r/perfectloops

MAJR Coins is a new initiative highlighting top projects for investors. Available for a limited time before going behind the paywall.

This is not investment advice. Do your own research. These are personal opinions only.

- MAJR TeamThe Internet Computer

Expanding the Superpowers of the Internet

“The internet is a public network that connects everybody and everything. The Internet Computer extends the public internet so that it can also host smart contracts.

The Internet Computer is a public blockchain that hosts smart contracts that run at web speed, can serve web from cyberspace, run efficiently, and can scale within an environment that has unbounded capacity. Smart contracts are a profoundly new and superior form of tamperproof and unstoppable software. They can imbue systems and services with new properties, enabling the reimagination of websites, systems, internet services and finance.” - The Internet Computer Association

Brief:

In this week’s addition of MAJR Coins, we’re breaking down one of the most highly anticipated projects in crypto, The Internet Computer. We cover the technology and its purpose and the team and its investors. We detail the pros and cons and provide a token rating score based on the project’s fundamentals, pumpamentals and market sentiment. The token information can be found at the end.

Matt Verklin

@mverklin

What is DFINITY?

The DFINITY Foundation is a not-for-profit organization based in Zurich, Switzerland, and oversees research centers in Palo Alto, San Francisco, Tokyo, and Zurich. Dominic Williams is the Founder and Chief Scientist at DFINITY, responsible for building the Internet Computer.

What is the Internet Computer?

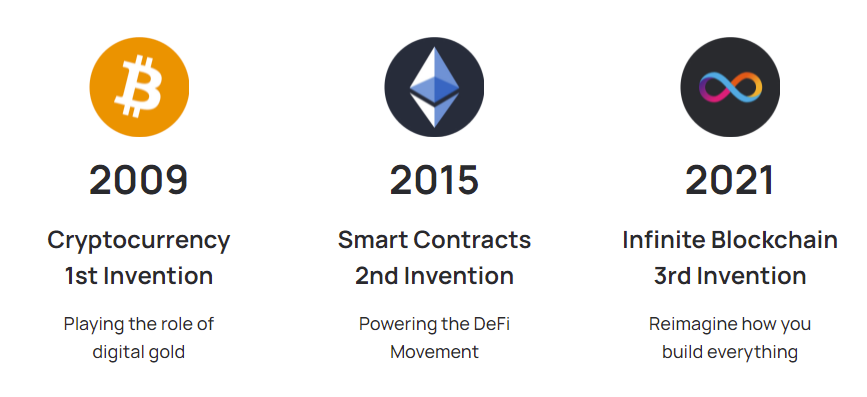

Since the organization’s inception in 2016, DFINITY’s mission has been to transform the public internet into a powerful decentralized cloud to host the next-generation of software and services. The Internet Computer is a blockchain protocol and a new smart contract layer 1 technology that’s similar to our last article on Solana, Polkadot and Ethereum. Only the Internet Computer is trying to bring the entire IT stack onto one blockchain - the application layer, the computation layer, the firewall layer and the database layer.

Target Market: Layer 1 Smart Contract Protocol

Smart contracts allow developers to code business logic (programs) and deploy these applications onto a blockchain. The decentralized applications (dApps) are tamperproof self executing code governed by the protocol. Smart contracts were first introduced by Ethereum and can be used for things like decentralized finance, non-fungible tokens (NFTs), gaming, decentralized storage (AWS) and many other applications.

It’s an extremely competitive space in crypto as many projects like Ethereum, Solana, Polkadot, Cardano, Algorand, Cosmos, Tezos, Hedera Hashgraph and others are experimenting with different consensus schemes, governance models and incentive structures.

The ultimate goal is to improve the internet by making it for the people, owned by the people and completely unstoppable (according to every project’s marketing).

Each project is trying to solve 3 problems.

Decentralization - no central power or authority has the ability to control or censor the protocol. A permissionless and trustless system.

Scalability - the ability to process tens of thousands of transactions per second while providing a fast and clean user experience.

Security - preventing attacks and making sure the data is correct and synced across the network.

Solving all of these issues without sacrificing one for the other is difficult for blockchains and remains to be seen from the layer 1 smart contract protocols.

How is the Internet Computer Different?

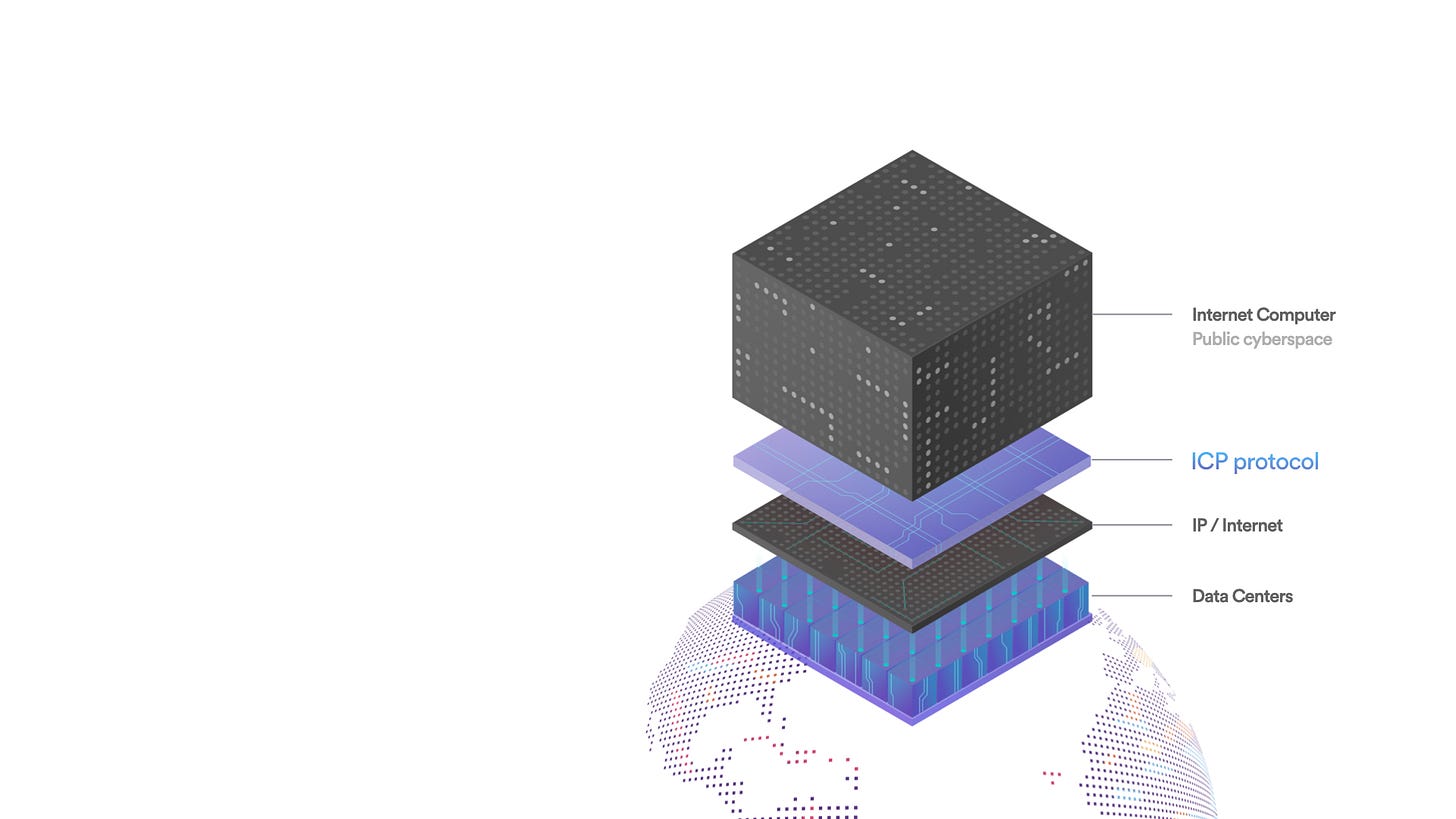

The Internet Computer uses a combination of specialized hardware devices (nodes) run by independent parties in independent data centers around the world and aggregates the machines into a single decentralized world computer through the Internet Computer Protocol (ICP).

The ICP leverages novel computer sciences and cryptographic techniques to reimagine network consensus (how the users agree on the state of blockchain) and network governance (how the users agree on protocol changes and upgrades).

The Different ICP Technologies & Components

The NNS is the autonomous software that governs the ICP and manages everything from economics to network structure. The NNS is part of the system of protocols that weaves the network together and helps reach consensus between subnets. It acts as the master blockchain that validates ICP transactions and tracks proposals and votes from token holders who’ve staked their tokens for specific upgrades.

Chain Key Technology is DFINITY’s breakthrough technology that allows the blockchain computer to run at web speed and scale millions of nodes. CKT works by splitting public keys and sharing them amongst the different network participants - the Network Nervous System (NNS), the Internet Computer Protocol (ICP) and node subnets. In order to come to consensus, 3/4 of the key signatures must align with ICP, NNS and node signatures.

IC’s new and improved smart contracts that allow for more scalability. Use WebAssembly that allows for more popular programming languages.

A special kind of blockchain that works within the ICP network. The subnet is a combination of nodes from independent data centers that host canisters to improve performance.

Allows the community of users to participate in the network governance by staking tokens for submitting and voting on proposals. ICP is a Proof of Stake blockchain, and the more tokens users have the higher weight of their vote. The ICP token is also used to run the network applications. ICP tokens convert to Cycles, which are tokens that power the computational work in Canisters.

Cycles are IC’s computational resource tokens derived from ICP tokens used to run applications in Canisters (smart contracts). Similar to “gas” for Ethereum.

Allow users to stake ICP for voting on governance proposals.

Team, Investors and Funding

The Internet Computer is being built by the industry’s leading team of distributed systems and cryptography experts, across several research centers around the world, and backed by investors such as Andreessen Horowitz and Polychain Capital. They’ve raised over $166 million in funding and just launched a $220 million fund for developers to build out the network.

The DFINITY team is strong with over 203 members of computer scientists, cryptographers, lawyers, marketers and financial professionals. They come from companies like Google, IBM, Uber, Apple, Microsoft, Intel, Samsung, Oracle, VMWare, Facebook, and Goldman Sachs. The Founder and CEO, Dominic Williams has had a distinguished career as a crypto theoretician and serial entrepreneur focused on the Internet and distributed systems.

DFINITY has ~100,000 academic citations and ~200 patents.

MAJR Conclusion:

The smart contract landscape is a competitive market with Ethereum leading in terms of market cap, development, number of users and institutional exposure. In addition, there are many strong token projects with experienced teams and serious funding. Each is attempting to build a general purpose blockchain that’s fast, decentralized and secure that comes with a great user experience. There are no clear winners and many of the projects already have lofty valuations. This makes investing in digital assets outside of bitcoin and ether highly speculative.

With that said, we believe the Internet Computer Protocol (ICP token) is one of serious the contenders.

What’s Ahead

The team has launched their public mainnet on May 7, Mercury Genesis beta launch. Now, it’s all about incentivizing development, expanding the network of data centers. You can see live metrics on link below. Their targeting 123 data centers and 4,300 nodes by the end of 2021 before their full mainnet launch.

They’re also looking into developing “Endorphin” a new operating system for phones, laptops and other devices.

Internet Computer Data Center

Articles

Dfinity founder takes aim at Ethereum’s complex layer-two solutions

Dfinity Launches $220M Fund for Internet Computer Developers

Dfinity responds to Internet Computer decentralization and privacy concerns

Existing & Target Projects

DSCVR, Sudograph, Fleek, Hypotenuse Labs, Internet Identity (access to web3 without any need for usernames and passwords), Open Chat (decentralized chat app), CanCan (open scalable video sharing dApp).

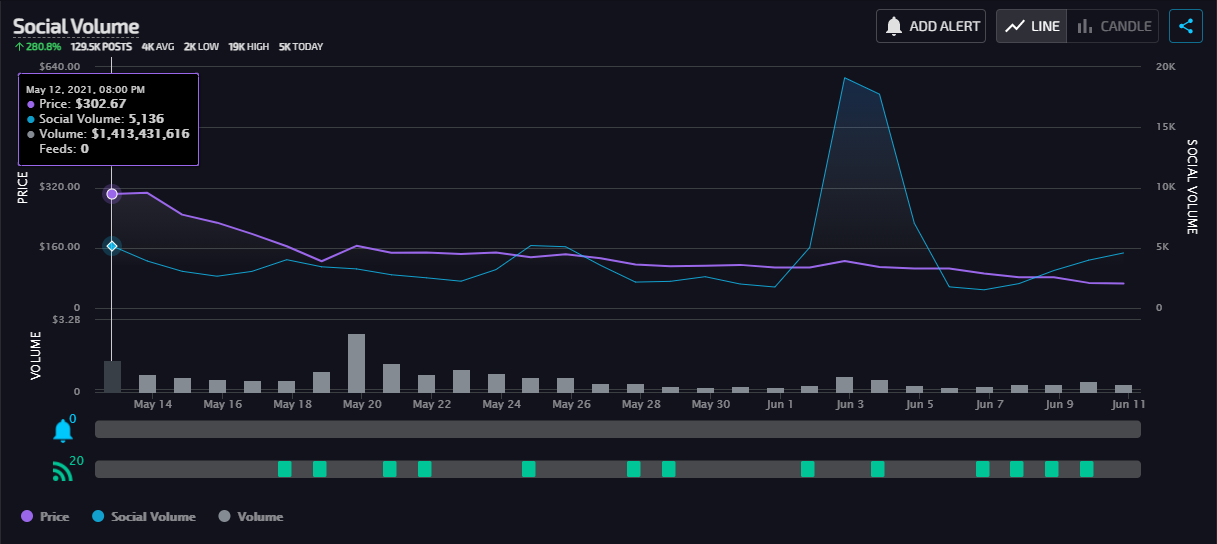

Sentiment Data

Sentiment for token popped when it was first launched breaking its way into the top ten coins. However, sentiment has cooled off, but ICP could be gearing up as the valuation has fallen. Strong community across socials.

Pros

Amazing team with all the right backgrounds.

Well funded. Led by big-name crypto investors in a16z and Polychain capital, along with SV Angel, Aspect Ventures, Electric Capital, ZeroEx, Scalar Capital, and Multicoin Capital.

Launched $220 million fund for developers.

Redesigning entire tech stack from the ground up. If successful, ICP would dramatically reduce IT costs for developers and entrepreneurs. No need for 3rd party database systems, security services or centralized DNS services.

~$9B market cap - smaller than competitors with more upside and provides target valuations in the short term. Ethereum @ $300B, Binance Smart Chain’s @ $62B, Cardano @$50 billion and Polkadot @ $20B.

Great marketing. Tons of press - Financial Times, Bloomberg, Business Insider, Coindesk, Fortune, and CNBC. This space is driven by narratives and they know how to tell their story.

WebAssembly makes it easier for developers to build with popular programming languages like Rust and JavaScript.

Centralized. This is a pro and a con. Decentralization is very important for money itself like bitcoin, but being more centralized can create a better user experience with web like speed. While this isn’t the best for the long term, most developers and users just want a great experience. We’ve seen Binance Smart Chain steal devs and liquidity due to performance and that’s because its more centralized. This can be good for price in the short term.

Max supply with token burning and staking incentive structure. Incentive to stake longer for more rewards takes liquid tokens off market, reduces sell pressure which will be good for price.

It’s listed on some of the biggest exchanges such as Coinbase, FTX and Binance. This is good when market starts to pick back up.

Cons

Founded in 2016, but the tech just launched and there’s little development, usage and network effects.

Honestly, confusing. This was one of the more complicated projects with lots of moving parts, brand new technology and a grand vision. Execution will be critical.

Possible centralization from data centers and large token holders - team, investors, whales. It’s highlighted in their staking governance model.

Dependent on specialized nodes and data centers. Rather than being a strictly software protocol, ICP leans on hardware solutions which eats into community rewards and creates more attack vectors.

Still a relatively high market cap with little development, although it’s seen a serious pullback and possibly bottoming.

Token inflation should be expected with only ~27% the total supply in circulation. Private sale investors got in at ~$4.

Lack of transparency with regard to code and data collection. Possible security issues given unique untested design. They’ve also patented their code. Not cool for open protocols. Goes against crypto ethos.

Token Data

At network launch, $ICP breakdown was as follows: early contributors (9.5%); seed fundraiser contributors (24.72%); strategic fundraiser contributors (6.85%); pre-sale fundraise contributors (4.75%); community airdrop (1.25%); and foundation endowment, team and partnership tokens (52.93%).

Market Cap: $9 billion

Fully Diluted Market Cap: $30 billion

Price: $71.31

24hr Vol: $400 million

Exchanges: Coinbase (US), Coinlist (US), Binance, FTX

Circulating Supply: 128,985,797

Max Supply: 469,213,710

30d Change: - 84.6%

ATH: $700

MAJR Rating: 58.3 / 70

Narrative: 9.1

Community: 7.5

Team: 9.8

Tech: 6.9

Liquidity: 7.5

Tokenomics: 8.5

Potential for Growth: 9

MAJR’s Top Projects:

Bitcoin, Ethereum, Polkadot, Kusama, Chainlink, Solana, Decentraland, Uniswap, Aave, Enjin, Maker, Filecoin, Terra, Litecoin

MAJR’s Simple Investment Strategies:

100% BTC - Min. Risk80% BTC / 20% ETH - Min. Risk50% BTC / 50% ETH - Med. Risk50% BTC / 25% ETH / 25% [insert coin above] - High Risk

Reminder: Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.