Crypto Download #66

Upcoming $183B Test for US Treasury Auction; Biden $3T Infrastructure Plan on the Table; Currency Crisis in Turkey; Crypto Banned in Morocco, but Bitcoin Buying is Soaring; Gemini Adds New Coins

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

U.S. Treasury auctions to test demand after volatile trading: Demand for U.S. Treasuries will be tested this week as $183 billion of notes are due to be auctioned, with one seven-year note sale likely to be closely watched after an auction of that maturity stumbled last month. The U.S. Treasury Department has increased debt issuance dramatically in the last year to finance stimulus measures to combat economic fallout from the coronavirus pandemic. Issuance in 2021 is slated to rise to $4 trillion. The supply increase, alongside the Federal Reserve's pledge to keep monetary policy loose while economic growth and inflation rise, has contributed to rising Treasury yields. Investors will also focus on Fed Chair Jerome Powell on Tuesday, who is expected to be peppered with questions at a congressional hearing about the potential risks from the Fed's super-easy policy including its bond buying program. Last week, the benchmark 10-year Treasury yield, hit 1.754%, a 14-month high. It traded around 1.68% on Monday. The Treasury will sell $60 billion of two-year notes on Tuesday, $61 billion of five-year notes on Wednesday and $62 billion of seven-year notes on Thursday. Read More.

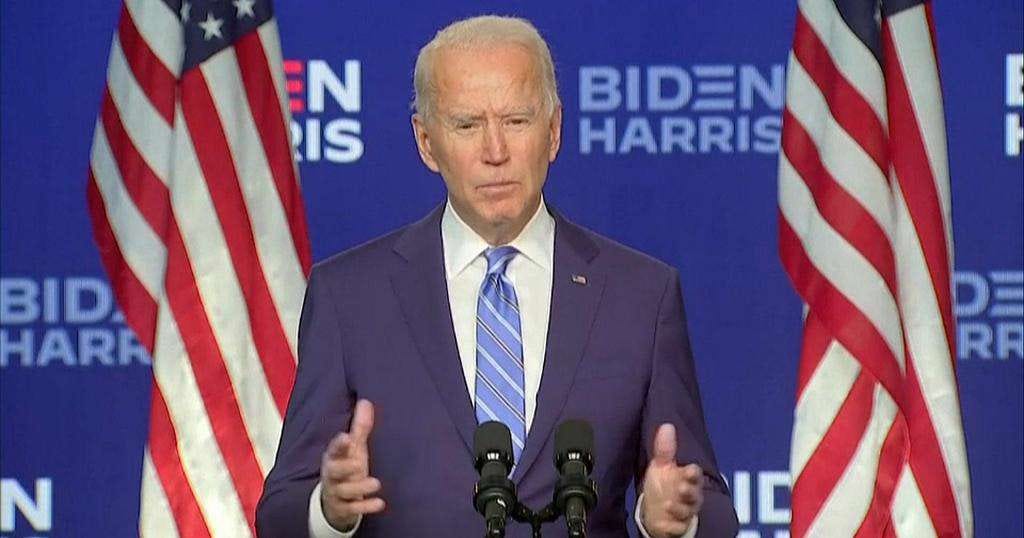

Biden Starts Infrastructure Bet With U.S. Far Behind China: President Joe Biden is betting that a multitrillion-dollar economic plan centered around infrastructure spending will do more than bolster an American economy hammered by the coronavirus pandemic: It will ensure his country’s competitiveness against China for decades to come. Biden’s advisers will present him this week with a detailed proposal for a plan whose cost could touch $3 trillion, according to three people familiar with the deliberations. Infrastructure and climate change have long been described as key efforts in the pending program, and the new details show the administration is eyeing some $400 billion in so-called green spending, according to one of the people. Read More.

“If we don’t get moving, they’re going to eat our lunch,” Biden told lawmakers in a pitch for his proposal shortly after his call last month with Chinese President Xi Jinping. “We just have to step up.”

Central Bank of Erdogan Has Foreign Cash Exiting Turkey: With President Recep Tayyip Erdogan’s sacking of his third central bank governor in less than two years, Turkey’s dominant political leader of the past century has demonstrated yet again his determination to fight the conventions of modern economics. Investor flight drove the lira down as much as 15% on Monday, adding to losses that have kept inflation in double digits for the past 16 months. The currency was little changed in early Tuesday trading. The yield on 10-year lira bonds rose by the most on record and stocks extended losses after their steepest slide since 2013.State lenders didn’t appear to be defending a specific lira level as they did for much of the past two years when they were selling Turkey’s foreign FX reserves, the traders said, asking not to be identified, in line with their companies’ regulations. The yield on Turkey’s 10-year lira bonds rose 21 basis points to 19.1% at 10:46 a.m. on Tuesday after jumping 484 basis points the previous day, the most in the 11 years since Turkey started selling those securities. Stocks slumped 7%, triggering circuit breakers that halted trading twice at the Borsa Istanbul within the first hour of trading. The cost of borrowing the local currency for one week surged to as high as 2,067% on Monday as traders scrambled to get their hands on lira liquidity needed to unwind their long bets. Read More.

“This is a sudden stop in capital flows,” similar to the currency meltdown in 2018, said Robin Brooks, chief economist of the Institute of International Finance in Washington. “The result back then was a deep recession due to tighter financial conditions. It’ll be the same now.”

UK jobless rate falls as workers drop out of labor force: Britain’s jobless rate unexpectedly fell in the three months to January, a change that partly reflected people giving up their job hunt as lockdown measures tightened at the start of the year. The main jobless rate dropped to 5.0% in the three months to January from 5.1% in the final quarter of 2020, in contrast to forecasts in a Reuters poll for a small rise to 5.2%. None of the economists polled had expected a fall. “The latest labor market data are somewhat mixed but show considerable resilience overall,” said Howard Archer, chief UK economist at consultants EY ITEM Club. Part of the drop in the headline unemployment rate was due to high jobless numbers for October alone dropping out of the three-monthly figures. Read More.

Bitcoin

Crypto Is Banned in Morocco, but Bitcoin Purchases Are Soaring: Cryptocurrencies are banned in Morocco, but peer-to-peer bitcoin trading platform LocalBitcoins is reporting all-time trading highs this year. February 2021 was the platform’s “best month ever” in Morocco in terms of trading volumes, approximately $900,000 worth of bitcoin was traded on the platform through the month. LocalBitcoins also saw a 30% increase in user registrations between 2019 and 2020, with over 700 new accounts created. Bitcoin purchases are rising despite a ban on cryptocurrencies in the North African country. In November 2017, Morocco’s Foreign Exchange Office informed the general public that virtual currency transactions were an infringement on foreign exchange regulations and subject to sanctions and fines. Financial regulators continue to view cryptocurrencies with skepticism, even as the country’s central bank investigates the benefits of a government-issued national digital currency (CBDC). Read More.

Billionaire Nandan Nilekani - Indians Should Be Allowed to Own Crypto: Amid concerns over a government ban on cryptocurrency, Indian tech billionaire Nandan Nilekani has come out in favor of the use of crypto in India, calling the sector a new “asset class” for citizens. "We should think of crypto as an asset class and allow people to have some crypto," said Nilekani in a Clubhouse session with crypto evangelist Balaji Srinivasan and venture capitalist Karthik Reddy. He added that the Indian government should also facilitate a way for small and medium businesses in the country to access capital using Bitcoin. Nilekani said that while crypto as a transaction medium won't work as fast as the country's Unified Payments Interface, an instant real-time payment system developed by National Payments Corporation of India, it has "enormous capital." As the co-founder of Infosys, one of the world’s biggest IT and business consulting companies, Nilekani is one of India's highest-profile advocates for crypto. He is also the man behind some of the country's most critical digital projects, such as digital payments network UPI, e-governance and identity system Aadhar, highway toll collection system FASTag, among others. Read More.

First Approved Brazilian Bitcoin ETF Seeks To Raise 500 Million BRL ($90,000,000 USD): Last week, Brazilian-based QR Capital received approval from the Brazilian Securities and Exchange Commission (CVM) to list an exchange-traded fund (ETF) composed solely of bitcoin (BTC), on the São Paulo-based B3 Stock Exchange. The ETF is the first 100 percent BTC exchange-traded fund to be approved anywhere in Latin America, and the fourth to be approved in the G-20 countries. The first three were approved last month in Canada. The U.S. still does not allow crypto ETFs to trade on national stock exchanges. Read More.

Crypto

NFTs Are Music Industry’s Latest Big Hit: After a year with no live performances, musicians are hoping to connect with their fans on the blockchain and make up for lost revenue by selling them nonfungible tokens. Electronic-music artist Justin Blau, known as 3LAU, has fetched $17 million in the past month from NFTs, helped in part by a tokenized release of his three-year-old album “Ultraviolet,” which grossed $11.6 million and briefly held the record for the highest price paid for a single NFT, $3.6 million. Read More.

“It’s a way to monetize your fan base in a way that’s never been possible,” said Mr. Blau, who doesn’t expect the exorbitant prices to last. “I think this technology will definitely change the world, but I’m cautiously optimistic because no one really knows how to value this stuff.”

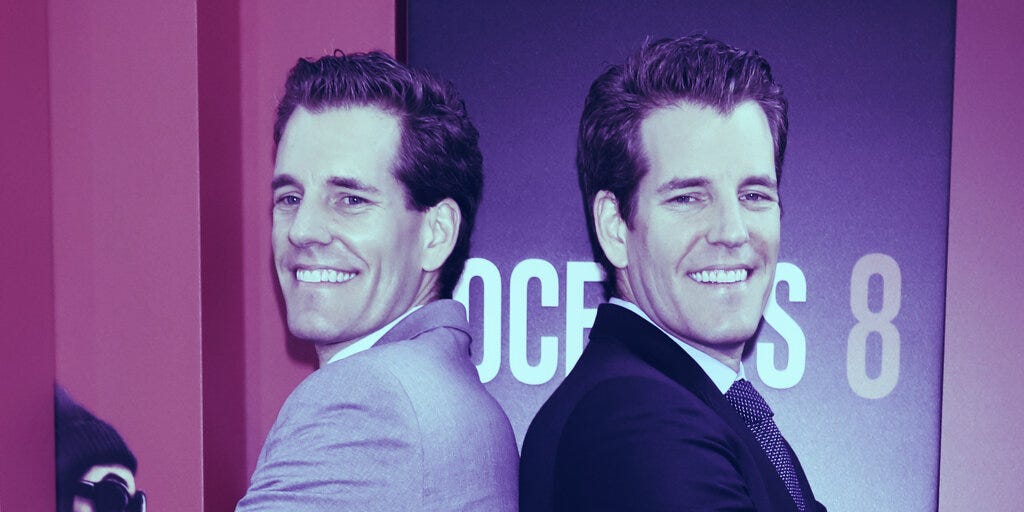

Winklevoss’ Gemini Exchange Goes Big on Gaming, DeFi Tokens: Cryptocurrency exchange Gemini has expanded its roster of supported tokens for trading today, adding seven new tokens including those with use cases in the decentralized finance (DeFi), Web3 infrastructure, and gaming and non-fungible token (NFT) worlds. Today’s new additions include DeFi-related tokens for 1inch Exchange (1INCH) and Bancor (BNT), blockchain infrastructure tokens for SKALE (SKALE), The Graph (GRT), and Loopring (LRC), and gaming-centric tokens Enjin Coin (ENJ) and The Sandbox’s in-game SAND currency. Gemini previously supported custody on ENJ and has now added trading, as well, while the other six tokens are entirely new to the exchange. Enjin Coin’s price has soared 269% in the last 30 days to $2.26 as of this writing. Enjin’s gaming platform allows game developers to implement the benefits of blockchains and NFTs—such as verifiable ownership of digital assets and cross-game asset compatibility— and last month Enjin launched an educational web game with Microsoft that unlocked NFTs for use in the massively popular game, Minecraft. The Sandbox is another game that has been riding the NFT collectibles wave in 2021. Animoca Brands’ open-world creation game sold more than $3 million in virtual LAND properties in February alone, and its SAND in-game currency has surged some 90% in value over the last 30 days. Read More.

Taco Bell to Charmin -10 Big Brands Jumping On The NFT Bandwagon: In recent days, brands have leapt aboard the multi-million dollar NFT bandwagon, with companies ranging from Taco Bell to Charmin minting their own non-fungible tokens. Reactions have ranged from bafflement to weary eye-rolls—but is it so surprising that brands are wholeheartedly embracing the opportunity to engage with their audiences via these unique, collectible tokens? Brand NFTs. Read More.

Media

Watch For This Bitcoin Catalyst Next

Bitcoin Borrowing & Lending Markets with Zac Prince

Repo Market Rates Turn Negative!! Is It Signaling The Next Financial Crisis?

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.