Crypto Download #59

Govt's to Borrow Record $20 Trillion in 2021, Global Bond Yields Creep Up, Square Buys $170M More Bitcoin (5% of Balance Sheet), MicroStrategy Buys $1B More Bitcoin (MSTR Holds 90,531 BTC)

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Pfizer-BioNTech Shot Could Help End Pandemic, Israel Study Shows

Discovery Warns of South African Death Spike in Covid Third Wave

Lessons From the U.K. About a More-Contagious Covid-19 Variant

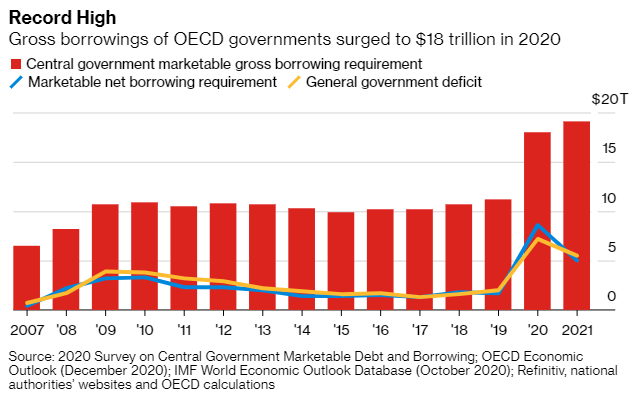

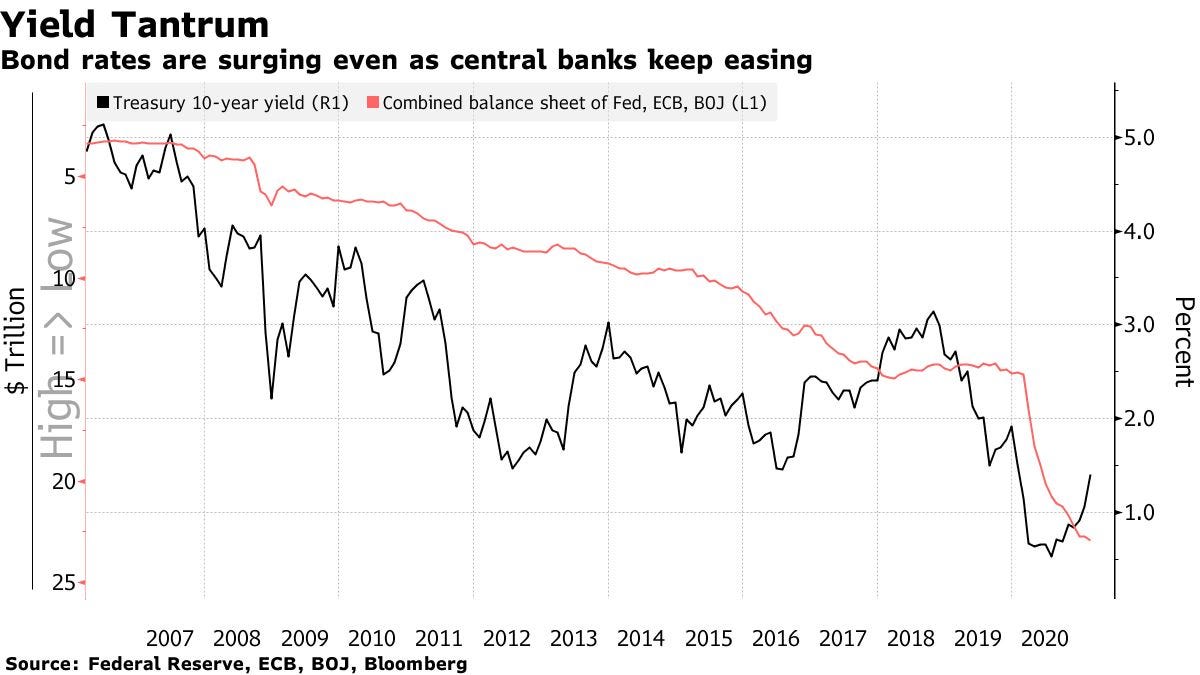

Government Borrowing Jumps by Most on Record in Covid Pandemic: Government borrowing from markets in the world’s richest economies surged by a record 60% in 2020, with an increasing reliance on short-term funding that intensifies refinancing risks. The jump is almost double that recorded in the 2008 financial crisis, and borrowing is expected to increase further still in 2021, albeit at a slower pace, to reach $19.1 trillion. Record low interest rates following swift and massive interventions from central banks have reduced the cost of the additional debt.

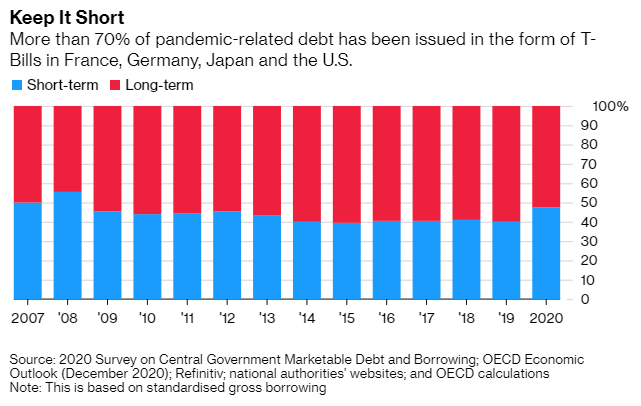

In 2020, more than 20% of government bonds in OECD countries were auctioned at negative yields. Still, the Paris-based organization warned that the share of short-term instruments in debt issuance has also jumped. Combined with an increase in funding needs, that weakens the resilience of governments and raises risks of refinancing difficulties. Read More.

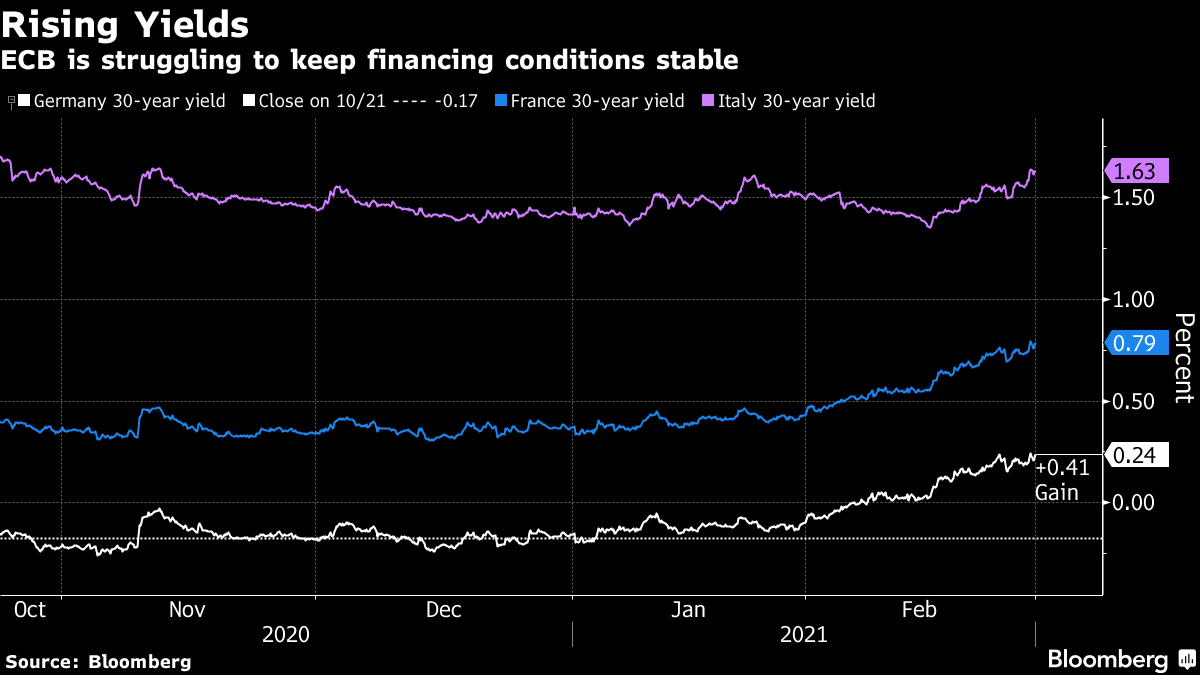

ECB Soothsaying Does Little for Bonds Caught in Global Rout: The European Central Bank’s pledges to fight back against unwarranted increases in bond yields are falling on deaf ears among investors. A selloff in bonds, which pushes up yields, was stemmed only temporarily on Thursday when ECB chief economist Philip Lane said officials will use the flexibility of their emergency bond-buying program to prevent any undue tightening in financial conditions. Yet Germany’s 10-year bond yield climbed to the highest level since March, its French equivalent rose above zero for the first time since June, and Italian yields climbed to the highest since November. Greek 10-year yields have doubled from a record low set in December. Bond yields are on the rise globally, in part due to spillovers from the U.S. economic recovery and the nation’s planned $1.9 trillion fiscal stimulus program. That’s testing central banks elsewhere, concerned that their own recoveries aren’t yet advanced enough to cope with higher borrowing costs. Read More.

“Lane didn’t tell us anything new,” said Rohan Khanna, rates strategist at UBS Group AG. “ECB bond-buying can’t prevent yields from rising if the macro outlook is one of roaring growth.”

Global Bond Rout Puts Australia’s Central Bank on Front Line: The Reserve Bank of Australia bought $4 billion of bonds Thursday, matching the record last March when it began quantitative easing. That eventually brought the targeted three-year yield down, but only after it hit a two-month high. A selloff that began in New Zealand also widened to Treasuries and Japanese debt, as the world’s sovereign bonds head for their worst month since April 2018. A $9 trillion rescue mission by central banks to haul the global economy out of its coronavirus recession is being tested by inflation bets that are threatening their ability to keep borrowing costs down. The intensifying bond rout is forcing a rising tally of money managers to scale back market exposures while Wall Street strategists pare back their bullish playbooks. Read More.

“The Australian bond market is in many ways caught in the crossfire of what’s happening in U.S. Treasuries,” said Chamath De Silva, a portfolio manager at BetaShares Holdings in Sydney. “I don’t see it as the market deliberately testing the RBA so much as global central bank dovishness in general.”

Bitcoin

Coinbase Files to Go Public on Nasdaq Via Direct Listing: Coinbase Global Inc., the biggest U.S. cryptocurrency exchange, filed to go public via a direct listing, in what’s anticipated to be a break-through moment for the industry. The company won’t raise any proceeds in the transaction, Coinbase said in a filing with the U.S. Securities and Exchange Commission on Thursday. Coinbase’s offering could be the first major direct listing to take place on the Nasdaq. All previous ones, including Spotify Technology SA, Slack Technologies Inc., Asana Inc. and Palantir Technologies Inc., were listed on the New York Stock Exchange. Started in 2012, Coinbase has raised more than $500 million from backers that include Andreessen Horowitz, Y Combinator and Greylock Partners, according to its website. It was valued at more than $8 billion in 2018 after a $300 million funding round led by Tiger Global Management. Read More.

Revenue more than doubled in 2019$322M net revenue of $1.14B in 202043M verified users, 2.8M active monthly usersListed under COIN (Nasdaq)

Square Bets on Bitcoin to Shape Its Future: Chief Executive Jack Dorsey on Tuesday said bitcoin will be the “native currency” of the internet, and Square said it bought an additional $170 million worth of the digital currency in the fourth quarter. Bitcoin now makes up about 5% of the company’s cash, cash equivalents and marketable securities. Read More.

MicroStrategy Bets Another $1B on Bitcoin: MicroStrategy announced the purchase of another $1.026 billion in bitcoin Wednesday, turning mountains of zero-interest debt into one of the single largest bitcoin investments ever executed by a publicly traded company. CEO Michael Saylor’s business intelligence firm bought the 19,452 BTC at an average price of $52,765 per coin. It now holds 90,531 BTC worth $4.78 billion at press time, almost certainly bolstering its perception among Wall Street types as a de-facto bitcoin exchange-traded fund. The latest buy, MicroStrategy’s single-largest dollar investment in the crypto, is second only to Tesla’s $1.5 billion investment on the list of (known) bitcoin allocations by a U.S. company. MicroStrategy was already and will likely remain the non-crypto firm with the biggest bitcoin bags as CEO Michael Saylor continues to pursue a coin acquisition strategy now codified in the business intelligence company’s mission. MicroStrategy’s practice of issuing zero-coupon convertibles as a cash-raising mechanism is in line with that strategy. Investors in this latest round of convertible senior notes have been promised a 50% premium on MicroStrategy’s Feb. 16, 2021, share price of $955. Read More.

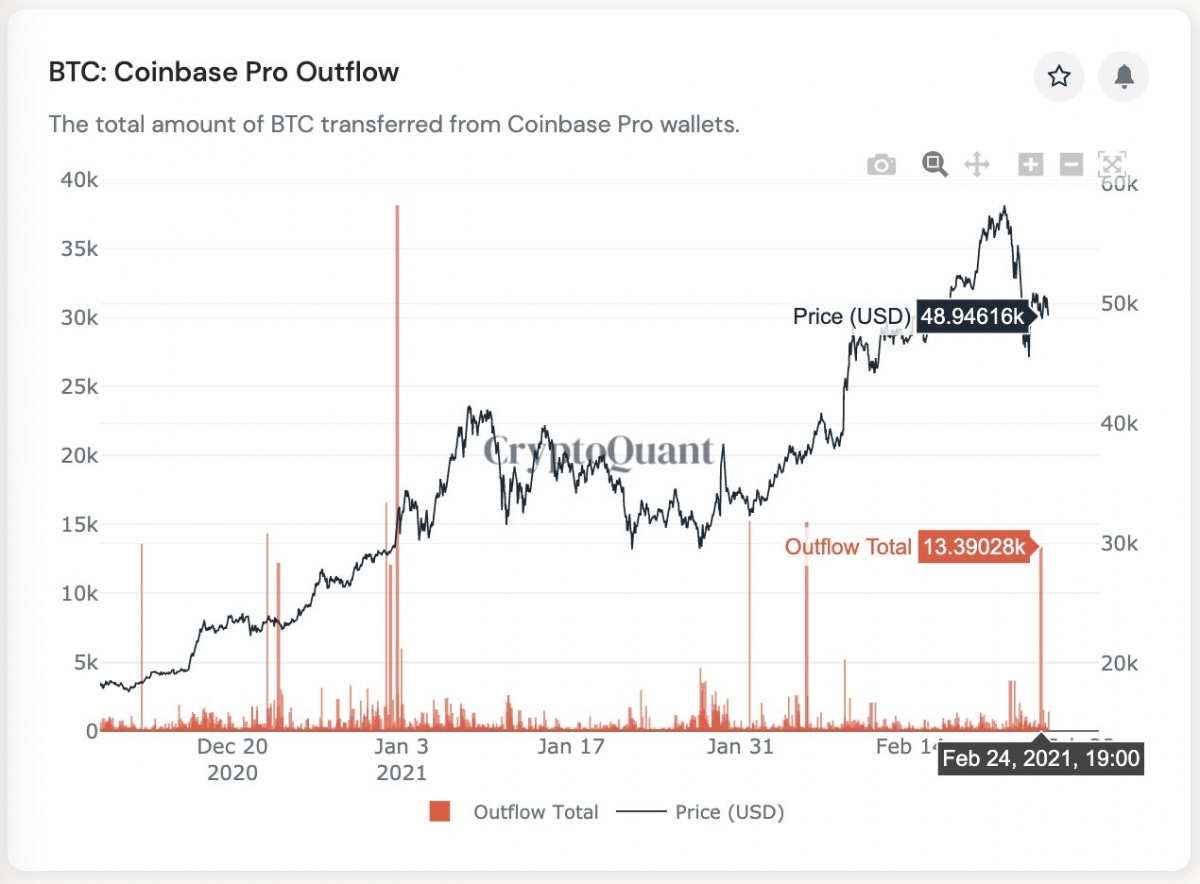

Bitcoin Outflows From Coinbase Suggest Institutions Are Buying the Dip: Large investors look to be accumulating bitcoin at relatively bargain prices in the wake of the cryptocurrency’s recent pullback. That’s the suggestion of outflows of the cryptocurrency from institution-focused Coinbase Pro exchange, which rose to over 13,000 BTC, worth roughly $650 million, on Wednesday. The figure represents the largest movement of bitcoin off the exchange in three weeks. The latest pick up in outflows is a sign that institutions remain undeterred by the recent price pullback and are confident about cryptocurrency’s long-term prospects. Read More.

Stone Ridge Adds Bitcoin to its Diversified Alternatives Fund: New York-based asset manager Stone Ridge has added Bitcoin as the seventh investment strategy in its diversified alternatives fund. As its name suggests, the fund is focused on investment strategies with potentially high returns, while diversifying away from stocks and bonds. Stone Ridge’s founders have been bullish on Bitcoin for several years. It created a subsidiary, the New York Digital Investment Group (NYDIG), which has raised $100 million in investment over the past two years. NYDIG now has 280 institutional customers and looks after $6 billion of their Bitcoin. It holds 10,000 of Stone Ridge’s Bitcoin, worth $500 million at current prices. Read More.

Crypto

Canada’s CI Global Files for What Would Be World’s First Ether ETF: In an announcement, the firm said its proposed “CI Galaxy Ethereum ETF” would be the first ETF in the world to invest directly in ether ETH, the native cryptocurrency of the Ethereum network. If approved, the ETF would trade on the Toronto Stock Exchange (TSX) under the ticker “ETHX.” ETHX will invest directly in ether with its holdings priced using the Bloomberg Galaxy Ethereum Index. Read More.

“Ethereum is the leading candidate to be the base layer of Web 3.0, and Ether is a growth asset that provides investors exposure to the explosion of decentralized applications,” said Mike Novogratz, chairman and CEO of Galaxy Digital, in the announcement.

Andreessen Horowitz Leads $25M Round in Ethereum Scaling Solution: Ethereum scaling solution Optimism will launch its mainnet this coming month after announcing a major investment from Andreessen Horowitz (a16z) that closed in November. Read More.

“We’ve spent a great deal of time looking at various approaches and teams building Layer 2s, and today we’re thrilled to announce we are leading a $25 million Series A investment in Optimism,” a16z’s Chris Dixon and Arianna Simpson wrote Wednesday. “Optimism’s exceptional team, carefully designed developer experience, major scaling benefits, years of research and testing, and full composability made it the obvious choice.”

Ethereum on track to settle $1.6 trillion this quarter: Ethereum usage is surging this year, with the value of transactions settled on the network skyrocketing during 2021. According to research from Messari, Ethereum has settled $926 trillion worth of transactions this quarter so far — 700% more than it processed during Q1 2020. The network is currently on-pace to settle $1.6 trillion in transactions for the first quarter of this year. In the last 12 months, Ethereum has already settled $2.1 trillion in transactions. If Messari’s $1.6 trillion forecast is accurate, Ethereum’s quarterly settlement value will have increased 1,280% compared to Q1 2020, and more than 5,000% compared to Q1 2019. Read More.

Legendary NFT Artwork Gets Resold for $6.6 Million: An NFT created by acclaimed digital artist Beeple has been resold for $6.6 million. The NFT, titled “Crossroad,” depicts former President Trump lying in a heap after losing the 2020 presidential election. Read More.

Media

BTC014: Bitcoin Mining and Energy w/ Marty Bent and Harry Sudock

Will Inflation Hurt Your Tech Stocks? | The Big Conversation | Refinitiv

How Unfunded Pensions Will Destroy Your Retirement (w/ Raoul Pal)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.