MAJR News 070

Square is now Block, Fidelity launches a Bitcoin Spot ETF in Canada, $100 million in digital land was purchased last week, Wear-to-Earn is the new thang in crypto, Inflation is no longer transitory...

@ailadi

MAJR NEWS BRIEF

Videos

Dr. Adam Back and Samson Mow talk with Preston Pysh about their assistance with El Salvador to issue a billion-dollar bond that's backed by Bitcoin and Bitcoin mining.

Bitcoin Reminder

Top Stories

BITCOINSquare Changes Name to Block in Nod to New Businesses

Square, the payments company re-branded as Block. This comes on the heels of Jack Dorsey leaving Twitter as CEO to focus on Bitcoin and Web 3. Square’s are two-dimensional, while blocks are three-dimensional which reflects the emerging technology - smart contracts and blockchain folding all of Square’s businesses into one - payments, music (Tidal) and cash / investments. This year the company announced big plans for a bitcoin hard wallet, mining rigs and DeFi for bitcoin.

Fidelity Launches Spot Bitcoin ETF in Canada

Fidelity, one of the world’s largest asset managers with over $4 trillion AUM is launching a spot Bitcoin ETF in Canada where investors can get exposure to the underlying digital asset as opposed to exposure through derivatives, like the futures ETF’s approved in the US. The SEC is coming under increasing public scrutiny as spot ETFs have been approved in other countries such as Canada, Brazil, Singapore and Dubai. The SEC is clearly not acting as independent agency without an agenda by picking and choosing products vs. supporting free markets.

MAJR Take: The SEC is only hurting Americans from preventing easy access for investors, especially retail from getting less risky exposure to bitcoin. It’s clear to me that the government bodies are either scared to support an alternative financial system or they want to give their inner circle a head start on getting bitcoin before opening the retail floodgates. It’s definitely not investor protection. I can understand the hesitation re: supporting a new system, but transparency should be a priority for the SEC.

Mass Mutual in Bitcoin for the Long Term - CIO

This is technically old news - Mass Mutual, one of the leading life insurance companies invested $100 million in bitcoin Q4’20, however the CIO made some comments not too long ago that are worth highlighting. When insurance companies and pension funds are buying bitcoin - the most risk off investors with a ton of capital power - you know bitcoin is here to stay and it’s a matter of time before a wall of money comes flowing into the digital asset. As Matthew McConaughey would say, “Green Light.”

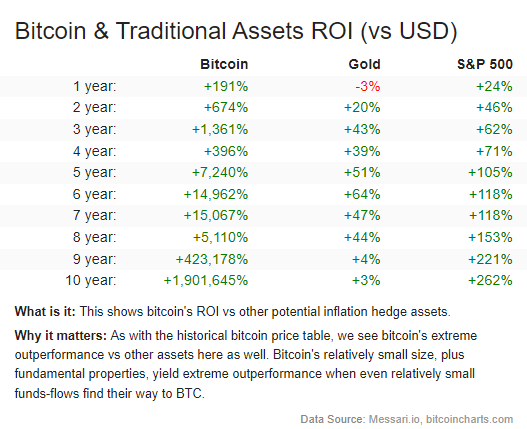

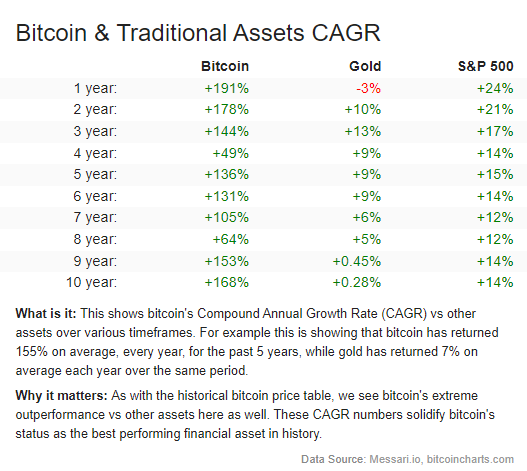

“Bitcoin’s unique characteristics—including digital scarcity, known supply growth, transfer characteristics, and hard cap on the total number of tokens—open the possibility that it may serve as a kind of “digital gold,” with the potential for significant price appreciation. He also pointed out bitcoin's volatility and risk profile, but noted: "In our position as a leading mutual life insurance company, we have the ability to take that long view."

Additionally, Mr. Corbett announced that Mass Mutual is launching Flourish Crypto, which he described as "a cryptocurrency investing solution built for Registered Investment Advisors (RIAs) and their clients", significantly raising the profile of bitcoin as an investment asset to the key group of investment advisors.

More on Bitcoin

Grayscale tells SEC 'no basis' to approve Bitcoin futures ETFs and not spot ETFs

Bitcoin Range-Bound Between $55K Support and $60K Resistance

Bitcoin Futures Trading Rises on CME as FTX US, Crypto.com Prepare to Enter Market

CRYPTOMetaverse Land Sales on Ethereum, Solana Top $100 Million in One Week

Last week, over $100 million of digital land was purchased across blockchains. Big name buyers are jumping in such as Adidas, Snoop Dogg, LG, SoftBank, and Animoca Brands. Decentraland and Sandbox are the front runners with the most institutional exposure - Sandbox sold $86.56 million and Decentraland moved $15.53M, with some parcels going for more than $2M. Other blockchains such as CryptoVoxels and Somnium Space sold about $4M. These are Ethereum based blockchains, but Solana applications are catching up with projects such as Star Atlas and Portals.

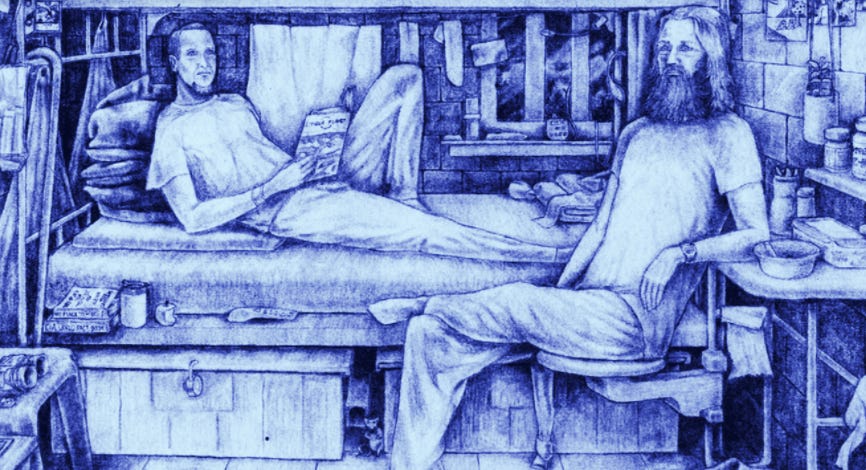

Silk Road Founder Ross Ulbricht to Launch NFT Collection on Ethereum

Ross Ulbricht, the founder of Silk Road, the underground marketplace on the Internet that first used bitcoin for transactions, mainly for illegal activity just minted an NFT collection on Ethereum from prison. The collection will launch at Art Basal in Miami today and run through December 8th on SuperRare’s NFT marketplace. Ulbricht was sentenced to 2 life sentences plus 40 years and has been incarcerated since 2013. Many believe this is an extremely harsh punishment for a non-violent crime and his NFT collection is to help bring awareness to his freedom efforts.

MAJR Take: You can support Ross here - FreeRoss.org.

Wear-to-earn NFTs target the billion-dollar fashion industry

Yes, you read that correctly, Wear-to-Earn. Crypto is taking over fashion and web3 companies are creating digital clothing that you can wear over your body that can only be seen with augmented reality technology. The “Play-to-Earn” space is taking off and is one of the main business models for crypto. Now people can be paid in crypto to flex their digital fashion brands.

More on Crypto

Facebook Reverses Crypto Ad Ban Following Metaverse, NFT Push

NFT drop causes glitch in The Matrix, FTX.US adds Ethereum NFTs, token Baby Sharks

MACROYellen Defends Spending Plans Amid Growing Angst Over Higher Inflation

Treasury Secretary Janet Yellen voiced her support Democrat and White House led ~$2 trillion spending bill even as inflation spikes to new record highs. Republicans are pushing back arguing that we’re only pouring gas on the fire with more spending. Her argument is that inflation is mainly due to supply chain disruptions and consumers shifting spending habits to goods and away from services…and only partly due to stuffing trillions of dollars into the economy.

MAJR Take: Everyone should be on high alert when the White House, Secretary of Treasury and the Fed are all working together. The definition of inflation has been muddled, but the true definition is the increase of the money supply which results in price inflation as more dollars are chasing fewer goods and services. This isn’t rocket science and every failed government has attempted to debase the money supply for political reasons. Just ask the Roman Empire about coin clipping. When you increase debt and print money, you burden businesses and pick the pockets of the lower and middle class who generally own zero assets and live paycheck to paycheck. Facts.

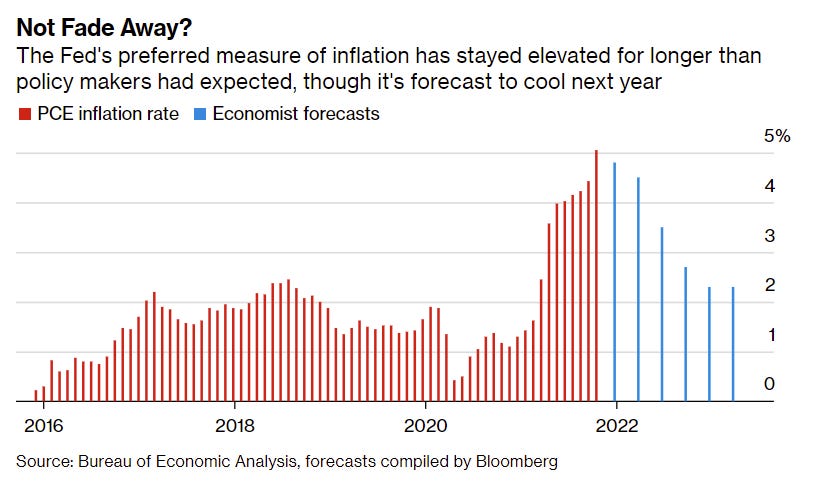

Powell Says Fed Policy Will Adapt Amid Risk of Persistent Inflation

Fed Chair, Jerome Powell finally admitted that inflation is much higher than originally forecast and we may need to taper faster and raise rates earlier than later. He also said we should stop calling inflation transitory as higher prices will linger into next year. Powell was confirmed for his second term by President Biden and starting in November they pulled back their monthly bond purchase program by $15 billion, now only $105 billion.

MAJR Take: Lol - why do we even listen to these people? They’re always wrong and changing their tune. They have hundreds of PhDs and economists dictating their monetary policy, yet they never seem to have a handle on the economy. Let’s be honest - Powell and his buddies were the only ones calling inflation transitory. These people either have no clue what they’re doing or they’re stuck and can’t admit that they don’t have control. I believe it’s the latter.

Turkish Central Bank Props Up Collapsing Lira

The Turkish economy is in crisis and the lira is in free fall. The central bank had to sell their foreign reserves in order to help bolster the lira after it breached new lows. Every day people are struggling to purchase every day items like foods, fuel and medicine given higher prices. Protests have broken out across the country calling for the resignation of President Erdogan. The lira has fallen in price by 40% this year and this is the second time the central bank had to sell their foreign reserves, first being last year.

More on Macro

As Omicron, Supply-Chain Problems Loom, Eurozone Inflation Hits Record

JPMorgan Says Buy the Dip as Omicron May Signal Pandemic Ending

MEDIABTC054: A Sovereign Bitcoin Bond in El Salvador w/ Adam Back & Samson Mow

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.