Crypto Download #62

Earth to the Global Bond Market...Yields are Spiking, Stage Set for Debt Monetization and Yield Curve Control, The Global Race for Bitcoin Heats Up, Coinbase $100B IPO, BTC Whales & NFT Madness

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Airlines and Travel Groups Urge U.S. to Develop Virus Passport

Recovered Covid patients have been reinfected with new virus strains, WHO says

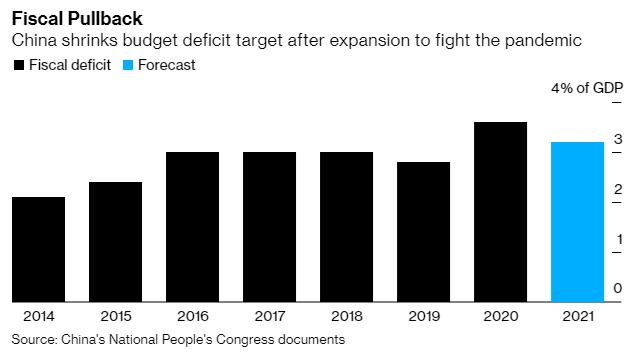

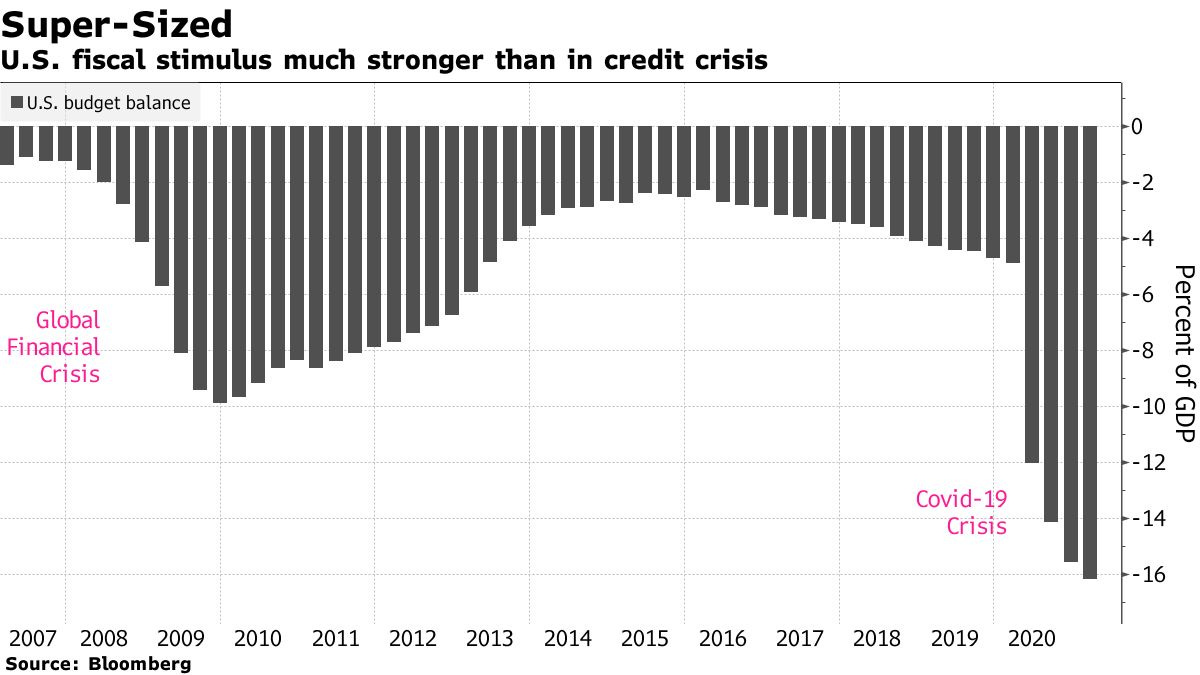

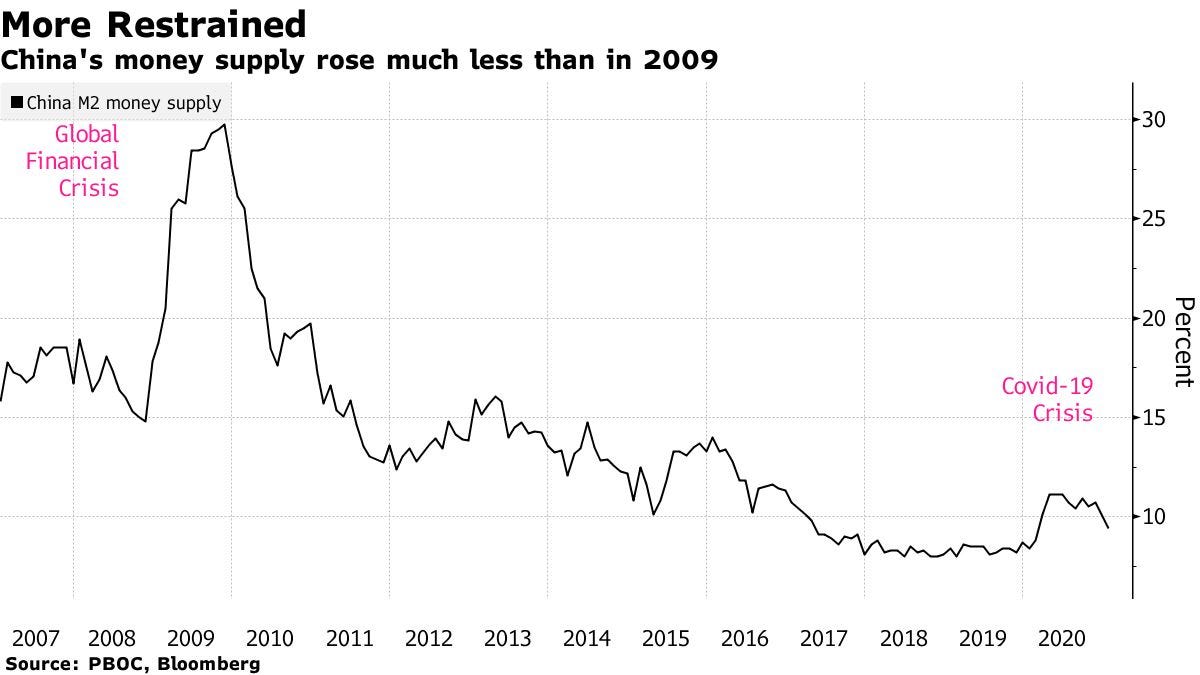

Haunted by 2008, China and U.S. Diverge on Stimulus Plans: The U.S. and China are pursuing divergent economic policies in the aftermath of the coronavirus recession in a role reversal from last time the world economy was recovering from a shock. One of the takeaways from the annual National People’s Congress under way in Beijing is a conservative growth goal, with a tighter fiscal-deficit target and restrained monetary settings. That’s a big contrast with Washington, where President Joe Biden is preparing a second major fiscal package after he gets final approval for his $1.9 trillion stimulus. The widening policy divergence is putting strains on exchange rates and could potentially reshape global capital flows. It stems, in part, from different policy lessons from the 2007-09 crisis.

A stunted and choppy U.S. recovery left key Democrats concluding it’s vital to “go big” on stimulus and keep it flowing. For monetary policy the moral was: “Don’t hold back” and “don’t stop until the job is done,” Federal Reserve Chair Jerome Powell said last week.

China’s leaders have a different take. A massive unleashing of credit growth back then led to unused infrastructure, ghost towns, excess industrial capacity and an overhang of debt. While rapid containment of the pandemic meant the economy didn’t need as much help in 2020, President Xi Jinping and his team are now winding things back to re-focus on longer-term initiatives to strengthen the technology sector and tamp down debt risks. Read More.

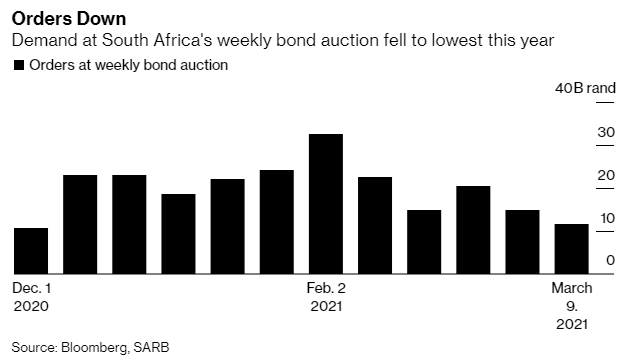

Weakest Bond Sale This Year Raises Flag for South Africa Debt Costs: South Africa’s weakest bond auction this year spells trouble for the government’s plans to reduce debt costs. The lowest demand since Dec. 1 raises concerns that the Treasury may struggle to finance its budget deficit in a macro environment of rising global yields and large outflows from the domestic bond market. While debt issuance is above target for this fiscal year, the government decided to keep sale amounts at current levels, reducing only the extra amount investors may buy through a non-competitive auction, further damping demand. Yields on rand-denominated bonds rose following the debt sale. Those on notes maturing in 2040 were the least in demand at the auction and climbed a sixth day by three basis points to 11.24%. That’s the highest since November. South Africa Reserve Bank has tempered its debt-buying program, meaning there is now less of a backstop for the country’s yields. Data released Friday showed the bank’s holdings of government securities dropped for the first time in a year, suggesting it has been less active in the secondary market. Read More.

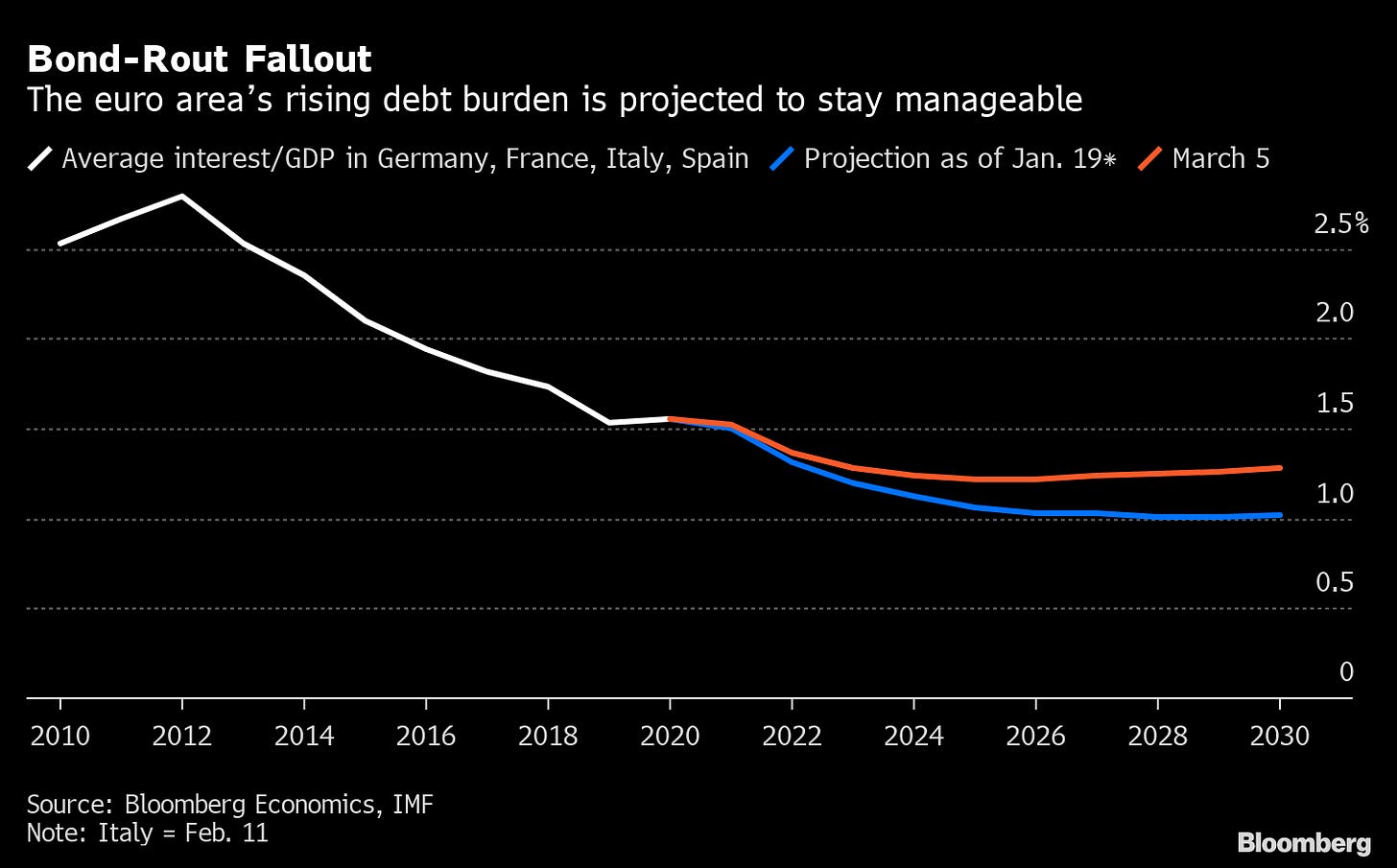

Global Bond Rout Noticeable But Manageable for Euro Area: Euro-area yields have risen sharply since the start of February, raising concern at the European Central Bank. Yet Bloomberg Economics’ analysis gives reason for calm -- borrowing costs would need to jump by four times as much to push debt servicing burdens back to the levels seen in the aftermath of the euro-zone crisis. The main risk would be if higher yields prompted an unhelpful focus on fiscal sustainability at a time when supporting the recovery should be the priority. Read More.

ECB Increases Bond Buying After Warnings About Higher Yields: The European Central Bank stepped up the pace of its emergency bond-buying last week after policy makers issued repeated warnings that a recent rise in yields threatens to derail the region’s economic recovery. Gross purchases settled under its pandemic emergency program totaled 18.2 billion euros ($21.6 billion) in the week ended March 5, compared with 16.9 billion euros a week a earlier. The ECB also said 6.3 billion euros of debt was redeemed, contributing to the relatively muted pace of net buying reported a day earlier. Read More.

Bitcoin

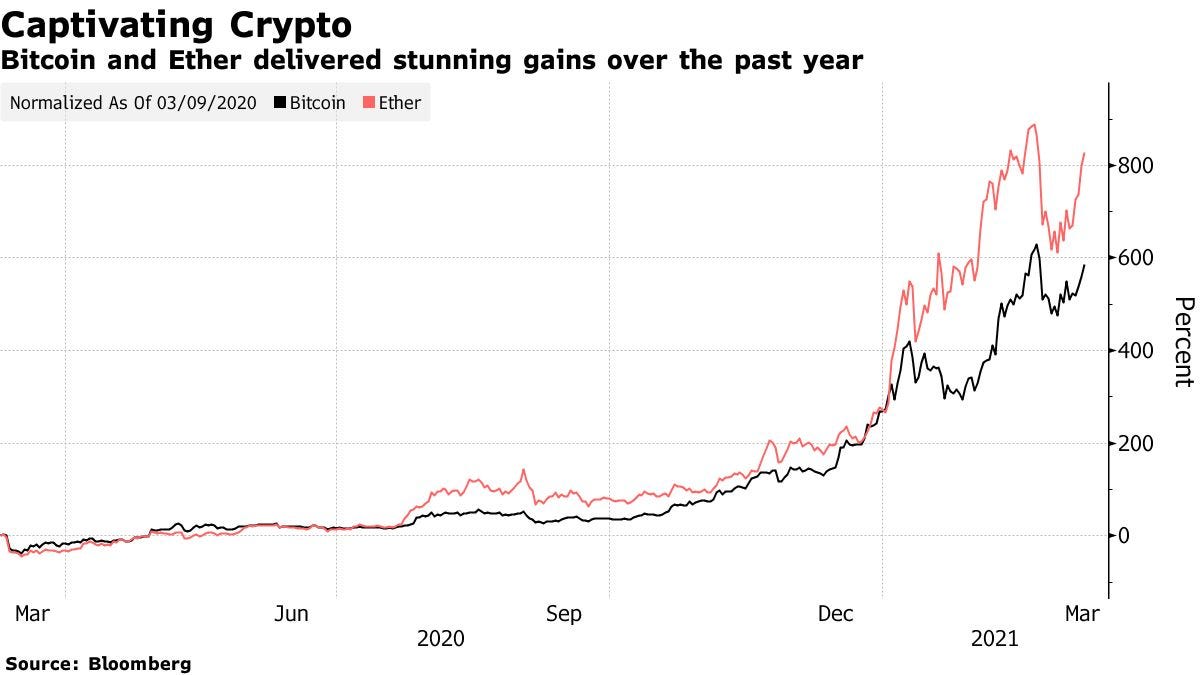

Bitcoin Hits Highest Level in Two Weeks as Big-Money Bets Flow: Bitcoin rallied above $54,000 as the digital currency rides a wave of investor demand for crypto assets. Prices jumped 4.6% in early U.S. trading, reaching the highest in two weeks. While high-flying bets like Tesla Inc. and the ARK Innovation ETF have cratered recently, Bitcoin has steadily climbed on news of more institutional involvement in crypto. On Monday, NYDIG, a provider of Bitcoin-related financial services, announced that it raised $200 million from investors including Stone Ridge Holdings Group, Morgan Stanley, New York Life, MassMutual and Soros Fund Management. NYDIG said Bitcoin adoption among institutions is accelerating, citing data that insurers have more than $1 billion in Bitcoin-related exposure on its platform. The narrative that longer-term investors such as family offices, insurers and corporate treasurers are adding exposure to tokens is controversial but gaining traction. Goldman Sachs Group Inc. recently said it’s seeing substantial demand from institutions as it works to restart its cryptocurrency trading desk. Technical analysis is also supportive of higher prices, according to a report by Evercore ISI strategist Rich Ross, who said Bitcoin could reach $75,000. Read More.

“Bitcoin and Ethereum bullishness are back as more big-money bets keep flowing into cryptocurrencies,” Edward Moya, senior market analyst at Oanda, wrote in an email. “Institutional interest still seems strong.”

Coinbase Is Said to Be Valued at $90 Billion in Private Auction: Coinbase Global Inc. shares changed hands at a roughly $90 billion value last week, in what could be the final chance for investors to trade its private stock before the cryptocurrency exchange goes public. That valuation is based on $350 a share, the price the stock was trading at on the Nasdaq Private Market auction that ended last Thursday. Some of the shares had traded at $375 earlier in the auction, which would roughly value the company at close to $100 billion. The offering will be the first major direct listing, an alternative to a traditional IPO, to take place on the Nasdaq. All such previous listings were on the New York Stock Exchange, including those by Spotify Technology SA, Slack Technologies Inc., Asana Inc. and Palantir Technologies Inc. Started in 2012, Coinbase has raised more than $500 million from backers that include Y Combinator and Greylock Partners, Tiger Global Management, Andreessen Horowitz, Ribbit Capital, Union Square Ventures and co-founder Frederick Ernest Ehrsam III among its biggest shareholders, filings showed. Read More.

Bitcoin’s 2021 Returns Destroy Everything on Wall Street, Goldman Sachs Says: Goldman Sachs, the storied Wall Street firm, didn’t start including bitcoin in its weekly ranking of global asset-class returns until late January, when the largest cryptocurrency quietly appeared atop the chart. But since then, bitcoin’s lead over assets from stocks to bonds, oil, banks, gold and tech stocks and the euro has widened. As of March 4, bitcoin’s year-to-date return, at about 70%, was roughly double that for the next-closest competitor, the energy sector, at about 35%, according to Goldman Sachs’s latest “US Weekly Kickstart” report. Read More.

Norwegian Oil Billionaire Joins the Bets on Bitcoin: Oil billionaire Kjell Inge Rokke has come out strongly in favor of Bitcoin, as he bets the cryptocurrency will prove the best defense against the disruption facing the finance industry and central banking. Rokke’s Aker ASA, which controls oil and oil service companies and has more recently branched out into green tech and renewable energy companies, is setting up a new business, Seetee AS, to tap into the potential of Bitcoin, according to a statement on Monday. The situation is different now compared with the 2017 Bitcoin bubble due to “huge” institutional demand across different industry types and from private banking clients. Read More.

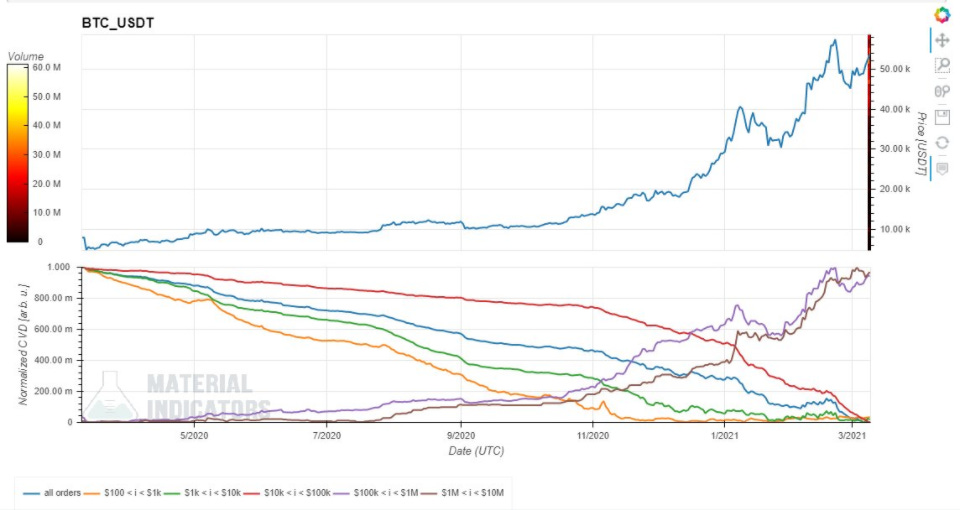

Bitcoin whales 'bought the dip' as orders for $100K or more hit all-time highs: Bitcoin whales and institutions alike have made the most of the recent BTC price "dip" by buying big, data suggests. n stark contrast to orders worth less than $100,000, larger buys are more frequent than ever before in Bitcoin's history. Smaller allocations have plummeted in 2021, matching an existing narrative that institutions are scooping up liquidity on exchanges which surfaced during the recent bull run. Read More.

"The $100k - $1M class is now also about to make a new ATH.” On-chain analytics service Material Indicators noted that buy orders of $100,000 and higher on Binance — the biggest cryptocurrency exchange by volume worldwide — are reaching all-time highs.

Bitcoin mania triggers fundraising rush by Chinese players: Bitcoin mania has fueled a surge in fundraising by Chinese companies seeking to expand their cryptocurrency operations or move into the red-hot sector. From large listed companies tapping public markets to smaller players raising funds from venture capitalists, a jump in cryptocurrency prices and signs of growing acceptance of the technology by mainstream institutions have fed the market boom. Chinese bitcoin mining machine manufacturer, Ebang International Holdings, which debuted on Nasdaq in June, conducted two fundraising rounds in February alone, raking in $170 million, even after a previous offering in November. Newcomer Code Chain New Continent Ltd, a Chinese waste recycling company, raised $25 million in February through a share placement to fund a foray into bitcoin mining. Read More.

In private markets, “competition is white hot and filled with sharp elbows,” said Jehan Chu, managing partner at Hong Kong-based blockchain venture capital firm Kenetic Capital. “Every good-quality funding round is oversubscribed within a week of it being announced.”

China’s beauty app maker Meitu boasts first bitcoin and ether investment for a Hong Kong-listed company: Chinese tech company Meitu, best known for its apps that let users make themselves look slimmer or fairer in their selfies, announced on Sunday that it bought US$22.1 million worth of ether and US$17.9 million worth of bitcoin, a move that its co-founder boasted as unprecedented for a Hong Kong-listed company. Meitu said the purchases were part of a cryptocurrency investment plan previously approved by the company's board of directors, which allows it to make a net purchase of up to US$100 million worth of cryptocurrencies. Investing in bitcoin, which Meitu calls a potentially "superior form to other alternative stores of value such as gold, precious stone and real estate", has become a fashionable treasury management strategy for tech firms. Meitu appears to have bigger ambitions in cryptocurrencies than just treasury ownership. While it said that holding bitcoin forms part of its "asset allocation strategy", holding ether - the native token of the Ethereum blockchain - is "a preparation to enter the blockchain industry". The company said it is currently evaluating the feasibility of integrating blockchain technologies into its overseas businesses, launching ethereum-based decentralised apps (dApps) and investing in blockchain-based projects outside China. Read More.

Crypto

Atari Is Building a Casino in Ethereum’s Virtual World Decentraland: Video game pioneer Atari is building a cryptocurrency casino in “Vegas City”—a district in the Ethereum-based Decentraland virtual world which will emulate the real-life gambling metropolis. Atari has partnered with crypto casino builder Decentral Games for the virtual casino project, which is based around its cryptocurrency $DG. Decentral Games has backing from the Digital Currency Group, the investment giant that oversees Grayscale. Read More.

Taco Bell Rides NFT Hype Train With Collectible Digital Tacos: Fast food chain Taco Bell has just sold its first batch of Taco-themed digital collectibles on NFT marketplace Rarible—and they were snapped up in a flash. The tacos were sold as non-fungible tokens (NFTs), unique digital items that can represent GIFs, artwork or even short video clips. Read More.

“Our Spicy Potato Soft Tacos can now live in your hearts, stomachs and digital wallets,” the company tweeted when the NFTs dropped.

Wonder Woman Crypto Artwork NFTs Lasso Up $1.85 Million: The recent explosion in interest around crypto artwork released as verifiably rare and authenticated non-fungible tokens (NFTs) has yielded another high-dollar sale, this time starring a very recognizable pop culture heroine. Today, crypto art marketplace MakersPlace announced that a sale of NFT artwork featuring DC Comics legend Wonder Woman has generated a total of $1.85 million in gross sales between limited and open edition variants. The artwork hails from veteran comic book artist José Delbo, who drew DC’s Wonder Woman comic from 1976-1981 and was the artist for other comics such as The Transformers and Batman Family. Read More.

Media

What Traditional Investors Think of Bitcoin with Raoul Pal

MacroVoices #260 Lyn Alden: Shifting from Monetary to Fiscal Dominance

Mark Cuban & CZ Fireside Chat! NFTs, DeFi, Bitcoin & More

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.