Crypto Download #63

712,000 New Unemployment Claims, ECB Increases Bond Buying, China Testing Digital Yuan with Russia's Digital Ruble Prototype in the Works, Israeli Pension Fund Invests in BTC, NFT sold for $69M

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Vaccines Fail to Check Covid Wave Overwhelming Europe’s East

Pfizer-BioNTech Covid Vaccine Blocks Most Spread in Israel Study

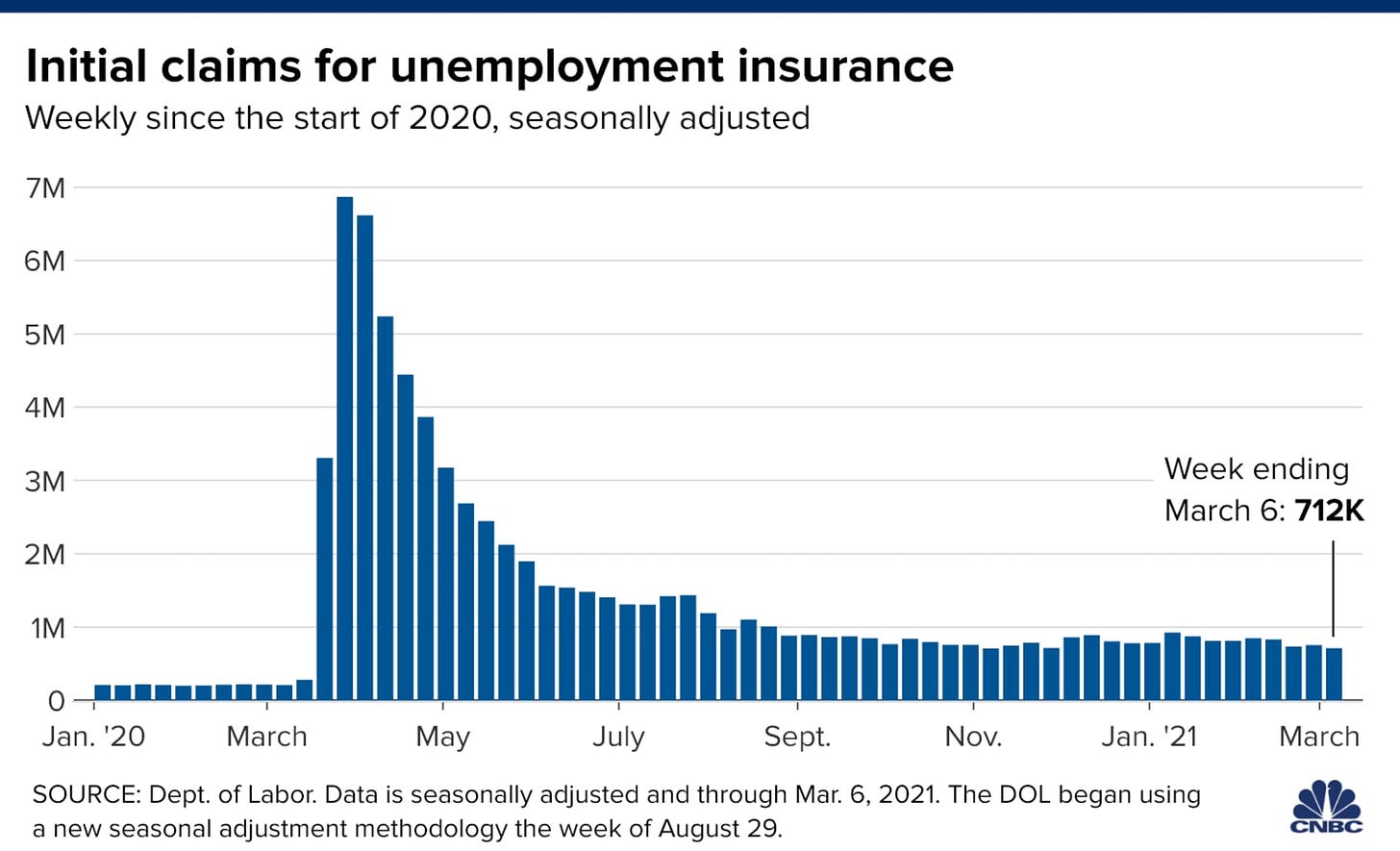

Weekly jobless claims total 712,000 vs. 725,000 expected: Weekly jobless claims rose less than expected last week, but remained above pre-pandemic levels, as the U.S. economy tried to shake off impacts from Covid-19 and employers waited to see if President Joe Biden’s $1.9 trillion stimulus would become law. The Labor Department on Thursday reported that first-time filings for unemployment insurance in the week ended March 6 totaled a seasonally adjusted 712,000, below the Dow Jones estimate of 725,000. Filings for state jobless aid, seen as a proxy for layoffs, have slowed in recent weeks but remain firmly above pre-pandemic levels. The pre-Covid record for first-time applicants was 695,000. The four-week moving average, which smooths out fluctuations in weekly numbers, was 759,000. Read More.

House passes $1.9 trillion Covid relief bill, sends it to Biden to sign: Here’s what’s in the bill.

It extends a $300 per week jobless aid supplement and programs making millions more people eligible for unemployment insurance until Sept. 6. The plan also makes an individual’s first $10,200 in jobless benefits tax-free.

The bill sends $1,400 direct payments to most Americans and their dependents. The checks start to phase out at $75,000 in income for individuals and are capped at people who make $80,000. The thresholds for joint filers are double those limits. The government will base eligibility on Americans’ most recent filed tax return.

It expands the child tax credit for one year. It will increase to $3,600 for children under 6 and to $3,000 for kids between 6 and 17.

The plan puts about $20 billion into Covid-19 vaccine manufacturing and distribution, along with roughly $50 billion into testing and contact tracing.

It adds $25 billion in rental and utility assistance and about $10 billion for mortgage aid.

The plan offers $350 billion in relief to state, local and tribal governments.

The proposal directs more than $120 billion to K-12 schools.

It increases the Supplemental Nutrition Assistance Program benefit by 15% through September.

The bill includes an expansion of subsidies and other provisions to help Americans afford health insurance.

It offers nearly $30 billion in aid to restaurants.

The legislation expands an employee retention tax credit designed to allow companies to keep workers on payroll.

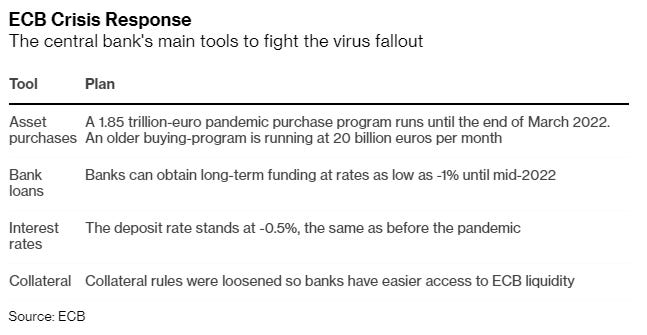

ECB Said to Agree Risks to Outlook Have Become More Balanced: European Central Bank President Christine Lagarde will say at her press conference on Thursday that the risks to the economic outlook have become more balanced. Speaking after the Governing Council’s policy meeting, she’ll present updated projections for growth and inflation that will be broadly unchanged compared to the previous set in December. Rising yields are driven partly by the speedy U.S. economic recovery from the pandemic, which has boosted inflation expectations. In contrast, the euro zone is mired in extended pandemic lockdowns and slow vaccinations. The economy is likely to contract this quarter. Read More.

VP Take: Rising yields are not due to a speedy recovery. Rising yields are due to massive monetary and fiscal stimulus about to come online while economic productivity is down and there’s unprecedented unemployment. Plus, global supply chains are in flux. Central bankers are out of ammo and their backs are against the wall, so what do they tell the public…the opposite of the truth.

ECB Pledges to Ramp up Buying Speed to Contain Bond-Yield Impact

Romania Central Bank Resumes Bond-Buying After Seven-Month Pause

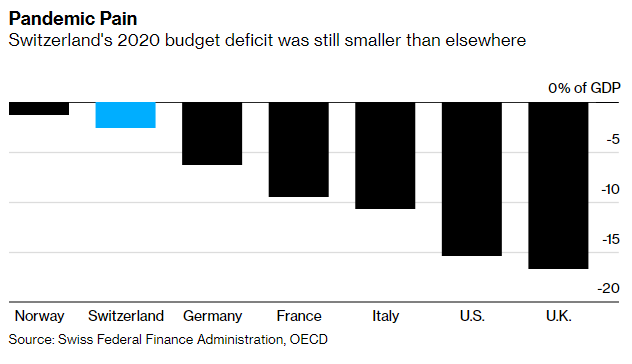

Switzerland Warns of Significant Rise in Debt Due to Pandemic

Death of 60/40 Portfolio Makes Returns Harder for Funds: Two of the world’s largest sovereign wealth funds say investors should expect much lower returns going forward in part because the typical balanced portfolio of 60/40 stocks and bonds no longer works as well in the current rate environment. Singapore’s GIC Pte and Australia’s Future Fund said global investors have relied on the bond market to simultaneously juice returns for decades, while adding a buffer to their portfolio against equity market risks. Those days are gone with yields largely rising. Brake said funds like hers will have to work harder to diversify their portfolios to seek out returns. She cited six major ways in which markets have changed with the pandemic, including increased regulatory intervention, higher inflation risks, additional drivers of performance and more “fragile” markets. Read More.

“You can’t hide in the corner and not invest any more because we have to get our returns and I don’t think it’s the kind of environment where we should be doing that…“As a long-term investor, we have some concerns about the use of stimulus,” he said. “We tend to like the use of capital and money that goes toward building long-term growth, long-term structural factors, rather than using the money to spend…“This is a chronic issue,” said Lim. “It is going to stay with us for a long time and we are likely to have occasional flare-ups, just like any chronic disease. You have to manage it properly.”

Bank of Russia Eyes Digital Ruble Prototype in Late 2021: Russia’s central bank is planning to showcase a prototype for its ruble-backed digital currency later this year, according to its deputy chairman, Alexey Zabotkin. Zabotkin explained the prototype would be available for people to “kick its tires,” but won’t support any real money transactions. Read More.

Chinese banks pilot digital yuan at Shanghai department stores: Shanghai’s New World City and New World Daimaru Department Store, and food caterer Taikang Food Store handled thousands of digital yuan transactions over the past weekend. As part of the trial, the retailers featured digital yuan payments as part of a sales campaign in conjunction with International Women’s Day. Brand director of Shanghai New World Li Wei said that the firm reached out to commercial banks to offer discounts as part of the campaign. Read More.

Bitcoin

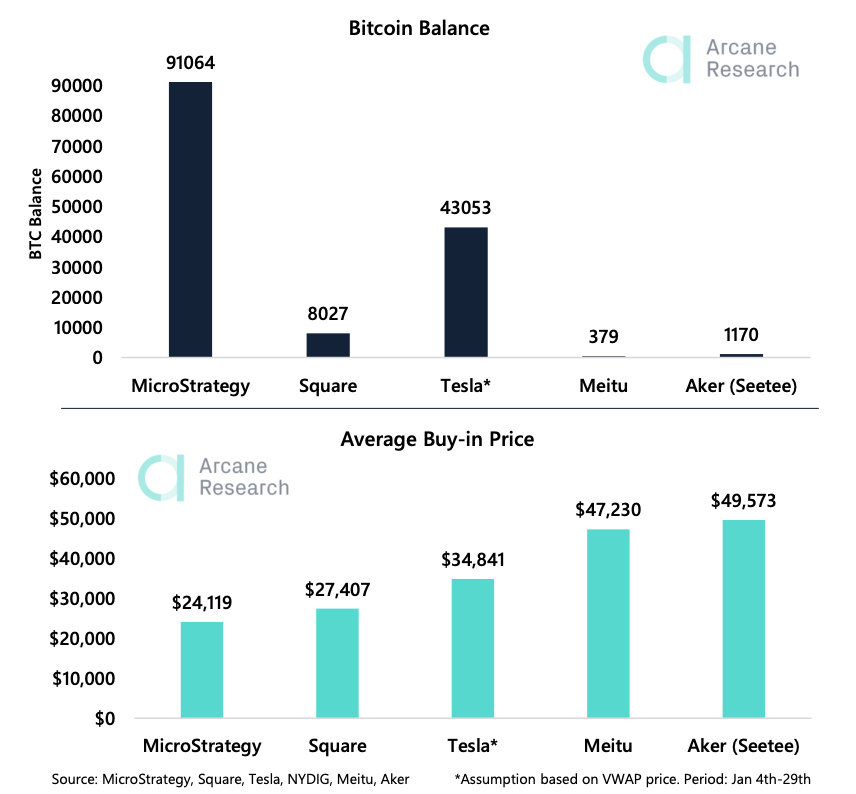

Bitcoin on the Balance Sheet? Corporate Buying Might Become a Global Trend: Bitcoin and ether purchases by companies in Scandinavia and Hong Kong are fueling speculation a wave of non-U.S. corporate treasurers might follow MicroStrategy, Tesla and Square into buying cryptocurrencies, according to a new report by the Norwegian analysis firm Arcane Research. The new corporate buyers appear intent on keeping the cryptocurrencies for the long term “and see further upside potential in bitcoin.” MicroStrategy, led by CEO Michael Saylor and based in Virginia, holds about 91,064 BTC purchased over the past three months, now worth about $5 billion. Meanwhile the U.S. electric-vehicle maker Tesla, headed by billionaire Elon Musk, bought about $1.5 billion worth of bitcoin in February. Read More.

Israeli Pension Giant Put $100M Into Grayscale Bitcoin Trust: Altshuler Shaham is one of the largest investment houses in Israel, with over $50 billion in assets under management. The firm made the investment into GBTC in the second half of last year, when bitcoin was trading at around $21,000. The revelations come at a time when institutional investors are scrambling to get exposure to cryptocurrency, either directly or at arm’s length via funds like Grayscale’s. Read More.

“Altushler has an alternative assets department that has ETH and BTC wallets. They were active in the past at some degree, and are looking into space again,” the source said.

Planned ETF Would Invest in Grayscale’s GBTC to Sidestep SEC’s Crypto Reluctance: A new exchange-traded fund (ETF) proposal seeks a way to allow institutional investors to get involved in the world of cryptocurrency even though the U.S. has so far blocked all attempts to list a bitcoin ETF. According to a prospectus filed with the U.S. Securities and Exchange Commission on Tuesday, the Simplify U.S. Equity PLUS Bitcoin ETF would invest in cryptocurrency indirectly via the Grayscale Bitcoin Trust, as well as equity securities of U.S. companies. Up to 15% of the fund, from New York-based Simplify Exchange Traded Funds, would be invested in bitcoin, solely through the $35 billion Grayscale Bitcoin Trust, with the remainder in equities. If approved, the ETF would trade on the Nasdaq under the ticker “SPBC,” and have a management fee of 0.5%. BNY Mellon would be the ETF’s administrator, transfer agent, asset custodian and accountant. Read More.

Crypto

Crypto Lender BlockFi Raises $350M at a $3B Valuation: Investors in the Series D funding round valued the company at $3 billion, BlockFi announced Thursday. The round was co-led by Bain Capital Ventures and joined by a slew of others. BlockFi is looking to cement itself as one of the leading lenders in the cryptocurrency industry, providing both trade execution services for institutions and opportunities for retail investors to get yield on their bitcoin holdings. BlockFi currently has $10 billion in outstanding loans, $15 billion in total assets and has been “operating profitably for several months,” BlockFi CEO Zac Prince told CoinDesk in an interview. The latest injection of capital will go toward doubling BlockFi’s 500-person team by the end of 2021, launching a bitcoin rewards credit card in the second quarter and expanding the focus of its retail products to markets outside the U.S., said Prince. Read More.

Gensler confirmation as SEC chair would be good for crypto, says Hester Peirce: Hester Peirce of the United States Securities and Exchange Commission is well-known as a regulator who has shown consistent support for digital assets, so much so that her moniker "crypto mom" has become unshakeable. The Senate Banking Committee has now voted 14-10 in favor of Gensler's nomination being sent to the Senate floor, after two Republicans joined ranks with 12 Democrats to support the choice. Peirce underscored Gensler's recent experience teaching courses on blockchain at the Massachusetts Institute of Technology, noting that he's been “surrounded by people who are enthusiastic about this technology.” In her view, Gensler understands the positive potential of the industry, as well as the need for more clarity in order to facilitate its development. Not having to convince him of these things will be “very helpful,” she said. Read More.

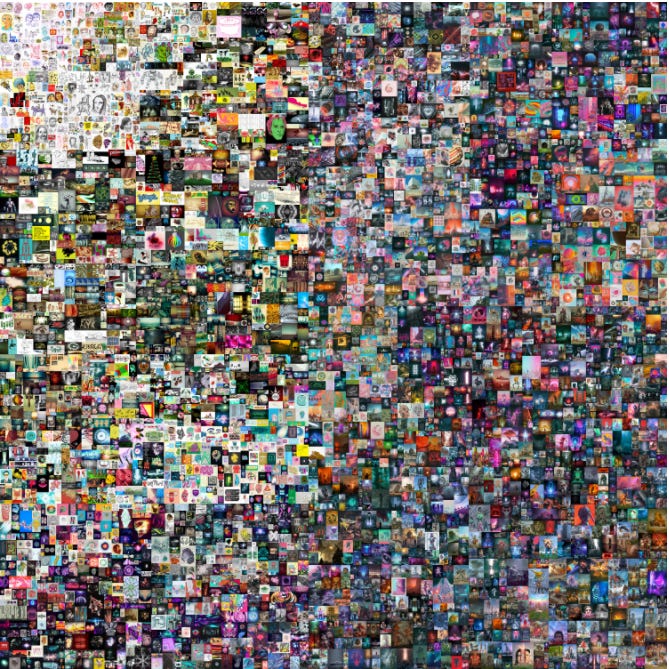

Beeple NFT Artwork Sells for $69.3 Million in Christie’s Auction: Crypto artist Beeple, real name Mike Winkelmann, has sold an NFT collection of digital artwork for $69.3 million at Christie's auction house, breaking records in the digital art world. Read More.

Tether tokens go live on Ethereum competitor Solana blockchain: Stablecoin issuer Tether has announced that USDT tokens are launching March 9 on the Solana (SOL) blockchain. Tether's chief technical officer said that the integration with the layer 1 blockchain promises to support a wide array of projects in the Decentralized Finance, or DeFi, sector and other Web 3.0. activities. Solana is being pitched as a competitor to Ethereum, with the hope of drawing DeFi actors into its network as they wait for the full benefits of Eth2 to finally kick in. According to Tether, Solana will enable users to transact USDT at speeds higher than 50,000 transactions per second. It also claims that transaction fees could be as low as $0.00001 each and that this lower-cost, higher-speed alternative to Ethereum will provide a boost to new applications and projects in the DeFi space. Read More.

Media

BTC016: Bitcoin Super-Cycle w/ Dan Held

The Federal Reserve & Wealth Inequality | Karen Petrou | Pomp Podcast #508

Polkadot: A Bet Against Maximalism (w/Gavin Wood and Sebastian Moonjava)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.