MAJR News 064

Everything is so bullish, New highs across the board - BTC ATH, ETH ATH, Total Crypto Market Cap ATH, OpenSea NFT Volume ATH, Institutional Crypto Inflows ATH, Inflation and Wages Approaching Highs...

@starfury

MAJR NEWS BRIEF

Videos

Next with Novo features Mark Cuban, an American entrepreneur, TV personality, philanthropist, and investor. They discuss the intersection between the Creator Economy and crypto.

Notes to readers

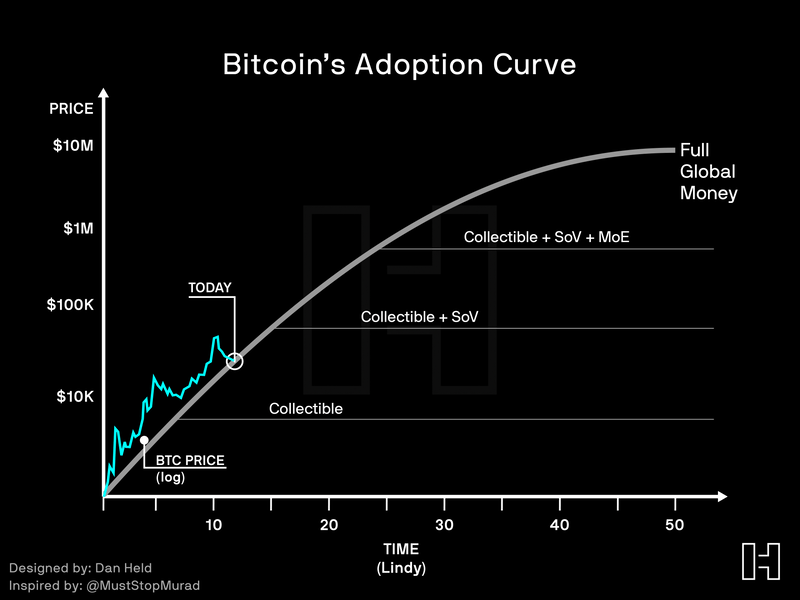

Bitcoin and crypto are about to get very volatile. Try to keep your emotions in check. Hold through crashes and take profits going into highs and coming out of highs. The cycle is closer to the end than the beginning, but it will most likely be a longer cycle than previous cycles given the new market structure. We have global institutional support just starting to pour in, a new narrative around digital store of value vs tulips and a giant melting ice cube that is the bond market. Inflation is here and it isn’t going any where. Bitcoin is the fastest horse in the race and the least risky investment across all asset classes with a long enough timeline. I’m never selling my bitcoin. It’ll be passed down to my kids’ kids. Don’t get caught up in the shiny things, altcoins and over trading. If you want to avoid the headache and risk, just buy bitcoin and chill. It’s that simple.

Top Stories

BITCOINBitcoin Soars Past $67K for the First Time as Ether Also Sets Record High

Bitcoin made new all-time highs breaking past $68k at the time of writing. The crypto total market cap also hit new highs, breaking $3 trillion, adding nearly $1 trillion in the past 30 days…wow. Glassnode is reporting nearly 39 million unique wallets on the blockchain holding more than 0 BTC, close to record 38.7 million from this May. Price discovery mode is locked in for bitcoin. Grab your socks and consolidate your alts. Bitcoin is about to rip for the next 2 months. Expect volatility.

Bitcoin Tops Record-Breaking $6.4 Billion in Institutional Money Inflows: CoinShares

Institutional money is flowing into crypto hitting $8.9 billion last week. Polkadot’s DOT saw record weekly inflows hit $9.6 million. Bitcoin accounts for 2/3 of all institutional inflows, next Ethereum with just over a $1 billion. There have been 12 straight weeks of growth.

Crypto Mining Stocks Rally After Bitcoin Surges Near Record, Ether Hits All-Time High

Monday’s gain in bitcoin and ether prices spurred crypto mining stocks such as Marathon Digital and Riot Blockchain to rise sharply. Other mining companies such Bit Digital, Bitfarms, Cipher, Hive Blockchain, Hut 8, Cleanspark, Stronghold, Argo, Sphere 3D and Greenidge Generation saw increases in their stock prices. MicroStrategy which has been used as a bitcoin proxy was also up 9%.

More on Bitcoin

NYC Mayor-Elect Eric Adams Wants Crypto Education In Schools

New ATH renews faith in PlanB’s prediction of $98K BTC by December

Record whale accumulation precipitated latest all-time high Bitcoin breakout

CRYPTOBitcoin, Ethereum Both Reach All-Time Highs

Bitcoin leads and the whole market follows. Ethereum hit $4,800 for the first time. The whole market is green, total market cap up 5% in the last 24hrs.

NFT Marketplace OpenSea Hits $10B in Total Volume

OpenSea, the largest marketplace for buying and selling NFTs - digital art, goods and collectibles - predominately on the Ethereum blockchain hits new highs. The platform has done $10 billion in lifetime volume - $473k in 2018, $8 million in 2019, $24 million in 2020 and $1.02 billion by August of this year. The platform added nearly $9 billion in the last three months alone. OpenSea has 635k traders and Rarible, the next largest decentralized marketplace has 83k.

Congress Passes $1.2 Trillion Infrastructure Bill, Paving Way for Extra Crypto Taxes in U.S.

Congress passed the $1.2 trillion Infrastructure Bill without rectifying bi-partisan request to fix broad language including miners, developers, applications and other services as “brokers.” This bill is less about regulation and more about using the burden of over reporting to collect taxes. The final vote passed with a 229-2016 in favor of the bill signed by President Biden. I doubt this language stays put for a long time with the crypto quickly becoming a bi-partisan issue. If it does, pro crypto investors, companies and financial innovation will move offshore.

More on Crypto

MACROBrainard Interviewed by Biden for Fed Chair as Search Heats Up

Federal Reserve Governor Lael Brainard was interviewed by the White House last week to take the helm of the central bank from sitting Chair Jerome Powell, his post ending in February. Brainard has a Ph.D. from Harvard University and is known for being tough on banks, bringing more power to the central bank and having a more dovish monetary perspective compared to Powell. She fits the bill for a Biden and Yellen administration if they think Jerome will hit the break and raise rates.

Fed Risks Repeating Past Mistakes in Calling Full Employment

The Fed is stuck. How far should they let inflation run? Repeat 2010s and tighten too early causing a market correction? Or let it run and roll the dice hoping higher wages don’t cause double digit inflation like in the 1970s? There are over 10.4 million job openings but 5 million fewer people on payrolls prior to the pandemic. More than 3 million American retired early because of the crisis. We had 5.4% increase in CPI recorded in August, much higher than their 2% target. Wages rose 4.2% YOY ending in Q3’21. The Fed knows there’s only one option…support asset and home prices. The show must go on as baby boomers, the largest generation - leave the workforce and retire. Mathematically the US would default on it’s debt if interest rates were to go much higher. There’s a good chance the economic playbook says “sorry bondholders, but we’re going into deep negative real interest rate territory.”

U.S. producer prices increase solidly in October

The producer price index that measures the change in the cost of producing goods has continued to increase over the last 12 months, rising 0.6%. The PPI has increased 8.6% since the beginning of 2021.

More on Macro

Biden Faces a Political Risk in Rising Gas Prices, With Few Options to Respond

Fed Officials Flag High Inflation and Some Warn of Rate Rises if Pressure Persists

Public Expects Inflation of 5.7% in a Year, New York Fed Survey Shows

Fed Officials Flag High Inflation and Some Warn of Rate Rises if Pressure Persists

MEDIAMark Cuban | Crypto and the Creator Economy | Next with Novo Podcast Episode 27

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime.

Click the button below to share the MAJR Newsletter. For more breaking news and updates, follow us on Twitter @majrcreatorsWe’ve moved some content behind the pay wall. This is the free newsletter that drops on Tuesday and Thursday.

Subscribe to get all MAJR content inclusive of podcasts, digital asset research and analysis and exclusive articles and media. THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.