Bitcoin Space Race

Wealth redistribution can happen in different forms. Government’s can tax the wealthy and transfer that value to lower and middle income classes. Monetary and authorities can lower interest rates and perform Quantitative Easing (QE) pumping financial assets hoping for some form of trickle down economics. Or there’s something akin to a gold rush, a public discovery of an unclaimed asset just sitting in the ground. Bitcoin is the latter, only it’s sitting in the internet and it will be the greatest redistribution of wealth of all time.

Right now, the world and in particular institutional investors - banks, pension funds, hedge funds, insurance companies, publicly traded companies and family offices are having the bitcoin light-bulb moment all at once. And, they’re having this realization against one of the worst economic and social backdrops we’ve seen since the 1930’s Great Depression era. Cash is being devalued ad nauseam at the cost of savers and bond holders. Markets have dislocated from reality; supported only by central bank liquidity and hopes for more fiscal. All under the shadow of a pandemic that is surging and mutating across the world. It’s a rather dark scenario wrapped in uncertainty. So how are investors reacting during these uncertain times?

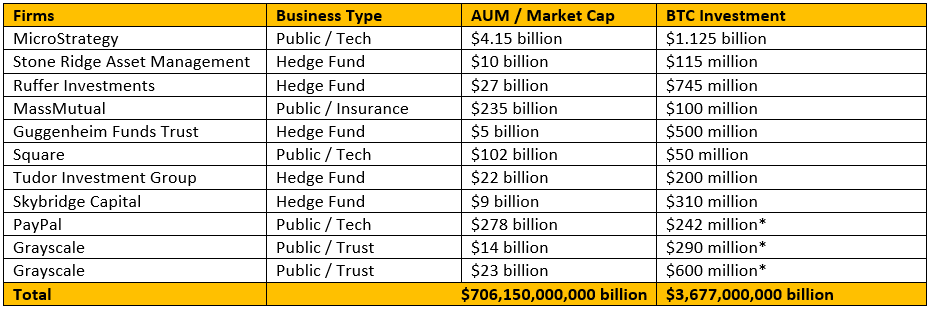

The below chart details some of the biggest public flows into the world’s most scarce financial asset and the newest store of value. Please keep in mind, these are only the investments made public and they were all made in 2020.

*PayPal is latest daily investment from retail

*Grayscale are the latest daily investments

This is the opportunity of a lifetime

We have a limited window of time to front-run trillions of dollars of global institutional investment into bitcoin. The above chart highlights large institutions only dipping their toe into the bitcoin asset class. And, these are some of the most nimble of the investors. When the pandemic shocked markets back in March 2020 translating into a $3 trillion dollar stimulus package, the clock started ticking for asset managers and corporate treasures. Each asking the same question, “how do I protect my assets from inflation (the increase of the money supply).” Hedge funds and family offices don’t have the restrictions that most publicly traded companies have - board approvals, compliance regulation, etc (CEO of MicroStrategy had majority voting control). But, we think it’s prudent to believe that they’re working towards allocating their balance sheets into bitcoin.

How will this play out?

Given the fact that bitcoin is a global monetary network that exhibits real network effects (bitcoin’s network effects) and has a fixed supply, it creates a positive feedback loop for investors via upwards pressure on price. There’s simply less float (liquid bitcoin) available for new investors to purchase (bitcoin shortage). We’ve already witnessed a dramatic run in the first 2 weeks of 2021. Bitcoin was at ~$30k to start the year and quickly ran up to $42k in two weeks. Depending on the average entry price, the above investors are already up 2x-3x on their initial investment. And, remember they’ve only dipped their toes into the asset class with .5-2% allocations of their total AUM. What does this signal to the rest investment community, the other insurance companies and pension funds who are desperate for yield (retirement crisis)?

Start your engines

The following two GIFs are how we envision the creation of bitcoin and the investment flows to follow.

Two monumental forces collide - a broken debt based financial system highlighted by the Great Financial Crisis in 2008 + human innovation desperate for solutions. These two forces gave birth to bitcoin, a savings technology for the world.

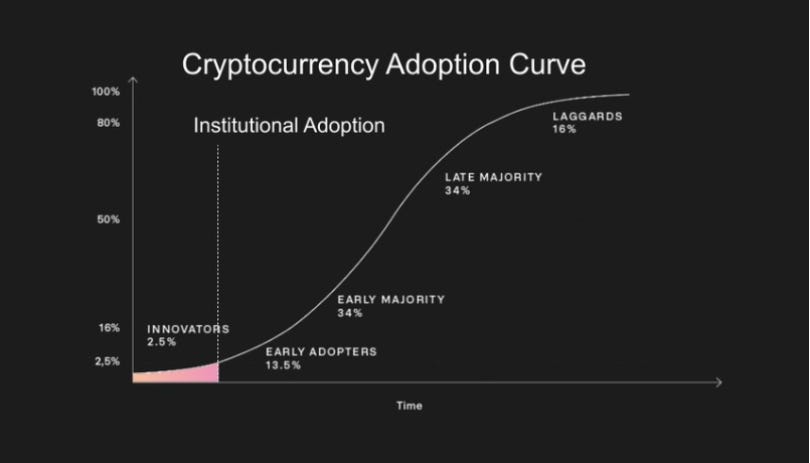

We’re currently at the beginning of the below. Bitcoin has crossed the Rubicon and has coopted the narrative of the best store of value. As more investors come online and purchase real estate on bitcoin’s blockchain, more investors will have to follow. It will be irresponsible for a fiduciary not have exposure to bitcoin. This will feed on itself creating global FOMO. People will slowly begin to pull from other investments - stocks, bonds - anything liquid and then bitcoin will start to absorb everything. After, the bitcoin epoch begins with new rules and new equity holders.

This sounds dramatic because it is. Bitcoin and these global monetary networks are new technologies similar to the invention of the internet, but for money. It took years to get to where we are today in terms of internet communication with better UI and fast connectivity speeds. But, technology is always exponentially evolving and improving, and we think the adoption of bitcoin will be no different, except faster. Think about it. Over half the population is online via mobile, 4.28 billion people. All it takes to acquire bitcoin, is an internet connection and one of the many on-and-off ramps into the asset. Currently, bitcoin sits at a ~$700 billion market cap and once it crosses the $1 trillion market cap (~$55k BTC), we’ve entered the realm of other major asset classes measured in the trillions. This will not be the top, only the start of the next cycle of investment.

Ready Set Go

Bitcoin is a technology and like most technology adoption, it follows the S Curve. We’re so early and only handful of institutions have fully wrapped their heads around the asset and its implications.

There’s hundreds of trillions of dollars coming. We may not have the pocket books that these investors have, but we have the agility.

Do your future self a favor and front-run the incoming wall of money.

Do not miss this opportunity.

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.