Crypto Download #77

Central Banks Tapping Breaks & Raising Rates, US Corps Buying More Robots Outside of Auto, Coinbase Decentralizes HQ, Bitcoin to 300M US Checking Accounts, NFL Gets 1st Bitcoin Sponsor, ETH Mooning

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

World’s Most-Vaccinated Nation Activates Curbs as Cases Rise

COVID spreading in rural India; record daily rises in infections, deaths

Vaccinations Decline Across U.S., Spurring Search for Holdouts

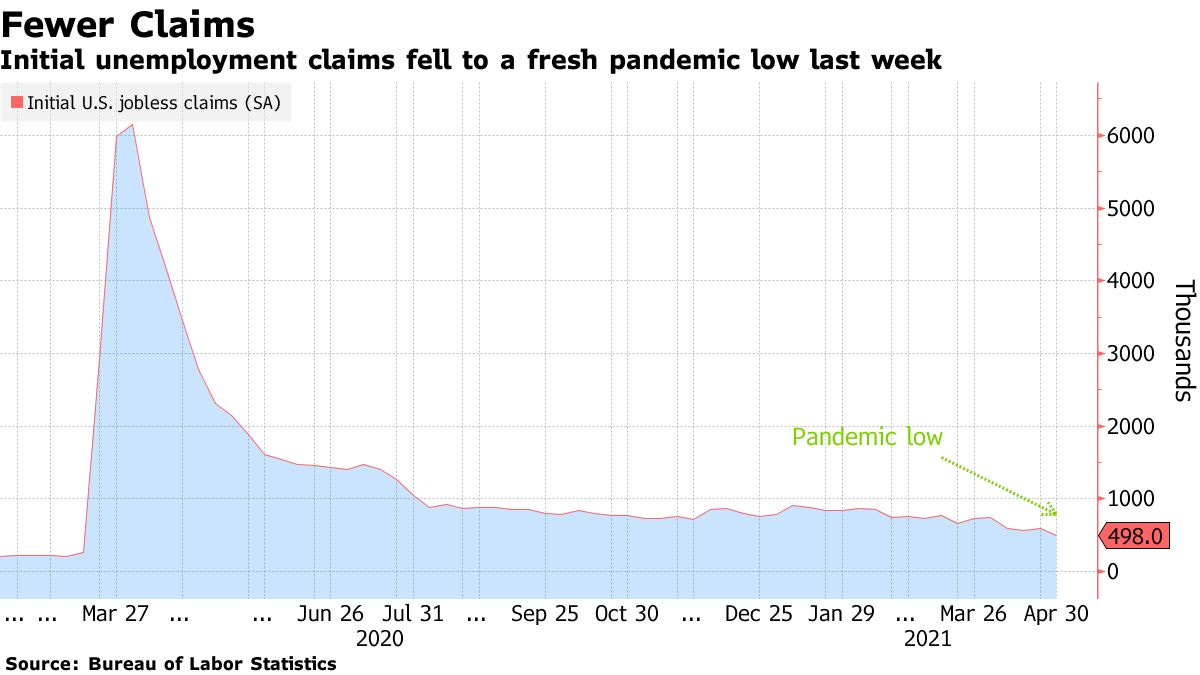

U.S. Jobless Claims Fall More Than Forecast to Pandemic Low: Initial claims in regular state programs fell by 92,000 to 498,000 in the week ended May 1, Labor Department data showed Thursday. The median estimate in a Bloomberg survey of economists called for 538,000 claims. The prior week’s figure was revised up to 590,000. Read More.

Yellen’s Interest-Rate Comment Illustrates the Market’s Greatest Worry: Speaking at an event with the Atlantic, Ms. Yellen said, “It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat, even though the additional spending is relatively small relative to the size of the economy.” She was referring in particular to the Biden administration’s planned long-term spending, some of it years down the line, when the economy will probably be much closer to full employment. How the Fed reacts to the economic recovery and the administration’s bulging spending plans isn’t all that matters, but it sometimes seems like investors believe that it is. Chairman Jerome Powell has repeatedly stressed that the Fed intends to sit on its hands and allow inflation to stray marginally above 2% without acting to cool the economy. Read More.

Bank of England slows bond-buying, sees economy bouncing back more quickly: The Bank of England slowed the pace of its trillion dollar stimulus program and forecast a faster recovery for Britain from the coronavirus slump on Thursday, but stressed it was not tightening monetary policy. Governor Andrew Bailey said it was good news that the economy looked set for a stronger recovery than previously forecast, with less unemployment. The central bank said it would reduce the amount of bonds it buys each week to 3.4 billion pounds, down from a current pace of 4.4 billion pounds a week. Read More.

Brazil Central Bank Raises Benchmark Selic Interest Rate to 3.5%: Brazil’s central bank raised its benchmark lending rate as policy makers work to counteract inflation amid high commodities prices and a weakened real, and signaled another rate increase of the same size at its next meeting in June. The bank on Wednesday raised its benchmark Selic rate by 75 basis points to 3.5%, as expected, after an increase of the same size at its meeting in March lifted the rate from its record low of 2%. The monetary policy committee said that more rate increases are needed, but that the economy is still in need of monetary stimulus. Read More.

“Inflation will moderate once the temporary commodity price shock is over,” said Étore Sanchez, chief economist at Ativa Investimentos, adding that the fragile economy still calls for interest rates at levels that boost growth. “They shouldn’t remove all the stimulus in this cycle of rate increases.”

North American companies buying more robots to keep up with demand: North American companies boosted spending on industrial robots in the first quarter as they scrambled to keep up with surging demand in the wake of the COVID-19 pandemic. Companies ordered 9,098 robots in the first quarter, a 19.6% increase over a year ago. Robots were once concentrated in the auto industry but are now moving into more corners of the economy, from ecommerce warehouses to food processing plants. The strongest growth in the latest quarter was to metal producers, where orders surged 86%. Orders to life science, pharmaceutical and biomedical companies rose 72%, while orders to consumer goods companies increased 32%. Read More.

Coinbase Plans to Close Its San Francisco Headquarters in 2022: Coinbase Global Inc., the biggest U.S. cryptocurrency exchange, plans to close its San Francisco headquarters next year and let employees continue to work remotely. A year ago, Chief Executive Officer Brian Armstrong announced the exchange would be “remote first” and not have a specific headquarters. Decentralization lies at the heart of crypto and in related businesses, many of which have employees spread all over the world and want to avoid regulation. Binance, the world’s biggest cryptocurrency exchange, also doesn’t have a headquarters. Read More.

“Closing our SF office is an important step in ensuring no office becomes an unofficial HQ and will mean career outcomes are based on capability and output rather than location,” the company said. “Instead, we will offer a network of smaller offices for our employees to work from if they choose to.”

Google Relaxes Work-From-Home Rules to Let More Staff Be Remote: In the email, Pichai said he expects about 60% of Google’s staff will work in the office “a few days a week.” Another 20% will be able to relocate to other company sites, while the remaining one-fifth can apply to permanently work from home. Google’s parent, Alphabet, ended the first quarter just shy of 140,000 direct employees. Read More.

Bitcoin

Mercado Libre Has Invested $7.8 Million Into Bitcoin: Latin America’s leading e-commerce platform Mercado Libre has become the latest publicly traded company to add Bitcoin to its balance sheet. According to Bitcoin Treasuries, MicroStrategy currently holds more than $5.2 billion worth of Bitcoin; Tesla, which sold 10% of its crypto stash in Q1, still holds a staggering $2.48 billion in BTC. Read More.

“As part of our treasury strategy this quarter we purchased $7.8 million in bitcoin, a digital asset that we are disclosing within our indefinite-lived intangible assets,” reads the filing.

NYDIG 'Making it Simple' To Buy Bitcoin From U.S. Banks: New York Digital Investment Group (NYDIG) has partnered with fintech giant Fidelity National Information Services (FIS) to enable U.S. banks to offer their clients the ability to buy, sell and hold bitcoin through their existing accounts. The two firms expect that this "industry-first" solution will be available in the coming months. Read More.

"What we're doing is making it simple for everyday Americans and corporations to be able to buy Bitcoin through their existing bank relationships," Patrick Sells, head of bank solutions at NYDIG, told CNBC.

Bitcoin is coming to hundreds of U.S. banks this year, says crypto custody firm NYDIG

While Fidelity National Information, which is a vendor to banks with nearly 300 million checking accounts, will handle the link to lenders, NYDIG will take care of bitcoin custody and trade execution. Disclosures will make it clear that it is NYDIG, and not the banks, that handles the bitcoin, and the cryptocurrency won’t be FDIC-insured, according to Zhao.

PayPal Posts Record Growth, Touts Crypto Buying: PayPal went on a tear last year as the fintech giant notched record profits, revenue and user growth—trends that are carrying over into 2021. Q1 revenues of $6.03 billion and earnings per share of $1.22, which handily beat analysts' predictions of $1.01. The latest results, which reflect a year over year revenue growth of 31%, are a result of PayPal benefiting from the same tailwinds as last year—namely, a pandemic-driven uptick in e-commerce and digital wallet adoption, and a new embrace by merchants of novel payment platforms. The company has made major strides into the cryptocurrency world, offering users the ability to buy and sell Bitcoin and Ethereum, and expanding crypto payments to merchants. More recently, PayPal added crypto buying and selling to its popular peer-to-peer Venmo app. Read More.

Crypto

Ether’s 1,500% Jump Is Just the Start for Crypto Faithful: The token affiliated with the Ethereum blockchain -- a digital ledger popular for financial services and sales of so-called crypto collectibles like online art -- is up about 1,500% in the past year and hit a new peak of $3,455 on Tuesday. The climb is stirring predictions of more gains ahead even as some technical indicators flash warnings that the rally may be overextended. Crypto proponents argue investors are now looking beyond Bitcoin to Ether and other tokens despite warnings of a stimulus-fueled mania in the sector. Ayyar sees Ether hitting $5,000 to $10,000 by early next year. Evercore ISI technical strategist Rich Ross has revised up his target to $4,100 from $3,900. Many traders are eyeing a run toward $10,000 before the end of 2021. Read More.

“The market is realizing how fundamentally undervalued Ether is given all the development activity on the network,” said Vijay Ayyar, head of Asia Pacific at crypto exchange Luno Pte. “While one may think Ether has risen a lot, when you compare it to Bitcoin, there is a long way to go.”

Grayscale Investments becomes the first-ever crypto sponsor of an NFL team after inking an exclusive partnership with the New York Giants: Grayscale Investments is the first-ever cryptocurrency company to sponsor an NFL team. Grayscale is now the "Official Digital Currency Asset Management Partner" of the New York Giants. The digital currency asset manager will also be the presenting sponsor of The Giants Foundation's golf outing, the presenting home game sponsor, and a supporting sponsor for the Giants training camp as a part of the deal. Grayscale also plans to host educational seminars on cryptocurrencies for Giants personnel each year. Read More.

"Our partnership with the Giants is incredibly meaningful because our roots are in New York…We're excited to partner with such a forward-thinking franchise, to work together on philanthropic initiatives, and to continue to support the New York metropolitan community," Michael Sonnenshein, Grayscale's CEO, said in a press release.

"We are excited to partner with Grayscale, who are innovative leaders in the digital currency market," Pete Guelli, the New York Giants' chief commercial officer, said in a press release. "During our extensive evaluation of the space, we determined that we not only wanted a partner that understood the value of aligning with the Giants brand, but also could guide us in navigating the cryptocurrency ecosystem."

Jay-Z, A16z Back $19M Funding Round for NFT Platform Bitski: Describing itself as the “Shopify for NFTs,” Bitski aims to provide an easy platform for brands, game developers and consumers to create, buy and sell digital goods. Serena Williams and Ari Emanuel, the CEO of media agency Endeavor, are also listed among investors who participated in the round. Bitski was backed by Galaxy Digital, Winklevoss Capital and Coinbase Ventures in a $1.81 million seed funding round in November 2019. At the time, Bitski’s focus was developing a crypto wallet that could be easily embedded into other applications, such as video games. The company has now pivoted toward the NFT market, providing a platform for the sale of NFTs by such brands as Adidas and World Wrestling Entertainment (WWE). Read More.

Media

BTC024: Plan B & Adam Back on Bitcoin Contango & Derivatives

This Month's Top Ethereum News, Innovation & Development – May 2021

Sergey Nazarov: Chainlink, Smart Contracts, and Oracle Networks | Lex Fridman Podcast #181

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.