Crypto Download #64

US Shopping Down in Feb; US Import Prices Rise; Small Businesses are Late on Payments But Hanging On, Stimmy Checks are One Way to Put Bitcoin in the Hands of Americans, ETH Could Scale 100x

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Health experts pore over AstraZeneca safety data as Europe reels from vaccine suspensions

World's top vaccine maker India criticized at home for exports as infections rise

U.S. Retail Sales Fell 3% in February: U.S. shoppers pulled back sharply on retail spending during February, but a broader economic rebound appears poised to accelerate this spring because of the easing pandemic and another round of government stimulus. Retail sales—a measure of purchases at stores, at restaurants and online—fell by 3% in February compared with the prior month. The decline followed robust January sales that were propelled by stimulus payments to households and other impact from the December pandemic-relief package. January sales advanced a revised 7.6%, up from the earlier estimate of a 5.3% increase. U.S. households broadly are sitting on cash potentially ripe for spending, as they boosted savings during the pandemic. Research has suggested that Americans have spent previous rounds of direct cash payments on bills, food and other goods and to pay down debt, while also stashing away some of the funds. Fiscal stimulus “is definitely adding purchasing power to households,” said Jack Kleinhenz, chief economist at the National Retail Federation. “The question is how much will actually be spent” in the coming months, he said. Read More.

“The bottom line is all about the pandemic. Once the pandemic is behind us, you’re likely to see a big rebound in consumer services,” said Mr. Brown, of Raymond James. “People are likely to go nuts, we think, in terms of wanting to get out there and do stuff.”

U.S. import prices rise strongly in February, boosted by crude oil, commodities: U.S. import prices increased strongly in February, boosted by higher costs for crude oil and commodities, strengthening expectations for an acceleration in inflation this year. The Labor Department said on Tuesday import prices rose 1.3% last month after surging 1.4% in January. Economists polled by Reuters had forecast import prices, which exclude tariffs, advancing 1.2% in February. In the 12 months through February, import prices accelerated 3.0%. That was the largest gain since March 2012 and followed a 1.0% rise in January. Oil prices have recovered to pre-pandemic levels amid expectations of a pick-up global economic growth, but the COVID-19 pandemic is caused disruptions to the supply chain, boosting prices of commodities. Inflation is expected to gain steam this year, driven by massive fiscal stimulus and the reopening of the domestic economy as vaccinations slow the spread of the coronavirus. But excess capacity in the labor market will probably stop price pressures from spiraling out of control. Imported fuel prices surged 11.1% last month after advancing 9.0% in January. Imported food prices shot up 1.6%. Excluding fuel and food, import prices climbed 0.3%. The so-called core import prices rose 0.9% in January. Read More.

U.S. Small Businesses Are Holding Off the Debt Apocalypse. For Now: Government relief programs and lenders’ forbearance have kept U.S. small businesses from defaulting on their debt in masse as revenue slumped during the pandemic crisis. For now, businesses are sitting on enough cash to pay their bills. Cash balances were up as much as 41% at their peak in late August, as the federal Paycheck Protection Program pumped out forgivable loans to keep small firms afloat. Those balances were still up by 35% through late September. Meantime, business owners have cut their expenses, often by slashing payrolls, and many lenders and landlords have been lenient with rent and other bills. Among small firms nationwide, 18.3% of business payments were past due in January, a modest increase from 17.7% in February 2020, the Urban Institute said in a report using Dun & Bradstreet data. Somewhat more affected were two big cities on the coasts, New York and San Francisco, which saw increases of 2.5 and 4.3 percentage points. Despite the relatively strong credit metrics, the future remains uncertain for a sector that employed almost half the country’s private workforce and was a growth engine of the economy before Covid-19 hit. Read More.

“Shrinking payroll, reducing physical space, and other accommodations are painful for small businesses and may constrain their ability to grow,” the Urban Institute, a nonprofit research group, said in its report. “It’s also unclear what will happen when creditors cease to offer flexibility for businesses on repayment of their built-up amounts owed.”

Congo Republic Offers $182 Million of Bonds to Help Repay Debt: The Republic of Congo offered 100 billion CFA francs ($182 million) of five-year domestic bonds to help repay debt and fund development projects, Finance Minister Calixte Nganongo said. The sale of the securities forms part of a plan to revive growth in the central African nation, after a six-year economic contraction, Nganongo said in a phone interview Tuesday from Brazzaville, the capital. The economy is forecast to expand this year for the first time since 2015, according to the International Monetary Fund. The bonds, which have a 6.25% coupon, will help fund the building of new infrastructure including roads and schools, he said.

“The offering aims to finance the projects which are intended to contribute to economic and social development in the country, as well as the partial payment of domestic debt,” Nganongo said.

Bank of Japan Governor Stresses Need to Prepare for Digital Currency Launch: Haruhiko Kuroda, governor of the Bank of Japan (BOJ), has said the central bank must “prepare thoroughly” for the possible future need to issue a digital yen. The BOJ has no plans at present for central bank digital currency (CBDC) launch, but Kuroda believes it must be prepared for a change in circumstances that could necessitate one. Neighboring China's plan to issue its digital yuan is firmly established, with the project in the public trial stages. South Korea is working on a digital coin too, having published research for a CBDC project and planning tests later this year. The BOJ will begin experiments later this spring. Read More.

China’s Economic Activity Soars but Jobless Rate Hits Ceiling Set by Beijing: Chinese economic activity surged in the first two months of 2021 when compared with the same coronavirus-battered period last year, though the picture was less rosy when weighed against growth momentum in the final months of 2020. Economic data released Monday by China’s National Bureau of Statistics showed industrial production, consumption, investment and home sales in January and February all jumping by more than 30% from the same period a year earlier, when the Chinese economy was largely shut down to contain the fast-spreading coronavirus. Industrial output in the January-February period rose 35.1% from a year earlier while retail sales, a major gauge of China’s consumption, expanded 33.8% over that same time frame. Both indicators topped economists’ expectations. Home sales by volume, an indicator of demand, soared 143.5% in the first two months of 2021 from a year earlier, while property investment by value gained 38.3% over the same stretch. Read More.

Xi Jinping Warns Against Tech Excess in Sign Crackdown Will Widen: China’s top leader warned that Beijing will go after so-called “platform” companies that have amassed data and market power, a sign that the months-long crackdown on the country’s internet sector is only just beginning. President Xi Jinping on Monday chaired a meeting of the communist party’s top financial advisory and coordination committee, ordering regulators to step up oversight of internet companies, crack down on monopolies, promote fair competition and prevent the disorderly expansion of capital. Internet companies need to enhance data security and financial activities need to come under regulatory supervision. The unusually strongly worded comments from Xi and his lieutenants suggest Beijing is preparing to amplify a campaign to curb the influence of its largest and most powerful private corporations, which has so far centered mainly on Jack Ma’s Alibaba Group Holding Ltd. and its affiliate Ant Group Co. The term platform economies could apply to a plethora of mobile and internet giants that offer services to hundreds of millions, from ride-hailing behemoth Didi Chuxing to food delivery giant Meituan and e-commerce leaders like JD.com Inc. and Pinduoduo Inc. Read More.

Bitcoin

Americans ready to pour $40 billion into bitcoin and the stock market as stimulus checks arrive: Another round of stimulus checks could provide a shot in the arm for stocks and, especially, bitcoin, according to a survey released Monday by Mizuho Securities. The poll of 235 individuals who expect to receive checks courtesy of the latest round of COVID-19 relief signed into law by President Joe Biden found that two out of five recipients plan to invest at least some part of the proceeds into bitcoin and stocks. Based on the responses, around 10% of the total gross payments, or around $40 billion of the $380 billion in direct checks, could be allocated to the world’s most popular digital asset and stock purchases. Read More.

eToro to Go Public Via Merger With SPAC; Combined Firm to Have $10.4B Value: Trading platform eToro said Tuesday it will become publicly traded via a merger with a special purpose acquisition company (SPAC). Through a merger with FinTech Acquisition Corp. V, the combined entity will have a implied equity value of about $10.4 billion, reflecting an implied enterprise value for eToro of about $9.6 billion. The deal includes $250 million in gross proceeds from FinTech V's cash in trust from a fully committed private placement in public equity at $10.00 per share that will close at the same time as the merger. Bakkt, the cryptocurrency exchange launched by Intercontinental Exchange (ICE) in 2018, is also expected to carry out a SPAC merger later this year, valuing the combined entity at $2.1 billion. Read More.

Oakland Athletics Baseball Team Accepting Bitcoin for Private Suites: The Oakland Athletics major league baseball team, known as “the A’s,” is temporarily allowing fans to pay in bitcoin for seasonal use of a private suites. Fans of the Oakland, Calif., team can now pay $64,800 in fiat currency or one bitcoin, worth roughly $56,155 at press time, for a private suite that seats up to six people. Read More.

“The price of a season suite may fluctuate depending on when it’s purchased, which adds to the excitement,” said A’s President Dave Kaval. “We invite our fans to become the first bitcoin suite holders in sports.”

New Details About India Banning Cryptocurrency Emerge — Crypto Community Sees Mixed Messages: The Indian crypto community is closely watching whether the government will ban cryptocurrencies, including bitcoin. A cabinet note regarding cryptocurrency legislation is being finalized and will soon be submitted to the cabinet. The latest information regarding the Indian crypto ban comes from Reuters which reported Sunday night that “India will propose a law banning cryptocurrencies, fining anyone trading in the country or even holding such digital assets.” The publication cited an unnamed senior government official who claims to have direct knowledge of the plan. He said that bill “would criminalize possession, issuance, mining, trading and transferring crypto-assets.” Read More.

South Korea's Regulator Threatens Bitcoin Startups With Jail: South Korea has beefed up its cryptocurrency regulations, with new laws on financial reporting for businesses involved in the industry set to be introduced on March 25. The amendment to financial reporting rules mandates that all cryptocurrency businesses must now file records of their transactions with the country’s Financial Intelligence Unit—its anti-money laundering watchdog. Startups will have six months to comply with the new regulations—and non-compliance could result in a fine of up to $44,000, or a five-year prison sentence for principal actors. Read More.

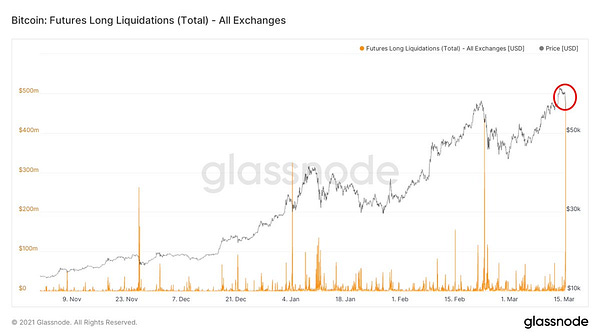

Record Breaking $1 Billion Bitcoin Futures Liquidation Sinks Markets: If you thought the market’s bloodletting was over (in this cycle anyway), we have bad news for you. The crypto pull back continued overnight and into Tuesday morning. Bitcoin is down 4.5% over the last 24 hours according to Nomics, racking up its second consecutive day of losses. From the highs of $61,500 hit on Sunday, Bitcoin traded as low as $53,000 in the last 24 hours, representing more than a 10% slide. According to a tweet from Glassnode co-founders Jan & Yann, there were $500 million liquidations of Bitcoin long positions - bets that the price would go up - in one hour. That was the most that has ever been liquidated, according to Glassnode. The founders chalked up the massive losses to “excess greed in the system.” But others pointed out that the losses were even greater than that. Exchange data company Bybt reported that losses were north of $1 billion. Read More.

Crypto

Solution to scale Ethereum '100X’ is imminent and will get us through until Eth2: Ethereum co-founder, Vitalik Buterin, believes the network is on the verge of scaling by a factor of 100, predicting the Optimism will release its layer-two solution in the coming weeks. Speaking on the Tim Ferriss podcast, Buterin noted Eth2’s developer are focused on working toward the chain merge with Ethereum, and are confident that layer-two solutions can support the network until sharding (breaking chain into smaller chains in order to free up computation) is developed. Rollups are second-layer solutions that process and store transaction data on a designated sidechain, before bundling batches of transactions together onto Ethereum’s mainnet. The solutions are designed to mitigate Ethereum’s scaling woes, where fierce competition for bandwidth on the Ethereum mainnet has resulted in skyrocketing fees. Read More.

“Rollups are coming very soon,” he said, adding: “we’re fully confident that by the time that we need any more scaling of that, sharding will have already been ready for a long time by then…The thing to remember is that if you have rollups, but you do not have sharding, you still have 100X factor scaling, right? You still have the ability for the blockchain to go up to somewhere between 1,000 and 4,000 transactions a second, depending on how complex these transactions are,” said Vitalik Buterin.

Sam Bankman-Fried’s FTX to purchase Miami Heat arena naming rights: Cryptocurrency exchange FTX is preparing to finalize a deal to sponsor the home of National Basketball Association team the Miami Heat — a move that will grant the exchange exclusive naming rights for the 19,600 arena. Read More.

“Miami-Dade County is getting closer to signing a cryptocurrency company to replace American Airlines as the naming-rights sponsor of the Miami Heat’s downtown arena, according to several sources — a deal that would deliver the NBA its first venue tied to bitcoin and other electronic currencies,” reads the report.

Can NFTs Change How We Value Music?: Last week, the Tennessee rock band Kings of Leon announced they’d be releasing their new album, When You See Yourself, as a non-fungible token (NFT) —a digital, blockchain-based collectible. In this case, it works a little like a deluxe edition or a bundle; the NFT comes packaged with a set of MP3s and an animated version of the cover art, as well as a physical copy of the vinyl. These perks aren’t nothing, but it’s tempting to view the whole rollout as a cynical attempt to cash in on the hype around NFTs and get the band widespread media attention—and it certainly did. NFTs are everywhere right now, from the NBA to Taco Bell, and artists like Grimes, Yaeji, and Toro Y Moi have been testing the waters. But behind the early-stage gimmickry is a genuinely intriguing question about the future of artist economies, and the ways we think about how music is owned. The music business has always been about assigning value to something that fundamentally resists precise valuation—who’s to say how much our favorite songs are worth? For the better part of the last decade, the answer has been streaming services like Spotify and Apple Music, which offer access to a vast library of recorded music for relatively low fees. Their implicit pitch: access has replaced ownership. (When was the last time you purchased a song through the iTunes Store?) It’s a business model that’s responsible for revitalizing the industry; the decline of physical media sales left a massive hole in the market, and streaming services walked right in. Per the Recording Industry Association of America’s most recent year-end report, streaming now accounts for 83% of the entire industry’s revenue. Read More.

Media

How NFTs Are Revolutionizing How Creators Make Money - Ep.220

The Sovereign Individual Pt 1 - Bitcoin: The Ultimate Offshore Bank with Robert Breedlove

Vitalik Buterin - Creator of Ethereum, Talking NFTs & More Ft. Naval Ravikant | The Tim Ferriss Show

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.

![Vitalik Buterin Ethereum [ETH] Founder | Calls Craig ... Vitalik Buterin Ethereum [ETH] Founder | Calls Craig ...](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F57130ed0-1f35-4036-bd3c-8d57accca814_678x381.jpeg)