Important Announcement

We're excited to announce that Verklin Protocol has partnered with MAJR, a bitcoin media company.

What’s MAJR?

MAJR is a bitcoin media company that’s focused on driving bitcoin adoption and financial education through content creation and community building.

What’s happening to the Verklin Protocol?

Verklin Protocol is not completely going away. The look and feel will stay the same, but under the MAJR brand. MAJR will help us add more content to the newsletter with a tighter focus on bitcoin and the digital asset ecosystem.

Our hope by joining MAJR, is to publish more content with a better reader experience - more digestible daily updates complemented with more exclusive research and analysis diving into different projects, market trends and opportunities. Ever since starting the Verklin Protocol, we wanted to add more value to our friends and family by making sure they had a lens to view the digital asset market accurately, now with MAJR we’ll be able to add more value to the newsletter and explore different platforms such as YouTube, Podcasts, TikTok, Instagram, etc.

With that said, we will be moving more content behind the paywall. All existing paying subscribers will not be affected until they reach their monthly / annual charge. All free readers will still receive the newsletter, but only once per week, which will only include the daily update.

Paying subscribers can expect the following content.

Daily news and updates about the digital asset ecosystem

Research and analysis covering bitcoin and different digital assets

Articles breaking down important topics, concepts and trends related to the crypto markets and the macro environment

Interviews and media with experts and market participants

THE NEW MAJR NEWSLETTER TEMPLATE AND CONTENT WILL BE ROLLING OUT MONDAY 5/24/21.

Thank You

Huge thank you to all our loyal readers and the folks who shared the newsletter. It’s been super fun building this product and audience, and we can’t wait to take it to the next level.

To all the new subscribers. We’re excited to have you on board and introduce you to the MAJR Newsletter.

See you on the other side.

- Verks

Crypto Download #81

This week was crazy, so here’s the last Crypto Download before the re-brand and changing templates. Cheers.

Macro

Europe to Reopen for Travel, Easing Rules for American Tourists: European Union governments agreed to allow quarantine-free travel for vaccinated tourists and visitors from countries deemed safe, paving the way for the resumption of hassle-free trans-Atlantic flights. Ambassadors from the EU’s 27 member states backed a proposal to waive quarantine for those with coronavirus inoculations approved by its drug regulator, including shots from Pfizer Inc., Moderna Inc. and Johnson & Johnson. The approval could be finalized this week and implemented soon after. Unvaccinated travelers can also avoid quarantine if they come from countries that have controlled the Covid-19 outbreak, meaning a 14-day new-case rate of less than 75 per 100,000. This would likely land the U.S. on a “white list” which is due to be adopted later this week. But with so many Americans already vaccinated, the designation may be less important to the travel industry than whether American officials reciprocate and loosen rules for European visitors. Read More.

Trust in EU governments falls amid pandemic, steady in EU as a bloc: European Union citizens' support for their national governments has fallen sharply since the COVID-19 pandemic began, although the supranational bloc itself has maintained trust, found in survey. Eurofound said the survey was based on three rounds of polling based on an overall sample of 138,629 people. Read More.

Trust in the EU Bloc itself was higher than national governments - 26 / 27 citizens had less faith in governments post COVID

People in Bulgaria, Croatia, Czech Republic, Cyprus, Greece, and Poland registered much lower support for government than a year ago

Austria saw one of the biggest falls in support mainly due to handling of vaccines

Denmark and Finland had the highest trust scores

Citizens in France, Hungary, Malta, Portugal, Romania and Spain said they trusted EU more now than at start of pandemic

"Failing to prevent the rise of economic and social inequalities among citizens and member states risks...triggering political discontent against the European social contract that binds all of us together," the survey said.

Fed Signals Eventual Shift From Easy-Money Pandemic Policies: The Federal Reserve has begun to telegraph an eventual shift away from the easy-money policies implemented during the pandemic as evidence builds of a robust economic recovery and mounting inflation. Several Fed officials said this week that the central bank is closely watching economic developments and will be ready to adjust policy when necessary. Minutes from the central bank’s policy meeting in late April, released Wednesday, reported that some Fed officials want to begin discussing a plan for reducing the Fed’s massive bond-buying program at a future meeting. Read More.

“If we got to the point where we were comfortable on the public health side that the pandemic was largely behind us, and was not going to resurge in some way that was surprising, then I think we could talk about adjusting monetary policy,” St. Louis Fed President James Bullard told reporters after a speech Wednesday. “I don’t think we’re quite to that point yet, but it does seem like we’re getting close.”

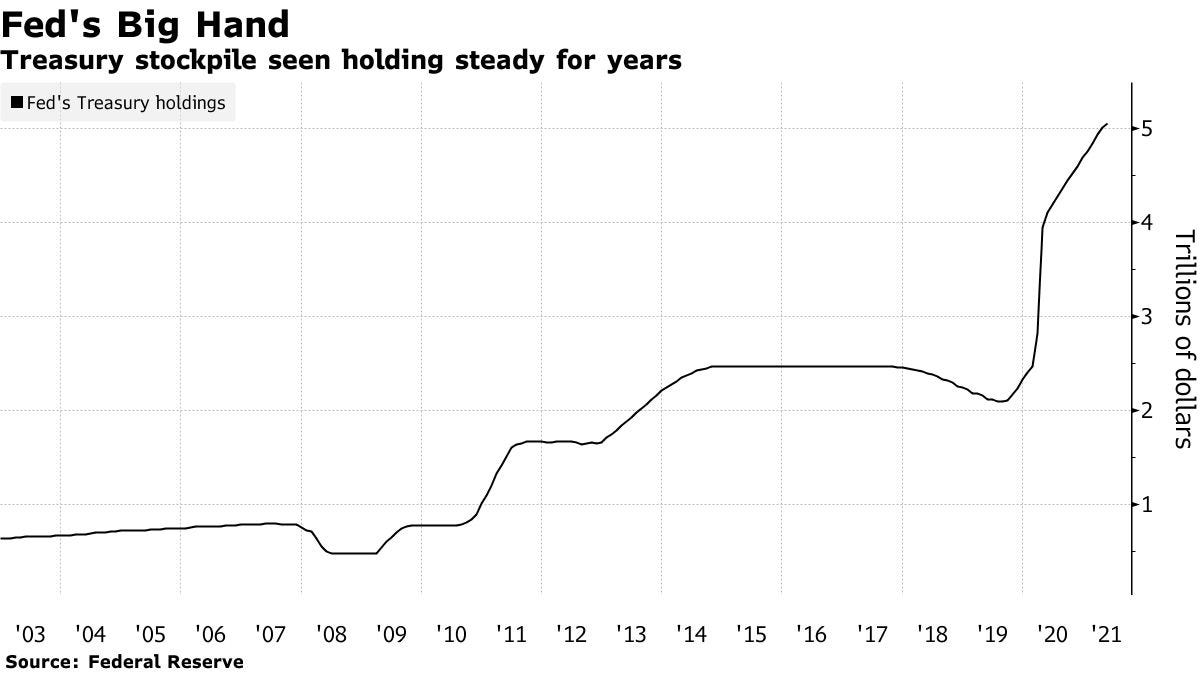

Fed’s Big Role in Treasury Market to Last Long After Taper Ends: Treasury investors fretting about when the Federal Reserve will scale back its bond purchases may be missing the bigger picture: Its more than $5 trillion stockpile will make it a major force for years to come. The prospect of a pullback in buying edged a little nearer Wednesday when minutes of the Federal Open Market Committee’s April meeting showed that a number of officials were willing to discuss it if the economy keeps improving. Yields rose on the news. But bond bulls say the Fed’s virtually inextricable presence in the world’s largest bond market means it will provide crucial support long after any price blips come and go when it brings the buying spree to a close. The central bank’s Treasury holdings have doubled since March 2020, accounting for nearly one-quarter of the total outstanding, a bigger share than it held even after the 2008 credit crisis. It’s a result of aggressive moves to keep the market functioning and hold down rates on everything from mortgages and car loans to corporate and municipal bonds. The stake is so large that even once the Fed’s purchases wind down, it is expected to keep its holdings steady by buying new Treasuries whenever old ones mature, reducing the amount that would need to be sold to the public. That’s given some investors confidence that rates won’t rise too quickly -- or by too much -- even as yields head back toward the approximately 14-month high hit in March amid fears the economy is at risk of overheating. The central bank’s holdings of Treasuries have been growing by $80 billion a month, and it’s also adding $40 billion in mortgage debt to its balance sheet. That’s left it on course to buy a total of $960 billion of Treasury notes and bonds in the secondary market this year after snapping up $2.18 trillion last year. Strategists at JPMorgan predict the Fed will buy $390 billion more in 2022 before wrapping up its purchases. Read More.

“The Fed is definitely not going anywhere anytime soon with regard to the Treasury market,” said Mike Pugliese, an economist at Wells Fargo Securities, which predicts the Fed will begin tapering its purchases in January 2022 and end them around November. But he expects the central bank to keep its stake steady through the next four years. “The Fed is going to comfortably hold between 20% to 25% of the Treasury market, remaining the largest holder of Treasuries, until about 2025,” he said.

Bitcoin

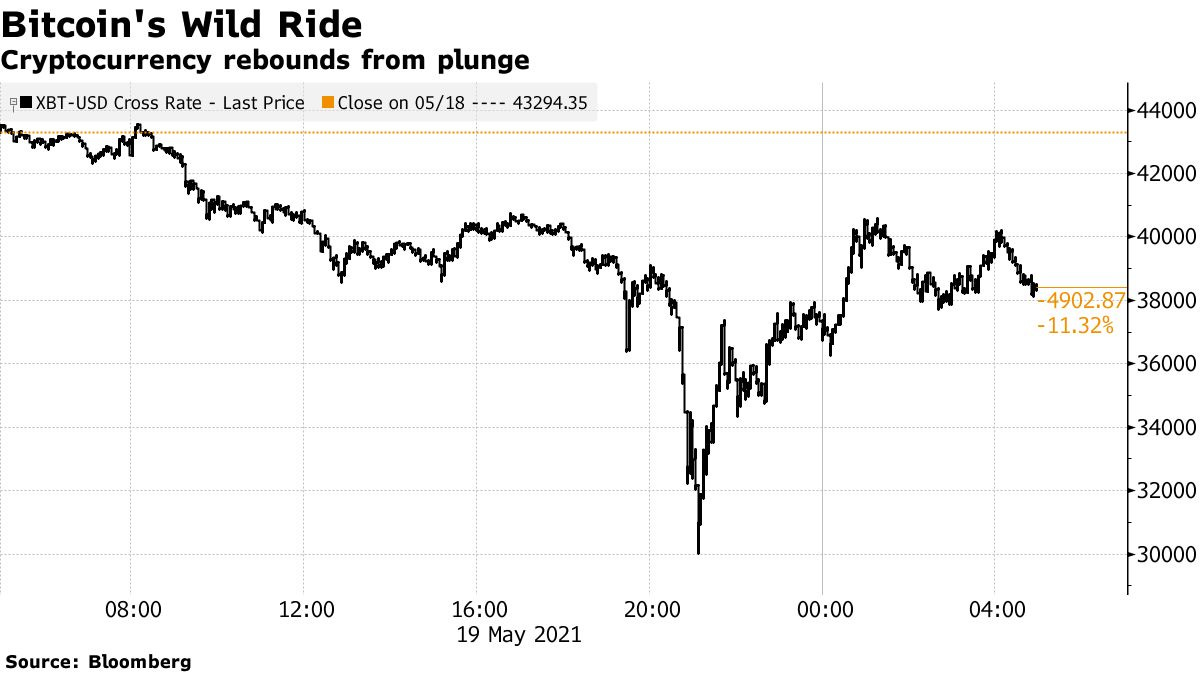

Bitcoin Whipsaws Investors With Same-Day Plunge, Rally of 30%: A 31% plunge in the morning. A 33% surge in the afternoon. Such was the wild ride Bitcoin took investors on Wednesday, lopping off billions in value before comments from some prominent proponents helped propel it on a torrid rebound. The extreme price swings in an asset known for its turbulence caused outages on major crypto exchanges and dominated chatter on Wall Street. The tumult elicited a tweet from Elon Musk that implied Tesla Inc. wasn’t among the sellers, while Cathie Wood said her monitors flashed a “capitulation” that put the digital token “on sale.” Justin Sun, a tech entrepreneur who founded the cryptocurrency platform Tron, tweeted that he bought $152 million in Bitcoin for around $37,000 a coin. Down to within a whisker of $30,000 just after 9 a.m. in New York, the coin pared its loss to 7% and periodically topped $40,000 again in the afternoon. It resumed declines into the next session and was trading around $35,500 as of 8:57 a.m. in Hong Kong on Thursday. Ether, the second-biggest coin, sank more than 40% Wednesday before cutting that nearly in half, and ended down 26%. It was down as much as 15% on Thursday. Rarely do they happen in a single session. The volatility dominated Wall Street on a day when stocks and commodities were also under pressure and the Federal Reserve was set to release minutes from its latest meeting. Frantic selling sparked outages on some of the biggest exchanges, from Coinbase Global Inc. to Binance. #Cryptotrading was trending on Twitter, where critics and fans alike were in a tither over the rout.

Tesla CEO Musk touched off the wild moves last week. Bitcoin plunged when he announced the carmaker wouldn’t take it as a payment, but then reversed when he said the company had no plans to sell its corporate crypto holdings. He seemed to imply in a tweet Wednesday that Tesla is not selling into the rout. Read More.

Ark Investment’s Cathie Wood Says Bitcoin Will Go to $500,000: Ark Investment Management CEO Cathie Wood said in a Bloomberg TV interview that bitcoin will go to $500,000 despite the largest cryptocurrency plunging to a low of almost $30,000 on Wednesday. Wood said on Wednesday that bitcoin is "on sale" now and said that even after today's drop, the cryptocurrency is not necessarily at a bottom. She describes the market as "emotional" and says it is difficult to call the bottom. During the interview, Wood briefly addressed Tesla CEO Elon Musk's environmental concerns on bitcoin mining, explaining that the adoption of solar energy in mining will accelerate dramatically. Wood said the prospects for a bitcoin exchange-traded fund approval in the U.S. this year have now increased because of the recent plunge in price. "The odds are going up now that we have had this correction," she said. Read More.

Senate Banking Chairman ‘Concerned’ by OCC’s Crypto Charters: Sen. Sherrod Brown (D-Ohio), the chairman of the Senate Banking Committee, told Acting Comptroller Michael Hsu that he is “concerned” about the Office of the Comptroller of the Currency’s (OCC) granting national trust charters to “financial and non-financial companies.” Some of the companies seeking OCC charters are unable to meet the OCC’s regulatory requirements, Brown said in the open letter, first reported by Politico. The lawmaker specifically pointed to the three crypto companies that have secured conditional OCC trust charters in the past five months: Paxos, Protego and Anchorage, and asked that Hsu “reassess” the conditional trust charters. Hsu, who took office barely two weeks ago, has already indicated that the OCC is reviewing how it approaches digital assets in testimony before the House Financial Services Committee earlier this week. Read More.

Sichuan province in China is home to a large number of bitcoin miners due to low electricity costs.

Chinese Bitcoin Firm to Invest $25M in Texas Mining Center: BIT Limited, a Chinese crypto mining company, has announced that it has entered into a binding investment term sheet with Dory Creek LLC to invest in a crypto mining data center in Texas. Dory Creek LLC is a wholly-owned subsidiary of Bitdeer, Inc. The Chinese company will invest $25 million and jointly construct and operate the Texas mining center with Dory Creek LLC. The mining center has a total power capacity of 57.2 megawatts. Currently, the majority of BIT Mining’s crypto mining operations take place in China’s Sichuan province, a hotspot for crypto miners due to the low cost of hydroelectric power. The move to open a mining center in Texas is part of BIT Limited’s objective to lower its carbon footprint. According to a prepared statement, the firm claims that more than 98% of its power capacity would be generated from green sources. According to Cambridge University, almost two-thirds of the world’s Bitcoin mining industry occurs in China. However, this figure is on the decline. In September 2019, China enjoyed 75% of the world’s Bitcoin mining industry. China still has a significant command of the Bitcoin mining market, but the United States has been pivoting to this industry, too. Today, the United States holds over 7% of the world’s Bitcoin mining industry, up from about 4% in September 2019. Read More.

Crypto

$ASS Coin Billionaire - Tales From the Fringe of the Crypto Craze: The Bud Light Mango Mai Tais were beginning to take hold when Eric Hackney — 38, unemployed and ticked off by watching other people get rich — figured, What the hell? and laid $500 on some crazy-sounding thing called ASS Coin. ASS Coin: officially, that’s Australian Safe Shepherd, one of those obscure virtual currencies that have YOLO’d and FOMO’d their way from crypto in-jokes to soaring — and now sinking — monuments to these strange financial times. The stage on which these actors strut: Decentralized Finance, or DeFi, Crazy Town of the Everything Rally. Here even Luddites can mint digital tokens — Shit Coins, in parlance of the trade — with a little off-the-shelf code. It takes maybe 10 minutes, no whiz-bang computers or complex math required. And so it is that Eric Hackney, husband of Brittany, father of two, former bartender, became the owner of 20,000,000,000 ASS Coins with his $500 investment. Read More.

“Screw it. Let’s go. Let’s see what happens,’’ Hackney thought.

DeFi Liquidations Up 14-Fold in Broad Crypto Sell-Off: Borrowers on decentralized lending platforms are unwinding positions fast, most likely to avoid expensive liquidations as the global cryptocurrency market tumbles Wednesday. According to decentralized finance (DeFi) wallet provider Debank, liquidations of collateral are up 14-fold during the most recent bad days on the lending market. Over the last 24 hours, DeFi platforms have shaken off $662 million in loans, led by the Binance Smart Chain lending application Venus, Aave (versions 1 and 2) and Compound, Debank data shows. A normal day has liquidations across DeFi products of $1 million to $5 million. On May 12, there were $39 million worth of liquidations. When major cryptocurrencies lose a large amount of value on the spot market, it can cause many corresponding positions, such as bullish bets in the form of derivatives and loans, to unwind rapidly. That can prolong a sell-off and drive the pain deeper, if temporarily. Read More.

5 Reasons for the Crypto Market's $500 Billion Bloodbath:

China - dramatic headline suggested that China had banned cryptocurrency. The actual news, it turned out, was much less dramatic: the country's central bank and a handful of payment firms had simply restated rules limiting crypto transactions that have been in place since 2017.

Elon Musk - The Tesla CEO has single-handedly wrecked havoc with the crypto markets in the last week, using tweets and media appearances to send the price of Dogecoin and Bitcoin up, down, and sideways. These include Musk's tweets last weekend, which suggested Tesla was dumping its $1.5 billion Bitcoin stash and triggered a wave of selling that helped touch off the broader volatility in crypto market this week. Musk's antics—the latest of which is a bullish "diamond heads" tweet in support of Bitcoin

Leveraged Liquidations - On Wednesday as exchanges triggered more than $8 billion in liquidations—which resulted in a flood of sell orders into an already panicked market, which then triggered more sales. Liquidations across the market didn't cause the initial sell-off but helped to exacerbate it. In plain English, what happened is that many firms had bet on Bitcoin using borrowed money (leverage)—the same way retail investors can get their brokerages to front them collateral based on the shares they already own.

Tax Day - This is a more banal but also plausible explanation for at least some of the recent sell-off. Namely, May 17 was the final day to file taxes for many Americans.

Broader Markets - The broader markets have been on edge as a result of macroeconomic factors, such as inflation warnings and the U.S. government and central bank's recent decisions to stick with loose fiscal and monetary policy (i.e. stimulus payments, deficit spending, and low interest rates). All of this means has given rise to broad fear and uncertainty.

Media

BTC026: Bitcoin Mastermind w/ Lyn Alden & Jeff Booth

Bitcoin, A Fiduciary Duty with Nik Bhatia

Michael Saylor: The Ultimate Interview on Bitcoin, Ethereum, Doge and The Future of Currency

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.