Crypto Download #78

Inflation Everywhere, Tech Stocks Decline, China Backed Blockchain-Service Network Tries to Incentivize Usage, Palantir To Accept Bitcoin, Druckenmiller Negative on USD Reserve Status

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

India’s seven-day COVID average at new high, WHO issues warning on strain

What we know about the Indian variant as coronavirus sweeps South Asia

Stocks Poised to Extend Decline, Led by Tech: U.S. stock futures and global indexes fell Tuesday after concerns about rising inflation resurfaced, prompting a selloff in highflying technology stocks. Futures tied to the S&P 500 dropped 1.3%, a day after the broad market index declined 1% from its record closing level. Nasdaq-100 futures retreated 2%, suggesting that tech stocks were poised for further losses after dragging broader indexes lower at the start of the week. Dow Jones Industrial Average futures fell 0.8%. Investors are betting that inflation is likely to climb steeply in coming months, driven by pent-up spending as well as supply bottlenecks and a leap in commodity prices. A sharp and sustained jump in inflation would erode returns on fixed-income assets and stocks whose valuations rely on future earnings. Some money managers are concerned that it may also prompt the Federal Reserve to pare back its easy money policies sooner than anticipated. Read More.

“Inflation is an issue that is on everyone’s minds right now, and it is injecting a lot of uncertainty,” said Peter Langas, chief portfolio strategist at Bessemer Trust. “The question is, how does the Fed react to that?”

Dallas Fed: Underlying Inflation Rate Remains Tame: A surge in inflation as measured by the personal-consumption expenditures index in March hasn’t made it into underlying price pressure levels yet, according to the Federal Reserve Bank of Dallas. The bank said in a report Friday that compared with the 2.3% year-over-year rise in the PCE price index, its Trimmed Mean PCE rose by 1.7% in March, after a 1.6% increase in February. Federal Reserve officials have said they expect inflation to jump largely on comparisons to very weak numbers last year and because of supply-chain bottlenecks tied to the reopening economy. The Trimmed Mean PCE data bolster the view that there hasn’t yet been a real shift in the inflation environment toward higher prices. Read More.

Corn Is the Latest Commodity to Soar: America’s biggest cash crop has rarely been more expensive. Corn prices have risen roughly 50% in 2021 and a bushel costs more than twice what it did a year ago. Corn has been one of the sharpest risers in the broad rally in raw materials that is prompting companies to boost prices for goods and fueling concern among investors that inflation could hobble the post-pandemic economic recovery. Lumber prices have shot to more than four times what is typical, pushing up home prices and obliterating renovation budgets. Copper, a cog of industry found throughout the home and in electronics, hit record prices Friday. Crude oil hasn’t cost so much since 2018 and soybeans are trading at their loftiest level since 2012. With corn climbing toward a record, Americans can expect to pay more for all sorts of items at the grocery store as well as at the gasoline pump. Corn is a key ingredient in making products ranging from tortilla chips and chicken wings to bourbon and Coca-Cola. About 40% of the U.S. crop is blended into motor fuel. Read More.

Beijing Tries to Put Its Imprint on Blockchain: China, home of the Great Firewall, is trying to bring order to a scrappy corner of cyberspace—and in the process put its mark on the next-generation internet. A Beijing-backed initiative aims to shape a category of online record-keeping called blockchain. Most commonly associated with bitcoin, blockchain holds broad promise for business and other uses but has been hobbled by a lack of uniform technical standards. With an offer of ultracheap server space, Beijing is beckoning blockchain’s global community of developers to adopt its vision for the technology. Success could put China in a powerful position to influence future development of the internet itself and promote international use of Chinese innovations, like a homegrown Global Positioning System and a digitized national currency. China is pitching its initiative, Blockchain-based Service Network, or BSN, as providing much-needed digital infrastructure for developers world-wide: server space at a few hundred dollars annually, programming tools to create blockchains and, most critically, templates to standardize some basic functionality. A little over a year into its operation, the BSN endeavor boasts 20,000 users and thousands of blockchain-related projects. A powerful state actor’s bid to build critical mass for blockchain both excites and unnerves a technology industry where upstarts have traditionally led breakthroughs. The potential of blockchain already enthralls American corporations: Boeing Co. has tested it to organize airspace for better flight safety, while experiments at Walmart Inc. use it to track food. Gartner Inc. forecasts that new uses of blockchain could generate $3 trillion in value by the end of the decade. Read More.

Bitcoin

Legendary Investor Stanley Druckenmiller, “USD Will Lose World Reserve Currency Status:” In an interview this morning on CNBC’s “Squawk Box,” legendary investor Stanley Druckenmiller gave his view on the dollar’s stance as the world reserve currency and the current U.S. fiscal and monetary policy. Druckenmiller did not hold back his views on what the massive amounts of liquidity meant for the bond market, or the U.S. and its position as the incumbent world reserve currency. Druckenmiller referred to the Federal Reserve’s continued monetization of the U.S. Treasury market, and the effects that the yield suppression was having on credit markets and the financial system more broadly. It seems that Druckenmiller holds that same view that many Bitcoin proponents share, that the U.S. dollar in the current macroeconomic environment is guaranteed to debase in value, and that U.S. fiscal and monetary policy is incentivizing individuals to venture further out on the risk curve to capture returns in a system where financial repression seems to be the path selected by policy makers to “escape” the debt trap. Read More.

“I am comfortable with the dollar losing reserve currency status, that is my central case…Without the Fed buying 60% of debt issued, the bond markets would be totally rejecting this,” Druckenmiller explained. “They are enabling this massive expansion in fiscal policy, and the problem is, if you end up getting inflation, and frankly even if you don't, the debt is going to be so big…My issue here is, in the future as we go forward… if the 10 year goes to 4.9%, the interest expense alone [on the federal public debt] will be close to 30% of GDP, every year,” he said. “There is no way we can afford to have 30% of all government outlays be toward interest expense, so what will happen is the Fed will have to monetize that. When they monetize it, I believe it will have horrible implications for the dollar, and that's why I said in that speech that I think it is more likely than not within 15 years we lose reserve currency status.”

Palantir accepts bitcoin in payment from customers: Peter Thiel-backed U.S. analytics company Palantir Technologies Inc said on Tuesday it accepts bitcoin in payment from customers. The company also said it was considering having bitcoin or other types of cryptocurrencies on its balance sheet. Read More.

Nebraska's Bitcoin Banking Charter Advances: Nebraska could become the second U.S. state to introduce a crypto banking charter. State senators voted Monday for a bill that would allow firms to register as digital asset depositaries, and offer services allowing their customers to buy and sell Bitcoin and other cryptocurrencies. The Nebraska Financial Innovation Act sailed through the vote to adopt the legislation, with near-unanimous approval—39 lawmakers voted to advance the bill to enrollment and initial review, with only one in disagreement. The move follows similar legislation enacted by the state of Wyoming, which chartered its first crypto bank, Kraken in September 2020, and another, Avanti, soon after that. The new crypto banks can hold digital assets, take deposits, and maintain digital payment systems. In January, underscoring the new interest among lawmakers, regulators, and industry leaders in the intersection between crypto and traditional finance, crypto company Anchorage became the first digital asset bank with a federal charter. Read More.

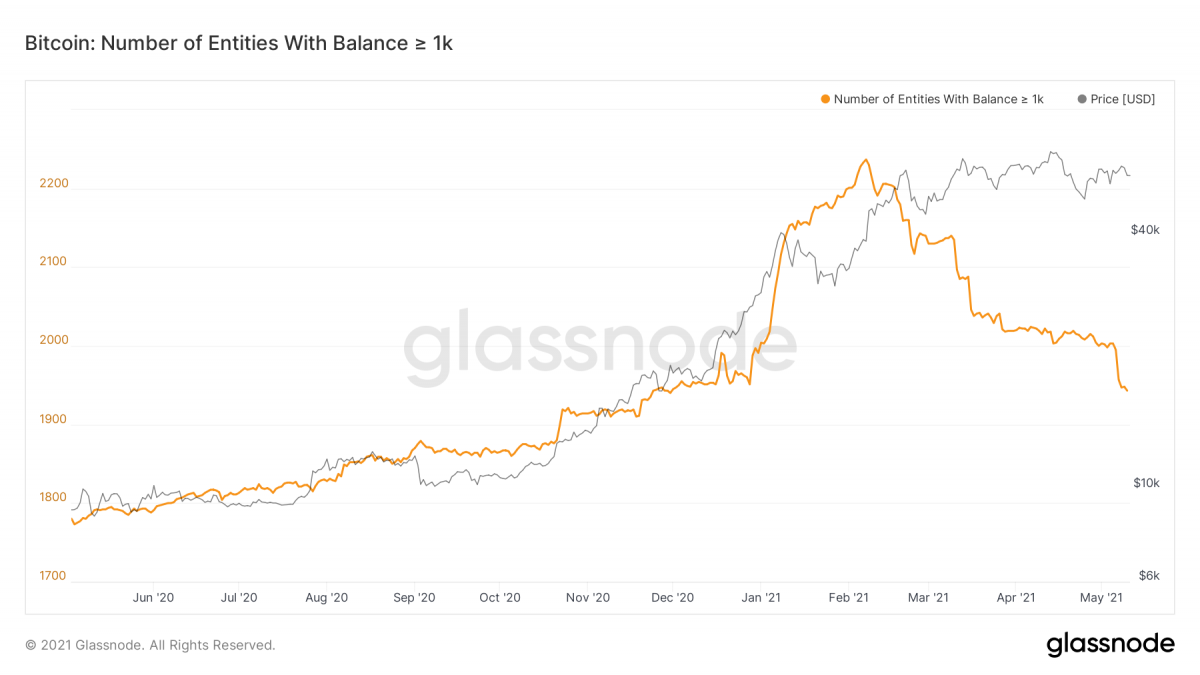

Bitcoin Pullback Risk Rises as Whales Resume Selling: Bitcoin’s blockchain data pointing to renewed selling by “whales” – large investors with the ability to influence markets. The number of whale entities – clusters of wallet addresses held by a single network participant holding at least 1,000 bitcoin fell to a 5.5-month low of 1,943 on Monday. The metric has dropped by 60, or 3%, in the past five days, extending the decline from a record high of 2,237 on Feb. 7. Whale selling had eased off in the second half of April. From October 2020 to February 2021, the number of whale entities had risen in lockstep with bitcoin's price, validating the narrative that the rally over that period was the product of increased participation by large investors. Bitcoin's price has been generally restricted to the $50,000 to $60,000 range since mid-March amid continued selling by whales. In other words, retail investors alone have been struggling to drive the rally. Recent market-wide price action suggests investor focus has shifted from bitcoin to ether and other alternative cryptocurrencies (altcoins). Read More.

Crypto

DARMA Capital Bets $3M on Scalable DeFi Exchange With Settlement Finality: Ethereum scaling solution Nahmii is being backed by DARMA Capital, the U.S.-registered investment fund launched by former ConsenSys veterans Andrew Keys and James Slazas. DARMA is leading a $3 million seed round in NiiFi, a decentralized exchange (DEX) being built on Nahmii – a “layer two” system for boosting Ethereum’s transaction capacity. Also included in the round are A195 Capital, AU21 Capital, Blocksync Ventures, Lotus Capital, Matterblock, Moonwhale Ventures, Protocol Ventures and Three M Capital. The NiiFi DEX promises institution-friendly features like instant settlement finality and know-your-customer (KYC) capabilities. Read More.

“Nahmii is where DARMA is placing its layer two scaling-solution bet,” Keys said in an interview. “We are concerned with commercial viability, and one of the most important considerations when employing blockchains is finality. NiFii uses Nahmii’s scaling capabilities to build a commercially viable DEX with instant, immediate finality, and we think that will be a huge differentiating point.”

IRS Taps TaxBit to Audit Bulk Crypto Transactions: The Internal Revenue Service (IRS) has contracted with crypto tax service provider TaxBit to help the U.S. tax agency audit entities and individuals. Utah-based TaxBit announced the one-year contract Tuesday, saying it would provide auditing services for cryptocurrency transactions as needed by the IRS, helping the agency verify whether high-volume traders accurately reported their crypto taxes. The company just raised $100 million in a Series A funding round. Read More.

“We’ll be providing data analysis and support and calculations for the IRS to help them really get to the right answer,” said Seth Wilks, TaxBit’s director of government relations. “We’ll fill some of the gaps in tools that just don’t exist right now within their own ecosystem, and so we’re coming in to make sure that they are fully understanding the data.”

Ubisoft Unveils the Next Batch of Crypto Startups It Plans to Help Grow: Gaming giant Ubisoft is the only major, traditional video game publisher that is deeply immersed in the blockchain scene. The publisher behind massive game franchises like Assassin’s Creed and Just Dance has not only released a couple of its own experimental crypto game projects to date, but also supports many startups in the space. Ubisoft’s Entrepreneurs Lab accelerator program is one way that the publisher has helped boost the knowledge and visibility of such startups. The initiative has turned into something of a rite of passage for crypto game developers, with the creators of top blockchain-driven games like Sorare and Axie Infinity taking part in previous seasons. This season’s new blockchain-related startups are aleph.im, Crucible, Guild of Guardians, Horizon Blockchain Games, and NonFungible. Read More.

Media

Bitcoin: Savior of a Dying Empire? (w/ Michael Krieger and Brent Johnson)

Is Inflation Out Of Control? | The Big Conversation | Refinitiv

Value Investing and Bitcoin with Peter Doyle

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.