Crypto Download #57

US / UK Labor Market Crisis Continues; BOE Neg. Interest Rates Seem Inevitable; Signs of Slow Down in Housing; BlackRock "Dabbles" in BTC; Coinbase Public Offering $77B; Caution: Crypto Mkt is HOT

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

More than 11,000 Ebola vaccines expected in Guinea this weekend

Covid-19 Pandemic Causes Largest Drop In U.S. Life Expectancy Since World War 2

U.S. Jobless Claims Hit Four-Week High in Fresh Labor Setback: Applications for U.S. state unemployment insurance jumped to a four-week high, indicating the labor market is suffering fresh setbacks even as the coronavirus pandemic shows signs of ebbing. Initial jobless claims in regular state programs totaled 861,000 in the week ended Feb. 13, up 13,000 from the prior week, Labor Department data showed Thursday. Last week’s report had originally shown a decrease but was revised up to show a 36,000 increase. Read More.

About 18.3 million people were still receiving some form of government unemployment benefit in the week ending January 30—shockingly high compared to the 2.1 million total claims filed in the comparable week in 2020.

That figure is greater than the roughly 10 million Americans considered unemployed due to the startling number of people who’ve dropped out of the labor force because they’re no longer looking for work.

The McKinsey Global Institute estimates that about 20% of business travel won’t return after the pandemic–a change that will likely result in fewer jobs in industries hardest hit by the pandemic, including retail, hospitality and restaurants.

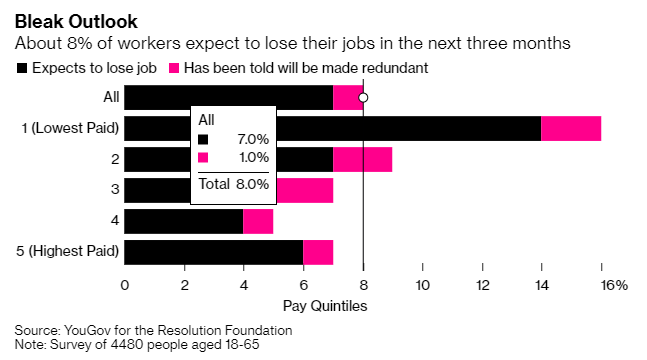

U.K. Risks Jobless Recovery From Covid Crisis, BOE Official Says: The U.K. economy risks a jobless recovery from the coronavirus, with surging gross domestic product and lingering unemployment, a policy maker at the Bank of England said. Michael Saunders, a member of the central bank’s Monetary Policy Committee, said the pandemic has gone on longer than anticipated and is hurting the finances of businesses and households. Read More.

“Strong quarterly growth rates that leave GDP well below its pre-Covid level and unemployment relatively high are not a boom,” Saunders said in a video conference in London on Thursday. “As time goes on, corporate balance sheets especially among small firms are steadily getting worse. The longer the crisis goes on, the greater the risk of long-term scarring effects that will weigh on demand subsequently.”

Big Freeze in Texas Is Becoming a Global Oil Market Crisis: What began as a power issue for a handful of U.S. states is rippling into a shock for the world’s oil market. More than 4 million barrels a day of output -- almost 40% of the nation’s crude production -- is now offline, according to traders and executives. One of the world’s biggest oil refining centers has seen output drastically cut back. The waterways that help U.S. oil flow to the rest of the world have been disrupted for much of the week. Brent crude briefly surged above $65 a barrel on Thursday, a level not seen since last January. Spreads indicating supply tightness also soared. Ten months ago, the price slumped below $16 because of a demand shock caused by Covid-19. Read More.

“The market is underestimating the amount of oil production lost in Texas due to the bad weather,” said Ben Luckock, co-head of oil trading at commodity giant Trafigura Group.

Negative rates may be BoE's best tool in future: Bank of England policymaker Michael Saunders said negative interest rates may soon be the best tool for the BoE, and raised the prospect of unemployment taking a long time to return to pre-pandemic levels. Earlier this month the BoE gave British banks six months to prepare for any decision to cut rates below zero - which economists currently view as a distant prospect given the likelihood of a rapid recovery in the second half of 2021. Saunders said more bond-buying could be the right choice if the BoE faced market turmoil like at the start of the pandemic in March. Changes to its Term Funding Scheme for banks would be the best approach if small businesses faced credit issues. Read More.

Zimbabwe central bank raises main lending rate to 40%: Zimbabwe lifted its main lending rate to 40% from 35% previously on Thursday in a bid to reduce excess liquidity and control speculation in its foreign currency market, the central bank said. Severe foreign currency shortages have been the clearest sign of an economic crisis that has sparked intermittent shortages of fuel, power and medicines and seen prices soar in the southern African nation. “The decision on interest rates takes into account the current liquidity conditions in the market and the need to continue controlling speculative borrowing,” The Reserve Bank of Zimbabwe said in a statement. The country has long struggled with severe currency depreciation. It reintroduced the Zimbabwe dollar in 2019 after a decade of dollarization, but the move failed to end severe cash shortages. Instead, it pushed up inflation and fueled a thriving parallel currency market. Read More.

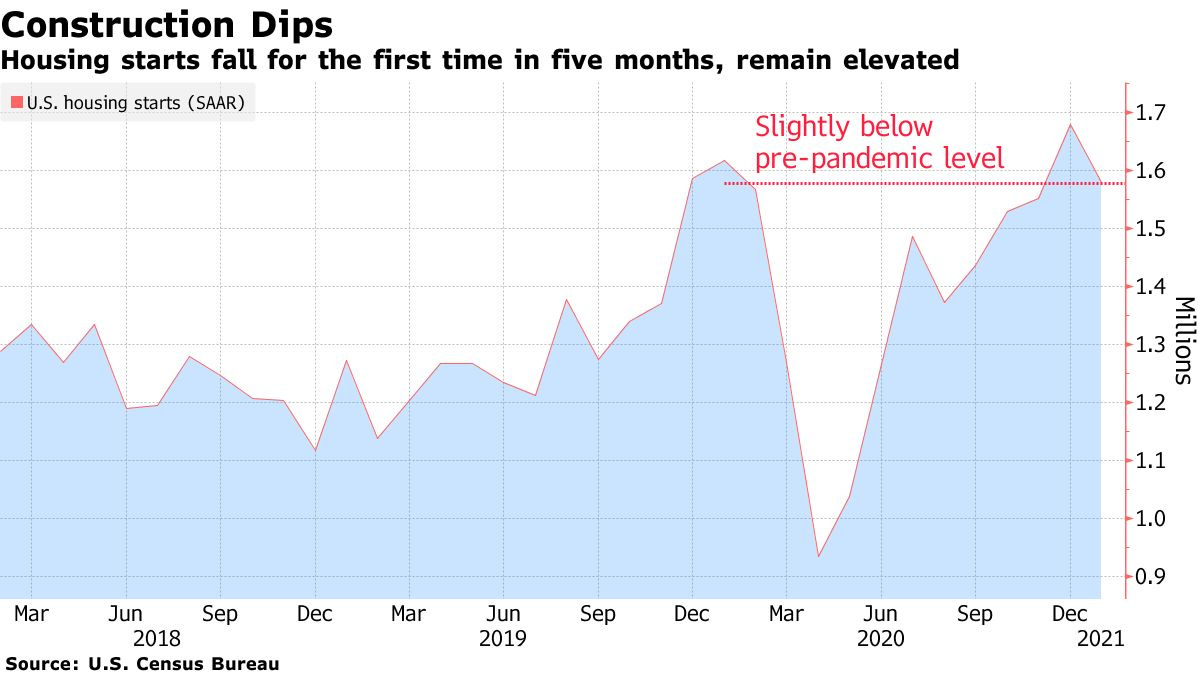

U.S. Housing Starts Fell in January for First Time Since August: U.S. home-construction starts fell in January for the first time in five months, signaling that rising residential real estate prices may be constraining buyer demand. Residential starts dropped by 6% from the prior month to a 1.58 million annualized rate, according to government data released Thursday. The median in a Bloomberg survey of economists had called for an decline to a 1.66 million annualized rate. Read More.

Bitcoin

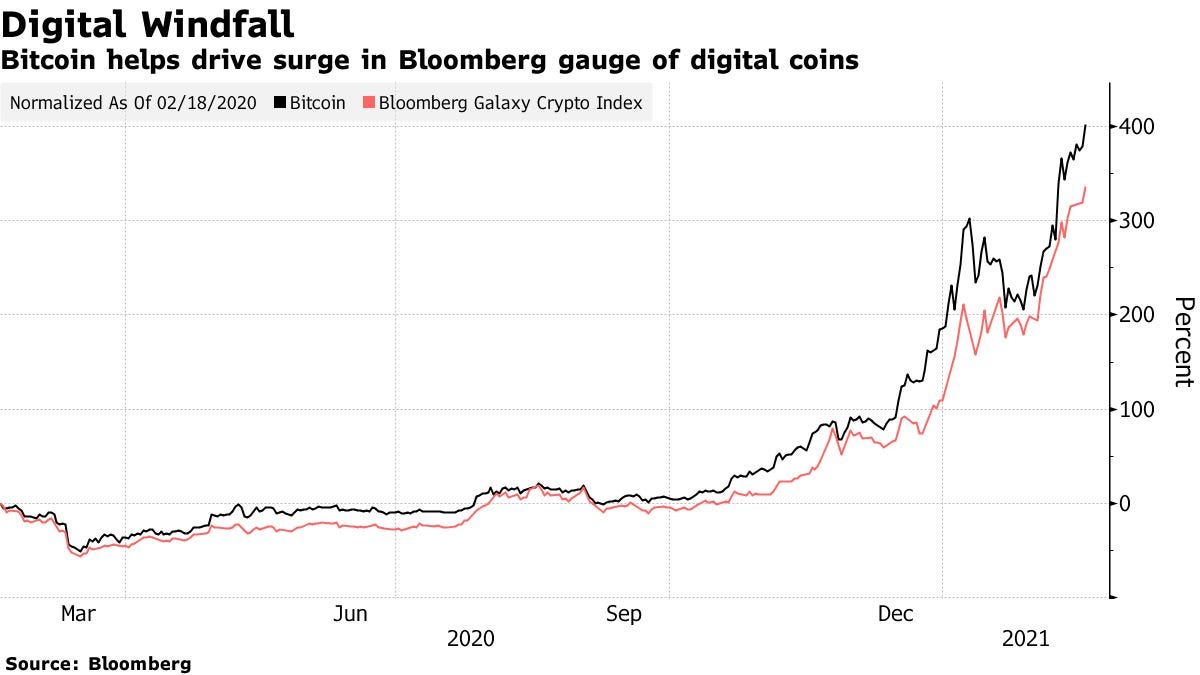

Bitcoin Keeps Hitting New Highs as Crypto Mania Accelerates: Bitcoin’s incredible rally shows little sign of abating yet after the token jumped past $52,000 for the first time. The largest cryptocurrency was little changed in Asian trading Thursday at about $52,100 after a fivefold surge in the past year. Bitcoin’s rally for some is emblematic of speculative froth in financial markets awash with stimulus. The crypto faithful counter that the digital asset is grabbing more mainstream attention, especially after Tesla Inc.’s recent $1.5 billion purchase. MicroStrategy Inc. boosted its convertible debt sale to buy Bitcoin by nearly half to $900 million and cut the coupon to 0%, making it virtually a straight bet on the price of the cryptocurrency. Read More.

$8.7 Trillion Asset Manager BlackRock Is Exploring Bitcoin As Institutions Flood Crypto: Rick Rieder, BlackRock’s chief investment officer of global fixed income, told CNBC Wednesday that the investment giant has “started to dabble” in bitcoin—it’s the latest instance of a major financial player dipping its toes into digital assets. Reider did not elaborate on BlackRock’s cryptocurrency strategy, but last month the investment giant filed documents with the Securities and Exchange Commission showing that it wants to include cash-settled Bitcoin futures as eligible investments for two of its funds. Read More.

“My sense is the technology has evolved and the regulation has evolved to the point where a number of people find it should be part of the portfolio, so that’s what’s driving the price up,” he said.

A number of other financial institutions, such as BNY Mellon and Mastercard, have made entrances into the crypto space in recent days. BNY Mellon, the nation’s oldest bank, will launch a digital assets unit later this year, while Mastercard intends to support certain cryptocurrencies on its formal network. Read More.

“We’re holding a lot more cash than we’ve held historically,” he said. “It’s because duration doesn’t work, interest rates don’t work as a hedge and so diversifying into other assets makes some sense. Holding some portion of what you hold in cash in things like crypto seems to make some sense to me, but I wouldn’t espouse a certain allocation or target holding.”

Coinbase, Readying for Public Listing, Gets $77B Valuation From Nasdaq Private Market: Cryptocurrency exchange Coinbase, which is preparing to trade publicly in the next few months, is being valued at $77 billion, based on trading of the company’s privately held shares on a secondary market. Those shares in the largest crypto exchange in the U.S. are changing hands on the Nasdaq Private Market at $303 a piece, according to two people with knowledge of the auction. That implies a total company value of about $77 billion – greater than Intercontinental Exchange Inc., the owner of the New York Stock Exchange. Read More.

“The third weekly transaction closed on Friday and the clearing price was $303 a share,” said a source. “The first week it was 200 bucks a share, the second week it was $301 a share, and the third week it was $303 a share. So you can kind of see price discovery happening.”

Mining Machine Manufacturer Ebang to Start Mining Bitcoins for Itself: Nasdaq-listed mining machine manufacturer Ebang (EBON) announced its plans to start mining bitcoins using its own machines. the company's board approved plans to operate a bitcoin mining business involving a combination of deploying its own machines, machines bought from other manufacturers, and leased computing power from other mining farms. Read More.

Motley Fool Drops $5 Million on Bitcoin, Aims to 10X in 15 Years: Despite its name, The Motley Fool is known for dispensing sage investing advice. Today, it advised readers to buy Bitcoin. Not only that, but the private investing advice firm is buying $5 million of the rapidly appreciating asset, which is currently trading at a record high above $52,000. Read More.

“While Bitcoin may very well continue to be volatile in the short term, we think it has 10x potential from today's levels over the long term as part of a diversified portfolio,” said the website in a post today. “We plan to hold this Bitcoin investment for many years.”

Crypto

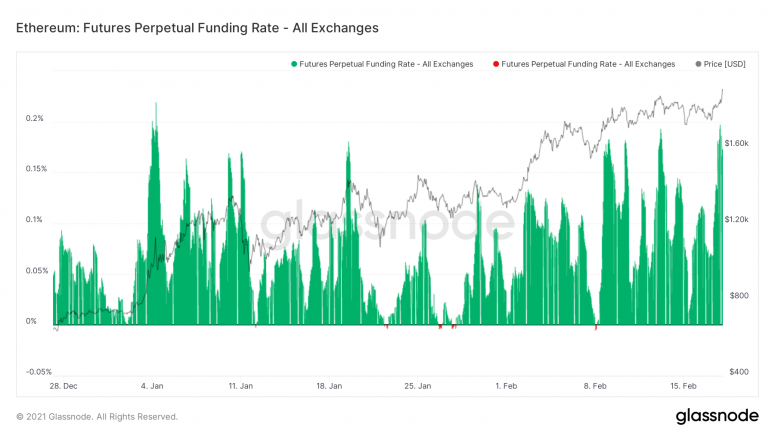

Ether Looks Overleveraged as Cryptocurrency Hits New High Over $1,900: Ether soared to new record highs Thursday, but an overheated derivatives market may suggest higher volatility is on the way for the short term. The second-largest cryptocurrency by market value set the new lifetime high of $1,928. In such situations, holding longs at high costs is attractive only if the bullish momentum remains strong. A pullback or consolidation can trigger an unwinding of longs, leading to a more profound price drop and a pick-up in price volatility. As of press time, ether is showing no signs of price congestion. Read More.

“It shows the derivatives market is overleveraged,” Patrick Heusser, head of trading at Swiss-based Crypto Finance AG, told CoinDesk. “With this current structure, I do not feel comfortable in running a lot of long exposure.”

Safello Partnership Enables Direct Crypto Purchases From Users’ Bank Accounts: Cryptocurrency exchange Safello has teamed up with payments platform Klarna to bring open banking services to customers. Sweden-based Safello announced Wednesday the new partnership allows its "more than 180,000" users to directly purchase cryptocurrencies from their bank accounts. Klarna has access to more than 5,000 banks in 18 countries across Europe and uses a single API that complies with EU open-banking regulations. Read More.

Cosmos Upgrades to Stargate: Another 2017 ICO Very Nearly Completes Its Vision: The last step before inter-blockchain communication goes live early Thursday. Stargate represents an important milestone for the Cosmos project on the way to launching its inter-blockchain communication (IBC) protocol that will allow the 200+ Tendermint-based blockchains to interoperate easily. The era of cross-pollinating blockchains is very nearly here. Stargate enables a number of other enhancements as well. The chain will run more efficiently, upgrades will be much faster and full nodes will be able to sync up more quickly. Read More.

Hollywood Producers Create Digital Currency to Fund Films: Mogul Productions is a content production company that is using blockchain technology. Fans vote for projects using the STARS token. The project announced its impending launch today. Read More.

Spiderman NFT sells for 12.75 ETH as Marvel comic artists land on Ethereum: With great rarity apparently comes great value. An Ethereum-based Spiderman NFT just sold for $25k as Marvel comics enter the blockchain realm. Read More.

Media

BTC013: Bitcoin Lending & Borrowing w/ Blockfi's Zac Prince & Mark Yusko

Galaxy Digital Presentation with Mike Novogratz

Fidelity Digital Assets Presentation with Tom Jessop

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.