Crypto Download #70

International Fiscal Policy is in Vogue, Vaccine Safety Concerns, Inflation is Here...Duh, China Quickly Becoming the Global Partner in Europe, Bitcoin and Ethereum Catch Fire with Coinbase IPO

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

U.S. Calls for Pause on J&J Vaccine After Clots, Roiling Rollout

Comparing the side effects and potential risks of the COVID-19 vaccines

India, big vaccine exporter, now seeks imports as COVID cases soar

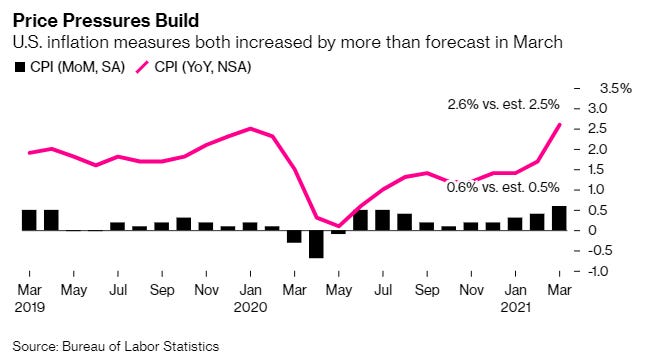

U.S. Consumer Prices Increased in March by Most Since 2012: U.S. consumer prices climbed in March by the most since 2012, adding to evidence of budding inflationary pressures as the economy reopens and demand strengthens. The consumer price index increased 0.6% from the prior month after a 0.4% gain in February. A jump in the cost of gasoline accounted for almost half the overall March advance. The year-over-year changes are distorted by a phenomenon known as the base effect. The CPI, like many other economic data points, declined at the start of the pandemic amid lockdowns and widespread business closures. When compared to those depressed figures, the year-over-year increases for March-May will appear abnormally large. Some analysts and economists argue a wave of pent-up demand paired with trillions of dollars in government spending will spur a sustained upward movement in inflation. Meanwhile, Federal Reserve officials, including Chair Jerome Powell, have said any meaningful increase in prices will likely prove temporary. Amid supply chain bottlenecks, supply shortages and surging input costs, producers are already feeling the pinch of rising costs. While not all cost increases will be pushed through to consumers -- given a variety of different measures firms can take to offset costs -- sustained pressures in the production pipeline raise the risk of an acceleration in consumer inflation. Read More.

IMF offers rosier view on Asia, warns of Fed fallout on markets: The International Monetary Fund offered a more upbeat view on Tuesday on Asia’s economic outlook than six months ago, but warned a faster-than-expected rise in U.S. interest rates could disrupt markets by triggering capital outflows from the region. While Asia is rebounding from last year’s slump caused by the COVID-19 pandemic, there is a divergence between nations benefitting from surging global demand and those reliant on tourism. The IMF expects Asia’s economy to expand 7.6% this year, up from an 6.9% increase projected in October, as advanced economies such as Japan, Australia and South Korea enjoy solid growth thanks to robust U.S. and Chinese demand. The region’s outlook, however, is bound with risks including the fallout from U.S. fiscal and monetary policy. While Washington’s massive fiscal spending will be positive for export-oriented economies, rising U.S. interest rates were already spilling over to emerging Asian markets. Read More.

“If U.S. yields rise faster than markets expect, or if there is miscommunication about future U.S. monetary policy, adverse spillovers through financial channels and capital outflows, as during the 2013 taper tantrum, could present challenges by compromising macro-financial stability,” Ostry said.

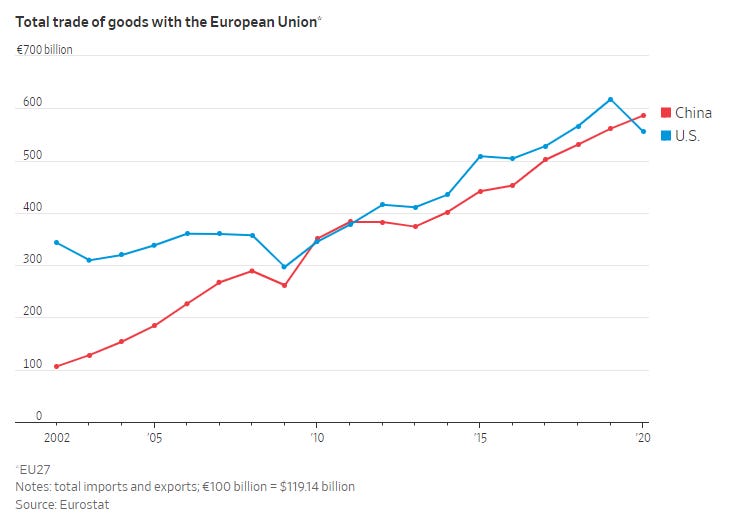

In Battle With U.S. for Global Sway, China Showers Money on Europe’s Neglected Areas: The struggle between the U.S. and China for global influence has come to Europe’s gritty industrial backwaters, where China is steadily co-opting local economies starting with their railroads. China overtook the U.S. as the European Union’s biggest trading partner for goods last year, a historic turning point driven in part by Europeans’ hunger for Chinese medical equipment and electronics during the Covid-19 pandemic. Increasingly, those goods are arriving in Europe through a new trade corridor consisting of railroads, airport hubs and ports built with Chinese support, often as part of China’s Belt and Road Initiative, the giant global infrastructure effort aimed at binding China more closely to the rest of the world. By greasing the wheels of China-Europe trade, those investments have lifted long-neglected, rust-belt cities in places like Duisburg, Germany, and Liege, Belgium. Chinese exports to the EU jumped 63% in January and February year-over-year, while imports from Europe rose 33%. Read More.

“Every month in 2020 was a record and now in 2021 we are growing 20% year on year,” he said.

Putin Looks to Spending to Get Economy Back on Track: Vladimir Putin wants to get Russia’s economy growing again after the pandemic with a burst of spending. His government is working overtime to find the money to pay for it. Just what the Kremlin leader has in mind is being kept secret until his annual address to the nation on April 21. But officials led by Prime Minister Mikhail Mishustin are already considering several possible ways to come up with the cash. Options include tapping the government’s $182 billion rainy-day fund, easing spending restrictions under a self-imposed fiscal rule, diverting money from other projects and raising taxes. The new program is likely to include a combination of infrastructure spending to boost investment and welfare and other benefits to help compensate the slump in incomes, officials said. Putin has already ordered the government to select projects ranging from high-speed rail to bridges and ports to get as much as 1 trillion rubles ($13 billion) from the wealth fund starting this year. Read More.

Spain Deploys $16 Billion of EU Funds for Electric Transport: Spain plans to invest 13.2 billion euros ($15.7 billion) to boost electric vehicle use, one of a raft of measures as the government prepares to deploy European Union pandemic recovery funds to modernize the economy. Electrifying transportation is one of 20 flagship investments that Spain plans to make over the next three years, spending part of its portion of the EU’s recovery fund. Other programs include 6.8 billion euros to be spent on improving the energy efficiency of buildings and 4.3 billion euros for modernizing the public administration. The fund is crucial to the economic recovery of euro-area member states, especially highly-indebted countries such as Spain that need its mix of cheap loans and grants to revive growth without sinking deeper in the red. Sanchez said the investments will boost economic growth by around 2 percentage points annually starting in 2022 and create more than 800,000 jobs. Spain and Italy are set to receive the greatest portions of the fund because their economies faced the deepest contractions last year. The government will also aim to jolt the process of digitalization among the country’s small- and medium-sized firms, roll out 5G across the country and boost competitiveness in the tourism industry, among other measures that will total around 70 billion euros through 2023. Read More.

Bitcoin

Bitcoin Rallies to All-Time High as Traders Eye Coinbase Listing: Bitcoin jumped to an all-time high as the mood in cryptocurrencies turned bullish ahead of Coinbase Global Inc.’s listing this week. The token rose as much as 5.3% to $63,179, exceeding the previous peak in March. Cryptocurrency-exposed stocks such as Riot Blockchain Inc. and Marathon Digital Holdings Inc. also advanced in U.S. premarket trading. Crypto bulls are out in force as growing list of companies embrace Bitcoin, even as skeptics doubt the durability of the boom. In one of the most potent signs of Wall Street’s growing acceptance of cryptocurrencies, Coinbase will list on the Nasdaq on April 14 at a valuation of about $100 billion. Read More.

Meitu now holds $100 million in BTC and Ether after latest Bitcoin purchase: Hong Kong tech company Meitu has taken the total value of its cryptocurrency holdings to approximately $100 million after the firm disclosed the purchase of an additional $10 million worth of Bitcoin on Thursday. Meitu HK, the wholly-owned Hong Kong subsidiary of Meitu Inc (incorporated in the Cayman Islands), acquired 175.67798279 units of Bitcoin for a combined price of $10 million, implying a purchase price of around $57,000 per coin. The purchase was reportedly made using existing cash reserves. Read More.

“The Board takes the view that blockchain technology has the potential to disrupt both existing financial and technology industries, similar to the manner in which mobile internet has disrupted the PC internet and many other offline industries…Some of these features potentially even render Bitcoin as a superior form to other alternative stores of value such as gold, precious stone and real estate. Being an alternative store of value, its price is primarily a function of future demand that is driven by consensus of investors and the general public,” states the disclosure statement.

Miami nightclub accepts Bitcoin as nightlife cautiously returns: A nightclub in Miami is set to return from oa COVID-19-related shutdown of over a year by accepting Bitcoin (BTC) and other cryptocurrencies as a form of payment. Luxury nightclub E11even Miami announced Tuesday that it will soon start accepting cryptocurrency as payment for tables, drinks, merchandise and other services. The list of supported cryptocurrencies will include Bitcoin, Bitcoin Cash (BCH), XRP and Dogecoin (DOGE). In order to provide the new payment method, E11even has partnered with a major cryptocurrency processing company. Read More.

“With the tremendous growth and relevancy of cryptocurrency coupled with Mayor Francis Suarez leading the charge for Miami’s tech boom, we felt it made sense to introduce Cryptocurrency as an option to our guests to pay for their night out," E11even creator and CEO Dennis DeGori said. "E11even is dedicated to always staying ahead of the curve, and we believe cryptocurrency is here to stay.”

Crypto

NYSE Is Doing NFTs and No One Knows What to Make of It: Cryptocurrencies aren't stocks. But now stocks are... going crypto? The New York Stock Exchange (NYSE) has issued non-fungible tokens, available via US-based crypto exchange Crypto.com and its associated blockchain, representing six stocks: Coupang, DoorDash, Roblox, Snowflake, Spotify, and Unity. NFTs are unique, blockchain-based digital assets that confer certain rights on the holder. They’ve been used as ownership deeds for artwork, music, and virtual trading cards. And now, in proof that irony is officially dead, the digital tokens are being used to help Wall Street rake in more cash. Read More.

“Innovation is what we do at the NYSE. We were the first with Direct Listings and at the forefront of the emergence of SPACs,” tweeted the exchange. “Now we want to help drive this new wave of NFT innovation.”

Ethereum Hub ConsenSys Raises $65M From JPMorgan, Mastercard, UBS, Others: Ethereum’s biggest supporter is back on track with the close of a carefully constructed funding round. ConsenSys, an Ethereum development operation headquartered in Brooklyn, N.Y., has raised $65 million from financial institutions JPMorgan, Mastercard and UBS, as well as leading firms in the decentralized finance (DeFi) space. In addition to the big banks, the $65 million round included Filecoin’s Protocol Labs, DeFi’s Maker Foundation, Fenbushi, The LAO, Sam Bankman-Fried’s Alameda Research, CMT Digital, China’s Greater Bay Area Homeland Development Fund, Quotidian Ventures and Liberty City Ventures. Several firms invested with Ethereum-based stablecoins, DAI and USDC, ConsenSys said in a statement. Read More.

Solana Dashboard Step Finance Raises $2M From Alameda Research, 3 Commas: Step Finance, a trading dashboard born out of the Solana hackathon, announced Tuesday a $2 million funding round from Alameda Research, 3 Commas Capital and more. Its investors are betting on Step Finance emerging as the “front page” of the high-throughput Solana blockchain. The Solana ecosystem is backed heavily by Sam Bankman-Fried, Alameda’s CEO. Other participating investors included Raydium, One Block, Solidity Ventures and a number of private individuals connected to the Solana ecosystem. The Solana Foundation raised $40 million from a pair of crypto exchanges last month in a bid to fund more software development on the network. While Ethereum users have suffered from high fees caused by blockchain congestion, Solana is said to have transaction speeds that rival traditional financial networks. Boosters of Solana and other base layers see now as the time to attract new users. Read More.

Polkadot and Cosmos connect as Plasm and Secret Network release bridge MVP: Plasm Network and Secret Network, two projects based on Polkadot and Cosmos, respectively, have launched the first iteration of a bridge to connect the two ecosystems, each representing a different “layer-0” protocol. The bridge allows users to transfer assets between Plasm Network and Secret, allowing them to enjoy transaction privacy and use SecretSwap, the first automated market maker exchange on Secret Network. The bridge would allow Plasm users to benefit from Secret Network’s privacy layer, which is based on hardware guarantees offered by Trusted Execution Environment, or TEE, cells. Secret nodes and validators use the TEE to perform operations requiring privacy, which makes them untraceable for the nodes themselves. In a longer term perspective, the Plasm team expects to become the gateway to Cosmos for other Polkadot projects. Key to this is winning the parachain auctions on Kusama and Polkadot, becoming fully embedded in their environments. Read More.

“Currently, we are focusing on becoming one of the first Kusama parachains. After becoming a parachain, we will implement [the bridge] on the mainnet and make it more and more decentralized and trustless step by step…This is the first commercial trial that brings Cosmos assets to the Polkadot ecosystem and vice versa. We would like to make the idea of 'Cosmos vs Polkadot' obsolete.”

Media

How Banks Work & Dictate the Economy - Interview with Richard Werner

Update from Raoul on the Dollar, Rates, Growth, and Crypto (w/Raoul Pal & Ash Bennington)

Why Bitcoin’s December Price Target Is Now ‘Above $300,000’- Ep.228

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.