Crypto Download #74

Biden's Aggressive Tax Plan on the 1%, Conservative Institutional Investors Search For Yield In JUNK Bonds with Little Yield to Find, Tesla Sells $275M of BTC, Bitcoin Adoption in the NFL

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

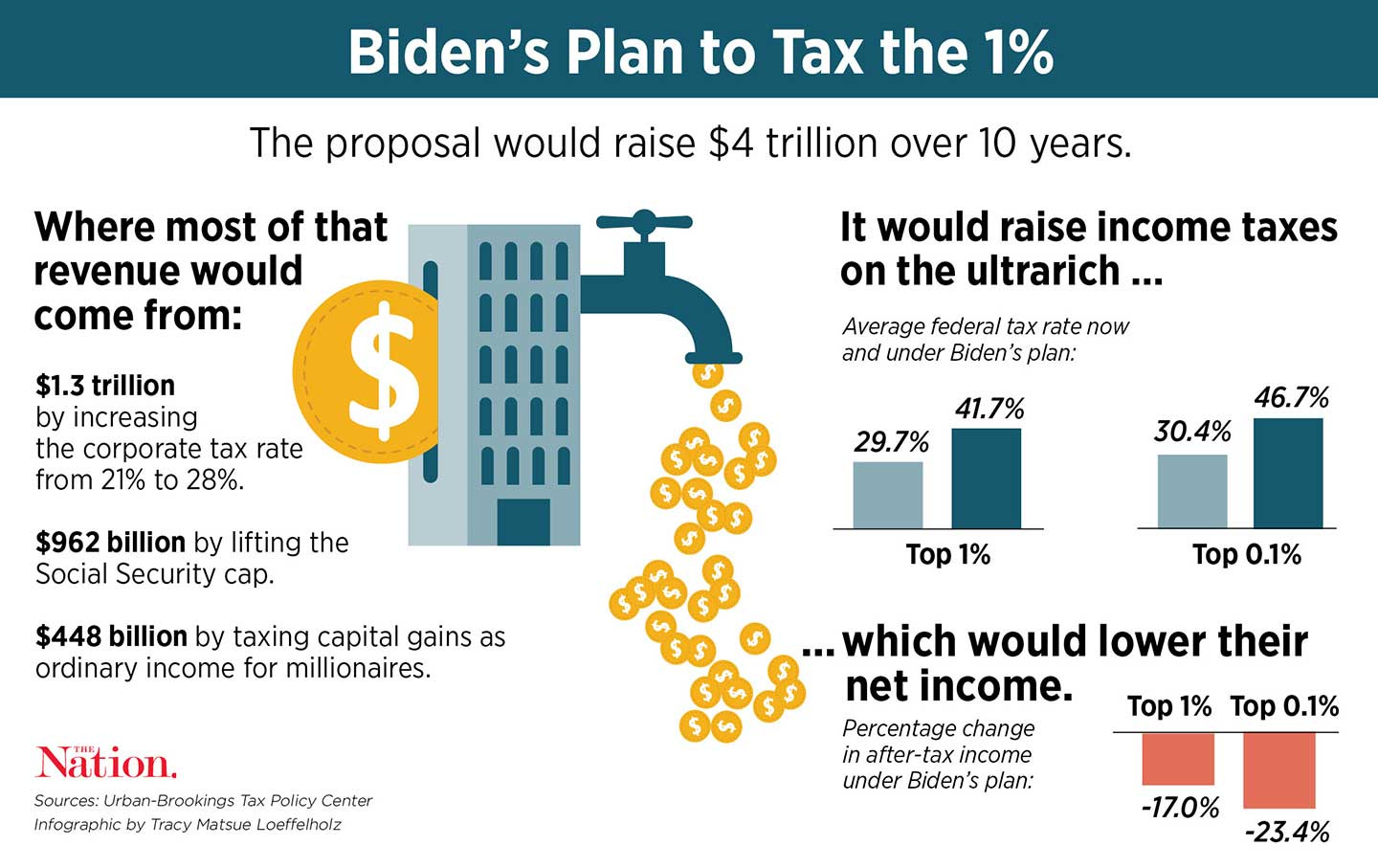

Biden to Propose Tax Hikes, $80 Billion for Audits of Rich: President Joe Biden’s coming tax package will feature an end to a major benefit for wealthy estates that drastically minimizes the levy for inheritors, along with a bump up in the top income tax rate and funding for strengthened IRS auditing. Biden’s plan will also include a top individual tax rate of 39.6% for those making at least $400,000, up from 37% today. That could affect roughly 1% of taxpayers if current income thresholds apply. The person didn’t say whether the $400,000 is also the figure for married couples filing jointly. Biden’s measures will include $80 billion to boost the Internal Revenue Service’s audit capabilities over the next decade for wealthy individuals and corporations, a change that could generate $700 billion in revenue. Higher income tax rates for top earners, along with a 39.6% capital gains rate for those earning $1 million or more, mean that many wealthy taxpayers will see a significant increase in the levies they owe annually and when they sell major investments, such as stocks or businesses. The proposals will be key elements to offset the cost of Biden’s “American Families Plan.” That program, expected to cost well over $1 trillion and potentially as much as $1.8 trillion, is anticipated to feature funding for paid leave, childcare and education. Read More.

Biden raises minimum wage for federal contractors to $15/hr: President Joe Biden on Tuesday will continue his push for a national $15 minimum wage with an executive order that raises pay to at least that level for hundreds of thousands of federal contract workers, according to senior White House officials. Read More.

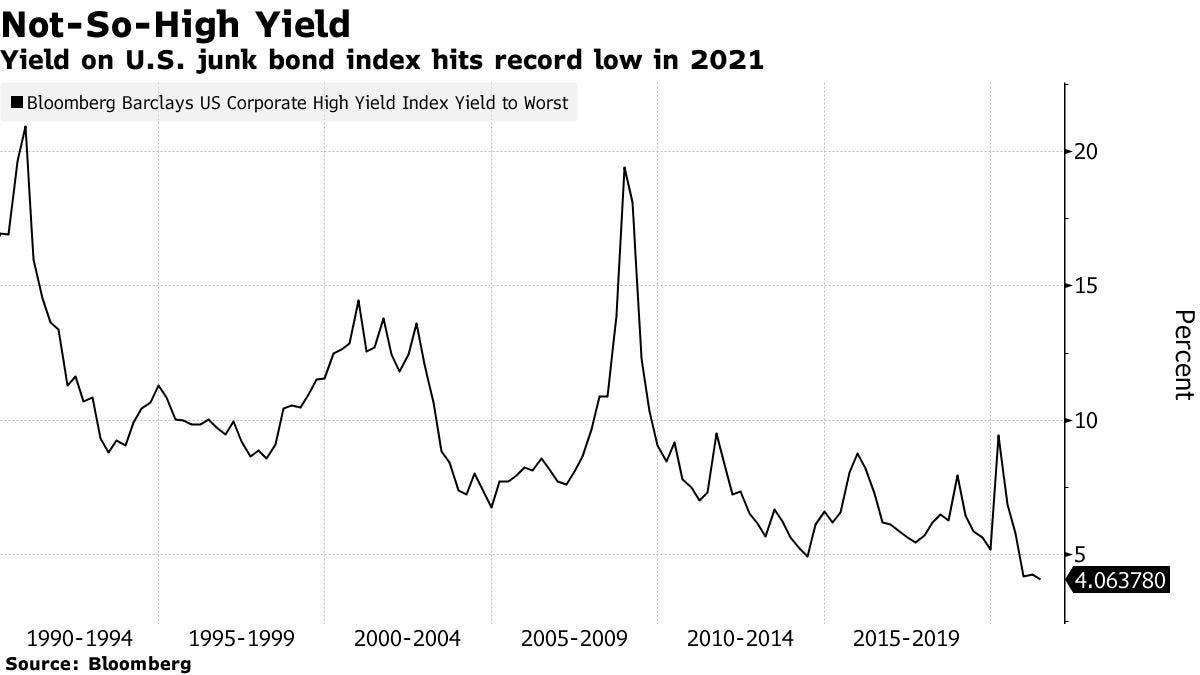

Bond Investors Take Ever-Riskier Bets in Hunt for Returns: Bond investors, emboldened by a recovering economy and a global vaccine rollout, are taking on more risk, sometimes a lot more risk. Insurers, pension systems and high-grade credit managers in the U.S. and Europe are buying bigger amounts of junk-rated debt to offset shrinking yields, forcing high-yield investors to jostle for allocations of BB rated bonds -- the safest and largest part of their class with 60% of the market. The soaring demand has reduced yields to record lows, pushing investors into the chancier subordinated parts of a company’s capital structure. Investors have been piling into speculative debt to wager on what they expect to be a roaring global economy in the second half of 2021 as more people are vaccinated. This optimism has driven down U.S. junk-bond yields. Average yields for dollar-denominated CCC rated bonds, the last credit rating before default, stood at 6.1% on Friday, the lowest on record. In Europe, CCC yields are touching 5.8%, the lowest since 2017, and down from a whopping 19% at the height of the pandemic last year. Some investors worry that junk bonds are priced to perfection.

“The issue with high-yield in general is the valuations are still quite stretched on a historical basis,” said Matt Brill, head of North America investment-grade at Invesco Ltd., a $1.4 trillion asset manager. “You think you’re getting a really interesting, attractive opportunity, and it still only yields 3.5% to 4.5%.” Contrary to his usual strategy, Brill says he’s been dipping into BB junk bonds with funds typically used for high-grade debt.

“With spreads and yields as tight as they are and such a lack of dispersion in the market right now, there’s very little upside, but plenty of downside if things don’t go to plan,” said Jeff Mueller, the London-based co-director of high-yield bonds at Eaton Vance, who helps manage $486 billion in assets.

Right now, central banks are supporting financial markets with low rates and easy monetary policy. The European Central Bank on Thursday said it’s stepping up its emergency bond-buying program, another support for economic recovery. But rising government bond yields, triggered by an uptick in inflation forecasts, means that sentiment could turn quickly. For those who loaded up on riskier debt, the scope for losses is much bigger. Still, the buying pressure for riskier debt has been relentless, helped by a surge into junk bonds by pension funds and insurance companies, typically more conservative investors. These institutions are increasing their orders of BB rated bonds by as much as 30% compared to last year, according to a person familiar with the matter. Regulatory filings show insurance companies, including Manulife Financial Corp. and Allstate Corp., are among the largest holders of Carvana Co.’s CCC rated bonds issued last fall. Carvana, a used-car retailer, has never posted a quarterly profit. In Europe, insurance funds have been buying significantly larger portions of new issue junk bond deals than they did last year. U.S. pension funds are also seeking high-yield debt. The California Public Employees’ Retirement System and the Kentucky Public Pensions Authority both purchased 11.75% American Airlines Group Inc. junk bonds issued amid pandemic uncertainty last summer. Read More.

HSBC to Cut Office Space 20%, Reduce Business Travel by Half: HSBC Holdings Plc expects to cut its office footprint by 20% this year and is budgeting for half its previous business travel costs as the adoption of flexible working spurs changes to longstanding practices. The bank, which has already committed to a 40% reduction in office space in the long term, expects to get halfway to its goal over the course of this year. As well as cutting commutes to the office, Stevenson expects bankers to pare back their business trips, replacing some with video conferences. Read More.

Bitcoin

Tesla Sold Bitcoin in Q1 for Proceeds of $272M: Tesla sold some of its bitcoin stash in the first quarter for $272 million in proceeds. The sale trimmed Tesla’s position by 10%. Elon Musk’s electric vehicle company purchased $1.5 billion worth of bitcoin in February. Tesla CFO said on the call that Tesla invested in bitcoin to earn yield on its excess cash in a low-interest-rate environment. While the company continues to deal with global supply chain crunches like semiconductor shortages or ship port capacity, he said the bitcoin market is a liquid market with an optimistic future. Read More.

“There aren’t many traditional opportunities to do this, or at least that we found … particularly with yields being so low and without taking on additional risk or sacrificing liquidity,” Kirkhorn said, despite bitcoin’s perception as a risk asset among most traditional financial analysts.

NFL Player Sean Culkin to Convert Entire Salary to Bitcoin: Following Russell Okung’s lead (image below), the Chiefs tight end will trade his NFL earnings for BTC—but he’s going all-in for the 2021 season. he Chiefs will not pay Culkin directly in cryptocurrency. Instead, they will pay him weekly in US dollars, and that amount will then be converted to bitcoin using the mobile payments app Strike. Culkin’s base salary for the year is $920,000. Today’s announcement was issued in a press release by Strike, suggesting a partnership between the firm and Culkin. Read More.

Future Jaguar Trevor Lawrence is the next athlete to be paid in crypto

Gemini to launch Bitcoin cashback rewards on Mastercard credit card: The exchange will offer up to 3% cashback in the form of cryptocurrency for users of its upcoming Mastercard credit card. New York cryptocurrency exchange Gemini announced on Tuesday the pending release of the Gemini Credit Card, which will allow cryptocurrency holders to spend crypto and receive cashback rewards in the form of bitcoin or any other cryptocurrency available on the Gemini platform. It is expected to be released this coming summer and has reportedly received over 140,000 sign-ups from waiting customers already, according to the company’s press release. Read More.

Iran Central Bank to Allow Money Changers, Banks to Pay for Imports Using Mined Crypto: The bank had previously stipulated only digital assets for import funding could be used by itself and no one else. Iran’s central bank is reportedly allowing the country’s financial institutions to use cryptocurrency, derived from sanctioned miners, to pay for imports. The Central Bank of Iran (CBI) has notified money changers and banks of its amended regulatory framework for crypto payments. The amendment means those institutions will now be able to pay for goods and services from other countries in a bid to circumvent U.S. economic sanctions. The local crypto mining industry could generate as much as $2 million a day in revenue. Read More.

Crypto

Helium’s Crypto-Powered Network Adds 5G Mobile Coverage: The Google-backed startup will continue growing its low-power, distributed Internet of Things (IoT) network while also exploring this new, more powerful 5G network. There's a crypto startup on a mission to disrupt the telecom giants of the world—an audacious goal that may now be a little closer within its reach. Billed as "the people's network," Helium is a decentralized, blockchain-powered network that allows users to earn cryptocurrency by running their own nodes, which power connectivity for Internet of Things (IoT) devices such as sensors and trackers. But now the Google-backed startup is aiming much larger: 5G mobile phone coverage. Today, Helium announced an alliance with open-source connectivity hardware maker FreedomFi to launch Helium 5G, a new service that uses a different spectrum than the original LongFi network designed for IoT hardware. As a result, the new Helium 5G network will be able to support calls from 5G smartphones and other compatible devices. As before, the Helium 5G network will rely on a distributed network of user-operated nodes, which will provide the connectivity for local users. As local users tap into the 5G signal provided by the nodes and calls are routed through them, the operators will mine Helium’s HNT cryptocurrency as a reward. FreedomFi expects that an end-to-end Gateway 5G node will cost between $1,000 and $5,000 to get up and running, depending largely on the 5G radio within. Read More.

Why Aave Is Bringing Yield Farming to Its DeFi Platform: In the “DeFi Summer” of 2020, Compound brought the heat by pulling out an old concept, liquidity mining. Its willingness to reward lenders and borrowers in its COMP governance tokens helped make it the biggest lender in all of Ethereum. Now, in an effort to keep pace, decentralized finance (DeFi) competitor Aave is trying out its own liquidity mining program. Starting today, the platform will pay its users in Staked Aave (stkAAVE) when they lend or borrow Ethereum, Wrapped Bitcoin, or stablecoins DAI, GUSD, USDC, and USDT. And we’re not talking about a few extra pennies. Liquidity mining, also known as “yield farming,” involves pooling your cryptocurrency into a fund so it can be lent out to others—not much different from a savings account or certificate of deposit (the latter of which pays more in exchange for an inability to move it). In exchange for providing the exchange or protocol with liquidity, it rewards you with another type of token. Aave users already earn staking rewards for staking (ie, locking up) Aave's native token as well as interest on their deposits. This program allows them to earn additional rewards in stkAAVE. Staked Aave is equivalent in value to AAVE, which is currently priced near $400, according to Nomics. To convert it to the AAVE governance token, they must wait 10 days after receiving it. Read More.

Serum (SRM) hits a new all-time high as Solana adoption gains traction: Decentralized finance (DeFi) has reshaped the face of the cryptocurrency market over the past year, attracting the attention of both institutional investors and retail traders alike as the traditional financial sector continues to warm up to blockchain technology. While the majority of the largest DeFi protocols that have a significant amount of volume and value locked in the platform operate on the Ethereum network, high fees and slower transaction times have allowed projects like Serum, a decentralized exchange (DEX) that operates on the Solana blockchain, to rise in popularity and gain market share. A major factor in the growth of Serum is the rising prominence of the Solana blockchain, which also saw its price surge to a new record high on April 26 as new users and projects continue to explore what the network has to offer. Read More.

Media

Pantera's $115k Bitcoin Price Target with Dan Morehead

Bitcoin, Ethereum, DeFi & Global Finance News – April 25th 2021

Inflation vs Reflation: Why Risk Asset Prices Hinge on the Difference (w/James Bianco & Ed Harrison)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.