Crypto Download #76

Covid Deepens in India as Nations Urge Citizens to Leave the Country, Inflation Rises in Assets, Food, Housing, Commodities - Central Banks Not Bothered, Bitcoin Ready for Big Move as ETH Hits New ATH

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

OVERRUN HOSPITALS IN INDIA

‘Last resort’: Desperate for oxygen, Indian hospitals go to court

Leading 20 Nations Set to Back Efforts for Vaccine Passports

U.S. Travel Ban Strategy Doesn’t Make Sense, Ex-FDA Chief Says

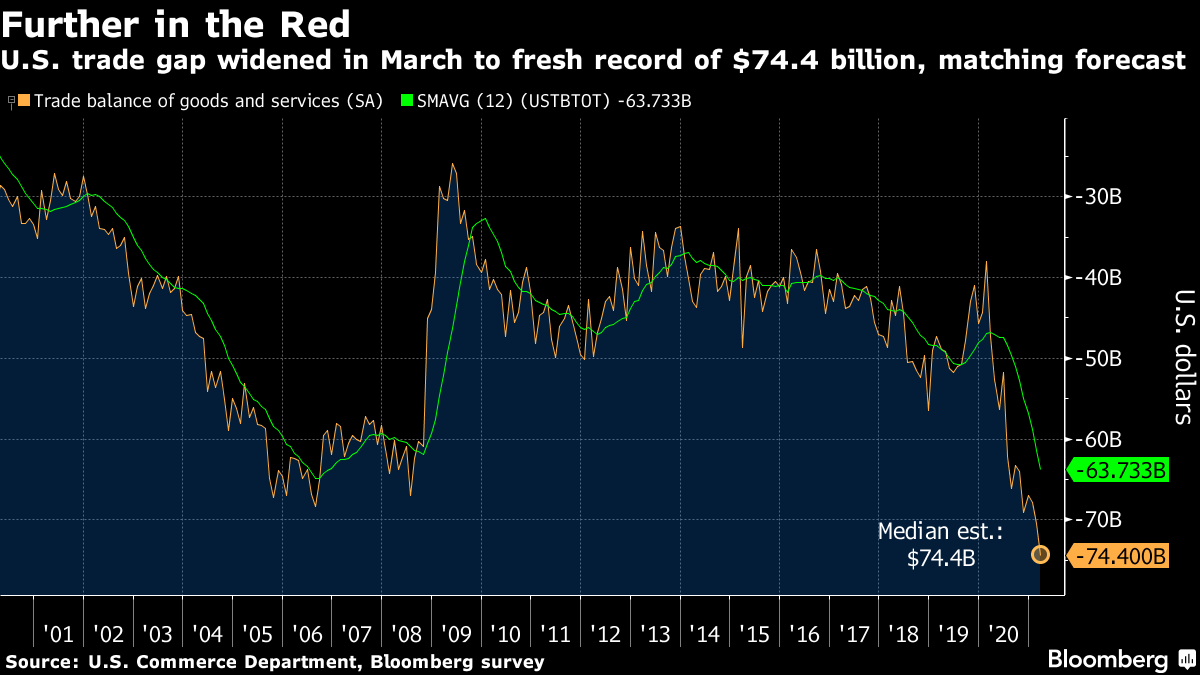

U.S. Trade Gap Widened to Fresh Record of $74.4 Billion in March: The U.S. trade deficit widened to a new record in March as the value of imports surged to a fresh high. The gap in trade of goods and services expanded to $74.4 billion in March from a revised $70.5 billion in February, according to Commerce Department data released Tuesday. mports rose 6.3% to a record $274.5 billion, while exports climbed 6.6% to a more than one-year high to $200 billion. Demand from American consumers stuck at home during Covid-19 has been sending U.S. imports to highs. Ports have been overwhelmed after the sudden stoppage of trade at the start of the pandemic last year and then the rush of purchasing that followed, even as exports remain sluggish. The merchandise-trade deficit rose to an all-time high of $91.6 billion, while the nation’s surplus in services trade eased to $17.1 billion, the lowest since August since 2012. The U.S. goods shortfall with China widened in March to $36.9 billion on a seasonally adjusted basis, the widest since December 2018. Read More.

Derby’s Take: Fed’s Williams Flags Potency of Mortgage Bond Buying: The housing market is on fire across the U.S., so why is the Federal Reserve still offering support to that part of the financial system? According to Federal Reserve Bank of New York President John Williams, it is because the Fed may get more bang for the buck when it buys mortgage-related debt than it does with its larger monthly purchases of Treasury debt. Mortgage bond purchases by the Fed “dollar for dollar have pretty powerful spillovers into other financial conditions such as corporate bond rates and other kinds of similar securities,” Mr. Williams told reporters after a speech Monday. Mr. Williams said he expects to see 7% growth this year and economic performance harking back to the go-go 1980s. But he also said “we are still far from our goals of maximum employment and price stability,” and “let me emphasize that the data and conditions we are seeing now are not nearly enough for the FOMC to shift its monetary policy stance.” The Fed met last week and maintained the near-zero interest rate policy it has had in place for a little over a year. It also maintained its $120 billion a month in bond buying, which includes monthly purchases of $80 billion in Treasuries and $40 billion in mortgage bonds. The housing market has been a significant beneficiary of low rates and the Fed’s asset buying. The median existing home sales price hit a record high in March and rose 17.2% from a year earlier, and analysts expect to see further price gains. That is fueling worries among some observers that the sector is overheating, or at least putting home purchases further out of reach for many Americans. Read More.

VP Take: The Fed has two main goals - maximum employment and price stability. We’re still seeing 500k-750k new unemployment claims per week, inflation in asset prices, commodities and housing...the opposite of their goals. The Fed is stuck and healthy market corrections are no longer an option. They are the #1 driver for the new everything bubble. Australia Central Bank Lifts Outlook, to Review YCC in July: Australia’s central bank upgraded its economic outlook and said policy makers will review its bond programs in July, while maintaining interest rates will remain at emergency levels until at least 2024. Reserve Bank Governor Philip Lowe kept the cash rate and three-year yield target at 0.10% on Tuesday. He said the board will decide at its July 6 meeting on a third tranche of quantitative easing and whether to shift yield curve control to target the November 2024 maturity from the current April 2024 bond. The RBA’s decision to stand still comes a week before the government delivers its annual budget that’s expected to include targeted spending to help boost jobs and spur a faster recovery. Treasurer Josh Frydenberg has lined up behind Lowe’s goal of pushing the economy to full employment as quickly as possible to rekindle inflation. Like the Federal Reserve and European Central Bank, it will keep pumping monetary support until the economy is fully repaired. It would also like to trail any move by the U.S. to avoid unnecessary exchange rate appreciation. The one area likely causing a headache for Lowe is the property market. Housing has surged in response to record low borrowing costs, government assistance and a lack of supply. Property prices rose 7.8% in the past year, and while similar increases have occurred across the globe, a return to boom times Down Under threatens to swell an already worrisome pile of household debt. Read More.

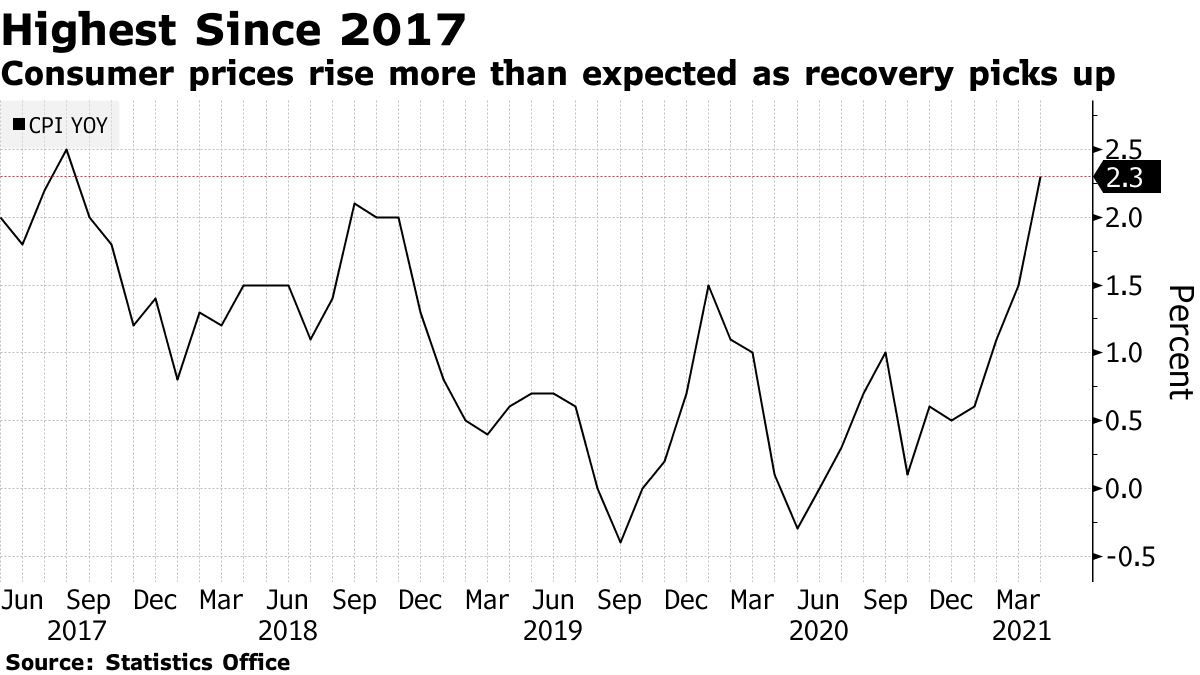

Korea Inflation Hits Four-Year High as Pandemic’s Grip Eases: South Korea’s inflation accelerated in April to the fastest pace since 2017 amid a broadening economic recovery, but the pickup is unlikely to stoke concerns over excessive price pressure as calendar effects helped buoy the gains. Inflation rose to 2.3% in April, data from the statistics office showed Tuesday, rapidly increasing from 1.5% in March. Economists expected consumer prices to increase 2.1% from a year earlier. While there were signs of improving domestic demand supporting inflation, the boost was largely driven by higher commodity and energy prices, which had plunged a year earlier as the pandemic spread across the world. Korea’s consumer prices fell 0.3% in May 2020, suggesting favorable base effects will remain in play for the coming months. Read More.

Bitcoin

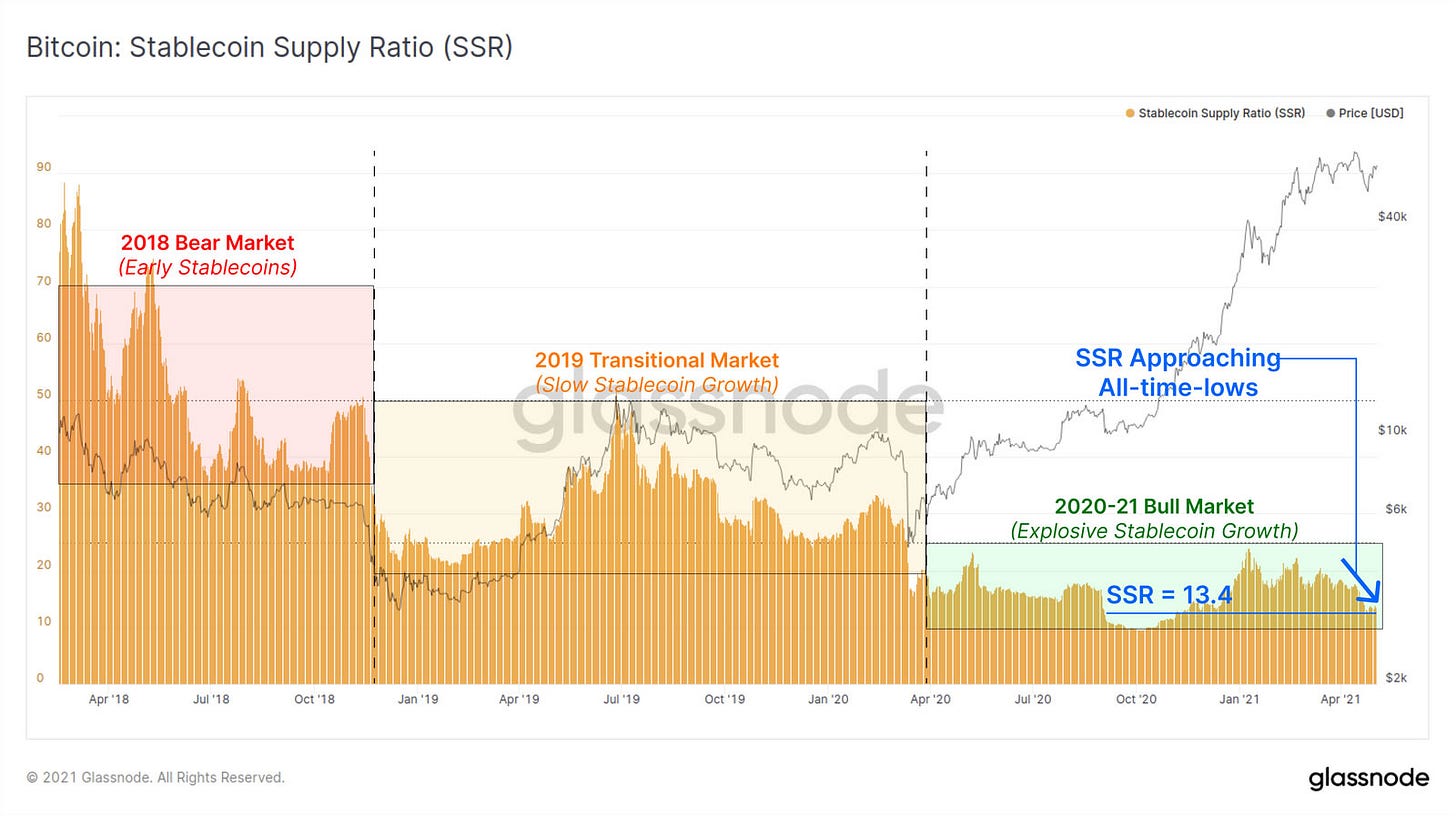

Glassnode predicts BTC rally as stablecoin supply tags record highs: The circulating supply of the four-largest stablecoins has spiked to new all-time highs, suggesting buyers could soon spark another leg up for the Bitcoin and crypto markets. With the surging supply, Glassnode highlights that Bitcoin’s Stablecoin Supply Ratio (SSR), which measures the Bitcoin supply divided by the stablecoin supply, is sitting at a year-to-date low of 13.4, and is approaching its all-time-low of 9.6. The chart shows that SSR has been persistently low during 2020 and 2021 as stablecoin supplies have largely grown in proportion to Bitcoin’s price appreciation. According to Glassnode, a decreasing SSR value is a bullish signal that the global stablecoin supply becoming larger relative to the Bitcoin market cap. Read More.

“As the total supply of stablecoins increase, it suggests an increased 'buying power' of crypto-native capital that can be quickly exchanged and traded into BTC and other crypto-assets.”

JPMorgan CEO Dimon Says He Doesn’t Care About Bitcoin—But His Clients Do: JPMorgan’s billionaire CEO Jamie Dimon—an infamous crypto skeptic—said Tuesday that he is still not a “supporter” of bitcoin, but added that he recognizes that many of his bank’s clients are looking to invest in the world’s largest and most popular digital currency as it continues to captivate retail traders and major institutions alike. In an interview at the Wall Street Journal’s CEO Council Summit, Dimon described how JMPorgan’s clients are now looking for ways to store their crypto assets securely with the bank, track their crypto holdings along with other assets and buy and sell crypto along with traditional assets. Read More.

Digital Currency Group Buying $750 Million in GBTC Shares: Digital Currency Group, a major crypto investment firm led by CEO Barry Silbert, plans to buy an additional $557 million of shares of the Grayscale Bitcoin Trust, the giant Bitcoin investment vehicle run by Grayscale, one of DCG's many subsidiaries. This would bring DCG's total investment into the trust—$193 million as of April 30—to $750 million. The Grayscale Bitcoin Trust commands $36 billion in assets under management, or more than 3% of all Bitcoin in circulation. Read More.

Crypto

Ether Price, on Cusp of Record 10-Day Winning Streak, Tops $3,500 for First Time: Ether is on track to extend its nine-day winning trend amid signs of institutions seeking exposure to the cryptocurrency. Ether (ETH), which is the native cryptocurrency of the Ethereum blockchain, has nearly quintupled this year, in a rally fueled by speculation over the future of decentralized finance, known as DeFi, as well as other use cases like non-fungible tokens or NFTs. There’s also mounting evidence of robust growth in transaction volumes and other network metrics. The rising popularity of ether futures listed on the Chicago Mercantile Exchange (CME) shows institutions are now seeking exposure to the cryptocurrency via derivatives markets. Read More.

S&P Dow Jones brings bitcoin, ethereum to Wall St with cryptocurrency indexes: he S&P Dow Jones Indices launched new cryptocurrency indexes, it said on Tuesday, further mainstreaming digital currencies including bitcoin and ethereum by bringing them to the trading floors of Wall Street. The new indexes, S&P Bitcoin Index, S&P Ethereum Index and S&P Crypto Mega Cap Index, will measure the performance of digital assets tied to them. The list will expand to include additional coins later this year. The company first announced the plan in December when it said it would cover more than 550 of top-traded coins and that its clients will be able to create customized indices and other benchmarking tools on cryptocurrencies. The indexes will use data from New York-based virtual currency company Lukka. Read More.

"Traditional financial markets and digital assets are no longer mutually exclusive markets," said Peter Roffman, global head of innovation and strategy at S&P Dow Jones Indices.

Sotheby's to accept bitcoin, ethereum for Banksy auction: Sotheby’s said on Tuesday it would accept bitcoin and ethereum as payment for Banksy’s iconic artwork “Love is in the Air”, a first for a physical art auction and the latest sign of growing mainstream acceptance of cryptocurrencies. Bitcoin hit a record high just shy of $65,000 last month, the latest landmark on the emerging asset’s march to wider acceptance. Its gains have been fueled by growing acceptance among major U.S. companies and financial firms. Cryptocurrencies have already made a mark in the world of digital art. A digital artwork - “Everydays - The First 5000 Days” by American artist Mike Winkelmann who is better known as Beeple - sold for nearly $70 million at Christie’s in March, in the first ever sale by a major auction house of a piece of art that does not exist in physical form. Read More.

Coinbase Expands Support for Tether Stablecoin: A day after adding the stablecoin on its Pro platform, U.S.-based cryptocurrency exchange Coinbase says it has listed tether for general users. The company said customers can now buy, sell, convert, send, receive or store USDT on Coinbase.com. With the exception of some jurisdictions, including New York, USDT trading will be available across all regions covered by the exchange. Coinbase Pro announced on April 23 it would start offering USDT trading, despite lingering concerns over the stablecoin's U.S. dollar backing. Read More.

Multicoin Launches $100M Crypto Fund with Sights Set on Solana DeFi: The Austin-based investment firm today announced the launch of a $100 million venture fund (2nd crypto fund), which it plans to use to back companies and token projects that fit into its “Crypto Mega Theses” investment strategy. It plans to use the money to invest in a range of "open finance" and Web3 projects, with a major focus on projects building on Solana. Read More.

“Solana is having a moment that few projects ever experience: the birth of a new DeFi ecosystem…The ultimate bull case for Solana is that it supplants Ethereum as the dominant Layer 1 smart contract platform,” said Multicoin Managing Partner Tushar Jain. “In other words, Solana aims to be the place that DeFi money goes to play…there’s now more than $1 billion locked in Solana DeFi and the ecosystem is just getting started…Over time, DeFi on Ethereum will naturally skew toward what it does best, just as it will on Solana. The billion dollar question is, what do traders want and who does that best. The race is on,” Jain said.

Media

The Truth About Inflation with Lyn Alden

Strike Launches in El Salvador with Jack Mallers, Miles Suter & Michael Peterson

Will the U.S. Leave the Value of the Dollar to "Market Forces"? -- Live with Luke Gromen

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.