BRIEF:

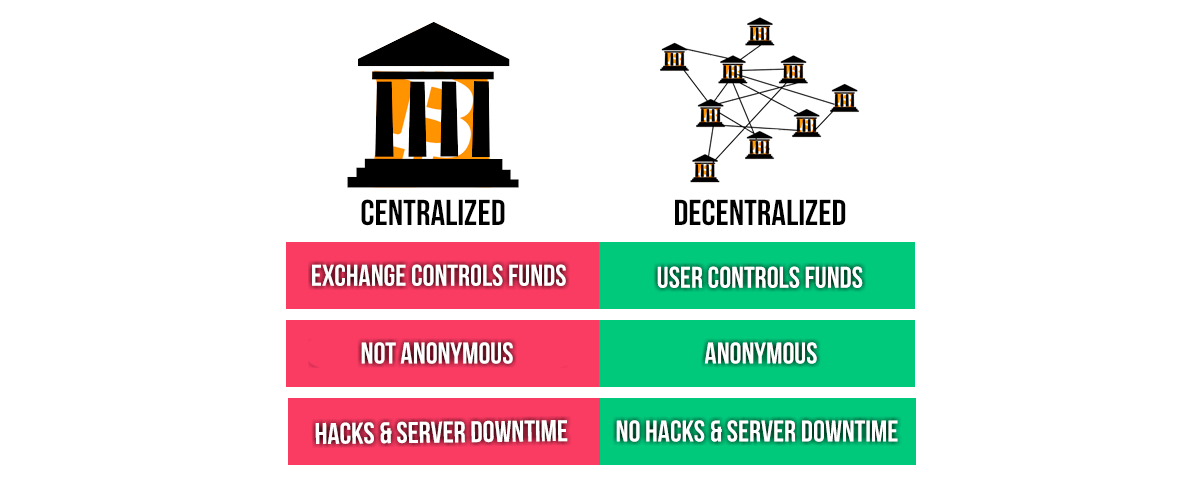

Decentralized exchanges, or DEXs, are specific platforms used to exchange digital assets without third-party intermediaries.

These platforms provide a more secure alternative compared to centralized exchanges.

Users custody their own coins.

The world of decentralized finance, or DeFi, is rapidly evolving and becoming more mainstream. One of the many important products offered through the decentralized finance ecosystem are DEXs. These have progressed to be critical components to the infrastructure and rails of cryptocurrency.

DEXs are peer to peer, on-chain protocols that facilitate the trading of cryptocurrencies without third-party intermediaries. The platforms are alternatives to centralized exchanges that allow the users to individually trade or safely store their digital assets on their own behalf.

Unlike centralized exchanges (CEXs), such as Coinbase or Binance, a DEX makes it possible for the participant to assume full ownership and responsibility for their personal cryptocurrency holdings. This is because the user retains full ownership to their private keys, so they retain full ownership to their digital assets. On a centralized exchange, this is not the case.

“You have to own your private keys and you should be the only one who has your private keys. If you are the only the one that has your private keys, you own it. If someone else has your private keys, effectively they own it too.”

- Elon Musk @ The B Word

Decentralized exchanges operate using smart contract (automatically self-executing agreements) functionality. This assists the process of trading between individuals while letting them be in complete control of their coins. The smart contracts seamlessly complete and record transactions to the blockchain.

In order to participate in one of the platforms, traders most commonly use a mobile wallet or hot wallet, such as MetaMask, that would then be connected to the exchange. Some platforms also accept Coinbase wallets making accessibility easier to the general crypto community.

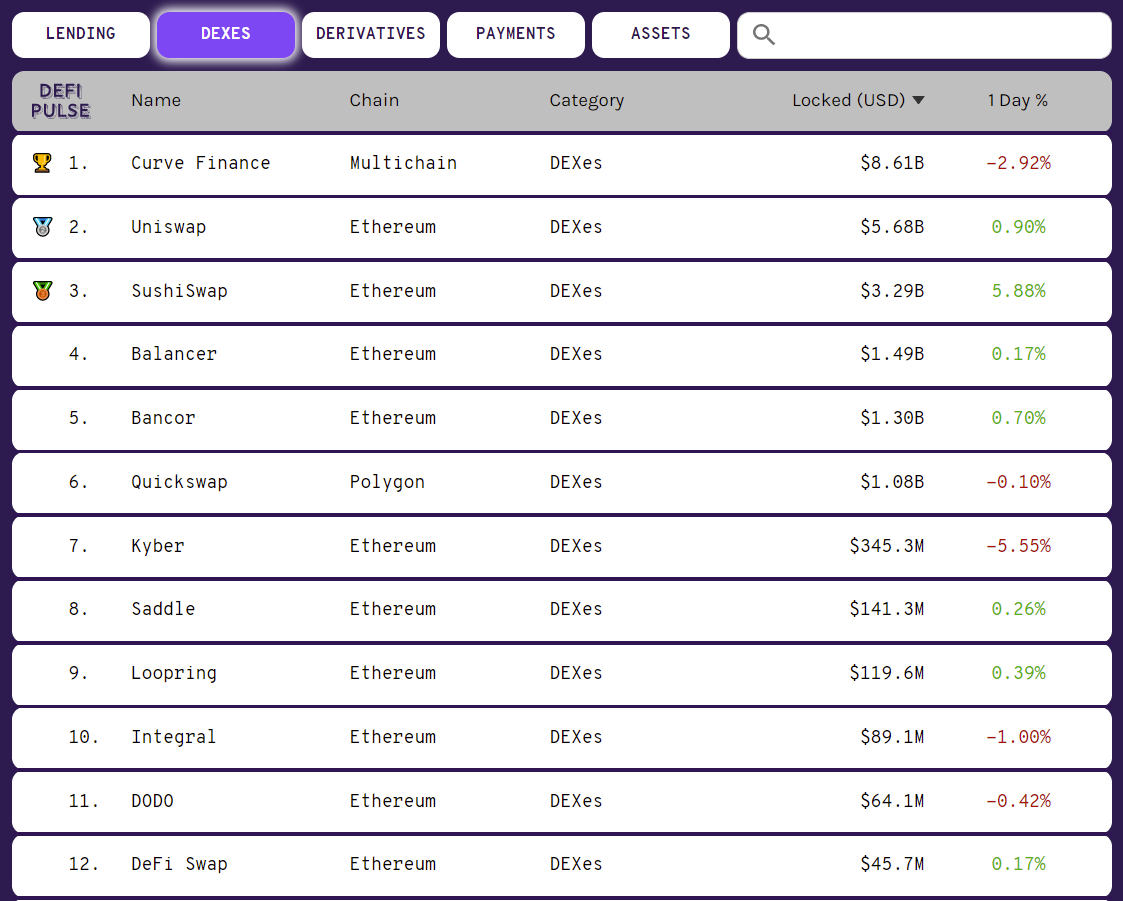

Top DEXs:

Uniswap

PancakeSwap

Compound

Curve Finance

1inch

Pros:

Custody - DEXs are non-custodial meaning traders maintain absolute possession of their private keys instead of the exchange having access to it.

Decentralized - Utilizing smart contracts and blockchain technology, these exchanges do not have to record every transaction themselves. This makes for a system with trustless transactions.

Flexibility - Most altcoins are available through DEXs. Various decentralized exchange protocols allow for users to make any token pair and save, trade, borrow, or lend however they want.

Privacy - There is no need to disclose information regarding one’s private keys or personal information like social security numbers or addresses.

More Tokens - Some centralized exchanges don’t have every token. Most small caps or hidden gems can be found and traded using DEXs.

User Experience - When the Ethereum network is not backed up, the user experience can be pretty easy and amazing. No KYC.

Cons:

Complexity - DeFi is complicated. There are a few more steps required of DEXs to get involved than a Coinbase. People must be familiar with how to use wallets so they can interact with exchange. Also, individuals must know the intricacies around funding, withdrawing, and trading with specific protocols as some have different features.

Unstable Fees - Although, Uniswap charges a 0.3% fee to swap tokens, fees can fluctuate when Ethereum’s network usage increases. If you’re not using second layer solutions like Polygon (Matic) or Uniswap V3 with Optimism, fees can be very expensive to swap directly on chain, sometimes hundreds of dollars, and even higher with less liquid tokens (smaller caps).

Slow / Stuck Transactions - Same situation as the above. When the network is seeing high usage, transactions can be stuck or very slow to complete directly on-chain. Layer 2 solutions are best from a performance standpoint and they’re becoming more integrated, however, it’s currently an extra step which can be confusing.

No Customer Service - You are in complete control and have total responsibility of your crypto. A mistake such as sending crypto to the wrong address will result in a loss of the given asset. There is no customer service to call if something went wrong.

Wrap Up

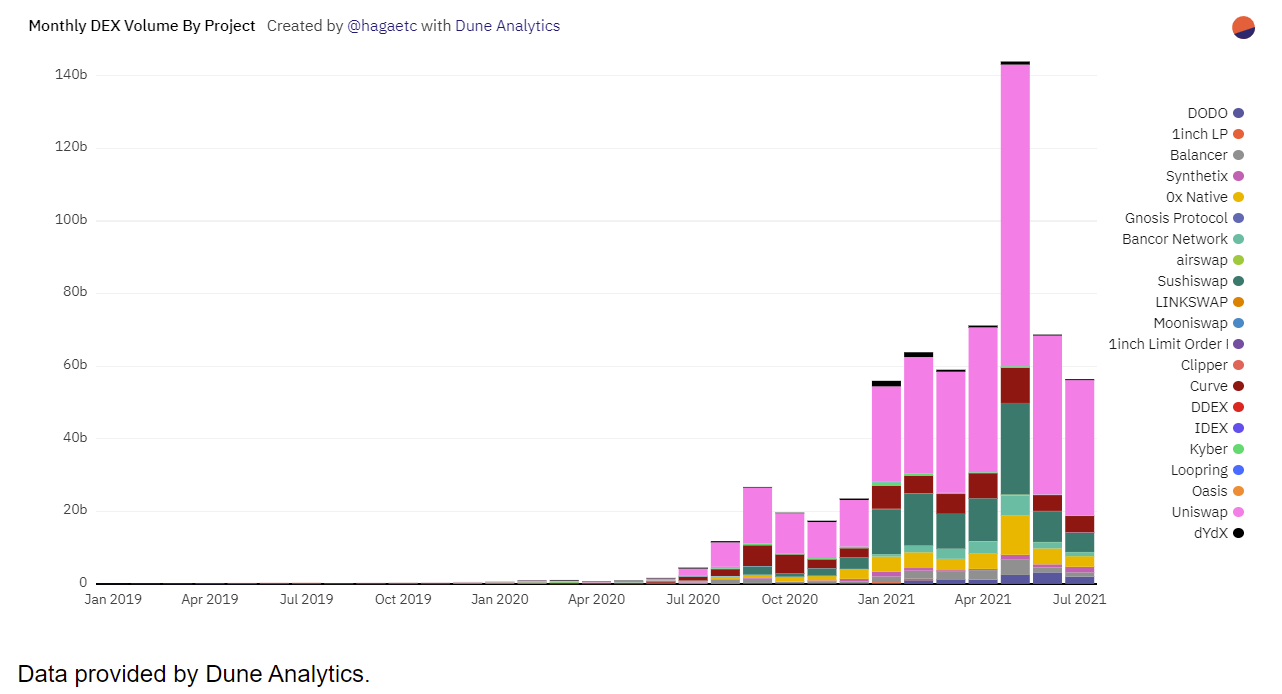

Although it is still early in their development, DEXs offer real benefits that every crypto investor needs to pay attention to. They embrace the key differentiator of DeFi…decentralization. The whole narrative about crypto and blockchain is to take control of your money and get it out of the hands of a third party. Decentralized exchanges make this happen. Also, they connect people with the DeFi sector and other projects that are experiencing growing popularity.

On the other hand, it can be intimidating being 100% responsible for your assets. I would recommend spending time learning the ins and outs of the processes required to become a market participant in a DEX before diving in.

Despite the learning curve, I believe these are the exchanges of the future and the userbase will continue to see exponential increases.

Own your crypto and be in control of your digital assets.

Brevin White

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.