MAJR News 071

Colombia partnership with Gemini allows bank customers exposure to bitcoin, 25% of US household own bitcoin, El Salvador buys the bitcoin dip again, Terra makes new ATH, Fed accelerates taper plans

MAJR NEWS BRIEF

Bitcoin Reminder - Play the Long Game and HODL.

Videos

Balaji Srinivasan on Bitcoin, The Great Awokening, Wolf Warrior Diplomacy, Open-Source Ecology, Reputational Civil War, Creating New Cities, and Options for Becoming a Sane but Sovereign Individual.

Top Stories

BITCOINColombia’s Largest Bank Taps Gemini to Offer Bitcoin, Ethereum Trading to Clients

Bancolombia, the largest bank in Colombia is allowing customers to buy crypto directly from their bank accounts via a new partnership with Gemini, the Winklevoss’ crypto exchange. Colombia is one of Latin American countries to watch for bitcoin and crypto adoption as they’ve created a regulatory sandbox for financial innovation and banks to provide crypto financial services. Customers will be able to buy Bitcoin, Ethereum, Litecoin or Bitcoin Cash.

Grayscale finds that over 25% of US households surveyed currently own Bitcoin

According to a new Grayscale survey, 26% of US households said they own bitcoin. Out of this group, nearly half also own Ethereum and Dogecoin. There were 1,000 respondents between the ages of 25-64. Most invest via cryptocurrency trading apps. The number of users using a financial advisor dropped from 30% in 2020 to 11% in 2021. Most investors view bitcoin as an investment and not currency. And 50% perceive bitcoin as a long-term play within their portfolio strategy. Of the respondents, 77% purchased BTC within the last 12 months.

El Salvador Again Buys the Dip

Over the weekend, Bitcoin and crypto markets crashed with BTC prices cratering from recent highs close to $60k to a temporary low of $42k. Most tokens were down between 20-30% over the last week. While, weak hands may have sold, this was widely considered as a “BTFD” opportunity and El Salvador was leading the way again, scooping up another 150 BTC at an average price of $48,700. President Nayib Bukele was tweeting and trolling twitter by saying he’s buying the bitcoin dip for his country from his phone. Lol.

More on Bitcoin

Crypto Lender Nexo Teams With Fidelity to Offer Products for Institutional Investors

Self-Described Bitcoin Creator Must Pay $100 Million in Suit

CRYPTOVitalik Buterin outlines ‘endgame’ roadmap for ETH 2.0

Vitalik Buterin, the core founder of Ethereum, the second largest blockchain and largest general purpose blockchain dropped a blog post detailing a possible roadmap for ETH 2.0 or the migration from POW (proof of work) to POS (proof of stake), called the “Endgame.” The long and short of it was, scalability will happen on second layer solutions called “rollups” - Arbitrum, Optimism, Zksync, etc, block production will be centralized, but verification of transactions will be decentralized.

MAJR Take: This is par for the course with regard to scalability solutions happening on blockchain second or third layers, but it’s also not a clear roadmap for how ETH 2.0 will get done by leaning on the community to pioneer new solutions using Ethereum’s main chain for settlement. Honestly, this migration to ETH 2.0 (scheduled for Feb’22) makes me nervous. Not just because its technically very difficult and risky given Ethereum’s $500B market cap riding on its success, but in addition, all of the ETH that’s locked up on the beacon chain - 8,528,820 ETH or $37B+ technically unlocks once the migration happens. That’s a lot of supply to hit the market which could hurt price. Personally, I’m holding my ETH and will revaluate in January’22.

Pak’s Experimental Ethereum NFT Drop 'Merge' Sells for Nearly $92M

Pak, one of the first mainstream NFT artists did a unique drop that generated $92 million sold in tokens. The drop was launched on Nifty Gateway (Gemini company). The NFTs were called “mass” tokens which will be used for Pak’s experimental Merge project. The drop was unique because the buyers didn’t purchase actual Ethereum NFTs, but instead their “mass” tokens will be combined to create dynamic, distinctive NFT collectibles following the sale. Tokens were sold out, prices starting at $299 for Pak collectors and $400 for general public, with 20k unique buyers - the largest sale on Nifty Gateway.

OpenSea Hires New CFO From Lyft, Plans IPO

OpenSea’s CFO Brian Roberts says he wants to raise more funds for its booming decentralized marketplace and plans to go public via IPO. Crypto users were upset given the fact they anticipated a possible OpenSea token drop. OpenSea has nearly 300k monthly active users with millions of NFTs sold every month.

‘One of the Most Transformative Moments in Our Lives’: Why TIME Is Betting Big on Crypto and NFTs

TIME magazine, the 98 year old print magazine is leap frogging into the future and believes web3 crypto technologies are the way forward for the brand. TIME has launched Ethereum NFTs of their magazine covers generating $446k worth of ETH. This move has since been followed by competitors such as Fortune, Rolling Stone, The Economist and Vogue. The company has also offered payments for their subscription in crypto and partnered with Grayscale to produce educational content. They’re making metaverse moves partnering with Galaxy Digital, they have their own ENS domain name and they’re holding ETH on the balance sheet. Times are changing and TIME is changing with the times.

Ethereum Rival Terra Hits Another All-Time High as It Enters Top 10 Coins

Ethereum competitor, Terra (LUNA) hit another all-time high despite the severe market correction which is very bullish for the cryptocurrency. The LUNA token is up 40% in the last 7 days at $71.69 and is now a top 10 market cap coin. The network is built using Cosmos based software and mainly known for it’s algorithmic stablecoin, UST which is native to its chain. Terra is the 5th largest smart contract chain behind Ethereum, Polkadot, Cardano and Solana.

More on Crypto

Virtual land in the metaverse dominated NFT sales over past week

Decentralized exchange aggregator trading volumes surge to new highs

Alameda Research leads $35M fund raise for crypto trading app Stacked

MACROPowell’s Fast-Taper Signal Presages Agile Fed on 2022 Rates

The Fed is signaling for a faster taper for its monthly asset purchases targeting sometime in mid-2022. They will also release fresh forecasts updating their ideal plan for raising rates starting sometime next year targeting 25 basis points in June, September and December. This is a very different plan compared to what’s been articulated thus far - “not even thinking about rate hikes,” said Fed Chair Powell literally a month ago.” This move is most likely to calm the markets about inflation, as inflation risk has psychological component and to hopefully give the Fed room to navigate choppy waters with the ability to lower rates when needed because…it will be needed.

High Inflation, Falling Unemployment Prompted Powell’s Fed Pivot

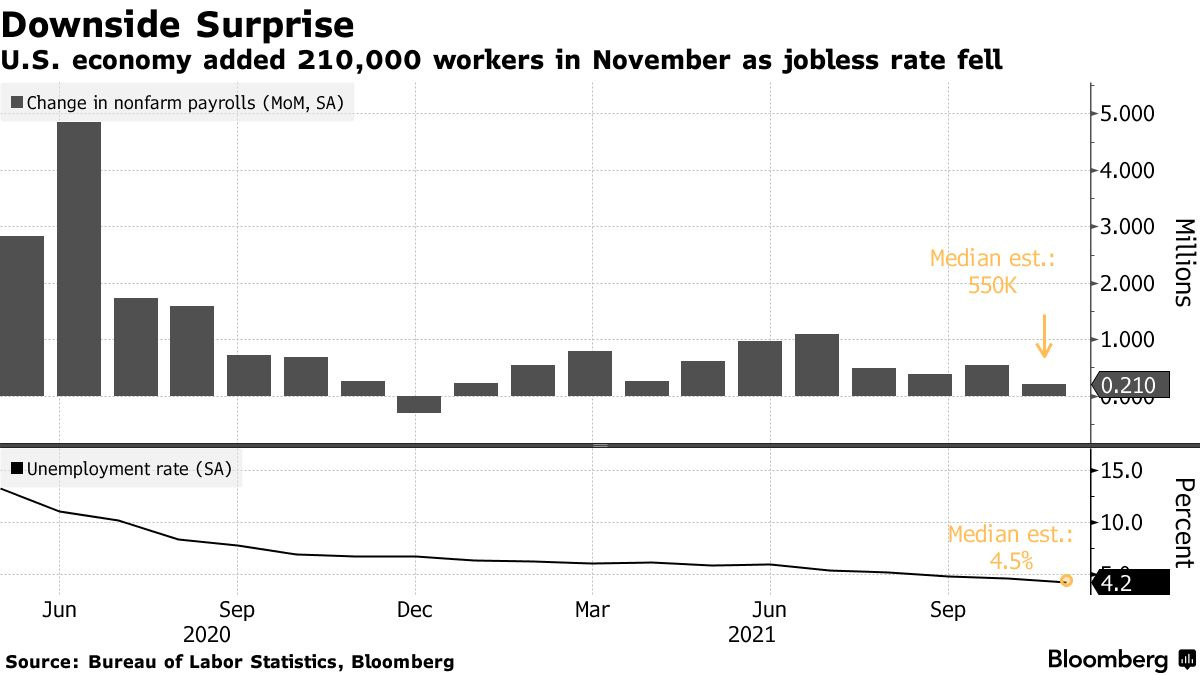

New jobs data and and high inflation is prompting the Fed pivot and with an accelerated timeline completing in March’22. The move is focused on inflation and less about encouraging employment. The unemployment rate was 4.2% in November with an increase in hires in October. Fed Chair Powell, believes inflation will come down meaningfully in the second half of next year.

U.S. Payrolls Growth Slowed in November While Jobless Rate Fell

US job growth registered it’s smallest gain of the year in November adding on 210k jobs, while unemployment rate fell to 4.2%. The jobs report is composed of two surveys - one from companies and the other from households. The company survey showed there was a slowdown in hiring across sectors, however, the household survey showed employment surge by 1.114 million people, essentially folks returning to work. Average hourly earnings rose 4.8% in November from a year ago, these figures are not adjusted for inflation, which means they didn’t rise enough to beat CPI which was last registered at 6.2%.

China Property Downturn, IMF on Australia, India Rate Decision

China’s massively inflated housing market and turmoil brought on mainly by mortgage lender Evergrande is taking a huge hit and is receiving fiscal and monetary support from CCP authorities. The People’s Bank of China (PBOC) cut bank reserve requirements ratios by .05%, which brings the average RRR level to 8.4%. For reference, the US is at 0% for our banking system. The PBOC is also injecting $188.19 billion in liquidity into the financial system. The Chinese housing market implosions seems to be mainly contained to China.

More on Macro

Biden Weighs Russian Banking Sanctions If Putin Invades Ukraine

Apple's 'hands-off' approach with Roblox draws focus in DOJ antitrust probe - The Information

U.S., Taiwan discuss chips again, to cooperate under new framework

MEDIABalaji Srinivasan on Bitcoin, The Great “Awokening,” Reputational Civil War, and Much More

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.