Crypto Download #69

Inflation is Here & It Hits Different, Trading on Margin Fueling the Everything Bubble, Thiel Goes Off on Bitcoin Big Tech and China, Coinbase is a Money Monster, Bloomberg Analyst $400k BTC in 2021

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Asia’s rising coronavirus cases a worry as vaccine doubts cloud campaigns

Australia Avoids AstraZeneca Shot for Under 50s on Clot Risk

U.S. weekly jobless claims unexpectedly rise: The number of Americans filing new claims for unemployment benefits unexpectedly rose last week, but the increase likely understates the rapidly improving labor market conditions as more parts of the economy reopen and fiscal stimulus kicks in. Initial claims for state unemployment benefits totaled a seasonally adjusted 744,000 for the week ended April 3 compared to 728,000 in the prior week, the Labor Department said on Thursday. Economists polled by Reuters had forecast 680,000 applications in the latest week. Read More.

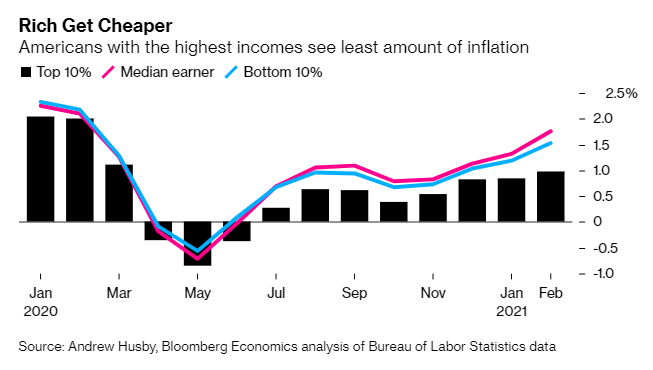

Inflation Has Gone K-Shaped in the Pandemic Like Everything Else: Low-income Americans bore the brunt of job losses when the pandemic arrived. Now they’re getting hit hardest by price increases as the economy recovers. The headline consumer inflation rate in the U.S. remains subdued, at 1.7% but it masks large differences in what people actually buy. Some of the biggest price hikes of recent months, for example, have come in gasoline. A gallon of regular is up 75 cents since late last year –- adding more than $60 a month to the budget of someone who fills up with 20 gallons a week. Food-price inflation is running at more than double the headline rate, and staples like household cleaning products have also climbed. Price increases like these are causing trouble all over the world and they tend to hurt low-income people most. That’s because groceries or gas take up a bigger share of their monthly shopping basket than is the case for wealthier households, and they’re items that can’t easily be deferred or substituted. The Fed, which is in charge of keeping inflation under control, says any increase will likely prove temporary. The central bank isn’t planning to use its inflation-fighting tool of higher interest rates anytime soon. The idea behind the Fed’s new thinking is that allowing the economy to run a bit hotter -- and inflation to creep a bit higher -- will actually help to reduce income inequalities, because it will encourage a strong jobs market that benefits low-paid Americans the most. There’s some evidence that this is already happening in the restaurant, hotel and other service industries. Read More.

Roubini Warns U.S. Yields Above 2% Will Bite Amid Excess Risk: A fresh spike in Treasury yields will rattle markets and could send more family offices and hedge funds down a similar path to Bill Hwang’s Archegos Capital Management, according to Nouriel Roubini. Roubini, a professor at New York University’s Stern School of Business and a former adviser to the U.S. government, said the combination of low-to-negative rates across advanced economies and fiscal stimulus is leading investors to take excessive risk. He pointed to cyclically adjusted price-earnings ratios at highs seen in 1929 and the early 2000s as one sign of the recklessness. Read More.

“We’re seeing widespread frothiness, bubbles, risk-taking and leverage,” Roubini said on Bloomberg TV. “Lots of players have taken too much leverage and too much risk and some of them are going to blow up.”

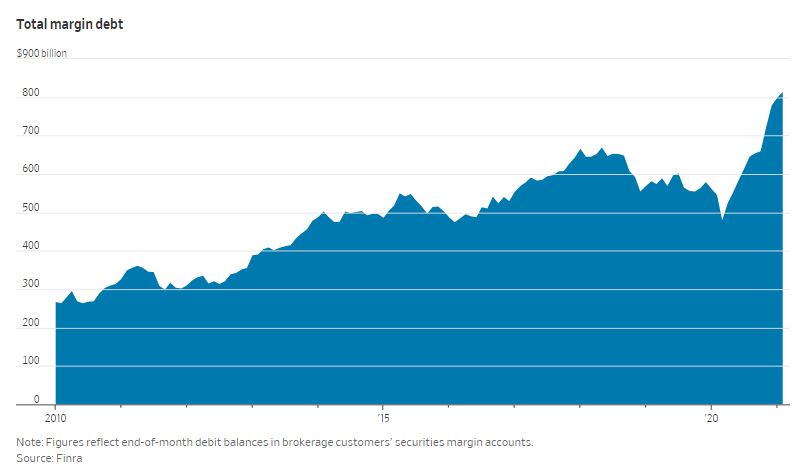

Investors Big and Small Are Driving Stock Gains With Borrowed Money: Investors are borrowing huge sums of money to buy stocks. Is that a problem? The “everything rally” that started in stocks last year has been boosted by investors betting money they have borrowed. That includes both small players like the day traders on Robinhood Markets Inc. and heavyweights like Archegos Capital Management, the investing firm that triggered a mini meltdown for several companies’ stocks. As of late February, investors had borrowed a record $814 billion against their portfolios, according to data from the Financial Industry Regulatory Authority, Wall Street’s self-regulatory arm. That was up 49% from one year earlier, the fastest annual increase since 2007, during the frothy period before the 2008 financial crisis. Before that, the last time investor borrowings had grown so rapidly was during the dot-com bubble in 1999. some analysts say run-ups in margin debt contribute to bubbles, and they fear that today’s levels of borrowing will hurt investors if the market has a downturn. Margin trading is a double-edged sword. Borrowing money gives investors more buying power, but it also puts them at greater risk. When stocks fall, lenders can ask investors to put up more collateral or sell the shares, a demand known as a margin call. Read More.

“It fuels bull markets and it exacerbates bear markets and to a certain extent you put it on the list of irrational exuberance,” said Edward Yardeni, president of consulting firm Yardeni Research. “The further that this stock market goes, the higher that margin debt will go, and when something blows up that will be one of the factors for why stocks are going down.”

Sovereign debt distress rise prompts Bretton Woods group action plan: The Bretton Woods Committee has formed a working group of senior bankers, academics and lawyers to propose ways to resolve a rise in sovereign debt distress in emerging markets as a result of the COVID-19 pandemic. The influential U.S.-based non-profit organization said it will examine how to promote greater transparency around sovereign debt and achieve equitable burden sharing among all creditors, namely official, bilateral and private sector. Poor nations around the world are battling a large build-up in debt resulting from lower economic growth and higher budget deficits as the coronavirus crisis tightened its grip. The group formed by the Bretton Woods Committee will also consider how to engage private sector creditors in any debt relief schemes, as well as analyzing options for state-contingent financing, which link a country’s debt service payments to its capacity to pay. Read More.

Derby’s Take: Fed Officials Unfazed by China’s Digital Money Launch: China may have beaten the U.S. to launching official digital money, but Federal Reserve policy makers don’t seem worried. The launch of the digital yuan is “something that doesn’t surprise me” and “I don’t think, at least for the—for the time being, that it jeopardizes the dollar’s role as the world’s reserve currency,” Federal Reserve Bank of Dallas leader Robert Kaplan said in an interview on Tuesday. “I don’t see this development by itself as being a threat” to the dollar’s dominant role in global finance, Mr. Kaplan said, adding that “there could be developments in the years ahead and we would be wise not to take for granted the dollar’s role as the world’s reserve currency.” Speaking to reporters on Wednesday, Chicago Fed leader Charles Evans also said that while China may have beaten the Fed to offering a fully digital version of its money, that nation’s currency still faces challenges tied to broader structural issues with its economy. “A lot of it still comes down to, what is the state of the Chinese economy, the openness that they have for capital movements in and out of that country?” Mr. Evans said. A lack of financial freedom in China can affect who uses the digital Chinese money and make it less attractive compared with the dollar, he said. Richmond Fed chief Thomas Barkin on Wednesday said the dollar holds its global reserve status “because we are trustworthy, and we are a rule-of-law country and we have a highly liquid and stable dollar and all of the various things that, you know, make it a currency people want to transact in.” For now at least, the dollar seems secure to rivals as long as the U.S. makes sound choices and sets policy prudently, Mr. Barkin said. Read More.

Bitcoin

Peter Thiel Calls Bitcoin ‘a Chinese Financial Weapon’ at Virtual Roundtable: Peter Thiel is “pro-crypto” and “pro-Bitcoin maximalist,” but he also thinks the cryptocurrency may be undermining America. Thiel, the venture capitalist and conservative political donor, urged the U.S. government to consider tighter regulations on cryptocurrencies in an appearance on Tuesday. The statements seemed to represent a change of heart for Thiel, who is a major investor in virtual currency ventures as well as in cryptocurrencies themselves. Thiel was joined by former Secretary of State Mike Pompeo and former National Security Advisor Robert O’Brien. The conversation between Thiel, who has frequently criticized American companies that do business with Beijing, and two hawkish former members of the Trump administration, was largely focused on U.S.-China relations. It was moderated by Hugh Hewitt, the talk radio host and the chief executive of the Nixon Foundation. Read More.

“I do wonder whether at this point, Bitcoin should also be thought [of] in part as a Chinese financial weapon against the U.S.,” Thiel said during an appearance at a virtual event held for members of the Richard Nixon Foundation. “It threatens fiat money, but it especially threatens the U.S. dollar.” He added: “[If] China’s long Bitcoin, perhaps from a geopolitical perspective, the U.S. should be asking some tougher questions about exactly how that works.”

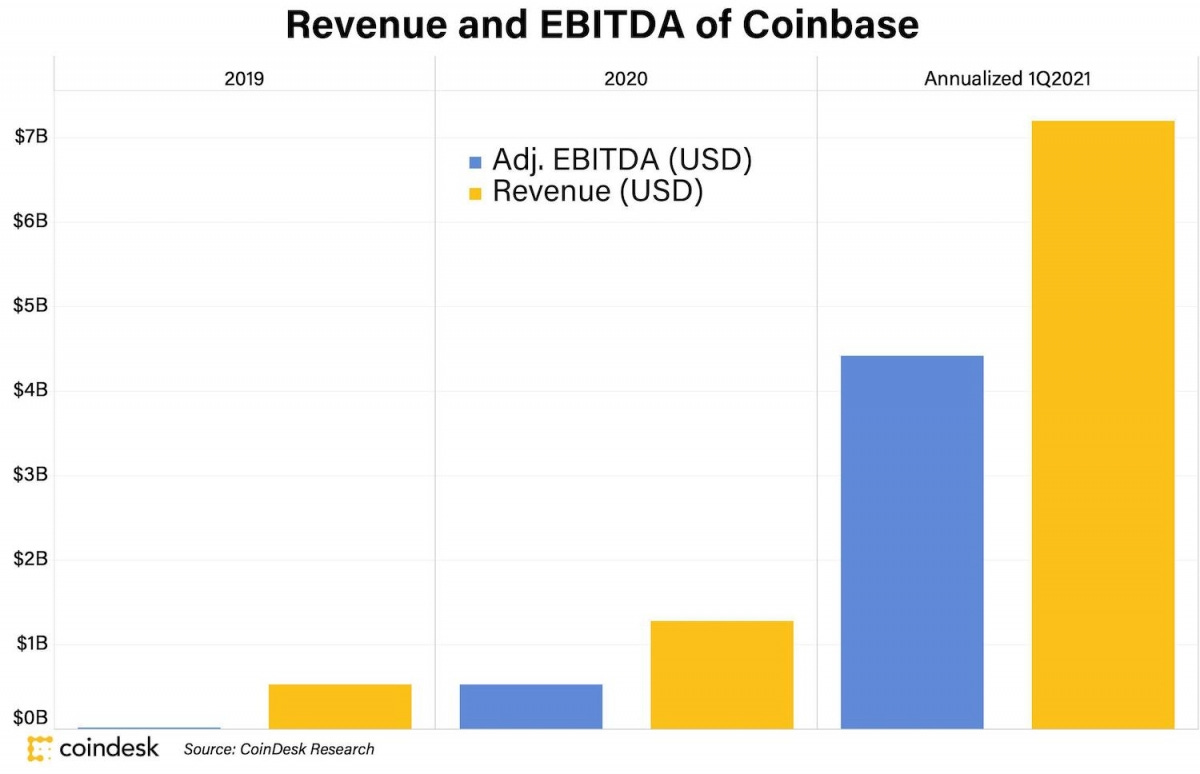

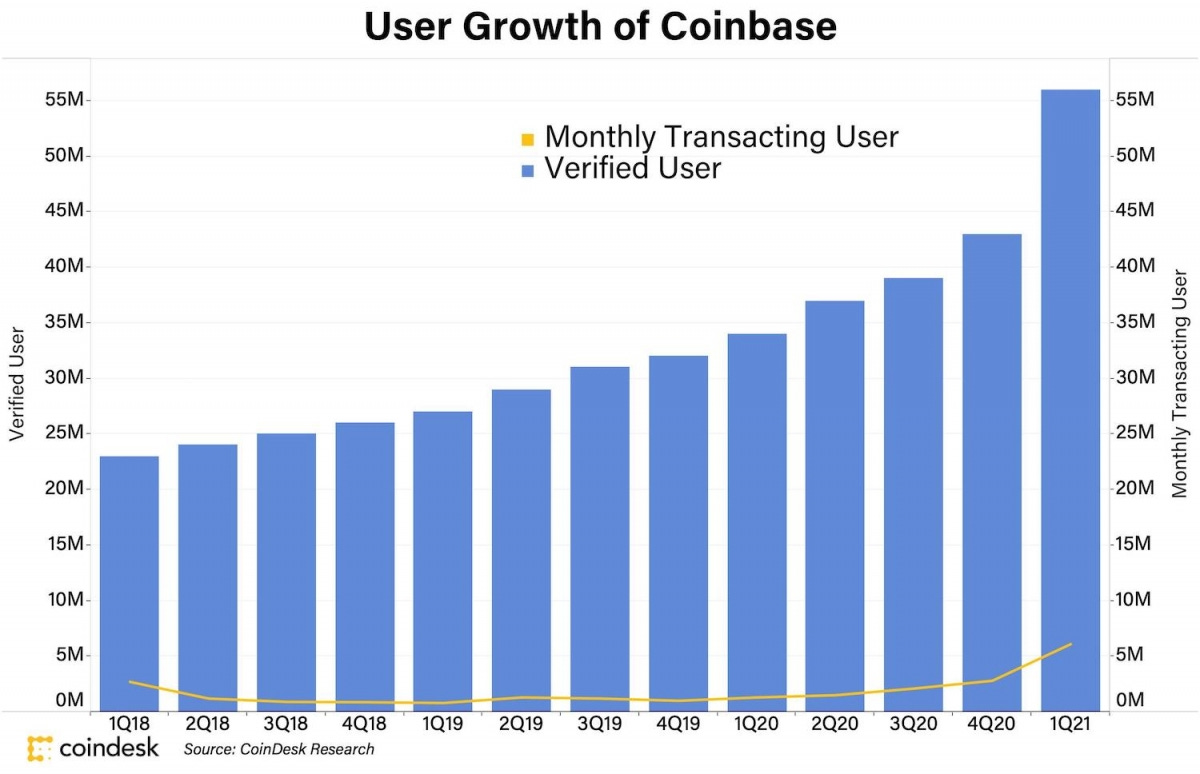

How Coinbase’s Wild Earnings Stack Up Against Normie Financial Firms: Based on earnings estimates announced Tuesday, nothing else in the financial services industry really compares to Coinbase right now. Wedded to the rising fortunes of cryptocurrencies themselves, soon-to-list Coinbase expects to make more money in the first quarter of this year than in all of 2020, and has seen an exponential rise in engaged customers. Coinbase’s revenue for the first three months of 2021 is expected to be $1.8 billion with earnings of about $800 million, compared with $1.3 billion in revenue and earnings of $322 million for all of 2020. Crypto is booming right now, with bitcoin holding its own not far below $60,000.

Ahead of next week’s listing of COIN stock, the obvious question is whether the current quarter is an outlier or, as some stolid crypto believers may be thinking, the new normal. When Coinbase debuts on Nasdaq later this month, it’s expected to command a value of about $100 billion. Even based on a conservative value of $300 a share, Coinbase is now worth more than InterContinental Exchange (ICE) Group, the owner of the New York Stock Exchange (NYSE). ICE reported earnings of $2.1 billion in 2020. Read More.

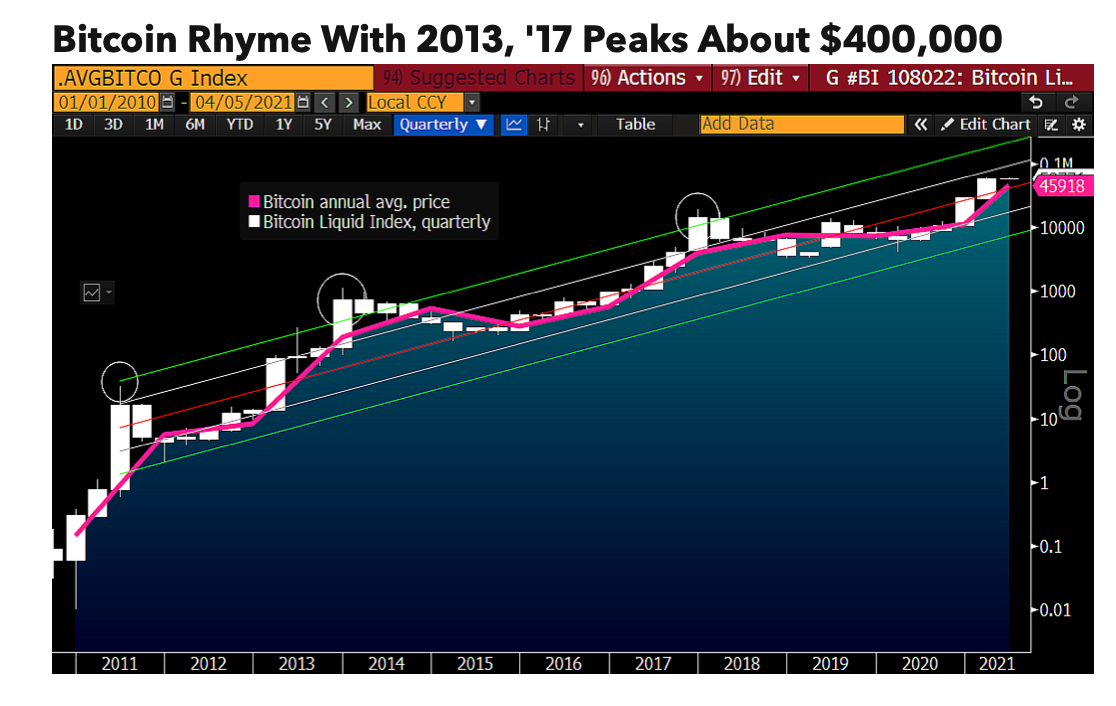

Bloomberg Foresees Bitcoin Rallying to $400K This Year: According to Bloomberg bitcoin analysts, the price could climb as high as $400,000 this year, from about $56,000 now. The uber-bullish prediction is based on bitcoin’s performance during the 2017 and 2013 bull runs. While past performance is no guarantee of future results, history might rhyme. The latest bull run comes in the wake of last May’s reward halving on the Bitcoin blockchain – an automatic, every-four-years, 50% reduction in the pace of new issuance of units of the cryptocurrency. Some observers fear a faster rise in bond yields could dilute the appeal of inflation hedges such as gold and bitcoin, pushing their prices lower. However, Bloomberg analysts foresee bitcoin remaining relatively resilient in a rising yield environment. Read More.

“Rising real yields are a headwind for gold prices, but less so for bitcoin, still in its price-discovery stage,” analysts noted. “Gold is fighting a battle with bitcoin, which can earn 6%-8% in crypto savings accounts and is well on its way to becoming a global reserve asset in a digital world…Our graphic depicts bitcoin on similar ground as the roughly 55x gain in 2013 and 15x in 2017,” Bloomberg Crypto noted in a monthly report published this week. “To reach price extremes akin to those years in 2021, the crypto would approach $400,000, based on the regression since the 2011 high.”

Miners are hoarding Bitcoin from record daily earnings: Bitcoin (BTC) miners are stashing away their coins for higher prices, with direct transfers from miners to exchanges having plummeted nearly 40% since mid-March. Data from on-chain analytics provider Glassnode shows that miners’ BTC balances have been increasing since late March, following heavy outflows throughout January and consistently reduced selling during February and earlier in March. Glassnode chief technology officer Rafael Schultze-Kraft noted several metrics pointing to recent miner accumulation — including flows from miner addresses, unspent BTC supply and miner position net change. Glassnode’s data shows that unspent supply — BTC that has never been transferred from the (miner’s) original recipient address — has begun to rise after seeing a sharp drop in January, when 15,000 previously dormant coins were moved from mining addresses for the first time. He also shared data showing that miner revenues are up by 300% in roughly one year, pushing into new all-time highs above $50 million to currently sit at a seven-day moving average of nearly $60 million. “Miners have little to no incentives to be cashing out right now,” he concluded, adding “selling or capitulation [is] not in sight.” Read More.

Crypto

State Street to Start Trading Crypto on Platform It’s Helping Build: State Street, the second-oldest bank in the U.S. with $3.1 trillion in assets under management, has signed up to use a new bank-grade trading platform for digital assets set to go live mid-year. Announced Thursday, State Street’s Currenex trading technology arm is working with London-based Pure Digital, infrastructure provider to the foreign exchange trading world, to create an institution-focused digital currency trading platform. The two companies said they plan to further explore the digital currency trading space. Asked if State Street would be using the platform to do its own crypto trading, Lauren Kiley, CEO of Pure Digital, told CoinDesk in an email, “That is the intention – State Street is one of the many banks that will be using this platform and we are looking at midway through 2021, although no date is set.” State Street subsequently confirmed it plans on using the platform. Institutions appear to be driving the current crypto bull run, a key difference from the retail-driven expansion of the space back in 2017. Big banks like BNY Mellon, Goldman Sachs and Morgan Stanley are now making moves, and eyes have been on State Street, as one of the biggest U.S. custody providers and trading operations, to see when/if it would move into crypto. Read More.

“Currenex is thrilled to leverage our experience and expertise in the FX and digital asset trading marketplace to provide Pure Digital with robust technology and infrastructure for this exciting digital currency trading initiative,” David Newns, Global Head of Execution Services for State Street Global Markets, said in a statement.

“All these banks are waking up to crypto and can’t ignore it anymore, “ Kiley said. “Either they find a way to get involved and provide services to meet client demand or they will start to lose relevancy over time.”

Paris Hilton drops surprisingly well-informed article about NFTs: Paris Hilton revealed she is not only bullish about nonfungible tokens but also has a good understanding of potential applications of the technology in an extensive blog post explaining her excitement about the sector posted on Wednesday. In a blog post titled “I’m Excited About NFTs—You Should Be Too,” Hilton demonstrates an informed understanding she said comes from learning everything she can about the subject by immersing herself in the NFT community on social media and “working with NFT collectors like WhaleShark, Illestrater, internet entrepreneur Kim Dotcom and the founders of Origin.” The 40-year old has a Twitter following of 16.9 million and operates 19 different product lines, with her perfume line alone generating more than $2.5 billion to date. Read More.

“I see NFTs, or non-fungible tokens, as the future of the creator economy. They use blockchain technology to help creators increase the value of their work and share it with fans in real time.”

Tom Brady Launching NFT Platform with Apple, DraftKings, Spotify Exec Advisors: Tampa Bay Buccaneers quarterback and seven-time Super Bowl champion Tom Brady is launching an NFT platform called Autograph. Brady and Richard Rosenblatt, the former CEO of Myspace parent company Intermix Media, will serve as co-chairs of Autograph, while the CEO will be Rosenblatt's 23-year-old son Dillon. Autograph has also loaded up a team of tech and sports heavyweights as board members or advisors, including: Apple SVP Eddy Cue; DraftKings cofounders Jason Robins, Matt Kalish, and Paul Liberman; Spotify CCO Dawn Ostroff; Lionsgate CEO Jon Feltheimer; Cameo CEO Steven Galanis; and Golden State Warriors part owner Peter Guber. Read More.

"I believe this is a smart and strategic venture in an industry that has seen an explosion of interest in the last year," DraftKings CEO Robins told Decrypt by email. "I'm looking forward to providing support to Tom and Rich as they launch Autograph."

Media

Bitcoin as Investment Portfolio Insurance with Greg Foss

Using Data Analytics To Predict Market Behaviour - Santiment April 2021

BTC020: Bitcoin & Quantum Computing w/ Andrew Fursman

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.