MAJR News 068

El Salvador is creating a Bitcoin City powered by volcanos, Another NFL player takes his salary in BTC, ETH gas fees are giving rise to alternative layer 1s like Avalanche, Jerome Powell keep his job

@dualvoidanima

MAJR NEWS BRIEF

Videos

In this episode of On The Margin Mike is joined by Jeff Snider of Alhambra Investments & Emil Kalinowski, Mining & Metals Researcher. Jeff & Emil are hosts of Eurodollar University, a podcast dedicated to analyzing the 2007 malfunction of the monetary system. Jeff & Emil share their thoughts on the myth of central banking, the Fed's effect on financial markets, why QE is not money printing, the interest rate fallacy & the role of Bitcoin & digital assets.

Given the rapid rise in Avalanche’s token price AVAX, we thought we’d share an educational video on the protocol, how it works and why it’s different. We first reported on Avalanche a year ago when the price was $4.41 at $100 million market cap and the second article was about two months ago when the price was $63 at $14 billion market cap. It’s now $143 with a market cap of $30 billion.

We can’t report all the best projects because there’s a lot of them, but we’ve been constantly right and very early with most of them. We hope you’ve been enjoying the content and the rewards.

Top Stories

BITCOINVolcano-Powered ‘Bitcoin City’ Coming to El Salvador, Says President Bukele

El Salvador is either executing one of the greatest marketing campaigns bringing positive attention to their small country of ~6 million people or creating the bitcoin adoption roadmap for other countries to replicate. Let’s recap - in 7 weeks they went from proposing bitcoin legal tender bills to making them actual laws through a majority vote in congress. Set up a public wallet for citizens to transact using Bitcoin’s Lightning Network and then airdropped $35 of BTC to the citizens with wallets. Started buying bitcoin for their public balance sheet for citizens to swap from USD to BTC and then started buying BTC dips with millions of dollars. Then began the process of setting up a bitcoin mining facility using clean and basically free geo-thermal energy from volcanos. Now, they’re building a tax free “Bitcoin City” - no capital gains tax, no property tax, no income tax, no payroll tax, no municipal tax - all powered by volcanos and fundraising fiat cash through $1 billion bonds selling in 2022 (Michael Saylor playbook). Crazy stuff.

Latin American E-Commerce Giant Mercado Libre to Enable Crypto Investments in Brazil

Mercado Libre, the Latin American e-commerce giant is enabling users in Brazil to buy, sell and hodl cryptocurrencies. The company has made headlines before launching a digital wallet that has 17 million users and they bought $8 million in bitcoin as part of their treasury strategy. This is big news because Brazil is the 9th largest economy in the world and has publicly telegraphed their intentions to adopt bitcoin and digital assets.

Odell Beckham Jr. to Receive Salary in Bitcoin, Give Away $1M in BTC

Bitcoin continues to see adoption coming from the world of sports. It was only 3 weeks ago when Aaron Rodgers, quarterback of the Green Bay packers announced that he was taking part of his salary in bitcoin and giving away $1 million in bitcoin via Cash App. Odell Beckham Jr, wide receiver for the Cleveland Browns made a similar announcement receiving his $4.25 million 2021-2022 salary in bitcoin and giving away $1 million in BTC to his twitter followers.

More on Bitcoin

Junk-Rated El Salvador’s ‘Bitcoin Bonds’ Look Explosive (Think Volcano)

Nearly One-Third of Hedge Fund Managers Plan to Invest in Crypto: Ernst & Young

First Mover Asia: Bitcoin Drops to $56.5K After Brief Rally; Ether Also Falls

CRYPTOWar Over Ethereum Gas Fees and Usability Continues

Ethereum, the leading smart contract platform has been plagued with high transaction costs known as gas fees. When the platform sees a lot of network activity around things like DeFi and NFTs, it can be very expensive and slow to use causing users and investors to look to other rising platforms like Solana, Avalanche and Polkadot. Co-founder of Three Arrows Capital - Su Zhu recently tweeted that he’s abandoning Ethereum because of the high gas fees. Ethereum is the most decentralized layer 1 outside of bitcoin and decentralization should be important to users and investors. Given it’s still so early, gas fees and speed can get fixed with time but centralization is much harder problem. Network effects are crucial to the success of these network and Ethereum has by far the largest network effect, but it shouldn’t be taken for granted as users can easily switch to another chain.

MAJR Take: We use a balanced portfolio strategy here. It’s so early that any platform could win in the long run, but that doesn’t mean all platforms won’t do well from a performance standpoint. Personally, I don’t think users will know which platform their transactions are settled on in the future, all chains will be interoperable.

Ethereum Rival Avalanche Continues Rapid Ascent, Soars 10% in 24 Hours

Avalanche’s token AVAX has seen a run in price gaining momentum as a top Ethereum competitor, gaining 44% in the last week and up over 100% in the last month. They are Ethereum compatible which means applications built on Ethereum can run on Avalanche much faster and cheaper, almost acting as a layer 2 solution. Their messaging has been concentrated on DeFi, but they have all the bells and whistles for NFTs and DAOs too. It’s a much more flexible and faster chain lead by an outstanding team that’s also doing a ~$200 million incentive program to develop on their network. We highly recommend reading our dedicated articles linked in the top of the newsletter to learn more.

DAO Aiming to Buy NBA Team Has Quickly Raised $1.7M in Ethereum

DAOs are the future of work and organization. We’ve said that here many times. We recently saw a group of 20k strangers across the globe come together in the ConstitutionDAO raising $45M in 7 days to buy an original copy of the US Constitution. They were unfortunately outbid last minute by a Wall Street hedge fund CEO, but what they did foreshadows what’s to come - the ability to rapidly coordinate and communicate resources to enter markets. Now, we’re seeing this with another DAO called Krause House has raised $1.7 million to buy an NBA franchise. Obviously, they’re nowhere close to meeting funding goals since NBA franchises are in the billions, but it’s the direction that matters.

More on Crypto

Funds are Bullish on DOT; BTC Continues to Struggle: Markets Wrap

Avalanche Slides into Top 10 as Ethereum Users Complain About Gas Fees

NFT Music Platform Royal Closes $55M Funding Round Led by A16z

MACROJerome Powell Secures Second Term as Inflation Persists

President Biden confirms that Jerome Powell will continue in his second term as the Chair of the Federal Reserve. Dr. Lael Brainard who was Powell’s main competition was selected for the vice chair of the board of governors. The difference between the two nominees is minimal outside of the fact that Brainard has a higher disliking for the banks and would like to concentrate more power at the central bank. The move by Biden is speculated to be one of projection making it seem like the central bank is independent from the government as Powell was the more bi-partisan pick. Regardless, the printing press will remain on and fiscal monetization is still the name of the game.

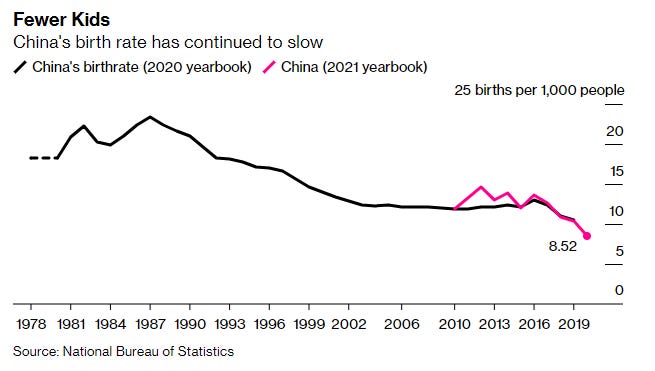

China’s Record-Low Birth Rate Underscores Population Challenges

China’s birth rate dropped to a new low in 2020, 8.5 births for every 1,000 people which is the lowest since 1978. This confirms the demographic challenges within the country. Their economy is slowing and so many citizens have so much tied up in the real estate sector which is way over developed and could have a dramatic pullback given the Evergrande crisis that seems to be contained within China. Demographics are one of the driving forces dictating economic conditions and the Chinese Communist Party has a huge demographic problem with a large aging population leaving the workforce and a newly lifted middle class that expects growth in a slowing economy. This will be the main driver for CCP policy decisions.

U.S. Home Sales on Track for Biggest Year in 15 Years

US home sales rose in October as buyers continue to compete for a limited amount of homes, sales increasing by 0.8% or 6.34 million homes in October. This is the highest pace since January of this year. The median home price rose 13.1% from a year earlier when home sales were at it’s peak, the median existing home sale price is $353,900. Generally, home sales slow down after the summer because of school, but that doesn’t seem to be the case this year. The hot market is making it tough for would be buyers as prices continue to increase, but also for people who are looking to sell, but don’t know where they would move after, which is another pressure tightening the already tight market.

More on Macro

Biden Says Powell's Renaming Keeps the Fed Stable and Independent

Dollar Surges to Four-Year High Against Yen on Faster Hike Bets

MEDIAWhy QE Is NOT Money Printing | Jeff Snider & Emil Kalinowski

What is the Avalanche Network? AVAX Explained with Animations

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.