Crypto Download #73

India's COVID Outbreak is Concerning, Biden Reaffirms US's Climate Ambitions, Bitcoin Market Dominance at All-Time Lows Hints Altseason, ETH All-Time High, Mass Institutional Investment in Crypto

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

ETHEREUM HIT NEW ALL TIME HIGH TODAY - $2,564 ETH

ICYMI: HERE’S AN ARTICLE I WROTE DETAILING THE INVESTMENT CASE FOR ETHEREUM OUTSIDE OF THE PLATFORM’S APPLICATION LAYER.

THE DAWN OF THE INTERNET BOND.

Macro

India Records World’s Highest One-Day Surge in Covid Cases: India saw the world’s biggest one-day jump in coronavirus cases ever as a ferocious new wave grips the country, overwhelming hospitals and crematoriums and prompting frantic cries for help on social media. The South Asian nation reported 314,835 new infections Thursday, topping a peak of 314,312 recorded in the U.S. on Dec. 21. People took to Twitter and Instagram to call for everything from hospital beds to medicine and doorstep Covid-19 tests. The grim milestone shows how the pandemic crisis has shifted firmly to the developing world, where variants and complacency are threatening containment measures and there’s a lack of vaccines, with supplies dominated by richer nations. India now has almost 16 million cases, the second-most globally, as it struggles to provide enough shots for its 1.3 billion people despite being home to the world’s biggest vaccine manufacturer. Lower vigilance around masks and social distancing have contributed to the resurgence, with large religious festivals and elections allowed to take place with few precautions. The outbreak threatens to derail the Indian economy, which had just begun to recover after a nationwide lockdown last year pushed it into a historic recession. A new virus variant with a double mutation has also been detected locally, and concerns are growing that it’s driving the new wave. Read More.

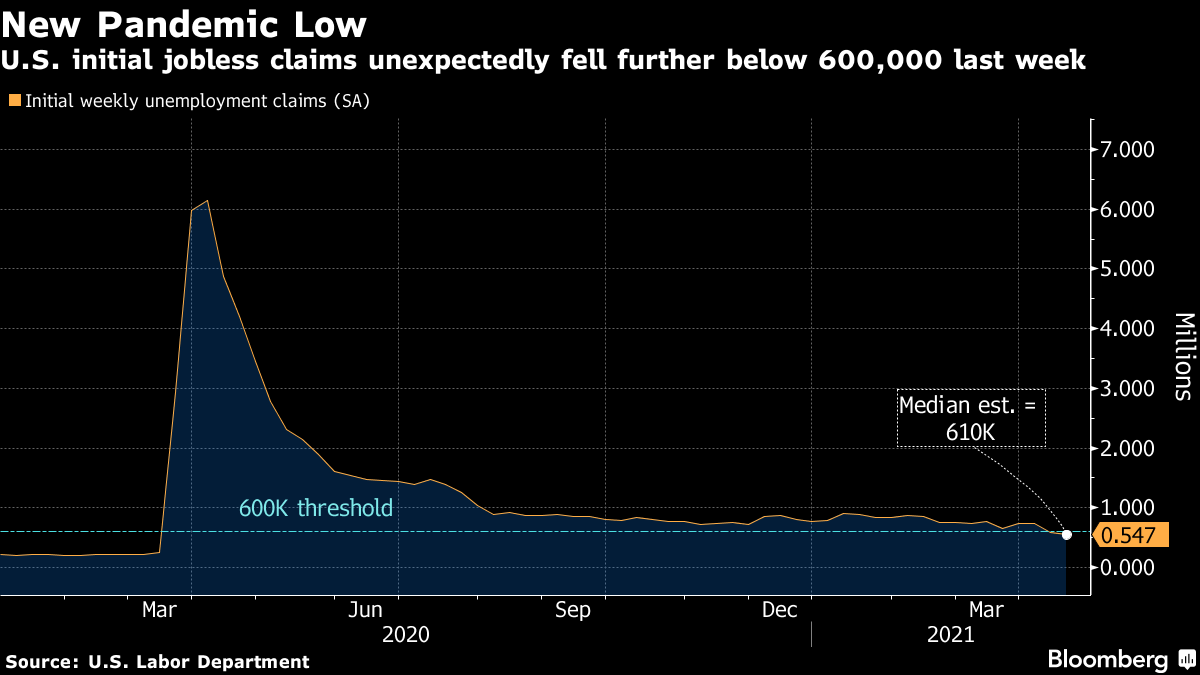

U.S. Jobless Claims Fall to Pandemic Low as Economy Accelerates: Initial claims in regular state programs decreased by 39,000 to 547,000 in the week ended April 17, Labor Department data showed Thursday. Economists in a Bloomberg survey estimated 610,000 claims. The prior week’s figure was revised up to 586,000. The job market is strengthening as employers look to fill positions that were left empty by pandemic restrictions that have now been eased. Growth should speed up even more following a nationwide goal of administering an average of three million vaccinations per day. The claims data follow strong manufacturing, retail sales and other indicators in recent weeks. Read More.

U.S. deepens emissions target at climate summit: The Biden administration on Thursday pledged to slash U.S. greenhouse gas emissions in half by 2030, a new target it hopes will spur other big emitter countries to raise their ambition to combat climate change. The United States, the world's second-leading emitter after China, seeks to reclaim global leadership in the fight against global warming after former President Donald Trump withdrew the country from international efforts to cut emissions. President Joe Biden unveiled the goal to cut emissions by 50%-52% from 2005 levels at the start of a two-day virtual climate summit. The U.S. climate goal also marks an important milestone in Biden's broader plan to decarbonize the U.S. economy entirely by 2050 - an agenda he says can create millions of good-paying jobs but which many Republicans say they fear will damage the economy. The U.S. emissions cuts are expected to come from power plants, automobiles, and other sectors across the economy, but the White House did not set individual targets for those industries. Read More.

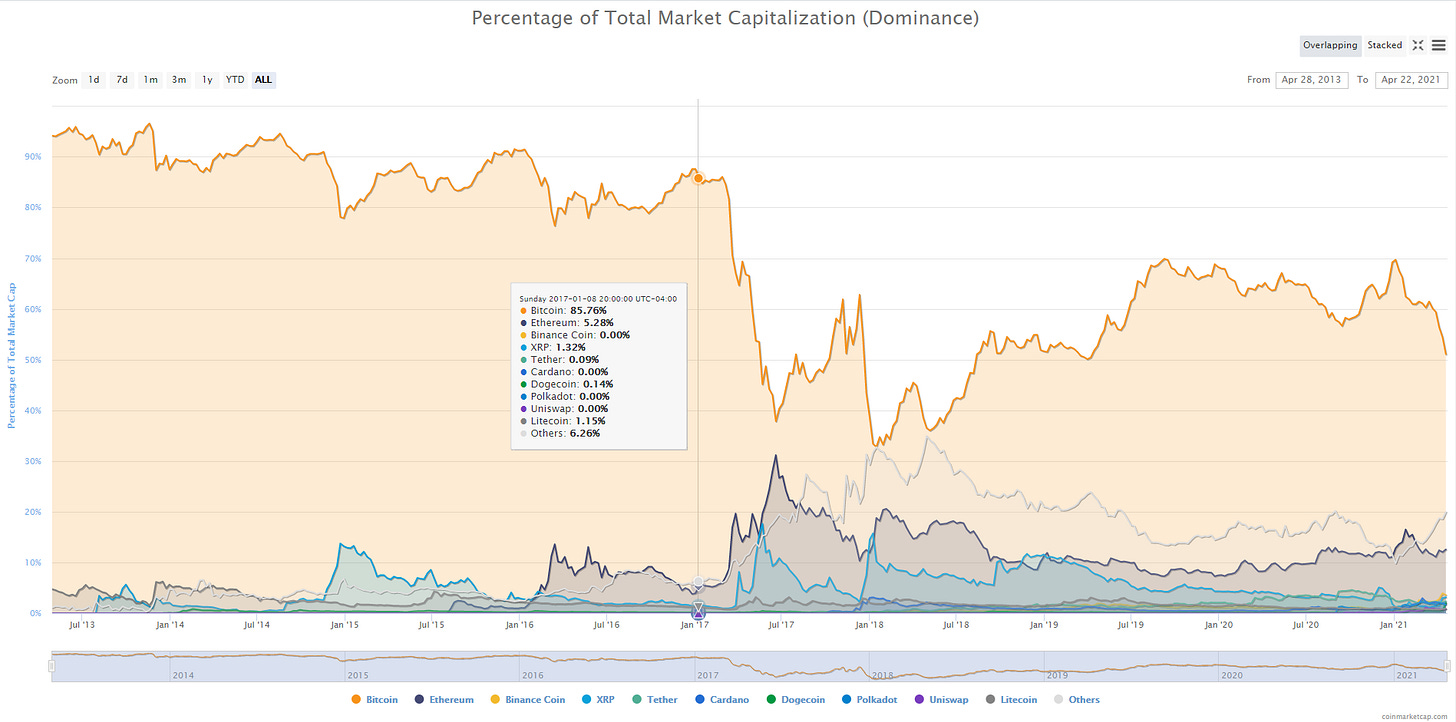

Bitcoin

Bitcoin dominance is about to drop below 50% for the first time in 3 years: Bitcoin revisited recent lows near $52,000 on Thursday as sustained weakness continued for the largest cryptocurrency. The move came as bitcoin was about to lose its market cap dominance supremacy to altcoins in what traditionally marks the “real” start of the “alt season.” Having decreased sharply this year despite its own price gains, bitcoin’s market cap share versus altcoins looked set to break through support, which has held for over three years. Should history repeat itself, it would be music to the ears of altcoin investors, many of whom have long claimed that an “alt season” is already underway but has yet to show its true colors. A race to the top this time around could surprise even them, meanwhile, as many altcoins have already put in unbelievable performances in 2021. Read More.

Bitcoin Broker NYDIG Acquires Firm That Finances Mining Farms: NYDIG has bought a commercial lender to extend its reach across the institutional bitcoin landscape. Arctos Capital provides financing solutions to bitcoin miners and other crypto firms. Earlier this year NYDIG acquired Digital Assets Data, a crypto research and analytics firm. NYDIG, a bitcoin-focused spin-off of Stone Ridge Asset Management, has raised $300 million since March from big names including Liberty Mutual, New York Life, George Soros, Morgan Stanley and more. Read More.

"We are thrilled about joining NYDIG to continue building financing solutions and other services that support the growth of the bitcoin mining industry across North America," Arctos Capital Managing Partner Trevor Smyth said in a statement.

Ark Investment Management Increases Coinbase Holdings to 1.5M Shares: Bitcoin bull Cathie Wood's firm purchased another 244,717 COIN Wednesday worth an estimated $76.3 million. The shares were split between 195,108 bought by the Ark Innovation ETF (ARKK) and 52,609 by the ARK Next Generation Internet ETF (ARKW). Three ARK funds also sold a combined 21856 shares in NVIDIA worth around $13.4 million. NVIDIA is a major graphics card manufacturer and its products are often used for crypto mining. The company’s funds initially purchased 749,205 COIN shares worth around $246 million on its first day of trading on April 14 followed by another 341,186 (~$110 million) on April 15. On Wednesday, the company followed its purchases with another 236,348 shares bringing the total amount of shares bought to 1,571,456. Read More.

Fireblocks, Celsius Back Zero-Knowledge Credit Scoring for Institutional Crypto Traders: There’s a ton of innovation right now in decentralized finance (DeFi), but crypto lending more broadly – sometimes called centralized finance (CeFi) – just got a whole lot smarter, too. Announced Thursday, San Francisco-based trading tech firm X-Margin and cryptocurrency custody provider Fireblocks are working to standardize the fragmented state of lending and borrowing of digital assets for institutional trading. The first users of this institutional credit sourcing platform are lending giant Celsius and crypto hedge fund Dunamis Trading. Unlike traditional capital markets, cryptocurrency trading began with retail and then gradually evolved towards institutional finance – as opposed to the other way round. A vibrant lending industry has since emerged to take advantage of inefficiencies, such as where firms have to pre-fund accounts at many different exchanges and trading venues. (In the traditional markets, traders only need to have capital at their prime broker, who will allow them to trade across many venues.) Meanwhile, crypto’s unique and nascent infrastructure allows for plenty of arbitrage opportunities so capital-hungry traders are happy to pay high interest rates. To iron out some wrinkles and finesse more of a prime brokerage feel to crypto trading, X-Margin has created a privacy-preserving credit management system for lenders and institutions. The partnership with Fireblocks ensures there’s a safe and secure walled garden for cross-exchange lending. Read More.

“The problem right now for crypto traders is that to get loans or receive leverage from lenders like Celsius or BlockFi, they need to over-collateralize,” Fireblocks CEO Michael Shaulov said in an interview. “So for every dollar of bitcoin they borrow, they have to post a dollar-point-two as collateral for the safety of the loan. Borrowers are suffering because they can’t get cheap loans and lenders are at risk because they lack visibility.”

Multi-billion-dollar investment trust backs Kraken ahead of possible listing: The $5.3-billion investment trust RIT Capital Partners has acquired a stake in leading crypto exchange Kraken. The London based-trust, formerly named Rothschild Investment Trust, holds ties to the Rothschild banking family of England through chairman Jacob Rothschild. In an April 12 note to investors, James Glass described the exchange as “one of the world’s biggest crypto exchanges having been founded in 2011. It has more than 6m clients and is the 4th largest exchange by trading volumes.” While the amount of RIT Capital’s investment was not disclosed, it appears the firm is bullish on Kraken amid the success of its main rival Coinbase, citing its “quarterly revenue of $1.8bn in the Q1 2021” and its public listing on April 14. The trust notes the potential of its investment in Kraken to also grow in the light of talks over a new fundraising round that could grow the company’s valuation to a reported price range between $10 billion and $20 billion. Kraken processed more than $2 billion in volume over the past 24-hours, while Coinbase processed around $3.9 billion within the same period. Read More.

Crypto

Ether Price Hits New Record High as Analysts Anticipate Supply Drop: Ether rallied to new lifetime highs on Thursday on speculation that an impending blockchain upgrade might result in a drop in supply. The native cryptocurrency of Ethereum’s blockchain rose to a record high of $2,564 during European trading hours, toppling the previous peak price of $2,546 reached on April 16. Read More.

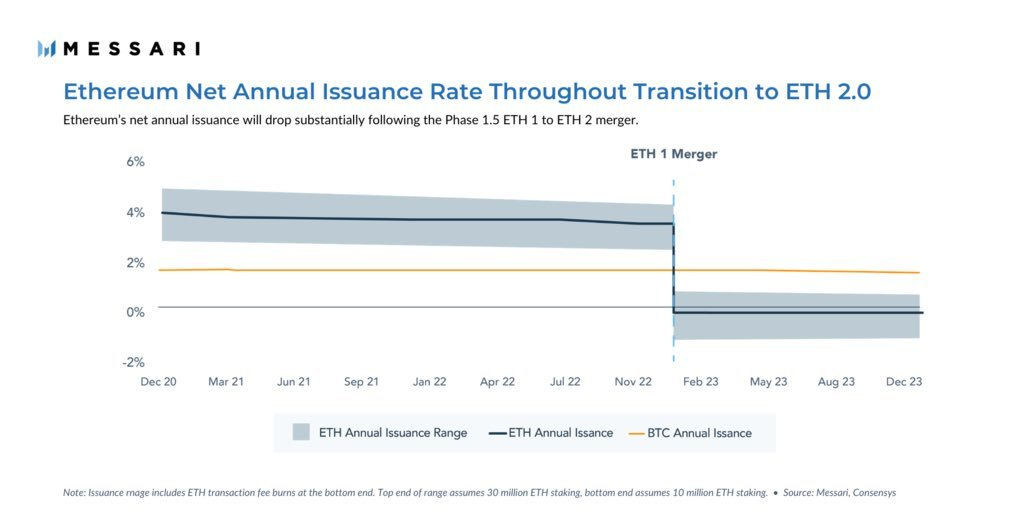

“Ethereum’s net annual issuance will drop substantially following the Phase 1.5 ETH 1 to ETH 2 merger,” Messari’s research Wilson Withum tweeted.

With the upcoming EIP 1559 upgrade, ether will “become a deflationary asset,” Nick Spanos, co-founder of Zap Protocol, told CoinDesk. “This feature will reduce the coin supply and have a corresponding effect on the price, creating an attraction point for more buyers.”

Grayscale Added Nearly $1B in Crypto in 24 Hours: This included increases to its Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) of $283.3 million and $586.5 million respectively. The digital asset manager added large numbers of altcoins to its holdings including horizen (ZEN) and livepeer (LPT). Read More.

Solana (SOL) hits new highs as DApps, DeFi and stablecoins join the network: The arrival of institutional investors and the rise of decentralized finance has been an incredible boon for the entire cryptocurrency sector, but it has also highlighted a number of persistent limitations that many blockchain networks encounter when faced with surges in activity and the need to scale. High fees and slower transaction times on the Ethereum network have left the door open for new layer-one solutions to emerge, and Solana is one such project that has been gaining traction lately. Solana (SOL) has increased 195% over the past month, rallying from a low of $12.19 on March 26 to a new all-time high of $36.10 on Monday on a record $1.4 billion in trading volume. Similar to how Ethereum rose to prominence in 2017, Solana’s strong performance in the past month was sparked by the launch of multiple projects on the Solana blockchain, with everything from legitimate DeFi protocols to pump-and-dump airdrops that brought speculators to Solana’s exchange. One of the biggest draws for the Solana network is its claim of being able to process 65,500 transactions per second, which is significantly faster than Ethereum’s current average of 18.3 TPS. The network’s ability to handle a larger load has also made the platform a cross-chain destination for projects such as Civic and the popular stablecoins USD Coin (USDC) and Tether (USDT). DeFi platforms such as Raydium and Serum have launched on Solana, and there is a growing list of projects in the process of transitioning to the network. Read More.

Nearly Two-Thirds of US Adults are 'Crypto Curious': Around 63% of adult US "nocoiners" are curious about cryptocurrencies, according to a survey by Gemini. Of the "crypto curious", over half are women—suggesting an impending "diversification of crypto’s investor base". According to the survey of 3,000 US adults, the “average” crypto investor who already has some digital assets is currently a 38-year-old male with an annual income of roughly $111,000. However, the findings suggested that the profile of the typical crypto investor is poised for rapid change. That's because out of all those labeled “crypto curious”—people who don’t hold crypto but are interested in it—roughly 53% are women, and 25% of them are “older women nearing retirement.” Interestingly, there are far more women in the UK (41.6%) than in the US (26%) who said they already have—or had—cryptocurrencies, based on the “State of UK Crypto” report published by Gemini in March. Meanwhile, only 23% of US adults said they have no interest in crypto at all. On the other hand, 77% of respondents—whether they hold crypto or not—said they are interested in learning more about digital assets, highlighting the significance of education in the sphere. Read More.

Media

BTC022: Dr. Adam Back & Bitcoin's Proof of Work

Are Chinese Authorities Tightening Their Policy? | The Big Conversation | Refinitiv

Bitcoin vs Gold - The Great Debate with Michael Saylor and Frank Giustra (Stansberry Research)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.