MAJR DAO Report: Yield Guild Games

The NFT Guild Business Model - Creating Cashflow with NFTs | How the “Settlers of Metaverse” are paving the future of P2E Gaming

In this special edition of MAJR News, we take a deep dive on one of the great recent success stories in GameFi that features what the space is all about in Yield Guild Games (YGG). Before we highlight the value proposition that YGG brings to the “play-to-earn”(P2E) space, let’s take a step back to understand gaming guilds in general and how this business model allowed YGG founder Gabby Dizon to turn a relatively simple digital asset-lending idea into a community of 45,000 gamers with a token market cap of over $230 million.

This article was written by MAJR DAO community member Mack.

The Growth of Guilds

The rapid rise of professional gaming brought about by the popularity of live streams and e-sports continues to multiply as focus shifts from traditional gaming platforms to the endless adventures awaiting in the worlds of the metaverse.

While the opportunity within the play-to-earn space is exciting and rewarding, there remains educational and financial barriers to entry for these metaverse ecosystems.

Lease, Play & Earn

The “lease, play and earn” model used by gaming guilds such as YGG helps remove these barriers by creating a more affordable way for gamers to use in-game NFTs and generate a new revenue streams for NFT token holders.

How exactly does this business model work?

Let’s jump back to YGG.

Yield Guild Games

As the pandemic brought more economic hardship across society, Philippines-based YGG founder Gabby Dizon saw much of his community struggling to find work let alone support their loved ones. Dizon, a veteran in the gaming industry, had an epiphany one day centered around Axie Infinity, the popular NFT-based online game.

What if you could enter into a profit-sharing lease agreement with capable blockchain gamers that would utilize your NFT assets in-game and generate extra yield?

Dizon started leasing his personal NFT assets, and the results were almost immediate. He had proof that the model generated a yield from the game and provided value for each party involved. Next step was scaling.

The model was straightforward, with the help of sponsors, YGG would acquire the most valuable metaverse NFTs and tools available, then recruit the most skilled gamers or “scholars” who could steward these assets and reap the rewards.

In addition to providing the scholars with needed NFT assets, YGG educates new scholars on what they need to know to be successful at playing these games.

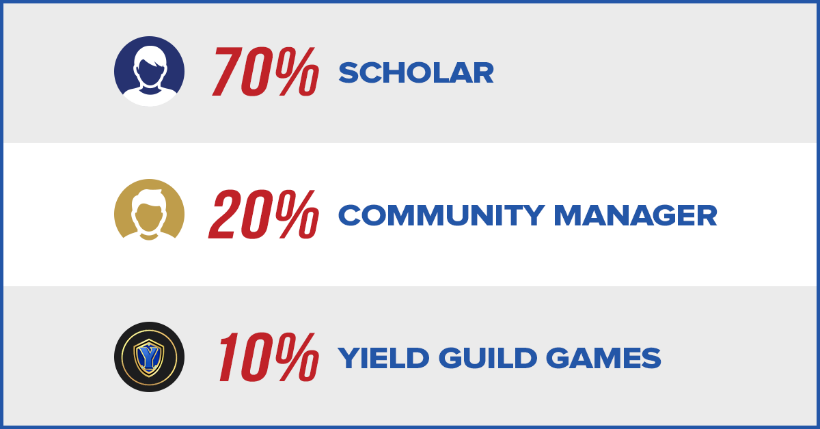

The profit-sharing breakdown decided upon by YGG is pictured below:

In addition to the appreciation potential of the underlying NFT assets themselves, the lease model provides the YGG treasury with additional funds to be re-invested into more promising assets and ecosystems.

The scholars retain a healthy 70% revenue cut to stay afloat while further expanding/developing the ecosystems they play in. The sponsors supporting YGG then receive payment from the YGG treasury while the majority of funds remain for future reinvestment.

YGG continues to leverage its growing community and influence to establish new relationships with game ecosystems, diversifying their exposure and minimizing risk should one of the gaming ecosystems in their NFT asset portfolio suffer from a sudden drop in popularity.

Significant YGG partners include the following:

The YGG partners seem to happening a regular basis. You can see the updates on their medium blog here.

Structure and Roadmap

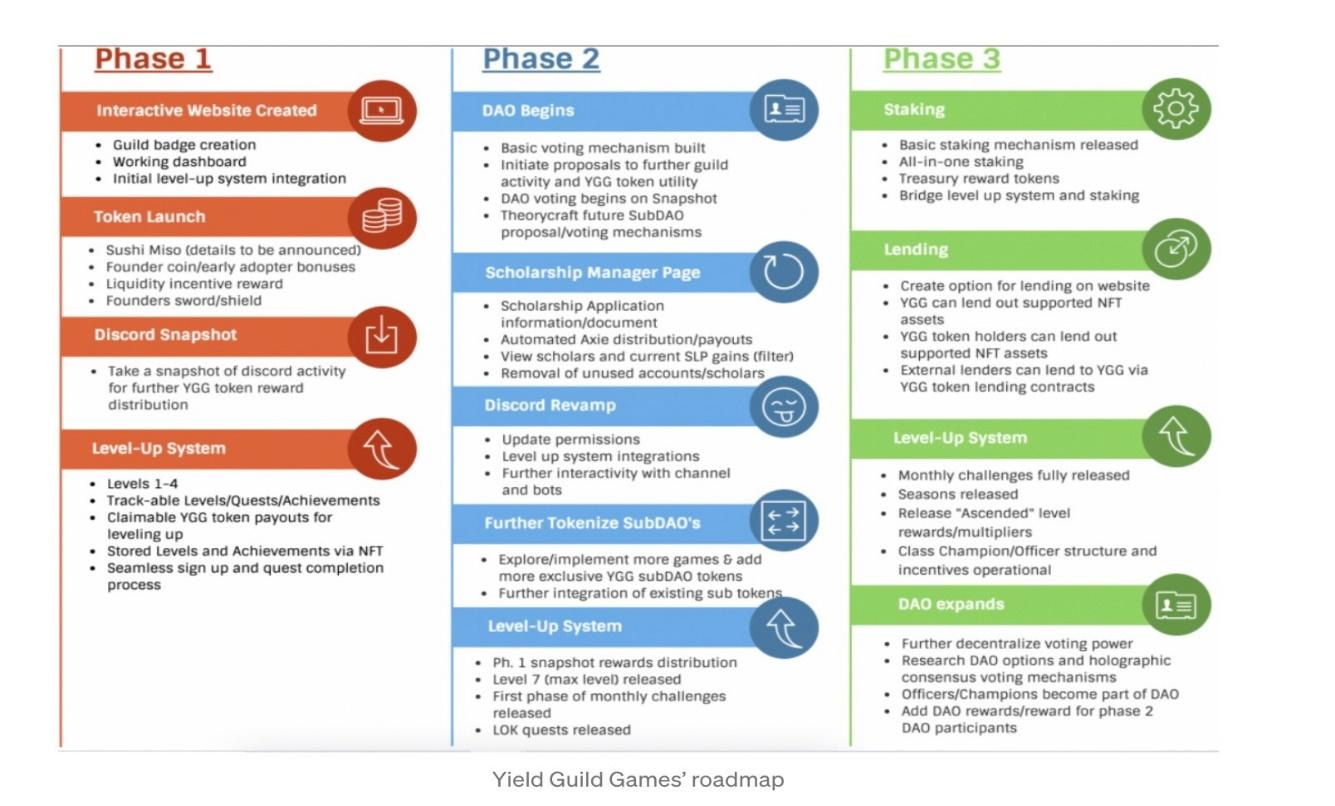

YGG believes that a DAO-structure best serves the future growth and decentralized desire of their member-focused organization. Currently, YGG subjects its community members to vesting and lockup periods. This reduces large volatile swings in its ERC-20 token prices, however, they project’s market cap has corrected with the rest of the crypto market. This presents an entry opportunity for investors and believers in this project.

YGG is slowly making the transition to a full decentralized DAO. The roadmap pictured above articulates their full development plan from last summer’s token launch to the future plans for lending, staking, and expansion opportunities.

2021 year end statistics emphasize the exponential growth of Yield Guild Gaming over the last 18 months, and many believe this is just the beginning as more large players enter the metaverse in 2022.

Conclusion

YGG truly exemplifies the best of what GameFi is intended to provide by adding value for players, investors, and creators alike.

YGG continues to make headwinds as they develop in-game economies and provide yield-farming opportunities and accessibility to all who are ready to join the “settlers of new worlds in the metaverse.”

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.