Crypto Download #56

Bitcoin hits $50k, Stimulus + TGA Liquidity to Hit Markets, Bond Market Having Trouble, MicroStrategy $600M Debt Capital Raise to Buy More BTC, Filecoin Growing It's Capacity, Uniswap $100B in Volume

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

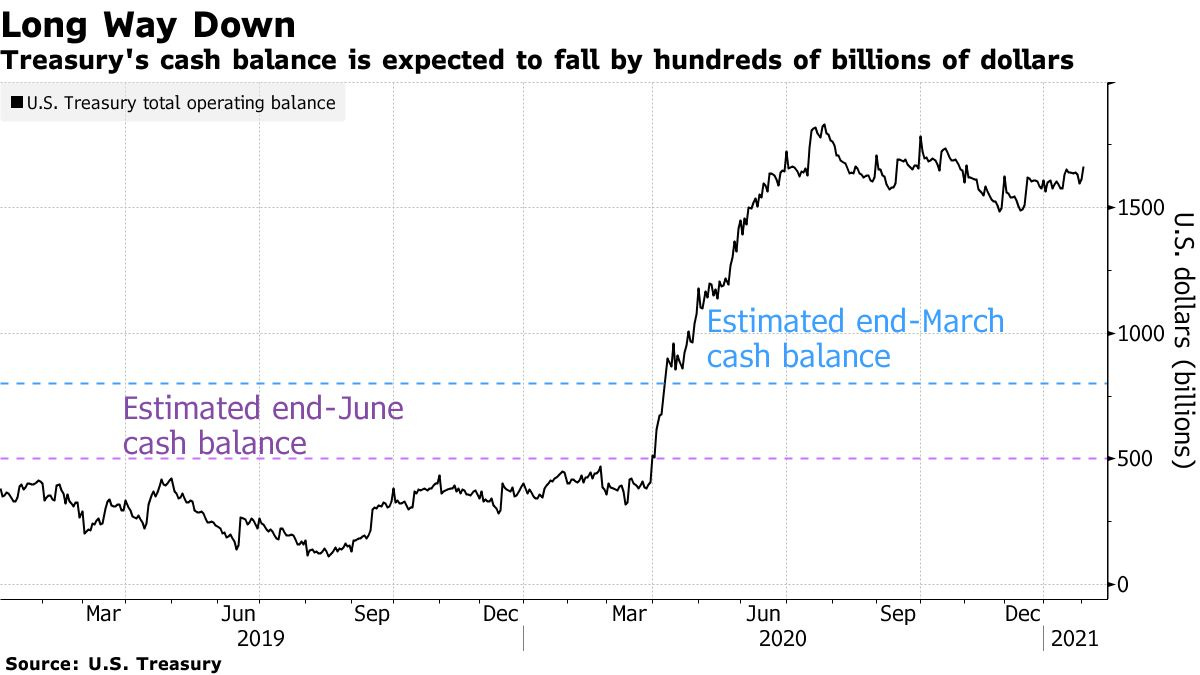

Yellen Shift on Vast Treasury Cash Pile Poses Problem for Powell: Treasury Secretary Janet Yellen is giving Federal Reserve Chairman Jerome Powell a bit of a headache when it comes to managing the money markets. Already low short-term interest rates are set to sink further, potentially below zero, after the Treasury announced plans earlier this month to reduce the stockpile of cash it amassed at the Fed over the last year to fight the pandemic and the deep recession it caused. The move, which aims to return its cash position at the central bank to more normal levels, will flood the financial system with liquidity and complicate Powell’s effort to keep a tight grip over money market rates.

Here’s how it works: Treasury sends out checks drawn on its general account at the Fed, which operates like the government’s checking account. When recipients deposit the funds with their bank, the bank presents the check to the Fed, which debits the Treasury’s account and credits the bank’s Fed account, otherwise known as their reserve balance. Read More.

“All this cash from the Treasury’s general account will have to go back from the Fed and into the market,” said Manmohan Singh, senior economist at the International Monetary Fund. “It will drive short term rates lower, as far as they can go.”

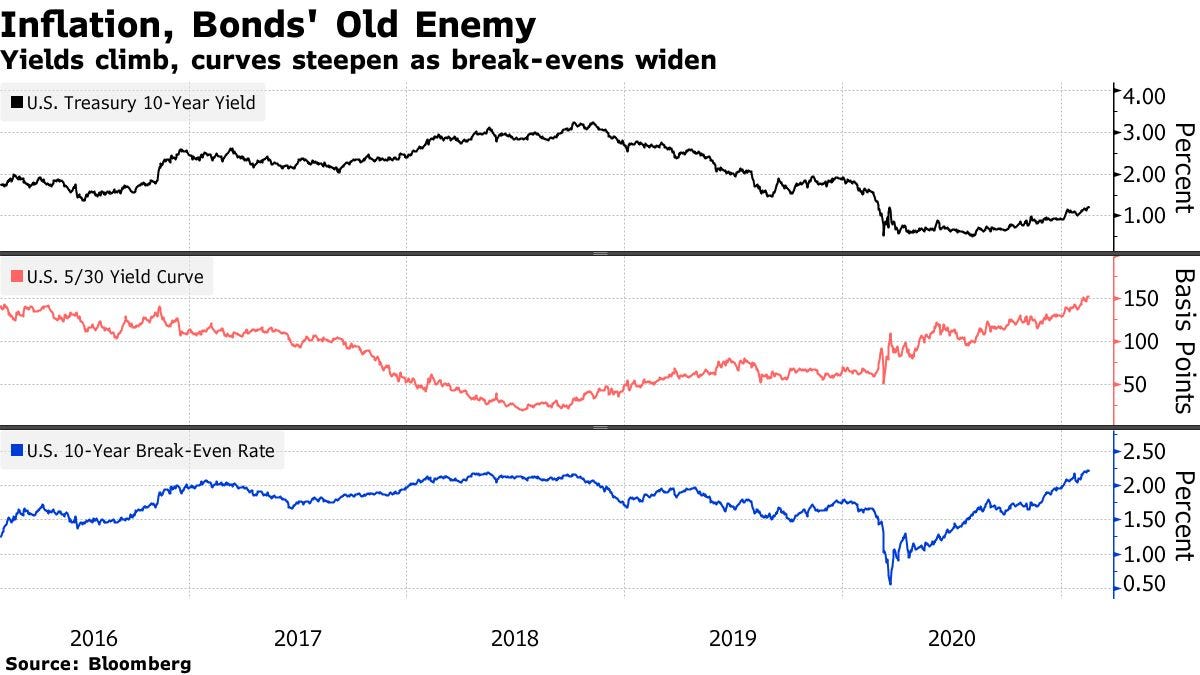

Global Bonds Are Suffering the Worst Start to a Year Since 2013: U.S. investors return Tuesday from the Presidents’ Day holiday to find the reflation trade in full force and global bond markets in retreat. How bad can it get for fixed-income investors, and where can they find solace? Former New York Fed President William Dudley last week outlined reasons why the U.S. central bank might have to pull back on stimulus sooner and with greater force than anticipated to keep inflation in check, potentially triggering a new wave of volatility akin to the taper tantrum. Many households have cash to spend and the recovery should be faster than the last one, he wrote. Treasury 10-year yields rose to 1.24% Tuesday, their highest since last March, while the spread between them and two-year yields reached the steepest since April 2017. Ten-year break-even rates entered the week at the highest since 2014. Read More.

Bitcoin

Bitcoin Jumps to $50,000 as Record-Breaking Rally Accelerates: Bitcoin blew through another milestone, surging past $50,000 for the first time as the blistering rally in the largest cryptocurrency continues to captivate investors worldwide. The world’s largest cryptocurrency reached about $50,191. in New York and is now up about 73% so far this year. Ether, a rival crypto, hit a record on Friday and is up about 140% year-to-date. After ending last year with a fourth-quarter surge of 170% to around $29,000, Bitcoin token jumped to $40,000 seven days later. It took just nearly six weeks to breach the latest threshold, buoyed by endorsements from the likes of Paul Tudor Jones, Stan Druckenmiller and Elon Musk. Bitcoin traded for a few cents for several years after its debut more than a decade ago. The 400% rally over the past year comes amid a backdrop of near zero borrowing rates from central banks and unprecedented stimulus from governments in the wake of the coronavirus pandemic. Bitcoin advocates have criticized the moves as money printing even though inflation remains subdued. Read More.

MicroStrategy to buy more bitcoins with debt sale proceeds: MicroStrategy Inc said on Tuesday it would sell $600 million of debt through convertible notes, with the proceeds to be used to buy additional bitcoins. Read More.

Former Federal Reserve Governor Now On Board with Bitcoin: Former Federal Reserve governor and one-time Bitcoin skeptic Kevin Warsh has changed his tune on the crypto asset. Following Bitcoin’s recent surge, and changing attitudes on the regulatory side, the asset now “does make sense” in a sensible portfolio, Warsh said today. That shift he’s referring to has to do with the Fed’s approach to stimulus, in keeping with what’s known as modern monetary theory, which posits that countries with their own currencies can spend a lot more than they have. This process of seemingly summoning money out of thin air this past spring, and the prospect of what that will eventually mean for the US dollar's longterm value, ended up stimulating the crypto markets too. Read More.

Warsh made the comment in an interview with Andrew Ross Sorkin, who hosts Squawk Box on CNBC. “I think that Bitcoin does make sense as part of a portfolio in this environment, where you have the most fundamental shift in monetary policy since Paul Volcker. This is a big shift that we’re seeing under the Powell Fed, rightly or wrongly.”

Crypto

Amazon Preparing to Launch a ‘Digital Currency’ Project in Mexico: Amazon’s grip on the internet economy appears to be coming for currency next, with the e-commerce giant preparing to launch a “digital currency” project in Mexico. The yet-to-be-announced project, which Amazon sketched out across a series of recent job posts, appears to be an effort to keep lucrative Prime customers eternally plugged into Amazon’s platform. Read More.

“This product will enable customers to convert their cash in to digital currency using which customers can enjoy online services including shopping for goods and/or services like Prime Video,” one job post said of Amazon’s “new payment product.”

Coinbase Ventures, Paradigm Invest $12M in Synthetix DeFi Platform: Decentralized trading platform Synthetix has raised $12 million from venture capital firms Coinbase Ventures, Paradigm and IOSG. The raise looks to be a rare occurrence of VCs investing through the purchase of a platform’s native token directly from its treasury rather than wiring funds to its founders. Synthetix is run by a DAO, or a decentralized automatic organization, a way for a project to govern itself without a traditional corporate structure. Token holders are typically encouraged to vote on the direction the DAO will take. In the case of Synthetix, a platform on which users can trade synthetic assets and commodities, including Brent Crude oil future, users can create these novel assets using the platform’s native synth token (SNX). The application has become a key component of decentralized finance (DeFi), with approximately $2.8 billion worth of crypto “locked.” Read More.

“We’re excited about supporting the synthetixDAO as it builds the leading synthetic asset platform,” Arjun Balaji, Paradigm investment partner, said in a press release. “Synthetix has one of the best communities in crypto and we’re glad to be a part of it.”

Crypto lender Celsius has paid out $250M in rewards: Celsius, a centralized cryptocurrency lending platform, claims to have paid out over $250 million in rewards to its 415,000 users, underscoring the rapid growth of blockchain lending protocols. Celsius announced the milestone in a Monday press release that highlighted the company’s significant growth over the past two years. Unlike decentralized finance protocols, Celsius offers a centralized alternative that lets users deposit crypto assets onto its platform. The deposited assets are lent out to exchanges and market makers, with the vast majority of interest payments distributed to depositors. Celsius users have the ability to earn weekly rewards of up to 18.5% annual percentage yield on over 40 crypto assets. The company now manages over $8 billion in cryptocurrency assets. Read More.

“Celsius remains one of the fastest-growing companies in finance as it achieves new milestones week-over-week,” the company said.

Filecoin Now Has a Global Capacity of 2.5 Billion Gigabytes: The Filecoin network has reached a total capacity of 2.5 exbibytes, according to an announcement today. In more familiar terms, that's 2.5 billion gigabytes of data. According to the release, this capacity is enough to store 725 million 1080p movies, 11,250 copies of Wikipedia, and 47 copies of the Internet Archive. So, a fair bit then. Filecoin is a decentralized storage network that enables thousands of computers around the world to get paid to store data. Because the network is decentralized, it means the data isn't held in one single place, reducing the risk of it being lost or corrupted. Read More.

"The importance of an open, decentralized Internet has never been greater. Reaching 2.5 EiB storage capacity is a pivotal moment for Filecoin and the wider Web 3.0 movement…The Web 3.0 pursuit to create a more efficient and secure web, free from corporate control, is coming into fruition," said Colin Evran, ecosystem lead at Filecoin.

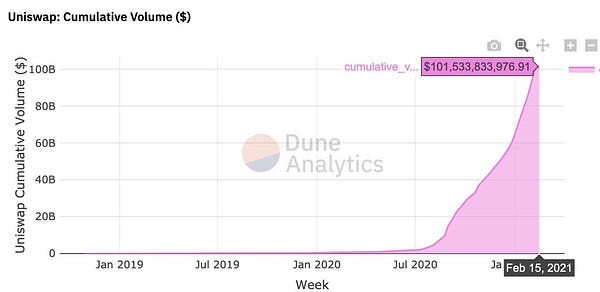

Uniswap Hits $100 Billion in Trading Volume: Decentralized exchange (DEX) Uniswap today became the first decentralized trading platform to process over $100 billion in cumulative volume. The exchange, which launched last May, has racked up on average $11.1 billion in trading volume every month. Uniswap allows users to swap ECR20 tokens. ERC20 tokens run on the Ethereum blockchain and are super popular in the crypto world because decentralized finance projects—which are mostly built on Ethereum—are attracting more attention from investors than ever before. The DEX’s creator, Hayden Adams, shared the news on Twitter where he described it as “an exciting milestone for DeFi.” Read More.

Media

Tesla’s $1.5bn Bitcoin Buy with American HODL & Preston Pysh

BTC012: Bitcoin On-Chain Analysis w/ Plan B & Willy Woo

Lyn Alden and Raoul Pal: Is Ethereum a Good Investment? - Ep.211

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.