Crypto Download #75

Biden's American Family Plan Brings Fiscal Spending to $6 Trillion, India Struggles with Covid as Deaths Climb, Copper's Price Approaches New ATH, Miners Hodling BTC - Bullish, Crypto Investment Soars

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

India’s coronavirus infections cross 18 million as gravediggers work round the clock

Just a Little Extra Weight Raises Risk of Severe Covid in Study

Biden’s Economic Plan Would Redistribute Trillions and Expand Government: Franklin D. Roosevelt created the modern government-funded social safety net in the 1930s to aid lower and middle-income families—paid for in part by jacking up taxes on the richest Americans. Dwight Eisenhower built the interstate highway system in the 1950s. John F. Kennedy defined federal industrial policy in the 1960s by pledging to put a man on the moon by decade’s end. In his first 100 days in office, Joe Biden has been attempting to emulate all three, seeking to combine and update for the 21st century his predecessors’ visions for a muscular Washington role in the economy. With his $1.8 trillion American Families Plan unveiled Wednesday—following his $2.3 trillion American Jobs Plan and his $1.9 trillion American Rescue Plan—President Biden has proposed $6 trillion in new federal spending for the next decade. That is far more than any recent president at a comparable point in their terms. Beyond expanding the size and scope of government, Mr. Biden’s program aims to redistribute trillions of dollars of resources from the highest-earning households and businesses to everyone making less than $400,000 a year. Read More.

Copper Extends Rally to Top $10,000 With All-Time High in Sight: Copper topped $10,000 a metric ton for the first time since 2011, nearing the all-time high set that year as rebounding economies stoke demand and mines struggle to keep up. Prices rose as much as 1.3% to $10,008 a ton on the London Metal Exchange. Prices hit a record $10,190 in February 2011. Copper has been among the best performers in a month where metals ranging from aluminum to iron ore have surged to the highest in years. The rally is being fueled by stimulus measures, near-zero interest rates and signs that economies are recovering from the virus pandemic. A push toward cleaner energy sources is also seen boosting consumption of copper, used in everything from electric vehicles to solar power systems, further straining supplies. Read More.

Fed Upgrades View of Economy While Keeping Rates Near Zero: Federal Reserve Chair Jerome Powell and his colleagues upgraded their assessment of the U.S. economy but said they were not yet ready to consider scaling back pandemic support. Marking a clear improvement since Covid-19 took hold more than a year ago, the Fed said that “risks to the economic outlook remain,” softening previous language that referred to the virus posing “considerable risks.” The statement also noted that sectors hit hardest by the Covid-19 pandemic had “shown improvement.” And on the risk of prices rising, policy makers said: “Inflation has risen, largely reflecting transitory factors.” The yield on 10-year Treasuries retreated to be slightly lower on the day as Powell spoke to reporters after briefly touching a fresh session high when the decision was announced and the Bloomberg dollar index slipped to a two-month low. The pricing of Fed policy tightening in the coming years was pared slightly, while the S&P 500 Index reversed an earlier gain to trade little changed. Read More.

Global Chip Drought Hits Apple, BMW, Ford as Crisis Worsens: The global chip shortage is going from bad to worse with automakers on three continents joining tech giants Apple Inc. and Samsung Electronics Co. in flagging production cuts and lost revenue from the crisis. In a dizzying 12-hour stretch, Honda Motor Co. said it will halt production at three plants in Japan; BMW AGcut shifts at factories in Germany and England; and Ford Motor Co. reduced its full-year earnings forecast due to the scarcity of chips it sees extending into next year. Caterpillar Inc. later flagged it may be unable to meet demand for machinery used by the construction and mining industries. Now, the very companies that benefited from surging demand for phones, laptops and electronics during the pandemic that caused the chip shortage, are feeling the pinch. After a blockbuster second quarter, Apple Chief Financial Officer Luca Maestri warned supply constraints are crimping sales of iPads and Macs, two products that performed especially well during lockdowns. Maestri said this will knock $3 billion to $4 billion off revenue during the fiscal third quarter. Read More.

“It’s a fight out there and you have to be in daily contact with your suppliers. You need to make sure that you’re important to them,” Nokia Oyj Chief Executive Officer Pekka Lundmark said Thursday on Bloomberg Television. “When there is a shortage in the market, it is things like how important you are in the big picture, how strong your relationships are and how you manage expectations.”

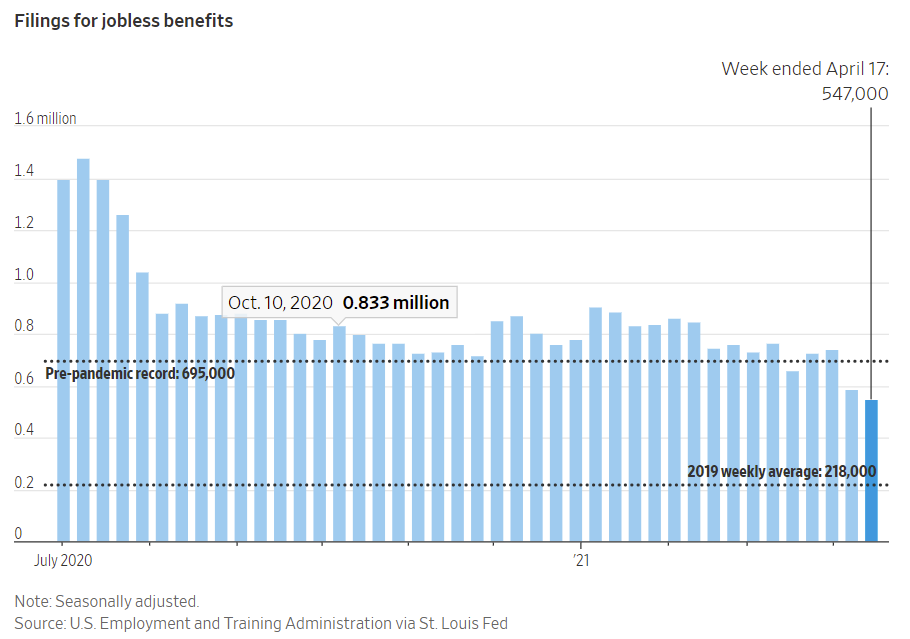

U.S. Unemployment Claims Fell to 553,000 in Latest Week: Jobless claims fell again to the lowest level since the pandemic took hold more than a year ago, another sign the labor market is rebounding this spring. Initial unemployment claims, a proxy for layoffs, fell by 13,000 last week to a seasonally adjusted 553,000, the Labor Department said on Thursday. The previous week’s figure was revised up to 566,000. The latest reading marked the third straight week jobless claims were below 600,000, their lowest levels since early 2020. The four-week moving average, which smooths out volatility in the weekly figures, was 611,750, also a pandemic low. Read More.

VP Take: This is still an absurd amount of people filing for unemployment every week. Pre-pandemic unemployment claims were more than half of what they are now.

Bitcoin

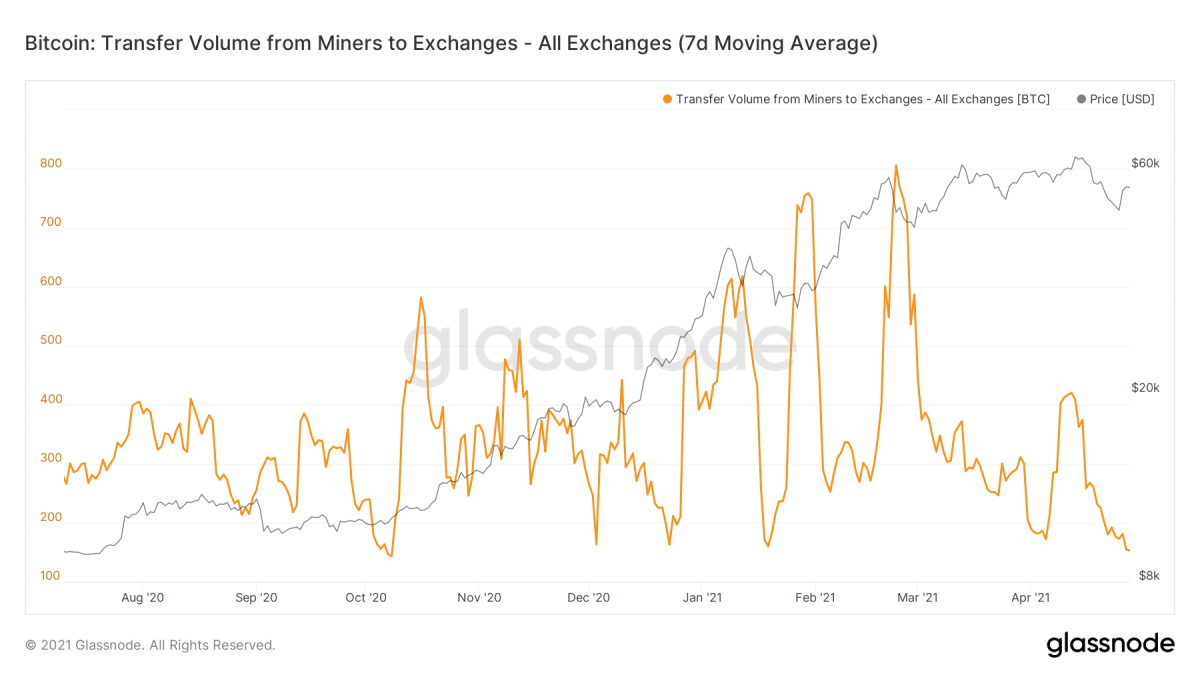

Bitcoin Transfers From Miners to Exchanges Hit 6.5-Month Low: Accumulation by miners is analogous to increased promoter holding of corporate stock and is considered a positive. Bitcoin miners continue to reduce their supplies to exchanges in a sign of bullish price expectations. The seven-day moving average of the daily volume of coins transferred from miners to exchanges fell to 152.77 BTC on Wednesday, the lowest since Oct. 8. The metric has declined by 80% since topping out at 805 BTC on Feb. 23. Reduced miner supply to exchanges is taken to represent bullish sentiment among those responsible for generating coins. By choosing to hold onto more of their BTC now, it implies miners anticipate selling them later at a higher price. Miners mainly operate on cash and are constant sellers in the market, liquidating at least some part of their holdings every day to fund operational costs. Read More.

SEC Delays Decision on VanEck Bitcoin ETF: The SEC is extending its review of a Bitcoin ETF proposal from the asset management company VanEck, per a new memo. The initial deadline for the SEC’s decision on whether or not to approve the ETF was May 3—45 days after the filing was logged in the Federal Register. The new deadline is June 17, but the SEC can continue extending it up to 240 days after the initial filing. An ETF is an investment product that offers exposure to an asset without direct ownership. If you want to get in on Bitcoin’s wild price swings but you’re nervous about actually opening up a wallet and holding Bitcoin directly, an ETF is the way to go. Read More.

CEO of Morton’s, Bubba Gump Shrimp, Says Restaurants will start accepting bitcoin this week: The chairman of Landry’s hospitality group, operator of restaurant chains like Morton’s steakhouses and Bubba Gump Shrimp Co., said in a recent interview with CNBC that most of his restaurants will be accepting bitcoin as payment very soon. Select locations of Matsro’s, one of the group’s chains, will be accepting bitcoin this week. A car dealership in Texas that Fertitta owns has reportedly accepted bitcoin since 2018 and he noted that his NBA franchise, the Houston Rockets, “are taking it as well.” About 20 days ago, Caruso, a major real estate company, disclosed plans to accept bitcoin as payment for rent. The growing acceptance of bitcoin payments across major companies, as well as the growth in the number of companies that hold bitcoin on their balance sheet, is a major indicator of the increasing adoption and mainstream acceptance of Bitcoin. Read More.

“We’ll have it, probably, within all of our restaurant brands — or 80% to 90% — in the next 90 days, where you don’t have to use a Mastercard or Visa or American Express anymore,” Landry’s Chairman and CEO Tilman Fertitta said. “You can use bitcoin or other digital currencies…It’s amazing how simple the transaction is, and it is here to stay,” Fertita explained. “This is where it is, and it’s inevitable that this was going to happen.”

Crypto

Paxos Raises $300M, Joins Crypto Unicorn Club at $2.4B Valuation: The back-end provider for PayPal and Venmo is raising “confidence capital” to expand operations, said CEO Charles Cascarilla. The $300 million Series D was led by Oak, a growth capital firm focused on health care and fintech. Previous investors Declaration Partners, PayPal Ventures, Mithril Capital and others were also involved. Paxos announced a $142 million Series C in December. The latest raise comes during a month when bitcoin hit all-time highs north of $64,000 and Coinbase’s public listing put the cryptocurrency industry in the national spotlight. Read More.

“We’re raising this capital not because we think this is some kind of local maximum,” Paxos CEO and co-founder Charles Cascarilla said in an interview. “This really puts us in a great position now to scale the business and take advantage of opportunities to make acquisitions.”

European Investment Bank Issues $121M Digital Notes Using Ethereum: The European Investment Bank (EIB), the lending arm of the European Union, used Ethereum technology to issue €100 million ($121 million) in two-year digital notes for the first time. Goldman Sachs, Banco Santander SA and Societe Generale AG served as joint managers for the notes, issued on April 28. The EIB said the transaction is a series of bond tokens on a blockchain, where investors purchase and pay for the security tokens using traditional fiat. The notes have a zero percent coupon and will be registered on the blockchain. The number of banks joining the club for state-backed blockchain bond issuance has been expanding. In September, the Bank of Thailand launched a blockchain-enabled platform for the issuance of government saving bonds. In November, the China Construction Bank (CCB) tapped Labuan-based digital asset exchange Fusang for the issuance of $3 billion worth of debt securities over a blockchain. Read More.

Yearn Finance made almost as much as in March as it did in 2020: Decentralized finance yield aggregator Yearn has released its financial report for the first quarter revealing some impressive earnings for the period. The platform had earnings of $4.88 million for the quarter. Declaring that these were earnings before interest, taxes, depreciation, and amortization, or EBITDA, Yearn Finance has made more in the first three months of 2021 than it did in its six operational months in 2020, which totaled $3.7 million. The yVault product line is the leading revenue generator and remains critical to Yearn’s core business. Vaults employ strategies to automate the best yield farming opportunities available by staking on other protocols. The version 2 vaults launched in January have increased top-line revenue for the period. Read More.

Alchemy raises $80M to power the NFT boom as the 'AWS of blockchain': Blockchain developer Alchemy has announced that it has raised $80 million in a Series B round to further develop platforms that power non-fungible token marketplaces. The funding round was led by technology-focused investment manager Coatue, and Addition Capital, a venture fund from American investor Lee Fixel. Also participating in the round was the Glazer family, who own the Tampa Bay Buccaneers and Manchester United, and VC firm DFJ Growth which has also invested in Coinbase, SpaceX, and Stripe. The band The Chainsmokers, and actor Jared Leto also contributed to the funding round which brings Alchemy’s valuation to $500 million. Existing backers include Pantera Capital, Coinbase, Samsung, Stanford University, and a number of high-profile individuals such as Charles Schwab, and Yahoo co-founder Jerry Yang. Alchemy has quickly become the technology behind many major NFT platforms, including OpenSea, Nifty Gateway, CryptoKitties, and Gods Unchained. Read More.

Media

Can Ethereum Scale Before Binance Smart Chain, Polkadot & Others Take The Lead

Abra: The Future of Crypto Banking (w/ Bill Barhydt and Raoul Pal)

BTC023: Bitcoin's International Impact w/ Alex Gladstein

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.