Crypto Download #58

Banks & Market Favor Stocks Over Treasuries, Commodities Capture Inflation Trade, Bitcoin & Crypto See Healthy Pullback as Liquidations Ripple Leveraged Market, Bull Market is Still Here BTFD

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

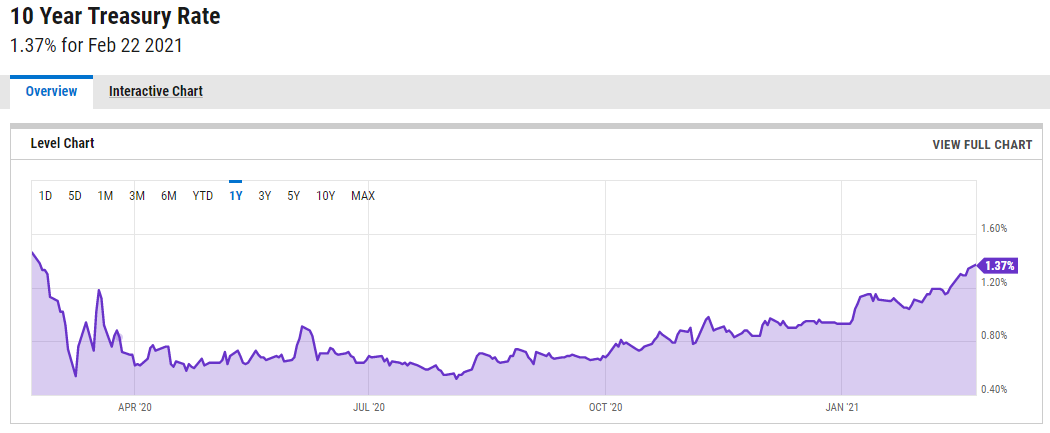

Debt Markets Brace for Higher Yields to Stay as Stimulus Sets In: President Joe Biden’s $1.9 trillion relief plan, plus the prospect of more stimulus later this year, is setting the stage for a shift away from historically low Treasury yields that’s likely to lead to a pickup in volatility in currency markets. U.S. yields have marched higher even before the plan’s arrival -- offering an inkling of what may be in store. BlackRock Inc. sees as much as $2.8 trillion in additional fiscal spending this year and the risk of a further rise in long-term rates. BNY Mellon’s John Velis says a 2% 10-year Treasury yield is possible by April as part of a “tantrum without the taper” of Federal Reserve bond purchases. And volatility in currencies is so low that it’s all but certain to go up, says Harley Bassman, creator of a widely watched gauge of Treasury-market movements. Read More.

“There’s a lot of stimulus in the pipeline that could add up to $2 trillion to $3 trillion in the end,” Velis, an FX and macro strategist at BNY Mellon, said via phone. That includes another package later this year focused on infrastructure and growth, he said.

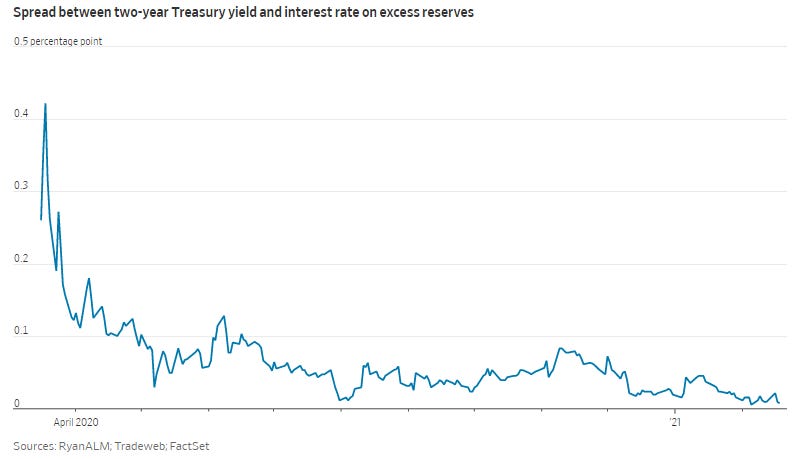

Key Short-Term Bond Spread Hits Lowest Level in Nearly a Year: The spread between the two-year Treasury yield and a key interest rate set by the Federal Reserve is the narrowest since the depths of the coronavirus market selloff, a potential sign of financial-system stress. The two-year Treasury yield, which closed Monday at 0.113%, is 0.013 percentage point above the interest rate on excess reserves, or IOER. It traded as low as 0.105% earlier in February. The Fed pays banks on the reserves held above and beyond those required by central-bank regulatory policy as part of its effort to maintain liquidity in the financial system. Traders said the shrinking of this spread reflects appetite for short-term debt as investors gobble up safe assets and park their cash. It also highlights a key tension point in financial markets: to what extent is Fed support for markets taking asset prices to unsustainable levels, and how vulnerable does that leave bond markets and other areas exposed to sudden reversals. Read More.

“I would characterize the phase we are in now as an era of hyperstimulation between fiscal and monetary policy,” said Thomas Pluta, global head of linear rates trading at JPMorgan Chase & Co. “The byproduct is all this cash sloshing around the system chasing assets like crypto, commodities and meme stocks.”

BlackRock downgrades government bonds, keeps faith with stocks: The world’s largest asset manager BlackRock has cut its stance on government bonds, preferring equities in light of the COVID-19 vaccine rollout and potentially up to $2.8 trillion of additional U.S. fiscal spending this year. In a weekly commentary note, strategists at BlackRock Investment Institute said the firm was increasing its ‘underweight’ on U.S. Treasuries. Yields on U.S. Treasuries, which move inverse to price, have hit their highest levels since February 2020 this week as investors have sold government bonds. Read More.

Commodities Hit Highest Since 2013 Amid Inflation Concern: Commodities rose to their highest in almost eight years amid booming investor appetite for everything from oil to corn. Hedge funds have piled into what’s become the biggest bullish wager on the asset class in at least a decade, a collective bet that government stimulus plus near-zero interest rates will fuel demand, generate inflation and further weaken the U.S. dollar as the economy rebounds from the pandemic. Advances on the day were helped by copper, which rose above $9,000 a metric ton for the first time in nine years, before extending gains further on Tuesday. Oil also jumped to the highest in more than a year on speculation that global supplies are rapidly tightening, while coffee and sugar rose. Read More.

“Folks who have really ignored commodities for quite a long time are now starting to get positioned,” said Bart Melek, head of commodity strategy at TD Securities. “The implication is that this could go on for a bit. It’s very much a function of expectations of scarcity.”

U.S. manufacturers grapple with steel shortages, soaring prices: An aerospace parts maker in California is struggling to procure cold-rolled steel, while an auto and appliance parts manufacturer in Indiana is unable to secure additional supplies of hot-rolled steel from mills. Both companies and more are getting hit by a fresh round of disruption in the U.S. steel industry. Steel is in short supply in the United States and prices are surging. Unfilled orders for steel in the last quarter were at the highest level in five years, while inventories were near a 3-1/2-year low, according to data from the Census Bureau. The benchmark price for hot-rolled steel hit $1,176/ton this month, its highest level in at least 13 years. Soaring prices are driving up costs and squeezing profits at steel-consuming manufacturers, provoking a new round of calls to end former President Donald Trump’s steel tariffs. Read More.

“Our members have been reporting that they have never seen such chaos in the steel market,” said executive director at Coalition of American Metal Manufacturers and Users.

HSBC plans to nearly halve office space over long term: HSBC plans to nearly halve its office space globally over the long term as part of a cost-cutting drive set out on Tuesday, in a further sign the pandemic could mean permanent changes to working patterns. The bank’s CEO Noel Quinn said the reduction would come from axing office buildings as their leases come to an end and would not include branches or HSBC’s headquarters building in London’s Canary Wharf. Read More.

Bitcoin

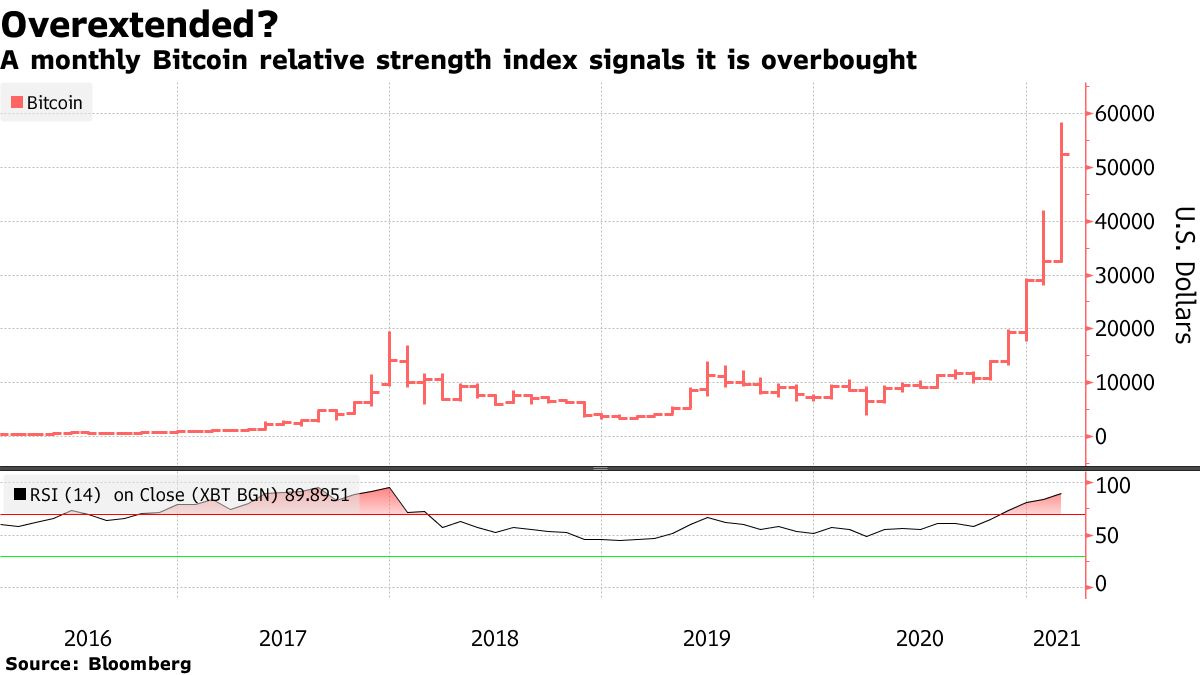

Bitcoin plummets as doubts grow over sky-high valuation: Bitcoin plummeted as much as 17% on Tuesday as investors grew nervous at sky-high valuations, triggering the liquidation of leveraged bets and sparking a sell-off across cryptocurrency markets. The world’s biggest cryptocurrency was facing its biggest daily drop in a month, falling to as low as $45,000. In choppy trading, it was last down 15.6%. The drop took its losses to over a fifth from a record high of $58,354 hit on Sunday and underscored the volatility of the emerging asset - though it is still up around 60% this year. Read More.

Yellen sounds warning about ‘extremely inefficient’ bitcoin: Treasury Secretary Janet Yellen issued a warning Monday about the dangers that bitcoin poses both to investors and the public. Despite a sharp slide in price to start the week, the cryptocurrency continues to trade above $53,000 as it has received boosts from various sources. Elon Musk’s Tesla recently made a substantial purchase and has said it will accept bitcoin for transactions. However, Yellen said there remain important questions about legitimacy and stability. Read More.

“I don’t think that bitcoin … is widely used as a transaction mechanism,” she told CNBC’s Andrew Ross Sorkin at a New York Times DealBook conference. “To the extent it is used I fear it’s often for illicit finance. It’s an extremely inefficient way of conducting transactions, and the amount of energy that’s consumed in processing those transactions is staggering.”

VP Take: Yellen clearly doesn’t understand bitcoin or is just creating FUD for the market. Whenever an incumbent says bitcoin is too slow, can’t process enough transactions, too volatile and only used for illicit activities it shows they haven’t done the work to grasp the facts and why bitcoin is important. These are the same arguments used 4 years ago when bitcoin was under $10k and only being bought by retail investors. Bitcoin is a store of value and way to securely clear and settle transactions within minutes vs. our current banking system that takes 3-5 business days to settle transactions, not to mention the dollar is no longer a stable store of value given the devaluation that Yellen is and will ultimately do over the next 4 years. Stay focused.

BNY Mellon Said to Hire Fireblocks for Bitcoin Custody Service: NY Mellon is working with Fireblocks as part of the banking giant’s plans to hold bitcoin and other crypto assets on clients’ behalf, according to three people familiar with the matter. The bank said earlier this month it was working with outside partners on the crypto custody play but did not identify them. With bitcoin edging its way onto Wall Street, big institutions are looking for ways to accelerate their offerings, creating a bit of gold rush for crypto-native service providers. Read More.

Bitcoin Mining Firm Northern Data Plans US Listing to Raise $500M: Northern Data is in talks with Credit Suisse over the listing, which could take place later this year. The Frankfurt-headquartered firm owns, among others, the world’s largest cryptocurrency mining facility in Rockdale, Texas, which has a planned capacity of 1 gigawatt by the end of 2021. Read More.

Crypto

Tether Deal With New York State Brings Quick Reversal of Crypto-Market Sell-Off: Bitcoin and other cryptocurrencies recovered partially from their biggest sell-off in a month after the New York state attorney general’s office announced a settlement of a dispute involving the stablecoin tether (USDT) that had rattled market confidence in recent weeks. Northern Data is already listed on Deutsche Börse's Xetra trading venue under the ticker NB2. Read More.

“After 2.5 years and 2.5M pages of info shared, we admit to no wrongdoing and will pay US$18.5M to resolve this matter,” Bitfinex tweeted, adding that no finding states that Tether ever issued [the stablecoin] without backing or to impact crypto prices.

ECB wants veto power on stablecoins in the euro zone: The European Central Bank wants veto power on the launch of stablecoins such as Facebook’s Diem in the euro zone and a greater role in their supervision, it has told European Union lawmakers. Central bankers around the world are worried that the rise of cryptocurrencies, especially stablecoins which derive their value from one or more official currencies. They fear that could dent control over payments, banking and, ultimately, the supply of money. The EU set out plans in September to create comprehensive rules for crypto-assets, including stress tests as well as capital and liquidity requirements, saying Facebook would have to adhere to them before launching its proposed stablecoin in the bloc. Read More.

NFTs: Non-Fungible Tokens

Media

WATCH LIVE: Fed Chair Jerome Powell testifies before Congress — 2/23/21

Bitcoin & Altcoin Update – Buy The Dip Or Heading Lower?

Bitcoin 1 Trillion - w/ Mark Yusko

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.