MAJR News 067

Bitcoin continues to correct below $60k, ConstitutionDAO displays impressive coordination to win a real copy of the US Constitution, Gemini raises $400M for metaverse play

@itsflossquiat

MAJR NEWS BRIEF

Videos

Andreessen Horowitz crypto partner Ali Yahya discusses “Crypto Business Models.” Yahya explains that the consensus mechanisms of blockchains create trust among independent participants in decentralized networks. At first glance, this may seem at odds with the idea of capturing value, since none of the factors that allow companies to build moats in traditional industries — trade secrets, intellectual property, or control of a scarce resource — apply in crypto. This leads to the “value-capture paradox” — how can easy-to-replicate, open-source code be defensible in a competitive landscape? The answer is that network effects are just as powerful, if not more so, in crypto than in traditional industries. This is due to the economic flywheel enabled by tokens, which incentivize participants and coordinate all economic activities in crypto networks.

Top Stories

BITCOINBitcoin Tumbles to 3-Week Low Under $60K; Next Support at $53K

Bitcoin price continues to pullback despite strong fundamentals. At press, the price is $57,770 a 2% correction in the last 24hrs. Next support level is ~$53k, approaching the 100 day MA and oversold territory on the RSI. ETH also dipped below $4k. We’re buyers here.

Eldrige leads Digital Currency Group's maiden $600 million debt funding round

Digital Currency Group, the private crypto conglomerate parent company of news site Coindesk and Grayscale Investment which manages more than $50B in AUM of digital assets, raised a $600 million in a credit facility to enhance strategic operating capabilities. The round was led by private equity firm Eldridge, Davidson Kempner Capital Management, Francisco Partners and Capital Group. This comes two weeks after DCG sold $700 million worth of shares to SoftBank valuing DCG at $10 billion.

Fidelity Approved to Become Canada’s First Institutional Bitcoin Custodian

Fidelity has been approved to be one of Canada’s first institutional custodians for bitcoin adoption. This will help institutions including pension funds, portfolio managers, mutual funds and ETFs invest in bitcoin.

“The demand for investing in digital assets is growing considerably and institutional investors have been looking for a regulated dealer platform to access this asset class,” Scott Mackenzie, president of Fidelity Clearing Canada, said, per the report.

More on Bitcoin

Indian PM urges democratic countries to collaborate on cryptocurrencies

What SOPR (Spent Output Profit Ratio) Can Tell Us About Bitcoin Market Sentiment

Bitcoin’s Recent Drop Shows Acute Volatility Remains a Hallmark

CRYPTOCrypto Could Undermine the Dollar and Destabilize Nations: Hillary Clinton

MAJR Take: Hillary Clinton reentered the spotlight shooting off standard political incumbents talking points about cryptocurrency adoption, and she’s 100% correct. Crypto will destabilize the dollar along with all fiat currencies and national centralized power will shrink. But, let’s take a step back and evaluate how we got here and who’s responsible…the current system and leadership under the international fiat regime. Global debt is +400% GDP, we’re more politically divided than ever, wealth inequality has never been higher and we’ve helped the Chinese Communist Party rise to power, steal our technology, infiltrate our universities and we’ve exacerbated climate change under the Petrodollar. Facts.

These talking heads need to study up and think critically for once. There’s only so many options for nation states moving forward. We’re either going to invoke national austerity measures, default on our debts, inflate away the debt destroying the middle and lower class or grow our way out of this situation via new technology adoption. Political vampires like Mrs. Clinton and the current political parties (left and right) will always default to the printing press, but crypto doesn’t have to destabilize the dollar or nations. It can help underpin digital fiat currencies with some type of value. Gold used to back the dollar, bitcoin can do the same. The next decade will not end well for the current system and we should have a Plan B - provide people with a potential offramp out of the chaos which is crypto. People are making money in crypto and the incumbents see this as destabilizing…I wonder why. Rant over.

“What looks like a very interesting and exotic effort...has the potential for undermining currencies, for undermining the role of the dollars as reserve currencies, for destabilizing nations,” Clinton said at Bloomberg’s New Economy Forum.

She added that—if in the hands of the wrong people—cryptocurrencies could be direct threats to nation-states.

“There’s a whole new layer of activity that could be extremely destabilizing or, in the wrong hands or in alliances with the wrong people, could be direct threats to many of our nation-states and certainly to the global currency markets,” she added.

Confusion Sets in After ConstitutionDAO Fails to Win Sotheby's Auction

For anyone that hasn’t been following the latest news in the world of DAOs, there was a group of strangers that came together - 20k discord members, formed a DAO (decentralized autonomous organization) - the ConstitutionDAO, raised $45 million in 1 week to bid for 1 of the 13 original copies of the US Constitution. While they didn’t take home the constitution, this is incredibly impressive and wildly ironic. A decentralized community came together to bid for what could be founding father’s original governance document declaring the decentralization for the US from centralized Britain. This is a preview into the future - immediate decentralized communication and coordination between strangers around shared interests and goals with monetary power materialized in a token.

Bitcoin Exchange Gemini Confirms $400M Raise at $7.1 Billion Valuation

Gemini, the Winklevoss cryptocurrency platform and exchange raised outside money for the first time to the tune of $400 million at a $7.1 billion valuation. The billionaire twins made a fortune off of Facebook and were super early investors in bitcoin. Gemini is one of the leading cryptocurrency exchanges in the US with trusted custody solutions. They rival Coinbase’s $70 billion and Kraken’s $10-$20 billion valuations. The round was lead by Morgan Creek, 10T, ParaFi and Jay Z’s Marcy Venture Partners. Gemini looks to be making a play into the metaverse given that it has it’s own NFT platform, Nifty Gateway.

More on Crypto

Acala wins first Polkadot parachain auction with over 32M DOT staked

Crypto.com Coin Price Jumps 30%, Hits All-Time High After Lakers Arena Deal

New Funding Round Would Give NFT Marketplace OpenSea $10B Valuation

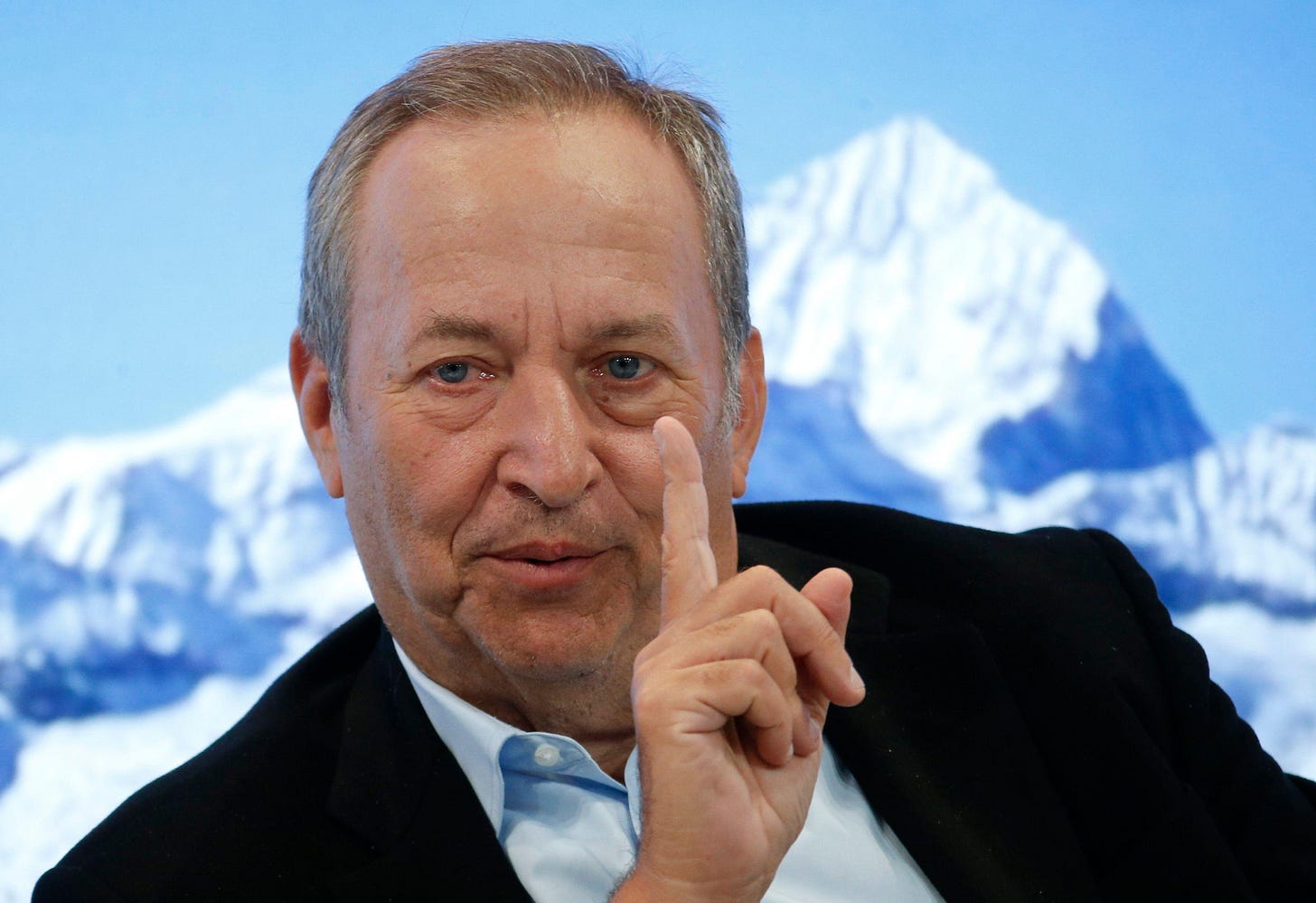

MACROSummers Sees Just a 15% Chance of U.S. Economy Working Out Well

The former US Treasury Secretary Larry Summers had some not-so-great forecasts for the US economy over the next year. He thinks the US economy has a, “10% to 15% chance of working out well, 50% to 55% chance that inflation runs hot well over the 2% target, and a 30% to 35% chance that policy makers put a clamp on inflation - more than needed.” The Harvard University professor and Bloomberg contributor didn’t anticipate this much inflation with CPI at 6.2% last month.

Top Fed Official Warns Against Coordinated Global Monetary Policy

Top Federal Reserve official, Vice Chairman Richard Clarida said that central banks should be careful about coordinating global monetary policy as it may hurt their credibility when communicating to the public. There’s the idea that if we all print together than no one country benefits or gets hurt, except the actual citizens who depend on the value of their currency for storing their time and energy to buy good and services. His comments validate the coordination between global central banks and the fact that institutional trust is already eroding with the public.

U.S. Unemployment Claims Steady in Tight Job Market

U.S. jobless claims are moving down toward pre-pandemic levels as employers avoid layoffs and many workers quit or remain sidelined in a tight labor market. Initial claims for jobless benefits edged down to seasonally adjusted 268,000 last week from a revised 269,000 a week earlier. Claims are at the lowest level since the pandemic hit the U.S. economy last spring. Workers are jumping from job to job looking for better wages and in the remote economy, it’s becoming much easier to leave. Recruiters reported that 53% of the roles being filed are backfills because of departures. We’re also seeing a tighter job market because of labor shortages amid school and childcare disruptions, therefore more parents are staying home vs. entering the workforce.

More on Macro

U.S. House passes Biden's $1.75 trillion social spending bill, sending to Senate

As inflation surges, Fed to debate faster taper, earlier rate hikes

MEDIAAli Yahya: Crypto Business Models

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.