MAJR News 066

Bitcoin and crypto markets pullback while fundamentals are strong, Bitcoin upgrade - Taproot goes live, Institutions are piling into ETH via Grayscale product ETHE, Calpers levers up to meet targets

@nadrient

MAJR NEWS BRIEF

Videos

Kyle Bass, the founder and principle of Hayman Capital Management. Hayman’s first major success came from effectively shorting the housing market in 2008 and Kyle was profiled in Michael Lewis’ book The Big Short. More recently, Kyle has been heavily focused on China and has been sounding alarm bells from everything from their accounting protocols, military initiatives and central bank digital currency development. In this interview, Kyle articulates why US interest rates must remain near zero for the next decade and expands his views on China.

Top Stories

BITCOINAnalysts See Bitcoin as Still in ‘Bullish Phase,’ Despite Pullbacks

Bitcoin (BTC) price is rangebound with a pullback from $69k to $60k, 13% drawdown in a week. However, despite price action we’re still in a bullish phase with strong support at $60k levels, the relative strength indicator (RSI) is below 50 on the daily charts and an immediate drop below the 200 day moving average on the 4 hour charts suggest a “buy the dip” opportunity. All systems are go on the fundamentals side - more institutional inflows, near ATH for hashrate and increase in network activity and new wallets. Not too mention, the long awaited Bitcoin protocol upgrade has gone live, Taproot.

Crypto mining stocks dip as SEC issues subpoena for Marathon Digital mining facility

Marathon Digital Holdings, one of the largest bitcoin mining stocks was issued a subpoena from the SEC with regards to one of its facilities in Montana. Shares dropped 17%, along with other mining stocks such as Riot, Bitfarms, Bit Digital and Hut 8. Earlier this month, Marathon Digital announced it was buying more BTC and miners through a $500 million debt offering. Marathon is cooperating with the SEC, but didn’t comment on details.

Galaxy Digital Reports Q3 Earnings of $517M

Galaxy Digital (GLXY), the publicly listed cryptocurrency conglomerate led by Mike Novogratz did record income in Q3’21 of $517 million, up 1,146% YOY. The company has reported $1.2 billion in earnings year to date, with approximately $400 million for in Q4’21 already. Galaxy Digital is heavily invested in bitcoin and across the entire digital asset ecosystem touching everything from alternative layer 1s, mining, infrastructure, gaming and NFTs.

More on Bitcoin

President Biden signs infrastructure bill into law, mandating broker reporting requirements

‘Bitcoin Senator’ Lummis Joins Wyden to Undo Crypto Language in Infrastructure Bill

Bitcoin Price Briefly Drops Below $60,000 as Strong Dollar Weighs on Crypto

CRYPTOParadigm Co-Founder on Record $2.5B Fund and Next Era of Crypto

Paradigm, one of the biggest crypto venture capital firms in the business has just raised the stakes and the record for the largest crypto focused fund, $2.5 billion. This beats the $2.2 billion crypto fund from VC giant Andressen Horowitz (a16z). The fund will focus on broader consumer decentralized applications (DAPPs) such as DeFi (decentralized finance) and DAOs (decentralized autonomous organizations) vs. crypto infrastructure. Paradigm’s previous $400 million fund is already up 200% in the first half of the year.

Ethereum-Based Holdings Among Institutions Up 19% in Q3: SEC Filings

The second largest cryptocurrency by market cap, Ethereum is up 19% among institutions holding Grayscale’s second largest trust, the Grayscale Ethereum Trust (ETHE). Firms with over $100m in AUM are required to file a 13F form to disclose what’s in their portfolio and there were 10 new holders with ETHE. The draw to Ethereum (ETH) makes sense as to where the institutional capital waterfall will trickle into - first stop is Bitcoin and next stop is Ethereum. The following stop may be alternative layer 1’s like Solana (SOL) or largest sector among crypto applications, DeFi (decentralized finance) which is predominately run on Ethereum’s blockchain. Cathie Wood’s Ark Invest is the firm with by far the largest amount of exposure to GBTC and ETHE shares with 82% of all GBTC and 42.6% of all ETHE. This is mainly due to their investment charter structure which prevents them from holding the underlying digital assets, but still extremely bullish on price.

'The Collectoooooor': Why Pplpleasr's Latest NFT Art Is on Solana, Not Ethereum

NFT artist, pplpleasr (Emily Yang) launched her first NFT project on Solana, “The Collectoooooor.” The NFT collection has different pieces that can be collected in a particular set. If one collector has a specific number of pieces in one set, it unlocks a new action where the owner can burn pieces (destroy) to be rewarded one of just 15 total limited edition 3D cityscapes encompassing all pieces from the set. This is a very interesting way to add utility and demand for digital art, but pplpleasr also used Solana to not only explore alternative blockchains but for its Fair Launch Protocol - a way to give community price control while also limiting the amount of NFTs can be minted by early buyers. Pieces were minted for less than 1 SOL and are now trading on secondary markets for 5x-100x.

More on Crypto

Grayscale's Metaverse Bet Is Paying Off: MANA Climbs 253% in Two Weeks

The Biggest Celebrity NFT Owners in the Bored Ape Yacht Club

New DAO Forms to Buy Copy of US Constitution at Sotheby's Auction

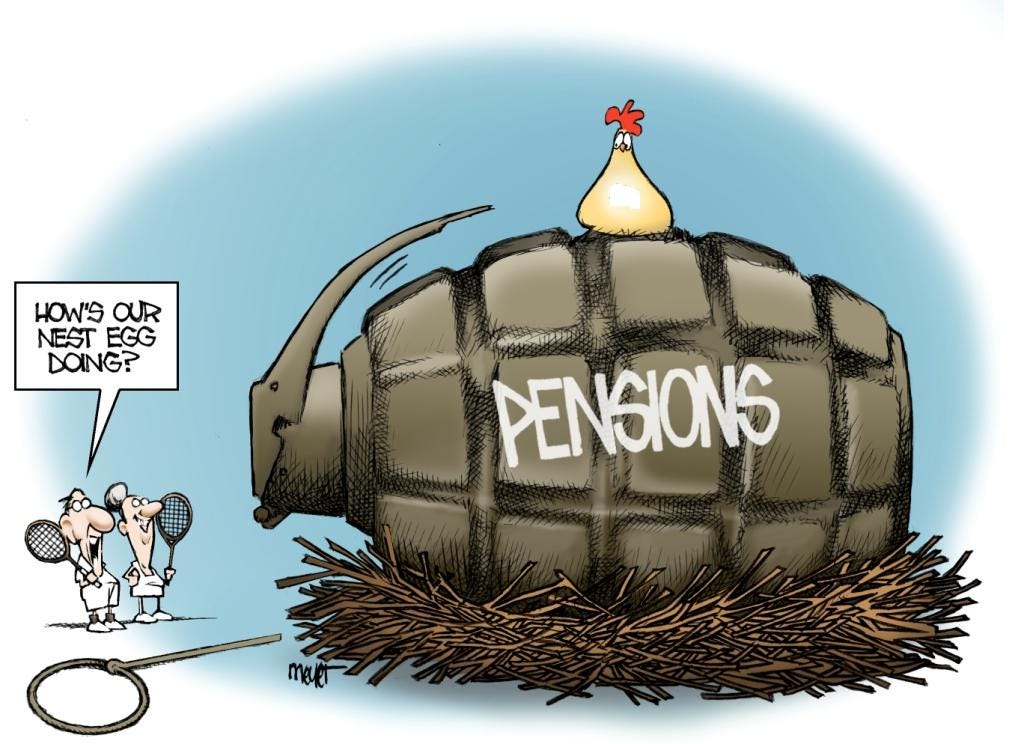

MACRORetirement Fund Giant Calpers Votes to Use Leverage, More Alternative Assets

Calpers, the $495 billion California Public Employee’s Retirement System votes to gamble with public pensions by voting to use leverage and alternative asset to reach 7% yield targets. Calpers is the largest pension fund in the country and has been hurting like many other pension funds and institutions in the 0% interest rate environment. They, like every other investor have to go farther out on the risk curve to find yield. When money is dirt cheap and everyone’s broke, what should they do? Well, they levered up and increased their liabilities by 5% or $25 billion, increased exposure to riskier assets like private equity from 8% to 13% and added 5% allocation to private debt.

MAJR Take: Rather than take on additional leverage and more debt, they could have just added an equivalent or smaller position to bitcoin. At least that’s what other pension funds are doing. Anyone who’s actually paying attention to market conditions should know that literally every public pension is in the same situation. Real Vision broke this story two years ago.

U.S. Shoppers Boosted Spending Last Month, Taking on Higher Prices

Retail sales were up 1.7% in October heading into the holiday shopping season despite higher prices. Consumers say they’re worried about inflation, but they’re actions say differently. Prices are high and they’re not going to come down anytime soon. Given the shortage in supply, perhaps shoppers are getting ahead of the empty shelves... Or, American’s are addicted to consuming, spending and debt. Imports are up 20% compared to 2019 and labor shortages are putting higher pressure on prices due to higher wage to entice workers. The inflation spiral is underway and it’s going to be hard to slowdown.

Fed’s Barkin Says More Data Is Needed Before Raising Rates

Federal Reserve Bank of Richmond President Thomas Barkin says we need more time and data to see if it’s time to raise rates. Is inflation going to retrace back to normal levels? Is the labor market going to open up? This is the Fed punting the question because they know raising interest rates is impossible given the amount of debt in the system and limiting the government’s ability to borrow by monetizing spending is not an option.

MAJR Take: Watch the video in today’s media section to understand why we’ll stay in a low interest rate environment for a long time… like the next decade. It’s just math.

More on Macro

ECB Eases Collateral Rules to Alleviate Government Bond Shortage

Inflation Poses High Risk for Investment-Grade Bonds, Morgan Stanley Says

New York Fed Sees Impact on Economic Inequality From Climate Change

Biden Weighs Choice of Jerome Powell or Lael Brainard as Fed Chair

MEDIAChina and Macro Impact w/ Kyle Bass (TIP396)

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.