BRIEF

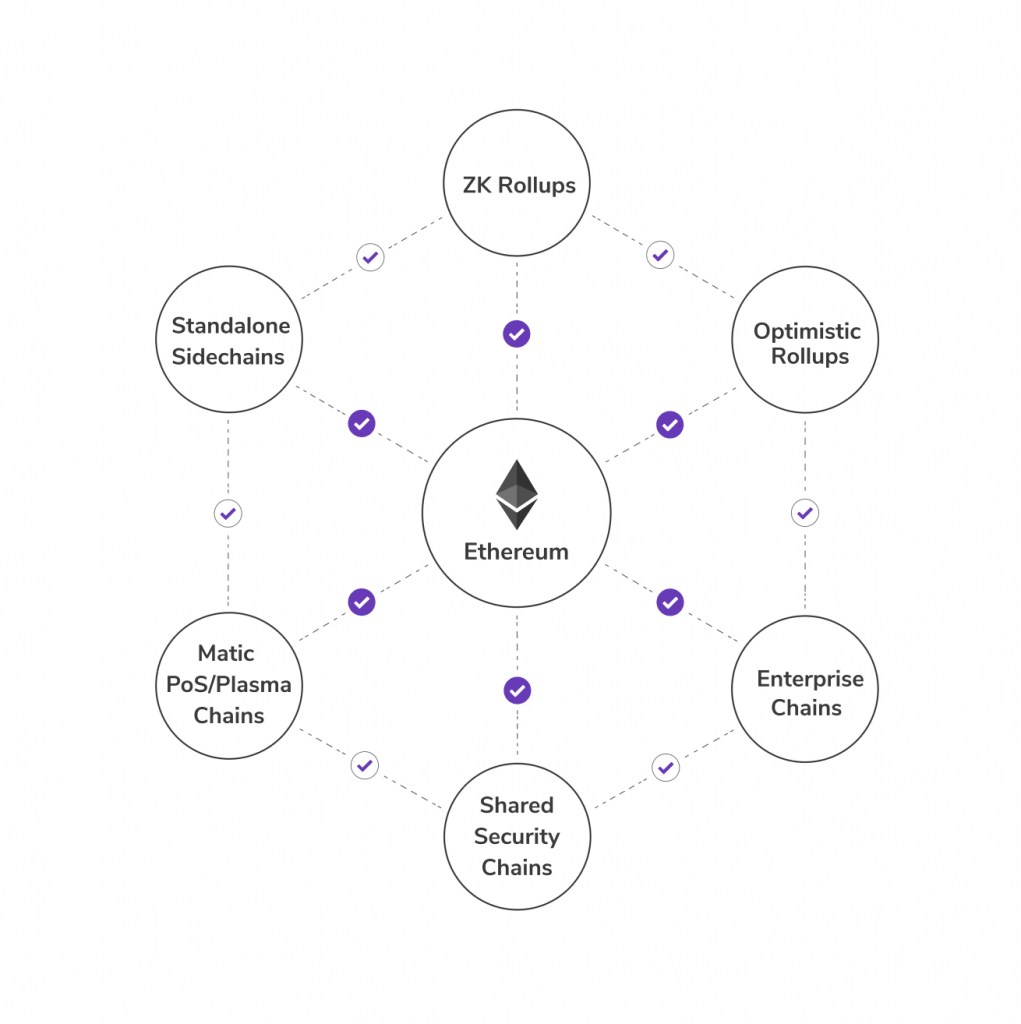

Polygon is a layer-2 (‘L2’) solution designed to scale Ethereum.

Scalability in crypto means faster transaction times (throughput) and lower gas fees. The protocol does this by processing transactions on a connected, but separate blockchains (batching or rollups) and then settling that batch of transactions back on Ethereum.

Polygon can connect Ethereum-compatible blockchain networks or dApps (decentralized applications).

Benefits by inheriting Ethereum’s network effects, greater security properties and a more open and powerful ecosystem.

Aims to enable Ethereum to become a multi-chain system interoperable with other chains and eventually become its own L1.

Large cap token - $10B market cap - $14.5B fully-diluted market cap - lower risk.

Token (MATIC)

Price: $1.46

Functions / Features:

ERC-20 token / Proof-of-Stake (PoS)

Supply - 7.8B of total supply 10B - 78% in circulation.

Used to pay for services in the Polygon ecosystem - transaction fees are paid in MATIC.

Serves as a settlement currency between users operating in the ecosystem.

MATIC owners participate in the PoS consensus and receive staking rewards in MATIC.

Token distribution: ecosystem (23%), foundation (21.9%), Launchpad sale (19%), team (16%), network operations (12%), advisors (4%), seed round (2.1%) and early supporters (1.7%).

Has a multi-chain framework similar to Cosmos or Polkadot.

Team

Great veteran team - founded in 2017.

Solid early investors - Alameda Research, Transcend Fund, Makers Fund, Animoca Brands.

Global video game leaders and game industry investors - Scopely, dune ventures, Union Square Ventures, Variant Fund, Seven Seven Six (Reddit founder Alex Ohanian), DCG, Sino Global Capital, Dragon Fly Capital and many more.

Most recent investors - Sequoia Capital India, SoftBank, Galaxy Digital, Tiger, Republic Capital, Alan Howard (Brevan Howard), Kevin O’Leary (Mr. Wonderful from Shark Tank).

Solid advisors - Hudson Jameson (Ethereum Foundation), Ryan Sean Adams (Bankless), Anthony Sassano (EthHub), Pete Kim (Coinbase) and John Lilic (ex-ConsenSys).

Pros

Lower market cap (~$10B) compared to other smart contract blockchains - lots of upside here. Polygon is a great pick up now, but if we see a crash - then definitely at lower valuations.

Down nearly 100% from highs - $2.92 MATIC / ~$20B market cap. And, we’re still SO EARLY.

The token is across all major US exchanges so this offers users greater liquidity and the ability to get on and off exchanges and into self-custody.

Lots of NFTs use Polygon.

Leverages Ethereum’s network effects.

No real inflation risk.

Total value locked (TVL) on-chain - $4.04B Locked - 2.28514 MCap / TVL - 7th.

Product market fit - faster and cheaper transactions on Ethereum, while Ethereum mainnet is slower and more expensive.

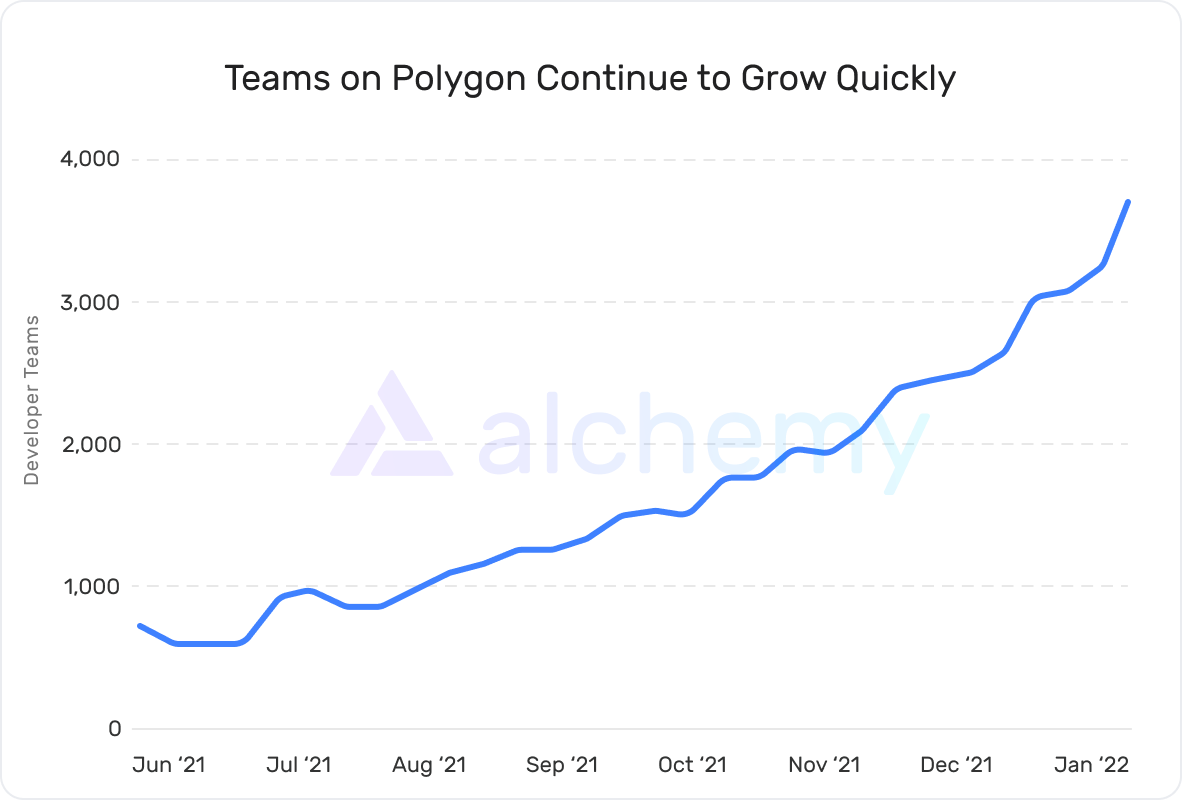

Lots of big time investors - raised a lot of money - $450M in February 2022 to incentivize web3 developers to build on its network.

Great team with great technology for scaling. Part of the $450M will go towards investing in cutting-edge zero knowledge (ZK) technology that will be key to onboarding the next billion users.

Polygon Studios for blockchain gaming was launched July 2020 bringing projects from DraftKings, Upshot, Aavegotchi, Zed Run, Skyweaver by Horizon Games, Decentraland, The Sandbox and more.

Lots of partnerships and projects - Aave, OpenSea, Lazy.com (Mark Cuban NFT Co.) and 7k-10k dApps use Polygon.

Of all the Ethereum L2 solutions, Polygon seems to have the most development. Development leads to applications and applications lead to use cases and users.

Cons

L2 solutions can bring user experience issues as users need to bridge their Ethereum tokens to Polygon. Complicated and annoying, even for crypto veterans.

Many other alternative layer one (L1) solutions are EVM (Ethereum Virtual Machine) compatible. This means the Ethereum applications can bridge over to other L1s for speed and efficiency such as - Avalanche, Polkadot, Fantom, Binance Smart Chain, Celo.

Better alternative non-EVM compatible L1s could start taking even more market share offering a better user experience with faster throughput and efficiency like Solana, Cosmos or Terra (both larger caps).

Lots of competition in scaling Ethereum such as Optimism, Aztec, Starkware, MatterLabs.

Sources:

Bitcoin and crypto adoption is here to stay. Don’t let your friends and family miss the opportunity of a lifetime. For more breaking news and updates, follow us on Twitter @majr_daoWe’ve moved some content behind the pay wall. Subscribe to receive all our research and analysis.This is not financial advice. Please do your own research. Investing in bitcoin and cryptocurrency comes with risk. The information presented in this newsletter is for information and entertainment purposes only.