Crypto Download #68

Biden Breaks Down $2 Trillion Infrastructure Plan, Despite Higher Unemployment Claims - Global Economy is Heating Up, Goldman Sachs and BlackRock Launch Bitcoin & Crypto Offerings, NFTs Everywhere!

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Pfizer-BioNTech Covid-19 Vaccine Protects for Six Months, Companies Say

J&J Says Covid-19 Vaccine Ingredient Batch Didn’t Meet Quality Standards

Macron orders COVID-19 lockdown across all of France, closes schools

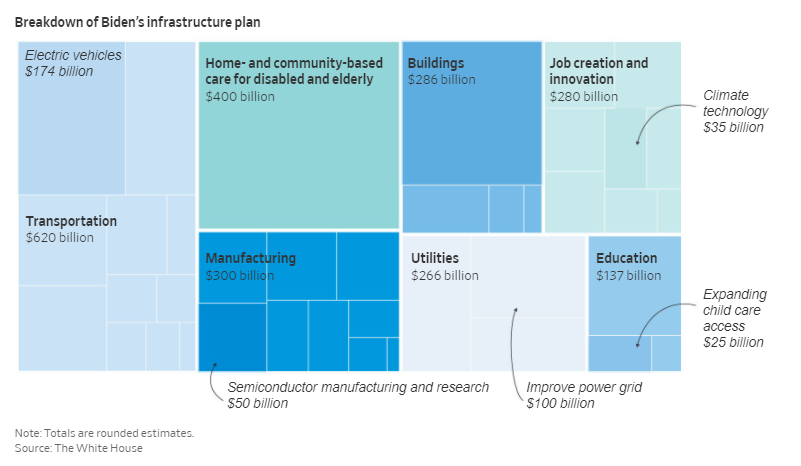

Biden’s Infrastructure Plan Visualized: How the $2.3 Trillion Would Be Allocated:

Transportation - Just over $620 billion in transportation spending would go toward upgrading roads, bridges and other parts of the nation’s infrastructure. Consumers would be offered tax incentives to buy electric vehicles as part of a $174 billion investment in the industry. The plan also includes building a national network of 500,000 electric vehicle charging stations by 2030.

Manufacturing - Beyond infrastructure, the plan dedicates $300 billion for domestic manufacturing, including disaster resilience and bolstering domestic production of semiconductors and supporting domestic manufacturers.

Job creation and research - The plan also includes hundreds of billions of dollars in investments in workforce development and research and development. The White House is requesting $50 billion for the National Science Foundation to focus on semiconductor and advanced computing research.

Housing, buildings and utilities - The proposal includes $40 billion to retrofit existing public housing to address energy efficiency as part of a $213 billion investment to create more affordable housing options. About $111 billion is geared toward water infrastructure, with the goal of replacing all of the lead pipes in the country. An additional $100 billion dollars would go toward expanding broadband access, especially in rural areas. The White House also wants to put $100 billion toward upgrading and building new public schools, in addition to $12 billion for infrastructure upgrades to community colleges.

Biden’s $2 Trillion Corporate Tax Plan Tears Up Republicans’ 2017 Blueprint: President Biden’s corporate tax plan would tear down much of the structure that Republicans built in their tax law less than four years ago, driving up rates on large U.S.-based companies and raising taxes on their foreign profits. Mr. Biden’s plan would generate about $2 trillion over 15 years to pay for the infrastructure spending. It would raise the corporate tax rate to 28% from 21%, increase minimum taxes on U.S. companies’ foreign income and make it harder for foreign-owned companies with U.S. operations to benefit from shifting profits to low-tax countries. In a response to complaints that some companies find legal ways to pay little or no tax, Mr. Biden would also add a 15% minimum tax on the financial-statement income of large corporations. That would create a secondary tax base with different definitions of income as a backup to all the other provisions. Republicans in Congress and business groups are dead-set against tax increases, warning of job losses and slower wage growth. The Biden plan would reduce corporations’ after-tax return on domestic investment and make it harder for U.S. companies to compete with firms based in foreign countries that don’t have similar taxes on their global profits. It would push the U.S. tax rate back toward the top among major economies. Read More.

“The bottom line is none of this moves us in the right direction or makes the U.S. a more attractive place to invest for U.S. companies or foreign companies,” said Caroline Harris, chief tax policy counsel at the U.S. Chamber of Commerce, which supports infrastructure spending because it would increase long-term economic growth but prefers to pay for it with user fees such as gasoline taxes rather than corporate tax increases.

Lagarde Says Market Can Test ECB Resolve as Much as It Wants: European Central Bank President Christine Lagarde said policy makers won’t shy away from using all their powers should investors try to push bond yields higher. The ECB has accelerated its emergency bond-buying program to push back against a rise in borrowing costs that threatens to undermine the euro area’s recovery. Yields have risen as part of a global reflation trade on the back of the U.S. economic rebound, yet the euro zone is bogged down in extended virus restrictions and a slow vaccination rollout. Read More.

“They can test us as much as they want,” she said in a Bloomberg TV interview on Wednesday. “We have exceptional circumstances to deal with at the moment and we have exceptional tools to use at the moment, and a battery of those. We will use them as and when needed in order to deliver on our mandate and deliver on our pledge to the economy.”

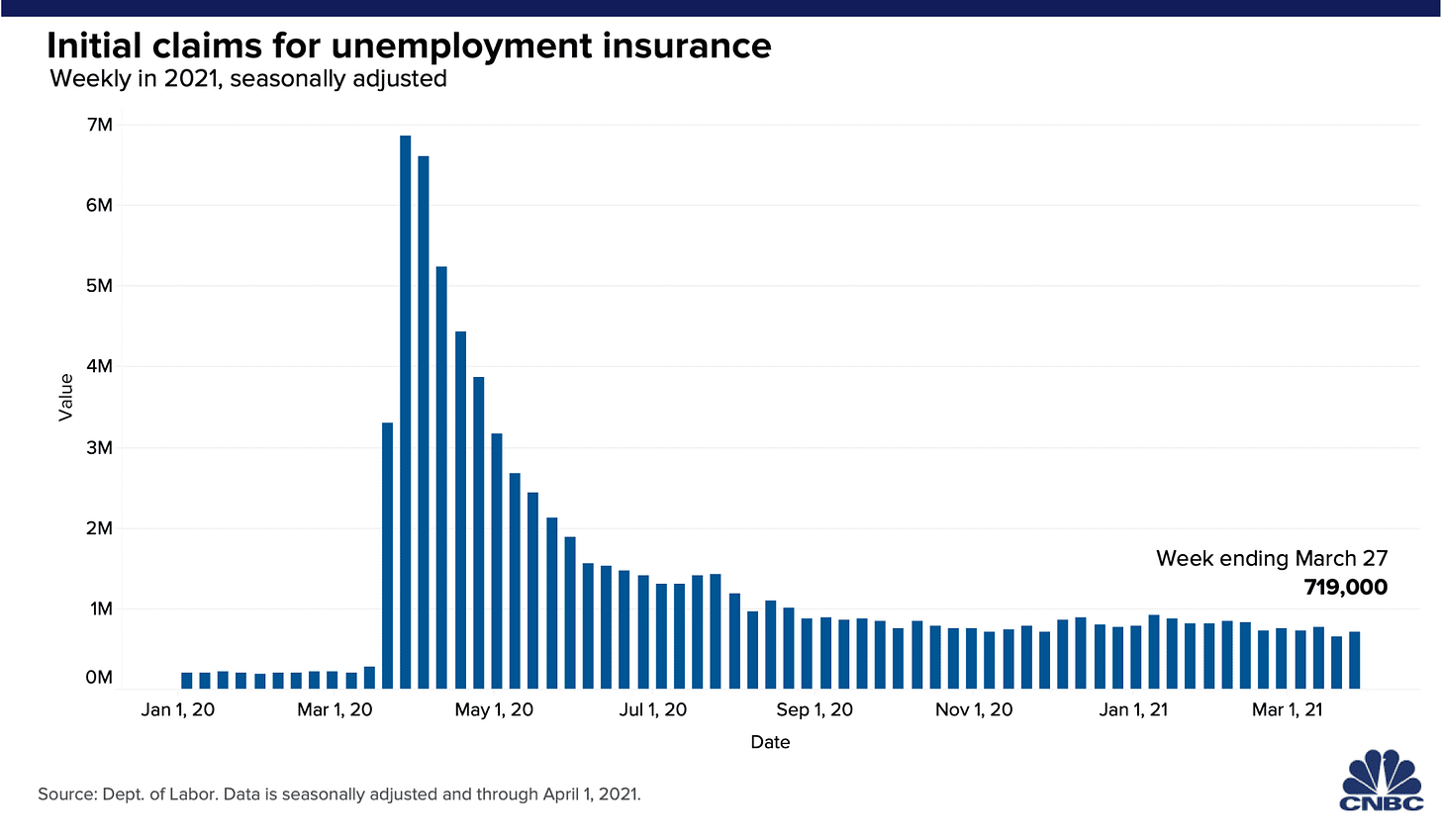

Weekly jobless claims higher than expected despite signs of labor market improvement: First-time claims for jobless benefits were higher than expected last week, with 719,000 more workers heading to the unemployment line. The total compared with the 675,000 estimate from Dow Jones and was above last week’s downwardly revised 658,000. Read More.

Global Economy Heating Up

Asia’s Surging Exports Show a World Economy Weathering Covid Headwinds

Asian Manufacturing Is Surging on Strong Global Goods Demand

Hotter U.S. Economy Risks Faster Cooldown as Biden Pushes Plan

Bitcoin

World’s largest asset manager, BlackRock, now deals in Bitcoin Futures: It is another great day for Bitcoin, as reports suggest, that the world’s largest asset manager, BlackRock, now deals with Bitcoin Futures. A regulatory filing suggested the new market focus of the asset management company. The company held $6.5 million in CME Bitcoin futures and also had a profit of $360,457. This represented a very small fraction of their entire profit and investments at just 0.03% and 0.0014%, respectively. The company has already given two of its funds the permission to go forward and trade BTC futures. The price of BTC is already skyrocketing and BlackRock starting to deal with Bitcoin futures is just another positive to the mix. Since it is the world’s largest asset manager, the impact it has is huge. They have over $8 trillion under management as of the last quarter of 2020, and we are pretty sure that is going up every month. And with such a client base dealing in BTC futures could mean a huge potential investment in the cryptocurrency. Read More.

Goldman Sachs To Become Second Big Bank Offering Bitcoin To Wealthy Clients: Less than two weeks after Morgan Stanley said it will start offering bitcoin exposure to its wealthy clients, banking powerhouse Goldman Sachs is also pushing deeper into the space, telling CNBC this week that it's looking to offer a "full spectrum" of cryptocurrency investments for its private wealth clients within the next few months. Goldman expects to begin offering bitcoin exposure to clients of its private wealth management division in the second quarter, Mary Rich, the division's new global head of digital assets. Though Goldman has yet to state which crypto investments it will support to begin with, Rich said the bank ultimately hopes to offer a "full spectrum" of digital asset investments, including tokens themselves, as well as derivatives and traditional investment vehicles. Read More.

"Bitcoin is on an inevitable path to have the same market cap and then a higher market cap as gold," former hedge fund billionaire-turned crypto investor Michael Novogratz told CNBC on Wednesday, . "It's just how fast adoption happens. Adoption is happening faster than I had predicted—it's shocking to me how fast people are moving into the system." The current market capitalization of gold is roughly $10.6 trillion, while bitcoin stands at about $1.1 trillion.

Bitcoin Newbies Are HODLing as Prices Rise, Blockchain Data Suggests: There’s a new generation of bitcoin HODLers. New research from Glassnode, an on-chain data platform, shows continued growth in bitcoin held between 1-month and 6-months, indicating strong conviction behind the recent price rally. These coins were accumulated throughout the recent bull market, which means new HODLers (a term that means holding, widely used in the cryptocurrency community) are sitting on a near 500% increase since October. BTC purchased between prices of $10,800 and $58,800 now represent 25% of the total supply with no sign of slowing down. This means that HODLers have continued to accumulate BTC, in size, throughout this bull market. "HODLed coins are beginning to mature, and continued outflows from exchanges demonstrates accumulation is not slowing down." And more BTC investors are moving their holdings into storage, which suggests less interest in short-term trading. Over the past 12-months, over 3% of the circulating BTC supply has migrated out of exchanges and into third-party wallets. Read More.

Crypto

Celebrities & Mainstream NFT Craze

Music Mogul Akon Gets In on the NFT Action With AkoinNFT Platform

From NFL to NFT: Vernon Davis Offers 'Golden Ticket' Meet-and-Greet for Fans

BossLogic’s 'Godzilla vs. Kong' NFTs Mark a First for Hollywood

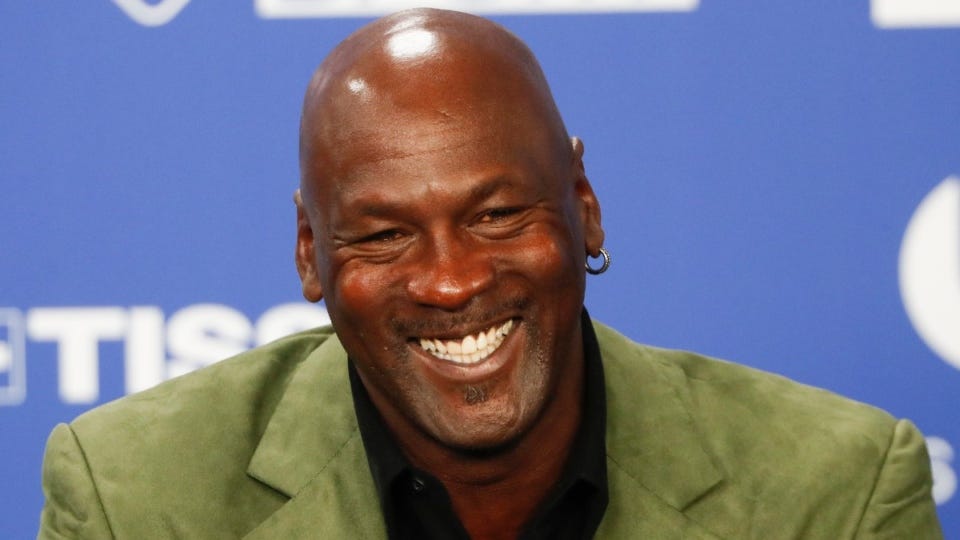

NBA Top Shot’s Dapper Labs Raises $305 Million in Latest Round: Dapper Labs, the company behind the popular NBA Top Shot digital collectibles platform, said it closed a $305 million funding round with backing from a roster of professional athletes and media personalities. The latest financing injection -- with endorsements from Michael Jordan, Will Smith, Kevin Durant and Stefon Diggs, among others -- brings the company’s total capital raised since February 2018 to $357 million, according to Roham Gharegozlou, the company’s co-founder and chief executive officer. Read More.

Assassin's Creed Publisher Is Making The Next Generation Of NFT Games: The blockchain gaming world is largely populated by startups built specifically to pioneer the burgeoning industry of crypto games. However, there is one very big exception: Ubisoft, one of the largest traditional game publishers in the world, and the storied brand behind mega-franchises like Assassin’s Creed, Far Cry, Just Dance, and various Tom Clancy-branded shooters. The gaming giant, which has dozens of international studios, first signaled its interest in blockchain technology by unveiling a proof-of-concept prototype called HashCraft, a crypto-infused riff on Minecraft, in 2019. Ubisoft has since continued on in the space by working closely with crypto gaming startups and releasing its own small-scale experiments. The publisher’s blockchain ambitions come from its Strategic Innovation Lab, which is headed up by Nicolas Pouard, Blockchain Initiative Director. “It’s a think tank and a ‘do’ tank, as we like to put it,” Pouard told Decrypt during a recent phone interview. “Our mission is to anticipate the future and help Ubisoft to be prepared for it.” Read More.

What is Livepeer (LPT)? Grayscale's Bet on Streaming Video: When Grayscale, the firm behind the GBTC investment vehicle, announced in March 2021 that it was creating new trusts based on other cryptocurrencies, most of the newly-announced trusts picked were well-known, unsurprising cryptos such as Chainlink and Filecoin. But there was one new addition that seemed to catch even crypto enthusiasts off-guard: Livepeer. Livepeer is an Ethereum-based decentralized service that aims to significantly slash costs for video streaming apps. It does so by distributing resource-hungry transcoding tasks to users who lend their computer’s processing power to the network. Like most decentralized services, there are incentives for network participants, such as the “orchestrators” who transcode video, and delegators who stake LPT tokens to ensure liquidity. Read More.

Media

Nic Carter: Bitcoin Core Values, Layered Scaling, and Blocksize Debates | Lex Fridman Podcast #173

Bitcoin Quarterly Report - Preston Pysh and Andy Edstrom - Swan Signal Live E55

Grant Williams Reveals the End Game for Central Bank Money Printing

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.