MAJR News 072

MicroStrategy buys 1,434 more BTC, US is the global leader in Bitcoin mining, Terra's LUNA token is hot & for good reason, Inflation death spiral puts US leadership btw rock & hard-place

@nog

MAJR NEWS BRIEF

Videos

Sahil Bloom talks with Preston Pysh about what the Cantillon Effect is and how it's important to the global economy.

Top Stories

BITCOINMicroStrategy Says It Bought 1,434 Bitcoins Since Nov. 29

MicroStrategy keeps buying the highs and the dips adding an additional 1,434 bitcoin over the last 10 days. The company now sits on 122,478 BTC or $6 billion of bitcoin with a market cap of $6.6 billion. Even though MicroStrategy’s stock is up nearly 600% since 2020, they look super undervalued to me considering the price predictions for bitcoin over the next 10 years.

MAJR Take: This is just one publicly traded company front running the wall of money that’s about to flow into bitcoin. MicroStrategy and El Salvador are just two small buyers in an ocean of capital that needs a home. They are good examples of what’s to come - dramatic increases in price floors as huge buyers step in on every dip opportunity. This is not a drill people. The starting gun was fired in 2009 and the race is well underway. Don’t be last.

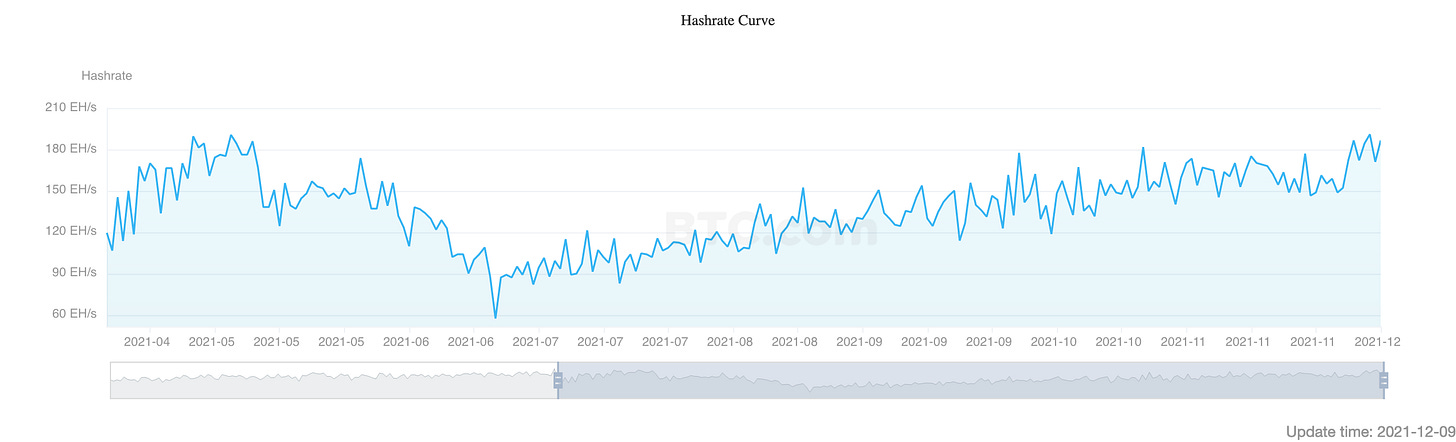

Bitcoin Hashrate Approaches Full Recovery From China Crackdown

Bitcoin’s mining hashrate crashed more than 50% from the strict China crackdown this year. Hashrate measures the bitcoin network security and how many machines are mining the network. In May, it dropped from +180 exahashes per second to below 60 exahashes per second and is now averaging 182.83 exahashes per second. Bitcoin’s mining difficulty is likely to increase due to recovery making even harder and more competitive for miners to collect the block reward, 6.25 BTC every 10 minutes.

MAJR Take: Bullish. What a gift China gave the US and the world.

US Claims Bitcoin Mining Crown Following China Crackdown

Chinese miners made up nearly 70% of the global bitcoin hashrate before the crackdown and miners unplugged their rigs to relocate. The United States attracted most of the miners having the benefit of the rule of law, capital and energy rich sources. While, China’s hashrate is near zero the US is now the leader in hashrate accounting for 35.4%, nearly doubling from 16.8% in April.

More on Bitcoin

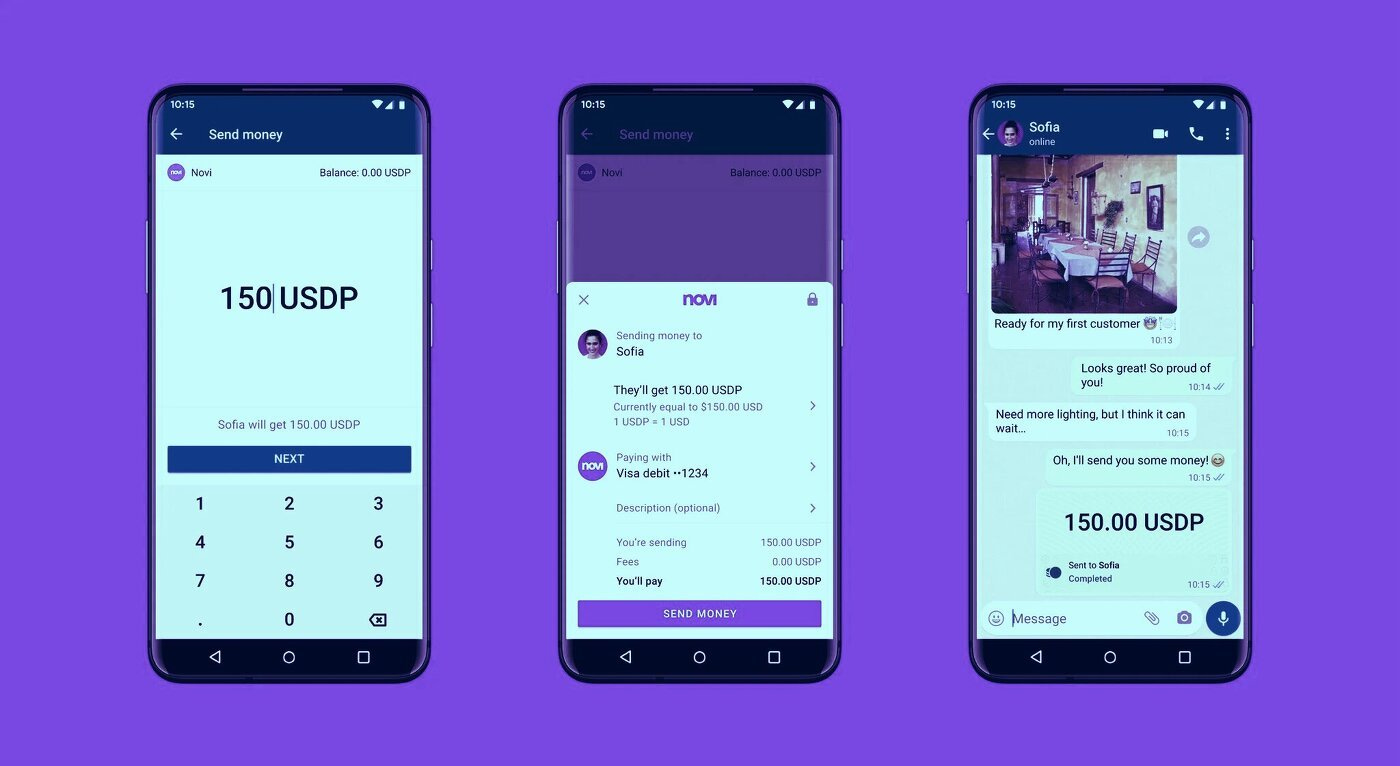

CRYPTOMeta's Novi, WhatsApp to Trial In-App Stablecoin Payments in US

Meta’s (Facebook) digital wallet Novi is making its test debut on WhatsApp by sending limited number of payments in the US using stablecoins (Pax Dollar - USDP) and custodied by Coinbase.

MAJR Take: This is a HUGE deal. Meta (Facebook) just hit 3 billion global users and with one upgrade or notification, users will now have access to an interoperable digital wallet that can hold fiat, stablecoins, bitcoin and most likely altcoins. Buckle up.

Why Terra Is Going Lunar

Terra is a general purpose blockchain and a competitor to Ethereum, however Terra is very different than other leading protocol due to it’s native algorithmic stablecoin TerraUST (UST). It’s not backed by dollars like USDC or an overcollateralized system like Maker’s DAI, but uses simple token minting / burning mechanisms for it’s LUNA token in order to maintain it’s $1 peg. The tokenomics also presents arbitrage opportunities for LUNA and UST holders. LUNA has weathered this moth’s crypto crash which is bullish for the project and ecosystem, but it’s predominately because in times of uncertainty investors and DeFi applications need a stable unit of account. Terra presents a flight to safety but also growth opportunities. Terra’s market cap is currently at $27 billion at press with a token price of $70.

MAJR Take: This project is a must have in your alternative layer 1 portfolio (Solana, Polkadot, Avalanche, Polygon, Cosmos, Fantom, Algorand, Elrond, Near - listed in no order), however the recent price action makes me cautious, so I’ll be waiting for a dip. Terra has been a popular project for a long time, with many early adopters who are now sitting on a lot of profits. Patience.

Ledger Launches Crypto Debit Card

Ledger, the most popular hardware cold storage wallet is now branching out into new business sectors, one being debit cards. This makes perfect sense for the company that safely helps you self custody your assets, and now added utility to spend crypto with their partnership with Visa. The card is called CL for “Crypto Life.” Available in early 2022.

Reddit Looks to Expand Ethereum Crypto Rewards to More Communities

Reddit has always been a home for crypto communities and is now moving ahead with a new beta program and waitlist for users to earn tokens through moderating and discussing content in different subreddits. Reddit has 3 million subreddits and the tokens could be used as an extra incentive for positive behavior and rewards for engagement, along with participating in community governance. Ultimately, they want these tokens to be liquid and swapped for other tokens on exchanges like stablecoins, ether and bitcoin.

MAJR Take: Welcome to the future of social media.

More on Crypto

AVAX’s Ava Labs Among Startups Chosen for Mastercard’s Crypto Accelerator

NFT Buyers Drop Serious Money To Become Snoop Dogg's Virtual Neighbors In The Sandbox

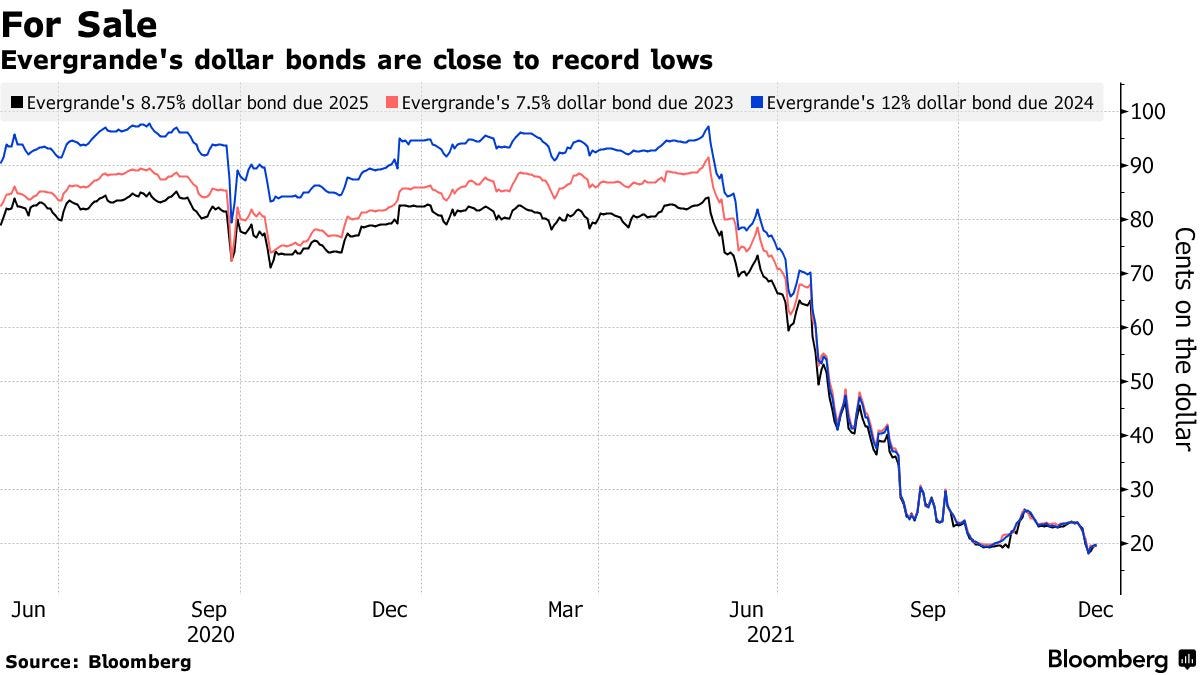

MACROEvergrande Declared in Default as Huge Restructuring Looms

Evergrande, the over-levered Chinese real estate development company failed to make two of their grace period coupon payments on their $19.2 billion dollar debt. In total, Evergrande has more than $300 billion in total liabilities. They’ve been downgraded to “restricted default.” Chinese President Xi is drawing a line in the sand by not bailing out the once “too-big-to-fail developer” allowing the overheated property market to cool off at the expense of additional Chinese defaults. The contagion seems to be contained within China, as company’s had months to prepare and the PBOC has cushioned the blow by injecting $119 billion into financial system and lowering banks reserve requirement ratios (RRR).

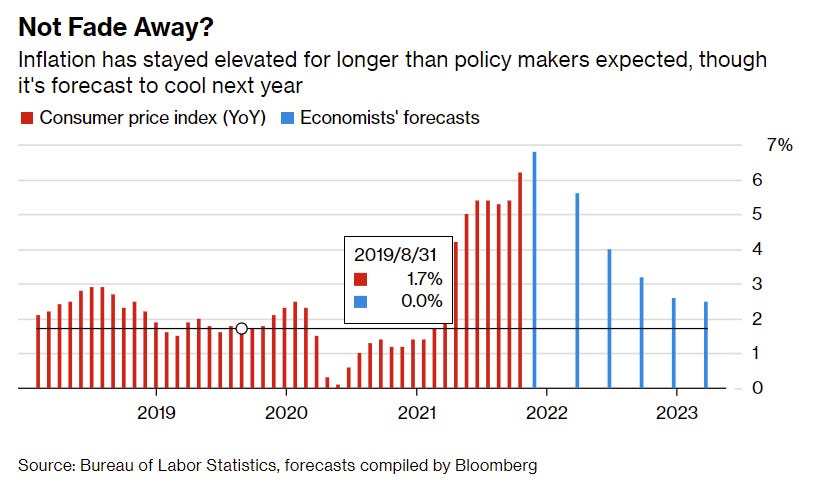

Inflation Near 40-Year High Shocks Americans, Spooks Washington

Inflation in the United States is the highest it’s been since the Ronald Regan era in the 1980’s. November CPI is forecast to hit 6.8%, higher than October clocking in at 6.2%. Price inflation is everywhere - hot pockets include used-cars up 40-60% since the pandemic, US gas prices are about 50% higher than year ago, and food prices were up 27% in November. The tables have turned quickly in Washington as the rhetoric has shifted from transitory price inflation to accelerated taper and rate hikes for 2022. Higher prices may seem good for companies, however, they’re costs have increased, especially as workers and DC demand higher wages to combat higher prices.

MAJR Take: This is the inflation death spiral that the Biden administration wants to avoid as his approval ratings are taking a hit. Yet, we have a ~$2 trillion stimulus package being debated in Senate and vaccine mandates being pushed across businesses causing more workers to quit. This puts increased pressure on prices. Forward guidance from the Fed tightening policy is important for taming the worst part of price inflation - the psychological component. But, with the US at ~140% debt to GDP and running fat fiscal deficits, easy monetary policy is their only real tool without crashing markets as the largest generation moves into retirement, leaning on their portfolios for living expenses. The spiral is here, so protect yourself - hard assets, commodities, real estate, bitcoin, digital assets and cash for the fall.

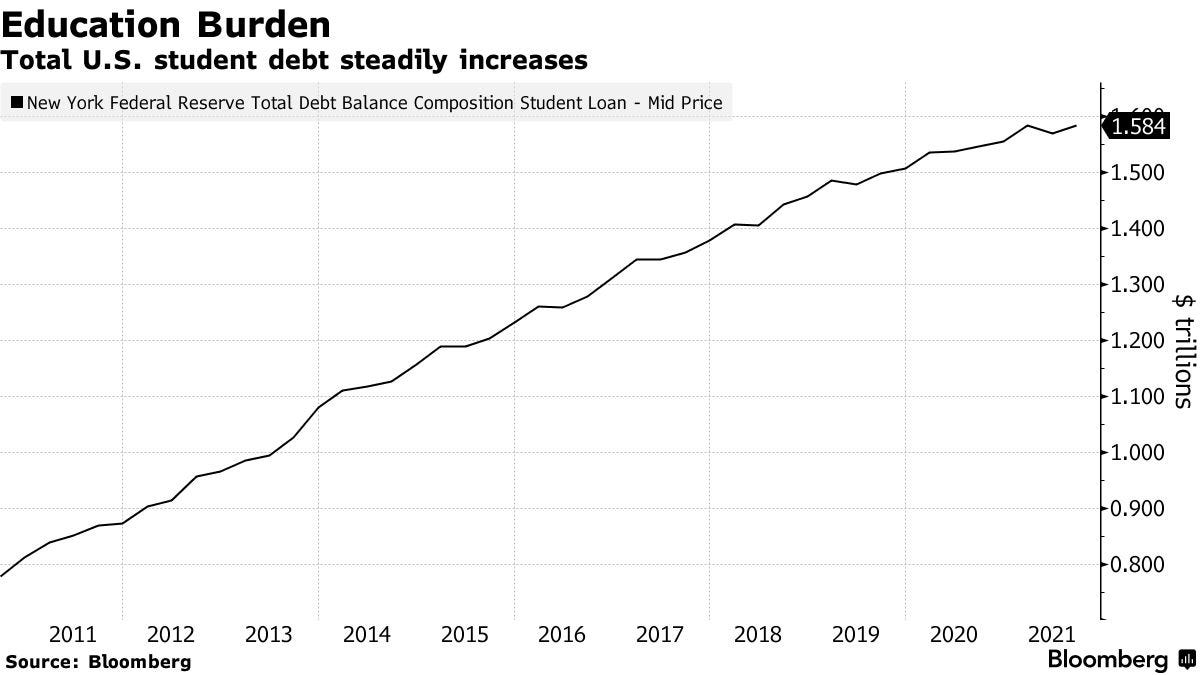

Fiscal Cliff Nears for U.S. Families as Pandemic Benefits Fade

At the end of December, the government’s benefits delaying student loan payments and stimulus checks run dry, unless Congress passes additional fiscal stimulus. A Gallup poll showed that 45% of Americans are worried about inflation and 60% think the economy is heading in the wrong direction. Shortly after the new year, the government debt ceiling will also be on the table as well. Biden’s Infrastructure bill has stalled in the Senate, which would continue relief for lower income families and provide jobs across infrastructure projects. US household wallets are tightening, hence the jump in credit card applications and Congress has some hard choices to make - more monetary expansion (inflation) or a dark financial reality for the country?

MAJR Take: The US economy looks like a crack head and it’s because of decades of corrupt inertia and bad policy. There’s no right answer and US leadership seems to be backed into a corner with a multi-faceted geo-political and financial puzzle - rising nation states (China, Russia, India), global debt levels at all-time highs (400% to GDP), a mutating virus, a divided country and a loss of trust in our institutions. Politicians have historically resorted to propaganda and the printing press, it’s the easy detour vs. solution. Only if there was a technological tool literally engineered to help solve the problem of bad money…only if…BTC. Oh yea, and term limits and age limits for political office - these people have gone mad.

More on Macro

From the Great Resignation to Lying Flat, Workers Are Opting Out

Senate Votes to Block Biden Vaccine Mandate for Large Companies

Brazil’s Central Bank Raises Lending Rate, Sees Increase at Next Meeting

MEDIAWhat is the Cantillon Effect w/ Sahil Bloom (BTC055)

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.