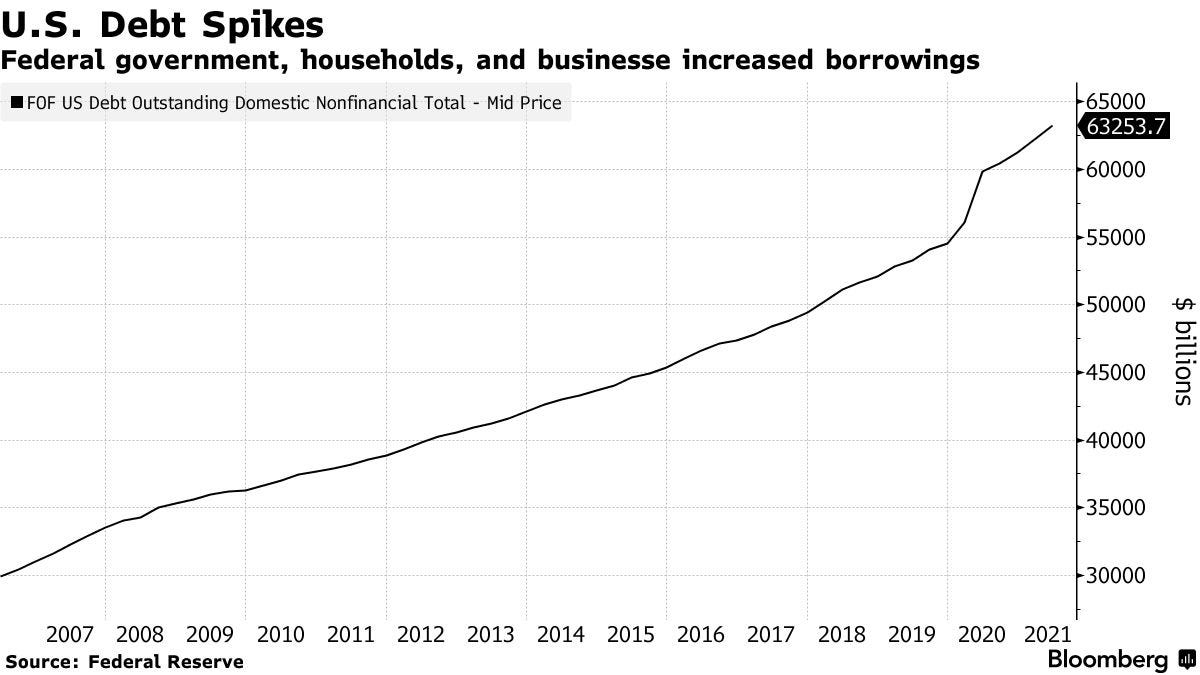

Massive U.S. Debts Could ‘Trap’ Powell as Fed Fights Inflation

Debt is at all time-highs. Government and household debt jumped during the pandemic. Corporate debt surged to $1.3 trillion since early 2020 as borrowers levered up hard due to low rates. If rates and borrowing spreads increase too fast combined with lower asset prices and another variant causing lockdowns on top of supply chain issues - this could throttle firms into bankruptcy. Per Moody’s, the average corporate credit rating has been declining which could signal that companies will struggle to meet debt service payments with higher rates. Due to central bank and government intervention, the economy is more vulnerable and sensitive than it has ever been.

More on Macro

Inflation Surge Pushes U.S. Real Interest Rates Into More Deeply Negative Territory

UBS Penalties Slashed by Around $3 Billion in French Tax Case

What Could Possibly Go Wrong? These Are the Biggest Economic Risks for 2022

MEDIAMiami: The Bitcoin City with Mayor Francis Suarez

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.