Crypto Download #80

Fed's Clarida Clarifies Need for Stimulus, MicroStrategy Buys More Bitcoin, Bitcoin Greener Than the Petrodollar, Ethereum Network Revenue Hits New ATH, Institutional Adoption for ADA & DOT, Aliens

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

New York lifts mask requirements for the vaccinated, California waits

Biden to Send U.S.-Authorized Vaccines Abroad for First Time

South Africa Widens Vaccine Rollout With Pfizer Doses Monday

Fed’s Clarida Says Job Market Calls for Continued Fed Stimulus: Federal Reserve Vice Chairman Richard Clarida said Monday the process of starting the economy back up again may be an uneven one, in comments that showed no appetite to dial back central bank stimulus yet. The official said that the U.S. economy could grow by as much as 6% to 7% this year. But he added that the job market still remains far short of where it was before the crisis, and that has implications for monetary policy. “We’re still more than eight million jobs short of where we were 14 months ago so there’s still a deep hole in the labor market,” Mr. Clarida said, adding, “It may take more time to reopen a $20 trillion economy than it did to shut it down.” Mr. Clarida, who is the Fed’s second-in-command, flagged what he saw as a disappointing April jobs report as a factor for the central bank to continue to offer significant support to the economy. The jobs data shows “we have not made substantial further progress” needed to pare back what is now $120 billion a month in bond-buying stimulus. Mr. Clarida also said that he expects upward inflation pressure this year from the reopening process to be temporary. But he added that the central bank remains vigilant on that front, adding, “If we were to see upward pressure on prices or inflation that threatened to put inflation expectations higher, I have no doubt that we would use our tools to address that situation.” But, he added, “That is not my baseline view” for central bank policy. Read More.

Japan’s Recovery From Pandemic Slows: Japan’s economy shrank in the first quarter of 2021 amid a resurgence of Covid-19 infections, but is expected to return to growth as soon as the current quarter with help from manufacturing exports. The world’s third-largest economy after the U.S. and China contracted an annualized 5.1% in the January-March quarter after growing in the latter half of 2020. Private spending was down 1.4% from the previous quarter. Shops and restaurants closed or reduced their hours during a government-declared state of emergency in place from January through March in areas including Tokyo and Osaka. It was reimposed in late April. Capital expenditures also declined 1.4% after strong growth in the previous quarter. Many economists see the downturn as a temporary interruption in the country’s recovery from the pandemic. Japan is benefiting from the comeback in the U.S. and China, its two largest trading partners. Overseas demand for Japanese goods such as cars and electronic parts is growing, helping counterbalance weaker service industries at home such as travel and restaurants. Read More.

Euro zone recession confirmed at start of 2021: The euro zone economy declined by 0.6% in the first quarter of 2021, data showed on Tuesday to confirm a technical recession, as gross domestic product contracted in all larger countries except France. The European Union’s statistics office Eurostat said GDP in the 19 countries sharing the euro fell 0.6% quarter-on-quarter in the Jan-March period, for a 1.8% year-on-year fall. The figures were in line with the initial flash estimate on April 30. Together with the GDP decline in the fourth quarter of 2020, of 0.7% in the quarter and 4.9% from a year earlier, the euro zone was in its second technical recession since the COVID-19 pandemic began. The economies of Germany, Italy, Spain and the Netherlands all contracted. France’s grew by 0.4% quarter-on-quarter. Read More.

East EU Economies Defy Virus Gloom to Near Pre-Pandemic Levels: Economies in the European Union’s east defied downbeat forecasts at the start of 2021, surprising analysts who appeared to overstate the knock-on effect of pandemic restrictions. Preliminary data released Tuesday showed first-quarter gross domestic product in Romania, Hungary and Bulgaria falling much less than predicted on an annual basis and unexpectedly jumping from the previous three months. The region’s two largest economies -- Poland and the Czech Republic -- released their numbers earlier, also largely exceeding estimates. Reasons for the outperformance will become clearer when full breakdowns of the figures are published and probably vary between countries. Hungary, for instance, was among the EU’s leading member states for vaccinations, while Romania implemented less stringent virus curbs and enjoyed a construction boom. One thing analysts agreed on, though, is that the outlook is only going to improve. Read More.

“Central European economies are likely to grow faster as they open up,” said Dan Bucsa, an economist at UniCredit Bank AG in London. “We expect economic activity to return to pre-pandemic levels already this year in Hungary, Poland and Romania, with industry and construction rebounding more than tourism and transport services.”

Bitcoin

Bitcoin ‘Greener Than Petrodollar’: Human Rights and Energy Analysts: Bitcoin is more environmentally friendly than the petrodollar, according to Alex Gladstein, chief strategy officer at the Human Rights Foundation, and James McGinniss, CEO and co-founder of David Energy. Both individuals appeared on the Unchained Podcast with Laura Shin earlier today. The discussion took place against the backdrop of Tesla CEO Elon Musk’s shocking u-turn on Bitcoin. Three months after overseeing Tesla’s $1.5 billion investment into Bitcoin, Musk announced that the company would no longer accept BTC as a form of payment due to concerns about its climate impact. Gladstein and McGinniss put their case forward in two parts. First, they provided several arguments in favor of Bitcoin, despite its energy consumption.

The petrodollar is the system of exchange that governs U.S. dollars being paid to oil-exporting countries for oil.

The petrodollar is fundamentally backed by the U.S. military, which is estimated to consume—much like Bitcoin—more energy than many of the world’s countries.

In 2017, it was estimated that the U.S. military used up to one million barrels of oil per day, which would, in turn, make the U.S. Defense Department the world’s 55th largest emitter of carbon dioxide if it was a country.

Gladstein also claimed that there is a very significant moral argument for Bitcoin, namely, that it provides people who live under state inflated national currencies access to capital. But regardless of whether someone buys into Bitcoin’s moral argument or not, both analysts maintained that Bitcoin’s chief goal was to be a “geopolitical disruptor.” In other words, Bitcoin was designed to take on the petrodollar. Read More.

“Bitcoin’s energy intensity is a feature, not a bug; it’s what creates security,” said McGinniss, adding, “From a technology standpoint, that’s actually what makes Bitcoin so fantastic…There are 1.2 billion people out there who live under double and triple inflation; there are 4.3 billion people out there that live under authoritarianism,” Gladstein said, adding, “Those who say Bitcoin has no social value, I’d love to see them commit to using the Sudanese pound for one year, and then come back to me and say that Bitcoin’s value is overblown or doesn’t exist…Bitcoin is actually a competitor to the world reserve currency, which I will call the petrodollar,” Gladstein said, adding, “that’s what its ultimate mission is, to replace the petrodollar.”

MicroStrategy: Another Dip, Another $10M Bitcoin Buy: Publicly traded business intelligence firm MicroStrategy (NASDAQ: MSTR) is making the most of the downturn in bitcoin prices, buying another 229 BTC for $10 million in cash. Disclosed by CEO Michael Saylor on Twitter and in an SEC filing Tuesday, the firm bought the cryptocurrency at an average price of $43,663 per bitcoin. Only five days ago, Saylor announced the purchase of 271 BTC for $15 million. The purchase means MicroStrategy now holds 92,079 BTC bought for a total of $2.251 billion at an average price of approximately $24,450 per bitcoin. Read More.

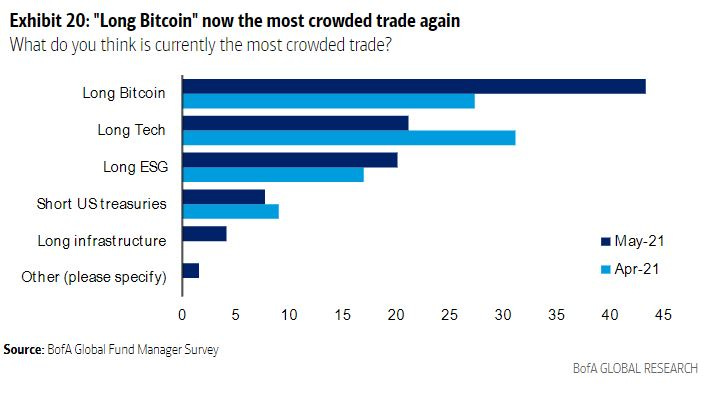

Fund Managers Say ‘Long Bitcoin’ Is the Most Crowded Trade in the World: In case there were any doubt about how hot Bitcoin or “crypto” is these days, look no further than the latest Bank of America fund manager survey. The poll, which captures 194 fund managers with $592 billion worth of AUM overall, says that “Long Bitcoin” is the most crowded trade in the world right now. As the notes in the survey suggest, being identified as crowded has historically been associated with tops: ‘"Long Bitcoin" is now the most crowded trade at 27%. Prior "peaks" in crowded trades (tech Sep'20 & Sep'18, US Treasuries Mar'20, US dollar Jan'17 & Feb'15) were associated with relative tops.’ This isn’t the first time that the cryptocurrency topped the list. Actually it was at the peak back in January, right before it went onto explored higher. It also topped the charts back in 2017 the last time crypto went nuts. Read More.

Bitcoin Chart Indicator Suggests Worst of Pullback May Be Over: Experienced hands look to be buying the dip as a key bitcoin price indicator suggests the pullback may be coming to an end. Bitcoin’s bull market correction may be coming to an end, according to the relative strength index (RSI) – a technical indicator widely used to gauge momentum and identify overbought and oversold conditions. The 14-week RSI has now dropped to 53.00, a level that has consistently acted as solid support and marked an end of corrective pullbacks during the 2016-2017 bull run. The RSI support has come into play as bitcoin charted a 35% drop from $64,801 to $42,000 in the past four weeks. While Twitter comments from Tesla CEO Elon Musk look to have scared some retail investors into selling, there were already signs of exhaustion in the market. Whales had started moving money out of bitcoin, leaving less wealthy investors struggling to do the heavy lifting above $60,000. However, the bull market looks intact, with the cryptocurrency still up 365% year-on-year and evidence of long-term investors buying the dip. Coupled with the weekly RSI hovering at historically strong support, that suggests the cryptocurrency may soon resume its uptrend. Read More.

Crypto

Ethereum Network Revenue Set to Smash Monthly Record of $722 Million: Total Ethereum transaction fees have never been higher, thanks to a combination of network use (and the ensuing congestion) and historically high ETH prices. Transaction fees for May 2021 are on track to break the current monthly record of $722 million at some point today, according to statistics from Coin Metrics, with two full weeks left to go in the month. If the trend continues, the blockchain network will pass its Q1 network revenue totals of $1.7 billion in ETH before the end of May. The previous high was set just three months ago, in February 2021. Read More.

Swiss Asset Manager Valour Launches Cardano and Polkadot ETPs: Fully backed by ADA and DOT, the products are listing on the Nordic Growth Market. The launches follow similar products by fellow Swiss digital asset manager 21Shares, which launched its DOT product in February and ADA equivalent in April, both on the Swiss SIX exchange. ADA and DOT have both enjoyed huge increases in price in 2021, surging by over 1,000% and 400% respectively. Read More.

Banking App Current Picks Polkadot for Its DeFi Debut: Banking fintech Current is gearing up for a crypto crossover on Polkadot. The financial services app said Tuesday it will integrate Acala, a Polkadot-based decentralized finance (DeFi) platform, into its core banking product. It’s a first step toward debuting on-app DeFi tools for Current’s 3 million users, CTO Trevor Marshall said in an interview. Wonky crypto-finance tools like multichain stablecoin transfers and yield farming, perhaps, won’t be showing up next to Current’s deposit, cash-back and checking account features until later this year, Marshall said. In the meantime, Current will join Polkadot’s validator set. Current, which last grabbed Web 3 headlines for its copyright lawsuit against a Facebook-backed stablecoin project (whose name and logo have both since changed), said the Acala integration marks its crypto debut after six years of carefully plotting its entrance. Read More.

Media

Bitcoiners Control the World with David Bailey

Galaxy Digital CEO Novogratz on bitcoin, crypto and ESG concerns

Navy pilots recall “unsettling” 2004 UAP sighting

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.