Crypto Download #61

Increased Jobless Claims Last Week, Market Awaits Fed to Address Rising Yields & Possible Yield Curve Control, Inflation is Here & The Reflation Trades Are Hot, $1M Bitcoin - Kraken CEO

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Zimbabwe Is First African Nation to Allow Use of Indian Vaccine

'When will it end?': How a changing virus is reshaping scientists’ views on COVID-19

A New Study of Athletes’ Hearts After Covid Shows Encouraging Results

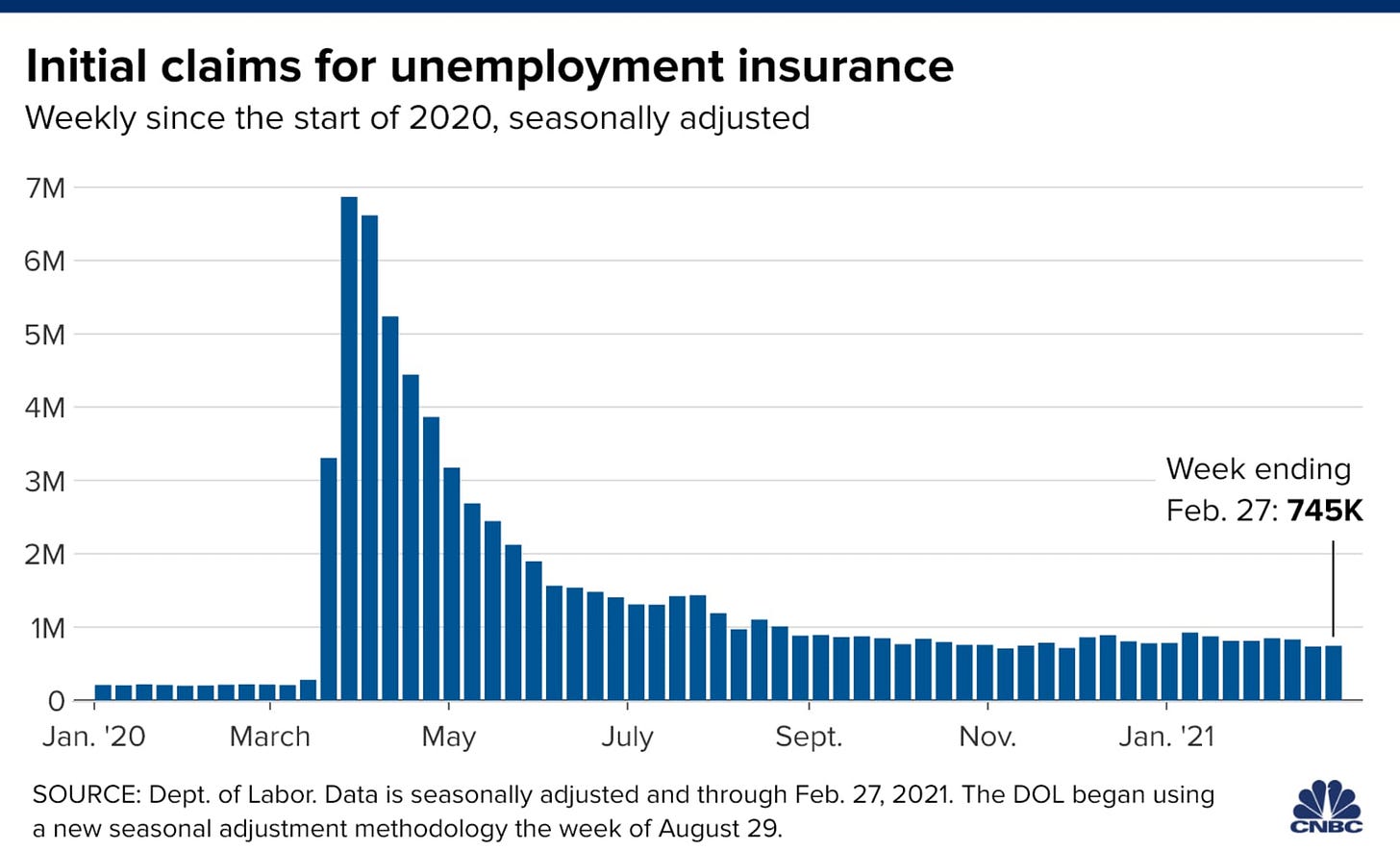

Initial Claims for U.S. Jobless Benefits Rose Slightly Last Week: Applications for U.S. state unemployment insurance rose slightly last week, underscoring the pandemic’s lingering restraint on the labor market recovery. Initial jobless claims in regular state programs totaled 745,000 in the week ended Feb. 27, up 9,000 from the prior week, Labor Department data showed Thursday. Economists in a Bloomberg survey estimated 750,000 claims. Read More.

Powell Likely to Push Back on Bond-Market Doubts Over Fed Policy: Federal Reserve Chairman Jerome Powell will probably seek to convince suddenly skeptical financial markets on Thursday that the central bank will be ultra-patient in pulling back its support for the economy after the pandemic has ended. Rather than trying to cap rising long-term interest rates, Fed watchers expect Powell to use his appearance at a Wall Street Journal webinar to reaffirm the Fed’s determination to meet its revamped employment and inflation goals by keeping monetary policy looser for longer, and to make clear he’d like to avoid a repeat of last week’s disorderly bond market. Read More.

Long-term interest rates have climbed this year -- the yield on the Treasury’s 10-year note was 1.48% Wednesday, up from under 1% at the start of 2021

Powell played down concerns that rising yields would hurt the economy, instead declaring at one point that they were a “statement of confidence” in the outlook

Expectations for the first Fed rate hike to early 2023 or 2024

The central bank is currently buying $120 billion of assets per month -- $80 billion of Treasury securities and $40 billion of mortgage-backed debt

The Fed could also emulate its Australian counterpart and adopt yield curve control, seeking to cap yields of short-dated Treasuries

TIPS ETFs Are Red Hot as Traders Prep for Inflation: Reflation expectations are rising fast, and so is the flow of cash into exchange-traded funds that track inflation-protected bonds. January saw almost $3.5 billion added to ETFs buying bonds that promise to protect against rising prices, the strongest monthly inflow on record. There were similar historic flows into aggregate bond ETFs ($12.8 billion) and municipal bond funds ($2.8 billion). Meanwhile, the exodus from government bond ETFs continued. Investors pulled out more than $3 billion from such funds in January, taking three-month outflows to almost $11 billion. Read More.

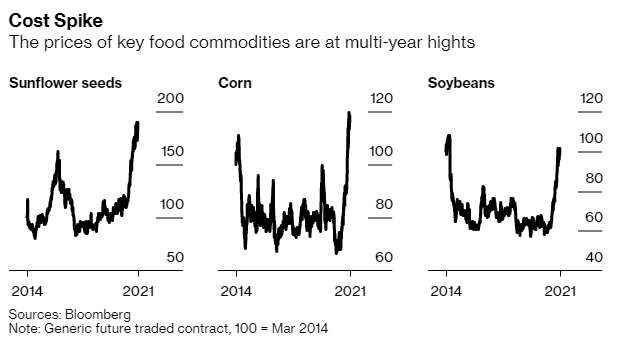

Food Prices Are Soaring Faster Than Inflation and Incomes: Global food prices are going up, and the timing couldn’t be worse. In Indonesia, tofu is 30% more expensive than it was in December. In Brazil, the price of local mainstay turtle beans is up 54% compared to last January. In Russia, consumers are paying 61% more for sugar than a year ago. Emerging markets are feeling the pain of a blistering surge in raw material costs, as commodities from oil to copper and grains are driven higher by expectations for a “roaring 20s” post-pandemic economic recovery as well as ultra-loose monetary policies. Consumers in the U.S., Canada and Europe won’t be immune either as companies — already under pressure from pandemic-related disruptions and rising transport and packaging costs — run out of ways to absorb the surge. The increases might not be immediately obvious to shoppers. Instead of raising the sticker price, retailers may cut back on multi-buy deals or special promotions. Last year, the number of grocery items sold on promotion in the U.S. dropped by 20 percentage points, partly because pandemic-driven logistical challenges squeezed supply. Read More.

“We are experiencing inflation right now as is everybody else," Conagra Brands Inc. Chief Executive Officer Sean Connolly said in an interview. Costs are up for oils, pork and eggs, plus packaging materials like cardboard and steel.

General Mills, the maker of Cheerios, Yoplait and and Blue Buffalo pet food, is also looking at price increases, said Jon Nudi, who leads the North American retail division, at least “in the areas we see significant inflation.”

Bitcoin

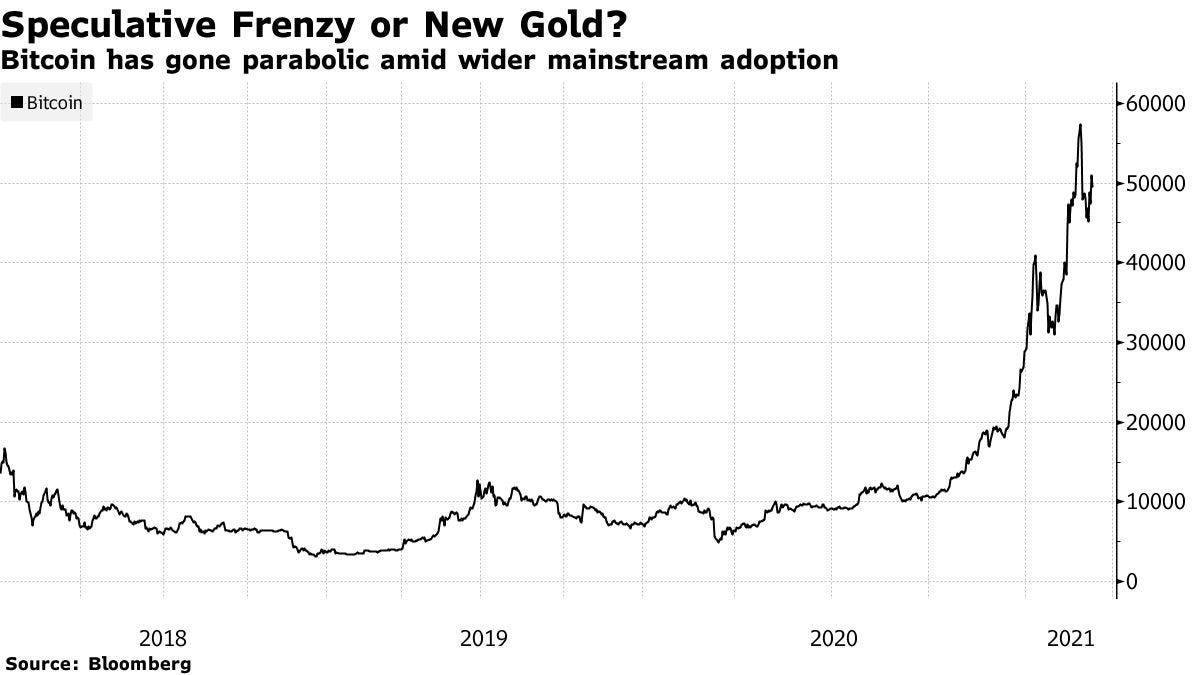

Bitcoin Could Reach $1 Million or More, Kraken CEO Says: As the leader of crypto exchange Kraken, Jesse Powell is bound to be bullish on Bitcoin. Yet he’s projecting a disruptive future that would stretch the imagination of even the most ardent crypto fans. In a Bloomberg Television interview, Powell said Bitcoin could reach $1 million in the next decade, adding that supporters say it could eventually replace all of the major fiat currencies. Read More.

“We can only speculate, but when you measure it in terms of dollars, you have to think it’s going to infinity,” he said. “The true believers will tell you that it’s going all the way to the moon, to Mars and eventually, will be the world’s currency…The dollar is only 50 years old and it’s already showing extreme signs of weakness, and I think people will start measuring the price of things in terms of Bitcoin…If you are buying into Bitcoin out of speculation, you should be committed to holding for five years,” Powell said. “You have to have strong convictions to hold.”

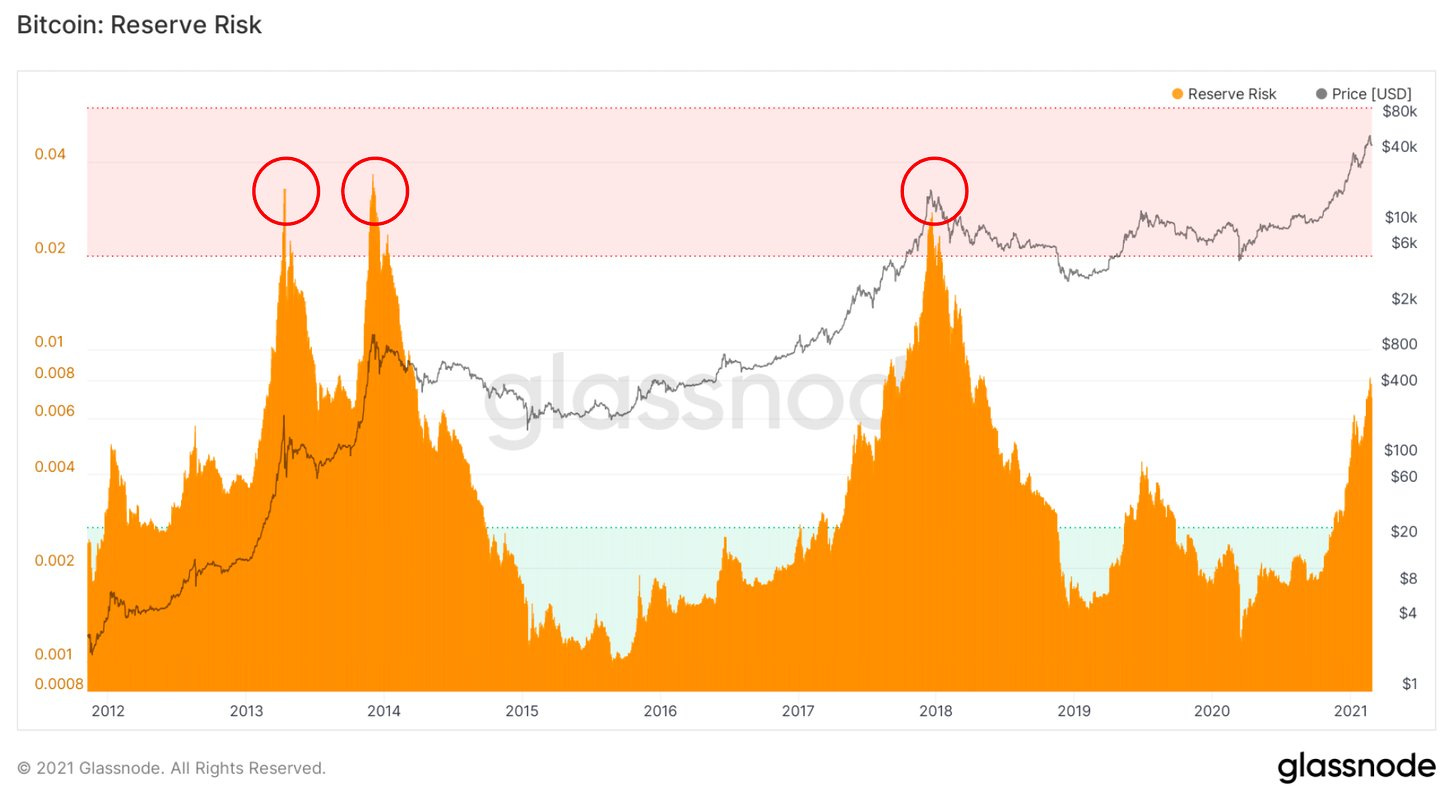

Bitcoin bull run is still in the early stages, key on-chain indicator shows: According to William Clemente, a cryptocurrency analyst, Glassnode's Reserve Risk indicator shows that Bitcoin's rally is still in the early to middle stage. As Clemente explains, the Reserve Risk is defined as price/HODL Bank. The indicator is "used to assess the confidence of long-term holders relative to the price of the native coin at any given point in time." Hence, if the Reserve Risk is still relatively low compared to previous peaks, it shows that Bitcoin is not at risk of nearing a macro top. Currently, the Reserve Risk of Bitcoin is at half the level seen in 2013, 2014, and 2017, when the price of Bitcoin crashed by well over 50% and entered a bear market. Read More.

BitGo Receives NYDFS Approval for New York Trust Charter: Digital asset financial services firm BitGo is coming to New York. After receiving approval from the New York Department of Financial Services (NYDFS) for a New York trust charter, BitGo plans to hold crypto funds in the state and offer custody as a service to large New York-based financial institutions, said Pete Najarian, chief revenue officer at BitGo. Najarian did not comment on whether the New York trust charter was a step towards BitGo pursuing a national trust bank charter from the Office of the Comptroller of the Currency as Anchorage did last year. Read More.

“We’re finding that the largest traditional financial institutions are all doing a considerable amount of work to determine what their level of participation will be in the digital asset space…For BitGo that can mean collaborative relationships in which we act as a sub-custodian or we work in partnership or we develop white label solutions.”

Najarian did not comment on whether the New York trust charter was a step towards BitGo pursuing a national trust bank charter from the Office of the Comptroller of the Currency as Anchorage did last year.

“We are constantly evaluating the right long-term path here,” Najarian said. “I would expect that over time it will make sense for ourselves and firms like us to continue to evaluate what’s the most seamless path to get to a regulatory designation that allows you to custody assets with every state in the U.S. without ambiguity.”

Mutual Fund Manager Ron Baron, “I Still Don’t Get Bitcoin:” Ron Baron, founder of investment management firm Baron Capital, said he still doesn’t get Bitcoin, describing it as a speculative investment. Read More.

Crypto

PayPal CEO Reveals Plans for New Crypto Unit: The company posted blowout fourth quarter 2020 financial results last month thanks to spectacular growth in its core app and Venmo unit, and from the success of its new buy-now-pay-later service. The firm is expecting an even bigger 2021 as the pandemic leads more consumers to embrace e-commerce and to turn away from cash altogether. CEO, Dan Schulman explained how PayPal is racing to adopt the next era of financial technology, including by launching a business unit dedicated to cryptocurrency. Read More.

"There is a ton of opportunity for us to be helpful in creating that next generation of infrastructure," Schulman said. "That’s what this business unit is about." He added that part of the mission is to "advance the utility of digital currencies."

Crypto.com Launches $200M Fund for Crypto Startups: To lead the effort, the Hong Kong-headquartered cryptocurrency exchange announced the launch of a new venture arm, Crypto.com Capital. They will lead funding rounds with investments of between $100,000 and $3 million at seed stage and between $3 million and $10 million at Series A. Read More.

Here Are the Biggest NFT Crypto Collectible Sales in the Last Month: Over the past month, the top five biggest non-fungible token (NFTs) projects generated over $366 million in sales, with NBA Top Shots being responsible for the lion’s share of that figure, according to metrics platform CryptoSlam. But while Top Shots took the majority of the volume, its biggest sales were dwarfed by one of Ethereum's earliest NFT projects. The prices of some non-fungible tokens have surged to over $1.5 million over the past month. CryptoPunks and Hashmasks are still the most expensive NFTs in terms of per-item prices. Read More.

VP TAKE: Top Smart Contract Blockchains(excluding Ethereum)

Media

Explained: Why Michael Saylor issued convertible debt to buy more bitcoin?

Explained: Where Samson Mow sees Bitcoin in the next five years?

Explained: Liquid

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.