Crypto Download #72

China Calls Out the US, Global Central Banks Stick to Easy Monetary Policy, More Merchants Accept Crypto as Payment, Dogecoin - the Most Powerful Meme, 3 ETH ETFs go Live in Canada Tomorrow

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

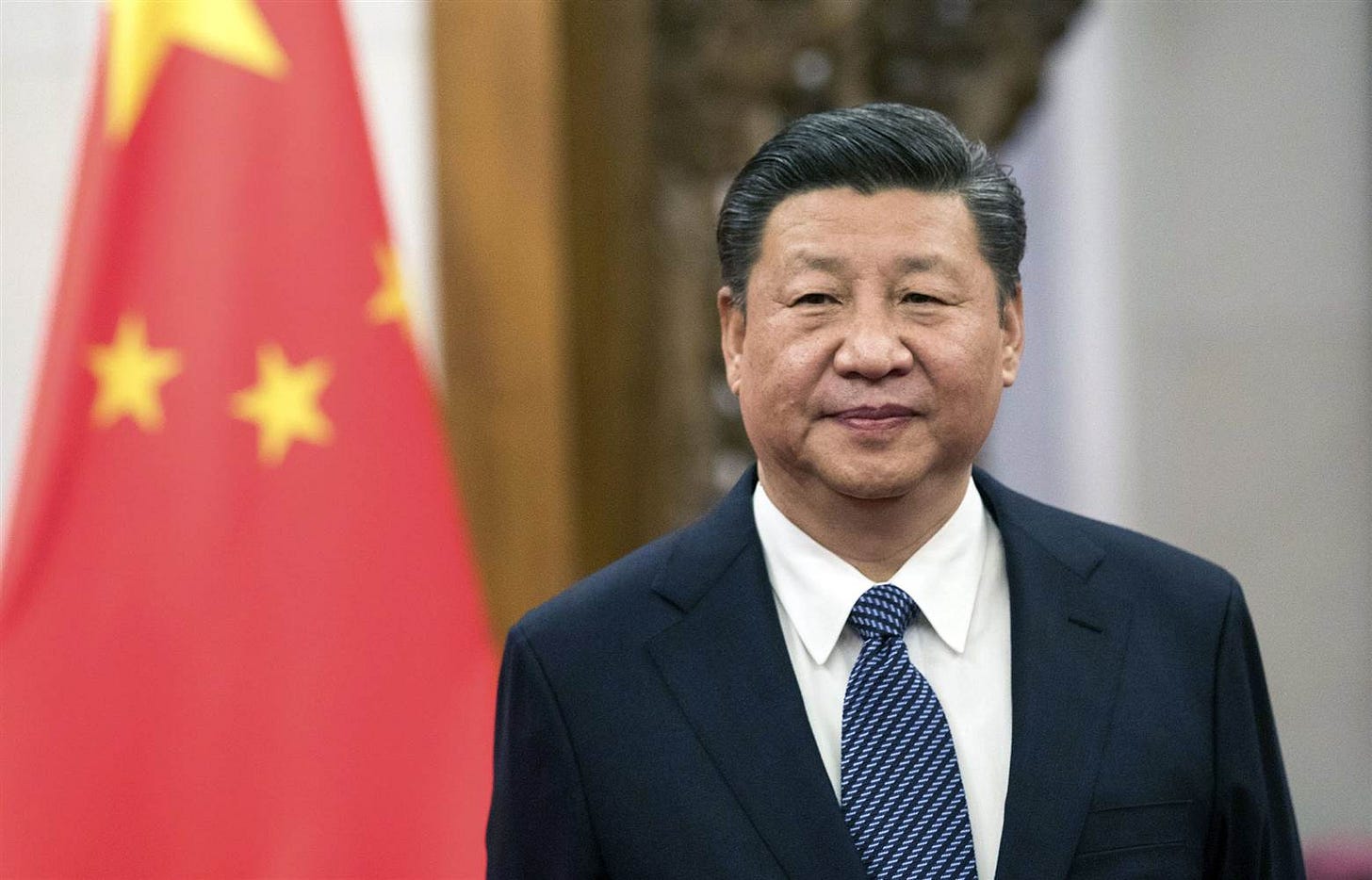

Xi Challenges U.S. Global Leadership, Warns Against Decoupling: Chinese President Xi Jinping called for greater global economic integration and warned against decoupling while calling on the U.S. and its allies to avoid “bossing others around.” In a veiled critique of U.S. efforts to reduce dependence on Chinese supply chains and withhold exports of goods like advanced computer chips, Xi said “any effort to build barriers and decouple works against economic and market principles, and would only harm others without benefiting oneself.” Xi spoke by video to more than 2,000 officials and business executives attending the Boao conference in person in the southern island province of Hainan. Global leaders and the heads of the International Monetary Fund and United Nations attended the opening ceremony via video-link. Read More.

“International affairs should be conducted by way of negotiations and discussions, and the future destiny of the world should be decided by all countries,” Xi said on Tuesday at the Boao Forum on Asia, without naming the U.S. specifically. “One or a few countries shouldn’t impose their rules on others, and the world shouldn’t be led on by the unilateralism of a few countries…What we need in today’s world is justice, not hegemony,” Xi said, adding that China would never engage in an arms race. “Bossing others around or meddling in others’ internal affairs will not get one any support.”

VP Take: There’s no doubt that the US is falling behind China in many ways - growing vs. slowing economy, digital currency adoption, increased global partnerships, the handling of the pandemic, etc. But, let’s not forget, China doesn’t play by the rules - they steal technology, infiltrate universities, commit cyber attacks, commit human rights violations against the Uyghur population, and have been opaque about the origins of COVID since day one. There’s been an increase in diplomatic rhetoric out of China, but we should pay attention to what they do and not what they say. It’s clear that a form of modern warfare is being executed by the communist country.

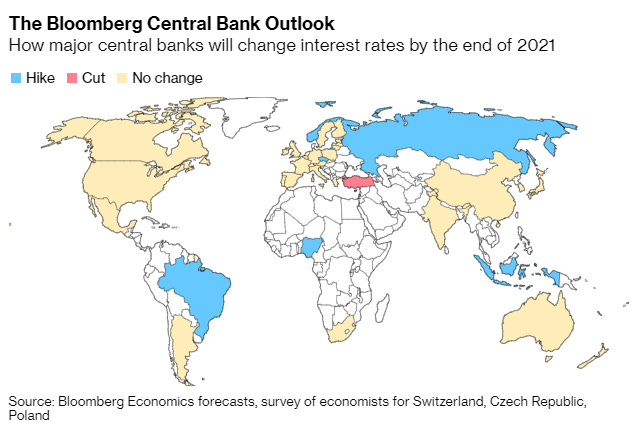

Central Banks to Pour Money Into Economy Despite Sharp Rebound: The aggressive rebound in global economic growth still isn’t enough for most of the world’s central banks to pull back on their emergency stimulus. In Bloomberg’s quarterly review of monetary policy covering 90% of the world economy, the Federal Reserve, European Central Bank and Bank of Japan are among the 16 institutions set to hold interest rates this year. The outlook suggests officials still want to guarantee the recovery from last year’s coronavirus recession by maintaining ultra-low borrowing costs and asset-buying programs. That may require them to accept any accompanying bounce in inflation. Six central banks, most of them in emerging markets, are still predicted to hike, including Brazil, Russia and Nigeria. Turkey is the only one of those monitored which is forecast to cut borrowing costs this year. Officials have vowed to keep buying $120 billion of Treasuries and mortgage-backed bonds every month until they see “substantial further progress” on inflation and employment. That test could be met sooner than anticipated if the U.S. labor market continues to perform as it did in March, when a better-than-expected 916,000 new jobs were added. Powell has so far avoided putting any time frame around when he thinks it’ll be appropriate to slow bond buying, but promises to give investors plenty of advance warning. The Fed has also signaled it expects to keep rates near zero through 2023. Read More.

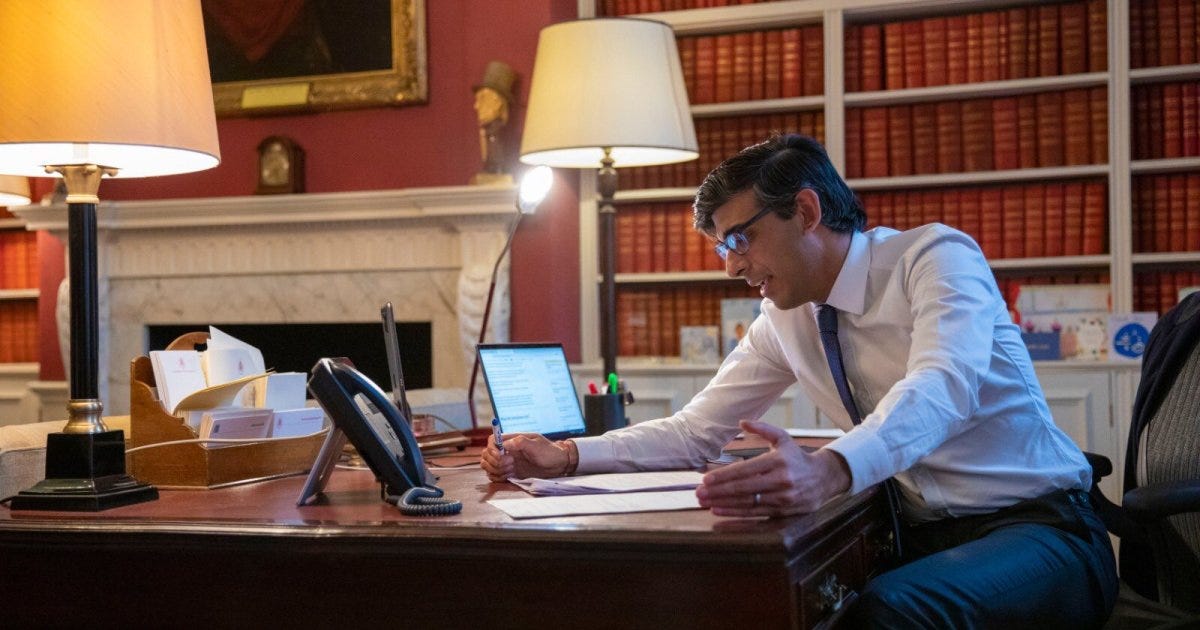

‘Britcoin’ not bitcoin? UK considers new digital currency: British finance minister Rishi Sunak told the Bank of England on Monday to look at the case for a new “Britcoin”, or central bank-backed digital currency, aimed at tackling some of the challenges posed by cryptocurrencies such as bitcoin. A BoE-backed digital version of sterling would potentially allow businesses and consumers to hold accounts directly with the bank and to sidestep others when making payments, upending the lenders' role in the financial system. Other central banks are also looking at whether to set up digital versions of their own currencies, essentially widening access to central bank funds which only commercial banks can use at present. This could speed up domestic and foreign payments and reduce financial stability risks. China is a front-runner to launch a CBDC. Last week the European Central Bank said it was studying an electronic form of cash to complement banknotes and coins but any launch was still several years away. Read More.

With Jobless Rate Yet to Peak, U.K. Has 1-in-6 Not Working: About 1-in-6 of the U.K. workforce remain off the job following the coronavirus pandemic, underscoring the task facing Chancellor of the Exchequer Rishi Sunak as he tries to revive the economy from its worst slump in three centuries. The “Covid employment gap,” as the Resolution Foundation calls it, totals more than 6 million people including about 4.7 million who are still receiving government furlough pay after their workplaces shut in the crisis. The risk is that many of them will be let go as government wage support is wound down. Read More.

“Unless this gap is closed before the furlough scheme ends in September, we are likely to see a worrying rise in unemployment later this year, which will extinguish many people’s hopes of a post-Covid living standards recovery,” said Nye Cominetti, senior economist at the London-based research group.

Procter & Gamble Will Raise Prices in September: Procter & Gamble Co. this fall will start charging more for household staples from diapers to tampons, the latest and biggest consumer-products company to announce price hikes. The maker of Gillette razors and Tide detergent cited rising costs for raw materials, such as resin and pulp, and higher expenses to transport goods. The announcement, which came as P&G disclosed its quarterly financial results, follows a similar move last month by rival Kimberly-Clark Corp. Several food makers have raised prices as well. Hormel Foods Corp. said in February that it raised prices on its turkey products, such as Jennie-O ground turkey, in response to higher grain costs. J.M. Smucker Co. said it recently raised prices for its Jif peanut butter and that it might do the same with pet snacks because of higher shipping costs and other inflationary pressure. Read More.

Bitcoin

WeWork Now Accepting Bitcoin and Other Cryptocurrencies: Real estate company WeWork has become the latest in a string of companies to start accepting Bitcoin and other cryptocurrencies through crypto payments provider BitPay. It will now let its customers pay for co-working spaces or fixed offices in cryptocurrency. WeWork will accept Bitcoin, Ethereum, USD Coin, Paxos and other cryptocurrencies. Like EV manufacturer Tesla, which recently announced that it would accept payment for its products in Bitcoin, WeWork is electing to hold the cryptocurrency on its balance sheet rather than have the crypto payments converted to fiat money at the point of sale. Read More.

PayPal Adds $1 Bitcoin Buys to Venmo: PayPal gave the entire Bitcoin market a boost in March when it launched a new "checkout with crypto" option that lets customers pay merchants in cryptocurrency. Now the payment giant is poised to expand the reach of Bitcoin still further with a new crypto feature inside its popular peer-to-peer app Venmo. On Tuesday, PayPal said it has begun rolling out a crypto button for its 77 million Venmo users. The button will let users instantly buy as little as $1 worth of Bitcoin, Ethereum, Litecoin, or Bitcoin Cash. Read More.

"Customers will have the ability to buy and sell cryptocurrency using funds from their balance with Venmo, or a linked bank account or debit card. All transactions are managed directly in the Venmo app," said the company in a statement announcing the news.

Coinbase insiders dump nearly $5 billion in COIN stock shortly after listing: Insider activity reports for Coinbase’s COIN stock indicate that multiple early investors and executives sold billions in equity shortly after COIN’s direct listing. While the filings initially indicated that multiple executives sold a high percentage of their stake in the company, a representative for Coinbase told Cointelegraph that the sellers maintain strong ownership positions. Data from Capital Market Laboratories and confirmed by filings on Coinbase’s Investor Relations website shows a total of 12,965,079 shares were sold by insiders, worth over $4.6 billion at COIN’s $344.38 per share Friday close. Notable transactions include Coinbase CFO Alesia Haas selling some 255,500 shares at a price of $388.73 (though her Form 4 states that she retains options), while CEO Brian Armstrong sold 749,999 shares in three transactions at various prices, netting a total of $291,827,966. According to his Form 4 disclosure, after the sale Armstrong retains 300,001 shares worth over $1 billion. In a filing prior to the direct listing however, he was reported to have 36,851,833 shares, indicating that he sold just over 2% of his stake in the company. Read More.

Crypto

Dogecoin at $50 Billion Makes It Bigger Than Ford and Kraft: For a cryptocurrency created as a joke, Dogecoin now finds itself in some serious company. After a 400% rally in the past week, the total value of all circulating Dogecoins in the world is about $50 billion. That makes it bigger than the market cap of Ford Motor Co. and Kraft Heinz Co. -- and nearly equal to Twitter Inc., the platform where Elon Musk and Mark Cuban have promoted the Shiba Inu-themed meme coin. No one thinks these blue-chip stocks are all that comparable to Dogecoin, a fringe asset with no real purpose beyond being a joke on social media. But the similarity of their market values underscores the boom in cryptocurrencies that’s taken Wall Street by storm. Read More.

Cryptocurrency Giant Binance Hires Former Top Bank Regulator: A former top U.S. banking regulator is set to join Binance, one of the world’s biggest bitcoin exchanges, in the latest move by a cryptocurrency company to deepen its ties to Washington. Brian Brooks, an acting head of the Office of the Comptroller of the Currency under the Trump administration, will become the new chief executive of Binance.US, the U.S. affiliate of overseas crypto-exchange giant Binance Holdings Ltd. Crypto companies have hired a number of former officials in recent months as they increasingly seek mainstream acceptance. Such hires could help companies such as Binance and Coinbase navigate potential pitfalls in the emerging U.S. regulatory framework for digital currencies. But they are also a striking contrast to the early, libertarian vision of bitcoin as a way to conduct transactions outside the reach of governments. Binance runs the world’s largest cryptocurrency exchange by trading volume, executing tens of billions of dollars of trades a day, according to data provider CryptoCompare. Founded in 2017, Binance was initially based in China. It later moved its offices to Japan and Malta and now says it is a decentralized organization with no headquarters. Read More.

Facebook-Backed Diem Aims to Launch Stablecoin Pilot in 2021: The pilot will be launched with a single stablecoin pegged to the U.S dollar. It will be based largely on payments between individual consumers, potentially with the option for users to buy goods and services. The Diem project is currently in talks with Swiss regulators to secure a payment license. Read More.

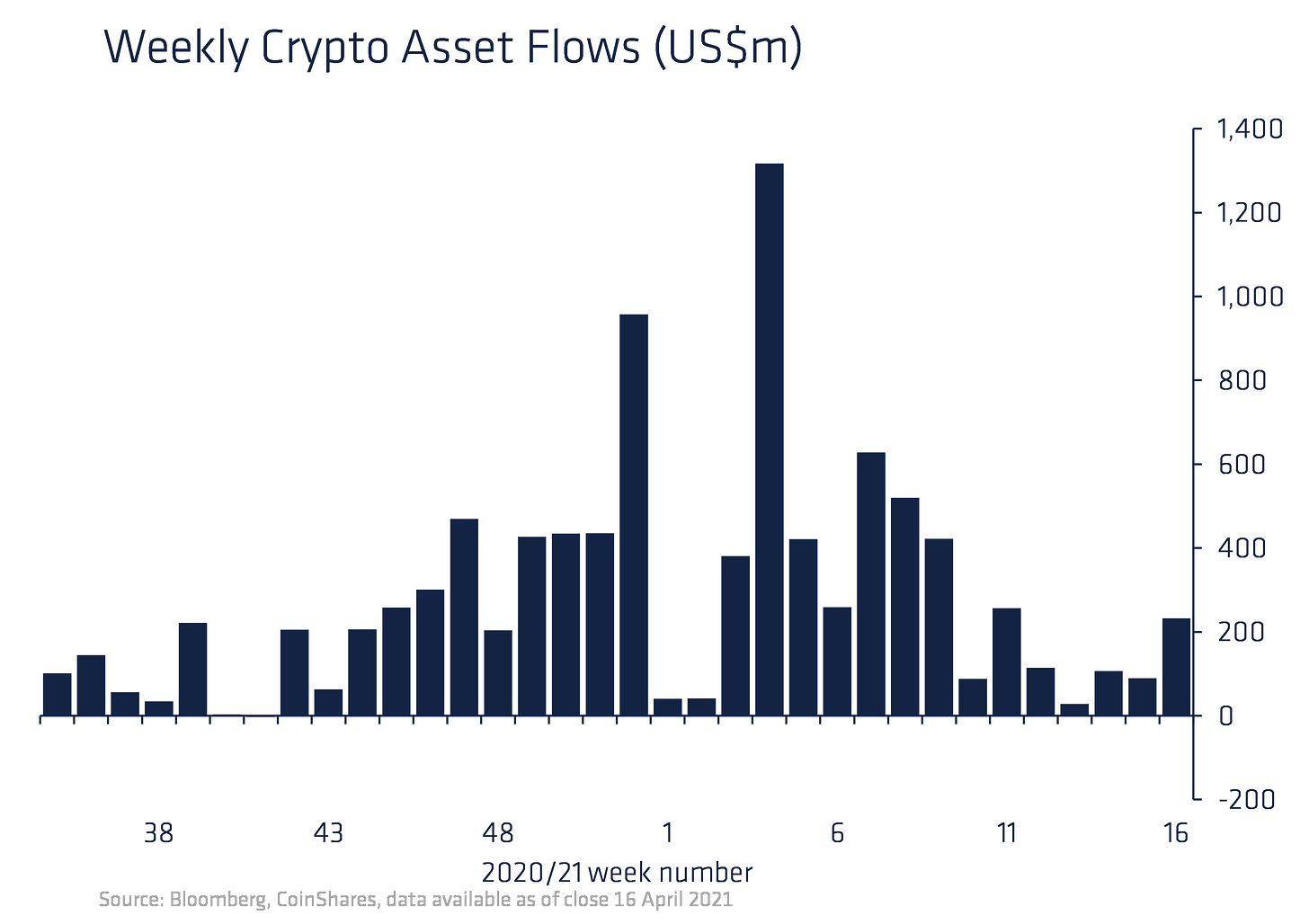

Crypto Fund Inflows Accelerated to $233M Last Week, Most Since Early March: Inflows into digital asset investment products nearly tripled to $233 million last week, according to a report Monday by CoinShares. Last week’s inflow of $150 million was the largest since early March, possibly reflecting bitcoin’s brief rally to an all-time high just below $65,000. However, the cryptocurrency has since declined to around $55,600 at press time. Bitcoin products saw the largest inflows of $108 million while Ethereum products continued to see outsized inflows of $65 million relative to its market cap. Read More.

Ethereum ETF Waives Fees Ahead of Listing This Week: Three Ethereum ETFs got approval in Canada last week. One of them, Evolve, has waived its 0.75% management fee until May 31. The move places it at a competitive advantage over the two other ETFs that will begin trading tomorrow - Purpose Investments, and CI Global Asset Management. All three ETFs will be trading on the Toronto Stock Exchange. Read More.

Media

Robert Breedlove: Philosophy of Bitcoin from First Principles | Lex Fridman Podcast #176

The Booth Series | Episode 1 | Inflation Fights Innovation

BTC021: Bitcoin and Bonds w/ Greg Foss

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.