MAJR News 069

Jack Dorsey leaves Twitter to focus on Bitcoin, MicroStrategy and El Salvador buy the Bitcoin dip, Metaverse tokens rip as land and partnerships trend higher, More workers quit their jobs

MAJR NEWS BRIEF

Videos

Pomp interviews the Mayor of Miami Francis Suarez and Strike CEO Jack Mallers. Strike is a Bitcoin lightning wallet application that instantly sends fiat or BTC over Bitcoin’s Lightning network and settles in BTC or any other fiat. It’s game changing technology that also lets users buy bitcoin at near zero fees. El Salvador is using Strike for their native wallet, Chivo and the application that the Mayor of Miami and his employees are using to convert parts of their salary into bitcoin, along other professional athletes and celebrities. They discuss bitcoin adoption, inflation and how important it is to educate people on the value of bitcoin and its open monetary network.

Top Stories

BITCOINBitcoin Advocate Jack Dorsey Steps Down as Twitter CEO

Jack Dorsey, the CEO of Twitter posted his resignation letter on Twitter yesterday announcing that he’s leaving the company after 16 years. He will be replaced as CEO by Parag Agrawal, the former Twitter CTO. Jack will remain on the board until May, before fully leaving the company to most likely focus on his CEO role at Square. The payments company has pivoted to Bitcoin applications and initiatives such as decentralized finance applications, a bitcoin only DEX, a bitcoin hard wallet and mining rigs. At the 2020 Bitcoin Conference in Miami, Jack said he’s made bitcoin adoption for the rest of his world his life goal.

Trillion-Dollar Investment Firm Invesco Launches European Spot Bitcoin ETP

Investco, the US investment firm with $1.3 trillion in AUM partnered with CoinShares to launch its first exchange-traded product (ETP) in Europe backed by ‘physical’ bitcoin, Investco Physical Bitcoin ETP (BTIC). ETPs are similar to ETFs as they both allow investors to easily get exposure to the asset class without holding the ‘physical’ underlying.

MicroStrategy’s Bitcoin Stake Has Doubled in Value to $7 Billion

Michael Saylor, the CEO of MicroStrategy bought the bitcoin dip…again, adding $414 million more of BTC to his already massive stack, with an average price of $59,187. The company now holds 121,044 BTC valued at $7 billion, with an average cost basis at $29,534 per coin. Shares of MicroStrategy (MSTR) jumped 4.5% to $693 on the announcement.

MAJR Take: You wonder when other corporations are going to wake up to the new game in town, the bitcoin accumulation game. If you’re not playing the bitcoin game, you’re not playing the right game.

El Salvador ‘Buys the Dip’ Again and Purchases More Bitcoin Amid Price Pullback

El Salvador took a page out of the Michael Saylor playbook, but only this time it’s a nation state ‘BTFD'. President Nayib Bukele took to Twitter to announce that the country purchased 100 more bitcoin adding to their growing stack, now over 1,220 BTC. In September, Bukele said the country purchased 150 BTC and then in October, the country bought the dip again adding 420 BTC. These purchases come on the heels of El Salvador’s “Bitcoin City” announcement that will be powered by bitcoin volcano mining…you can’t make this stuff up.

MAJR Take: Do you think El Salvador and MicroStrategy will be the only public companies and countries buying the dip in 2022? If so, you better get your hands on some bitcoin because there’s only ~18.7M out of 21M in circulation with less than a 20% available float…not to mention strong hands and miners who are no longer selling.

More on Bitcoin

CRYPTOMetaverse Token SAND Rallies 75% in 1 Week to Become Top 50 Cryptocurrency

Metaverse tokens like SAND have been ripping as more traditional tech and other companies announce their pivot to the metaverse. The Sandbox (SAND) is a virtual world video game built on blockchain technology where user’s avatars can meet online, own digital property and goods like land. At press, SAND is up 46% over the last week, currently priced at $6.97.

MAJR Take: There’s currently 30% of supply in circulation, so while inflation is expected for SAND, the increased market demand definitely dampens dilution risk.

Decentraland’s MANA Token Hits All-Time High After Sale of Virtual Real Estate

The leading metaverse token by market cap Decentraland (MANA) is also on a tear reaching new all-time highs and up 16% in the last week, priced at $4.73. Decentraland witnessed a couple record sales over the holiday’s as parcels of virtual land were sold for over $2.3 million and $3.2 million at press. Recent transactions for MANA have been over $100k, which signals institutional capital is moving in which doesn’t surprise me as VC firms are now targeting specific narratives in crypto like metaverse tokens and Decentraland is part of the suite of Grayscale Trust products. Institutional capital will flow to top market cap coins first before hitting smaller caps, MANA is the first stop.

Budweiser Launching Ethereum NFTs as ‘Key to the Budverse’

Budweiser is getting into NFTs and sees their application crucial to their metaverse play, “Budverse.” The beer company is dropping 1,936 NFTs ranging from $499 to $999, that unlock future benefits and perks. They partnered with Rocket Factory to build the collection and they even launched their official discord server. NFTs (non-fungible tokens) are the necessary building blocks to bring the real world into the digital world, the metaverse. This is because they’re able to represent unique digital assets which is like 99% of the things in the real world like brands, identity, certificates, etc. We’re only scratching the service of what NFTs will become.

More on Crypto

Adidas Goes Full Metaverse With Coinbase Partnership and The Sandbox Real Estate

Galaxy Digital raises $500 million in convertible debt to fund business expansion

MACROIsrael Is Stepping Up Its Central Bank Digital Currency Efforts

Israel is fast-tracking research for their central bank digital currency (CBDC), but didn’t announce any time lines. Their central bank governor, Amir Yaron said they’re “committed to to being at the forefront of economic and technological knowledge.” They also said they’re looking to Ethereum’s blockchain for their CBDC.

MAJR Take: Readers should know that CBDC’s are not a threat to crypto since it’s most likely not going to be decentralized and most likely without any hard cap. It’s just fiat on blockchain rails. If anything, these government moves only quicken the adoption of digital assets like bitcoin by providing more users with a digital wallet.

Workers Quit Jobs in Droves to Become Their Own Bosses

Employees are leaving their pre-pandemic corporate jobs in record numbers to start their own companies. Entrepreneurship has gone mainstream and has brought more than 500k employees to take the leap of faith since the start of the pandemic bringing the total to 9.44 million people, the highest since 2008 crisis. Applications for federal tax-identification numbers to register new businesses has hit 4.54 million this year, up 56% since 2019. September set a record for quits with 4.4 million leaving their jobs siting reasons such as entrepreneurship, more flexibility, desire to be remote, Covid mandates and Covid itself.

MAJR Take: The future of work is digital. Do you really think Gen Z that’s investing in crypto and making fortunes will want to work a typical 9 to 5 and climb a corporate ladder with a commute? Definitely not. Traditional businesses and the overall economy is going to have a dramatic shake-up over the next decade. Brace yourself.

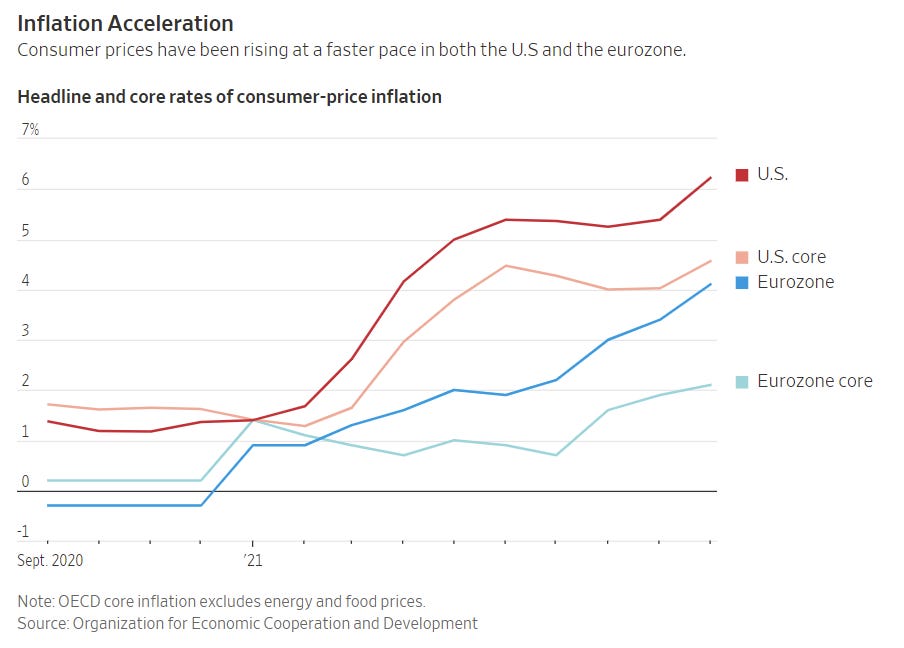

Eurozone Inflation Likely Hit Record High in November

Consumer price inflation is expected to hit new records in the Eurozone for November, but economists and central bankers believe that inflation should retreat come 2022. The price data has caused reasons to doubt the credibility of central banker’s claim that price inflation is transitory as it’s gone on much longer than expected. Central bankers continue to blame supply chain disruptions as the main cause for increased prices, and even President Biden claimed producers were price gauging. Definitely not the trillions printed and stuffed into the economy in the least productive places…

MAJR Take: While supply chains are certainly a mess and part of the problem, inflation at it’s core is the increase in the money supply and if you look at the M2 Money Supply, it was up 27.12% YOY in Jan’21 and now at up 13.01% YOY today compared to the US 6.2% CPI print. Today’s CPI numbers are massively distorted and have been changed over the years to better fit the central planning narrative. If you used the original 1980’s measurements for CPI, CPI would be closer to 15% which is closer to the M2 numbers and increase in the stock market. If 6.2% inflation is what we’re hearing from governments, it’s obviously much worse.

More on Macro

In Low Key Move, Singapore’s Central Bank Adds 26 Tons To Its Gold Reserves

CDC Says Everyone 18 and Older Should Get Covid-19 Booster Due to Omicron Variant

New Omicron Variant Exacerbates Inflation Uncertainty, Powell Says

MEDIABitcoin Is Here To STAY: Jack Mallers & Francis Suarez: Full Interview

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.