Crypto Download #79

Unemployment Claims Fall, but Still High, Record $1.9 Trillion US Fiscal Deficit, Tesla's Bitcoin Payments U-Turn "Watch What They Do, Not What They Say," Bitcoin Hashrate Hits All-Time High

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

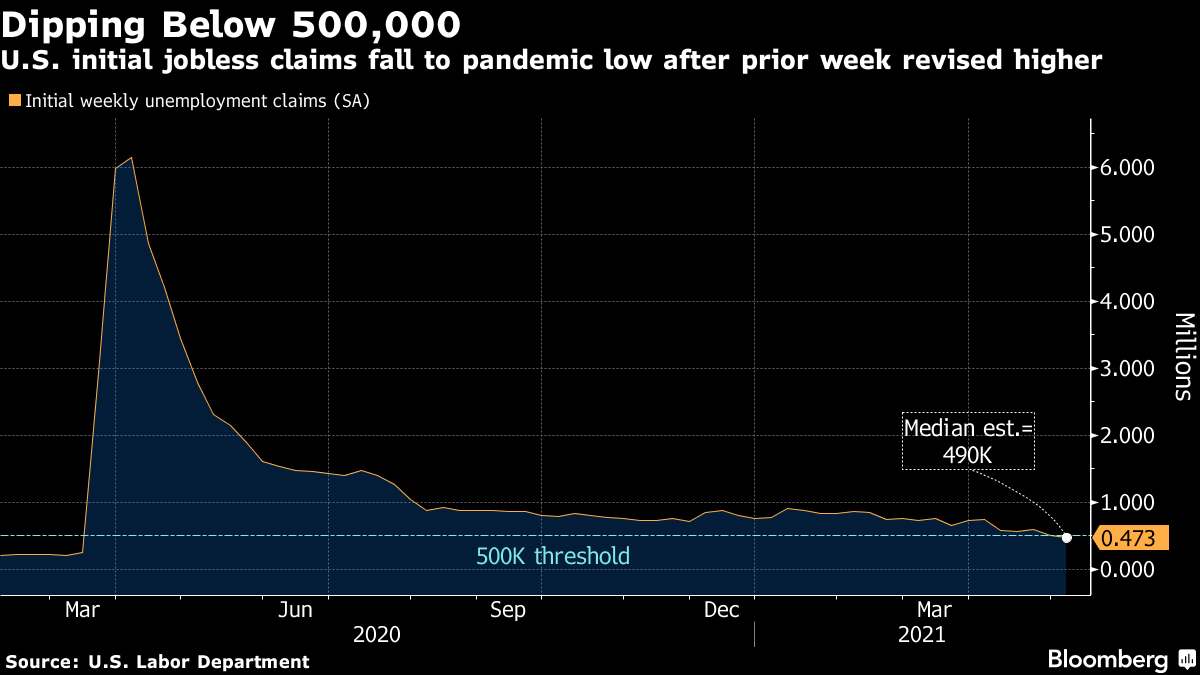

U.S. Initial Jobless Claims Fell by More Than Forecast Last Week: Applications for U.S. state unemployment insurance fell to a fresh pandemic low last week as business confidence strengthens and employers seek to fill more positions left open by restrictions. Initial claims in regular state programs declined by 34,000 to 473,000 in the week ended May 8, Labor Department data showed Thursday. The median estimate in a Bloomberg survey of economists called for 490,000 claims. The prior week’s figure was revised up to 507,000. Read More.

U.S. Ran Record $1.9 Trillion Budget Deficit in First Seven Months of Fiscal Year: The U.S. budget gap widened in the first seven months of the fiscal year, as federal spending continued to outpace rising tax receipts while the nation recovers from the economic fallout from the Covid-19 pandemic. The government ran a $1.9 trillion deficit from October through April, a record for the seven-month period and a 30% increase from a year earlier, the Treasury Department said Wednesday. Outlays rose 22%, to a record $4.1 trillion, driven by higher safety-net spending such as jobless benefits and nutrition assistance, as well as Covid-19 relief programs including emergency small business loans and stimulus checks. Tax revenue rose 16%, to $2.1 trillion, primarily due to higher receipts from individuals and corporations, which are larger so far this year compared with 2020, when Congress delayed tax-payment deadlines until July. Federal tax receipts also hit a record for the seven-month period ending in April. Over the past 12 months, the U.S. deficit totaled $2.7 trillion, or 12.2% of gross domestic product. Read More.

U.S. Job Openings Reach Record as Hiring Slows: Job openings reached a record level of 8.1 million at the end of March, reflecting a widening gap between open positions and workers willing and able to take those roles. Available jobs rose by a seasonally adjusted 600,000 in March to exceed the prior record of 7.6 million set in November 2018, the Labor Department said Tuesday. Data from job search site Indeed.com separately showed job posting continued to rise in April, ending the month 24% higher than February 2020’s pre-pandemic level. The Labor Department said the highest rate of open jobs was in the South, while the strongest growth in openings was in the Northeast. Government and private data showed increasing openings in construction, manufacturing and hospitality. The growth in available jobs came as hiring cooled to a seasonally adjusted 266,000 in April from a gain of 770,000 the prior month, the Labor Department said last week. There were still more unemployed Americans—9.7 million in March—than open jobs, but there are several factors economists see for why workers aren’t taking available positions. Those include expanded unemployment benefits, fear of contracting Covid-19 and a lack of child care. Some unemployed workers may not have the skills or desire to take available jobs in fields such as manufacturing, which added 134,000 available jobs in March, or construction, which added 72,000. Openings in accommodation and food service rose by 185,000 in March to nearly one million. However, average hourly wages in that sector, $16.63 an hour in March, was in line with what many people receiving unemployment benefits receive, and workers often start at lower wages. Read More.

Bitcoin

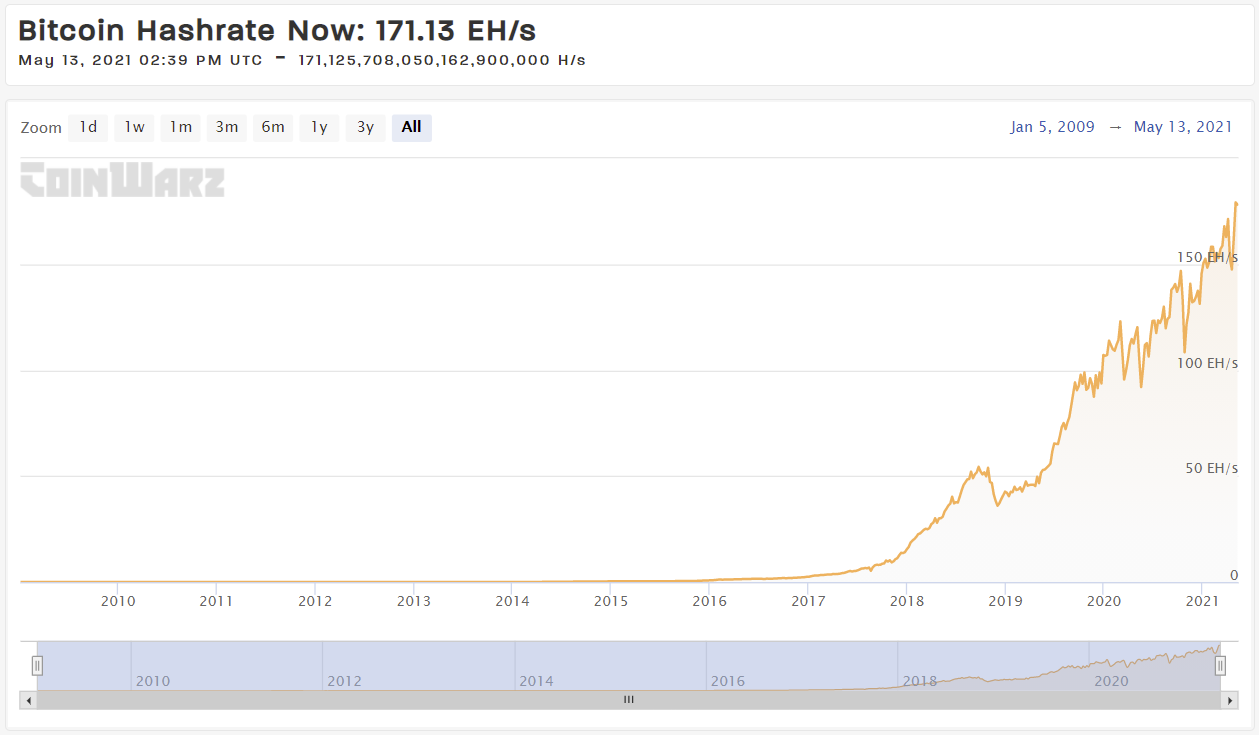

Bitcoin’s Mining Difficulty Hits New High; Taproot Begins Its Second Signaling Attempt: Bitcoin's price may be taking a dip, but its mining difficulty has never been higher. Bitcoin’s mining difficulty – a self-correcting score that determines the computational effort it takes to mine bitcoin – set a new all-time high Thursday. Bitcoin’s difficulty adjusted upward 21.53%, at 25.04 trillion, after dipping to 20.61 trillion in the last adjustment, according to this journalist’s Bitcoin node. This comes after Bitcoin’s hashrate, which is a measure of the combined computing power of Bitcoin’s miners, rose to an all-time high this week. Bitcoin’s difficulty is an internal score that begins at 1 (the easiest level) and grows or shrinks exponentially depending on how many miners are competing on the network. Today’s adjustment was the largest in seven years. Read More.

Bitcoin Falls Below $50,000 as Musk Calls Energy Use ‘Insane’: Tesla Inc.’s Chief Executive Officer Elon Musk doubled down on his attack on Bitcoin’s energy demands, calling recent consumption trends “insane.” Musk posted a chart on Twitter from the University of Cambridge showing Bitcoin’s electricity consumption has skyrocketed this year. It’s the second day he’s criticized crypto mining for using fossil fuels and comes after an announcement that Tesla would suspend car purchases using Bitcoin. The turnaround by one of crypto’s loudest believers took investors by surprise and sent prices tumbling across the board. Bitcoin plunged 10% in early U.S. trading to below $50,000. Exchange operator Coinbase Global Inc. sank 2% in the premarket and other tokens including Ether and Dogecoin slumped. Read More.

VP Take: Watch what they do, not what they say. Tesla still holds billions of dollars of bitcoin on their balance sheet. ~75% of bitcoin mining is coming from renewable energy. I wouldn’t be surprised if this is a publicity stunt for a Tesla mining product in the future. Bitcoin as a global peg for value is one of the biggest incentives to drive innovation for renewable energy. Nothing has changed about bitcoin or it’s value prop. Be greedy when people are fearful.

MicroStrategy Keeps Buying Bitcoin, Adds Another $15M: MicroStrategy disclosed a $15 million bitcoin purchase Thursday, as it bought 271 coins at an average price of $55,387 per bitcoin, even as the crypto market raced lower. The publicly traded business intelligence company has now spent $2.24 billion on bitcoin. It has purchased bitcoin in $15 million tranches at least once a month since March in accordance with CEO Michael Saylor’s “sat-stacking” treasury reserve policy. Sat stacking means accumulating bitcoin by buying smaller amounts at certain intervals. MicroStrategy’s purchase also comes on the heels of signs of rising inflation as U.S. government data released on Wednesday showed the consumer price index (CPI) rose 4.2% year-over-year in April, the fastest rate in 12 years. Higher inflation will likely lead to higher interest rates, which could mean an end to the cheap money that has helped fuel bitcoin’s bull run. Read More.

Crypto

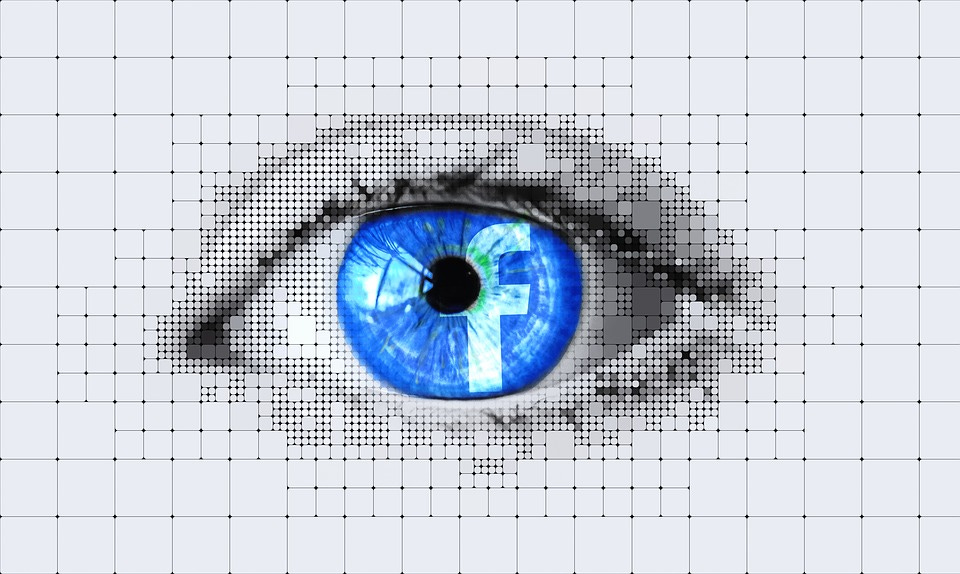

Facebook-Backed Diem Partners With Silvergate Bank to Issue US Dollar Stablecoin: The Diem Association, the Facebook-linked group building a stablecoin, is partnering with Silvergate Bank to launch a U.S. dollar-pegged stablecoin. Diem Networks US, a subsidiary of the association, will run the Diem Payments Network and register as a money services business with the Financial Crimes Enforcement Network (FinCEN), while Silvergate will be the formal issuer of the Diem USD stablecoin. Silvergate will also manage the reserve backing the token. The DPN will be a permissioned network, allowing only approved participants to transact, according to the Wednesday announcement. Silvergate already operates its own payments network, the Silvergate Exchange Network, and provides support for stablecoin transactions. The move represents a sharp departure from Diem’s origins as the Libra Association, which was announced by Facebook in the summer of 2019 and formally created as a partnership with buy-in from a host of different companies in Switzerland that fall. Diem hoped to launch a FINMA-approved product as recently as this past December. The then-Libra Association abandoned the original stablecoin vision – as a token backed by a basket composed of different fiat currencies – after regulatory pushback from policymakers worldwide, instead choosing to launch a set of tokens, each backed by a single fiat currency. Read More.

“We are committed to a payment system that is safe for consumers and businesses, makes payments faster and cheaper, and takes advantage of blockchain technology to bring the benefits of the financial system to more people around the world. We look forward to working with Silvergate to realize this shared vision,” Diem CEO Stuart Levey said in a statement.

Samsung Adds Ledger Wallet Support in Latest Crypto Tie-Up: The cold-storage option comes as monthly active users have doubled over the past seven months. Samsung is connecting its smartphone’s cryptocurrency wallet to Ledger storage devices, adding to a string of recent crypto-centric news to come out of the South Korea-based technology giant. The Samsung Blockchain Wallet that comes with Galaxy smartphones will support Ledger Nano hardware storage devices, designed specifically for the safekeeping of cryptocurrency. Since launching with the Galaxy S10 in 2019, the Samsung Blockchain Wallet supports bitcoin (BTC), ether (ETH), ERC-20 tokens, tron (TRX) and Tron’s ERC-20 analog. A software development kit allows third parties to create “D-apps,” which could include things like paying for goods and services in crypto by scanning a merchants’ QR code. More recently, the Samsung wallet announced its integration with U.S. crypto exchange Gemini. Read More.

“By providing support for hardware wallets we are providing our customers with not just enhanced convenience, but also an entirely new level of security…We will begin with providing support for Ledger products including Nano S and Nano X. Then we plan to expand our support to more cold-storage wallets,” said Woong Ah Yoon, Samsung’s VP and head of blockchain.

Polkadot-centric derivatives exchange raises $6.4M in seed funding: Decentralized exchange dTrade is bringing derivatives trading to the Polkadot ecosystem after concluding a $6.4-million seed investment round, setting the stage for wider decentralized finance use cases on the developer network. The private investment round was led by some of the biggest names in the blockchain venture capital world, including Three Arrows Capital and DeFiance. Polychain Capital, ParaFi Capital, Huobi, Mechanism Capital, Bixin Ventures, IOSG Ventures, Hypersphere Ventures and Fenbushi Capital also participated. Several companies have also stepped up to support liquidity on dTrade, including Alameda Research, CMS Holdings, MGNR, Kronos and Wintermute. Alameda Research has invested heavily in Defi this year, allocating $20 million toward Reef Finance and $4 million toward Coin98 Finance. As a decentralized exchange, dTrade allows for the trading of perpetual swaps and options with on-chain settlement. In theory, the platform can accommodate unlimited derivatives markets without custodial and counterparty risks. The trading platform is not available to United States-based traders. Read More.

“Derivatives are on track to become the largest market in decentralized finance, similar to how they are the largest asset class in traditional finance,” said Nikodem Grzesiak, co-founder of dTrade. “Derivatives are an exciting use case of blockchain. Entirely new perpetual swaps for blockchain-based assets within Polkadot's multi-chain architecture can be added through a simple governance proposal.”

Media

Stanley Druckenmiller: Current Fed policy is totally inappropriate

BTC025: Bitcoin Security & Lending w/ Parker Lewis & Joe Kelly

Opposing Views on the Role of Government and the Essence of Money (w/Michael Green & Peter Schiff)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.