Crypto Download #55

Unemployment Still Terrible; Germany Economy GDP Contraction Due to Lockdowns; Tons of Bullish Bitcoin News; Institutional Demand for ETH as Grayscale Accumulates 70k ETH; DO NOT BUY DOGECOIN

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Macron’s Lockdown Conundrum Will Decide France’s Recession Fate

World faces around 4,000 COVID-19 variants as Britain explores mixed vaccine shots

Tanzania Shunned Lockdowns. Now It’s Rejecting Covid-19 Vaccines.

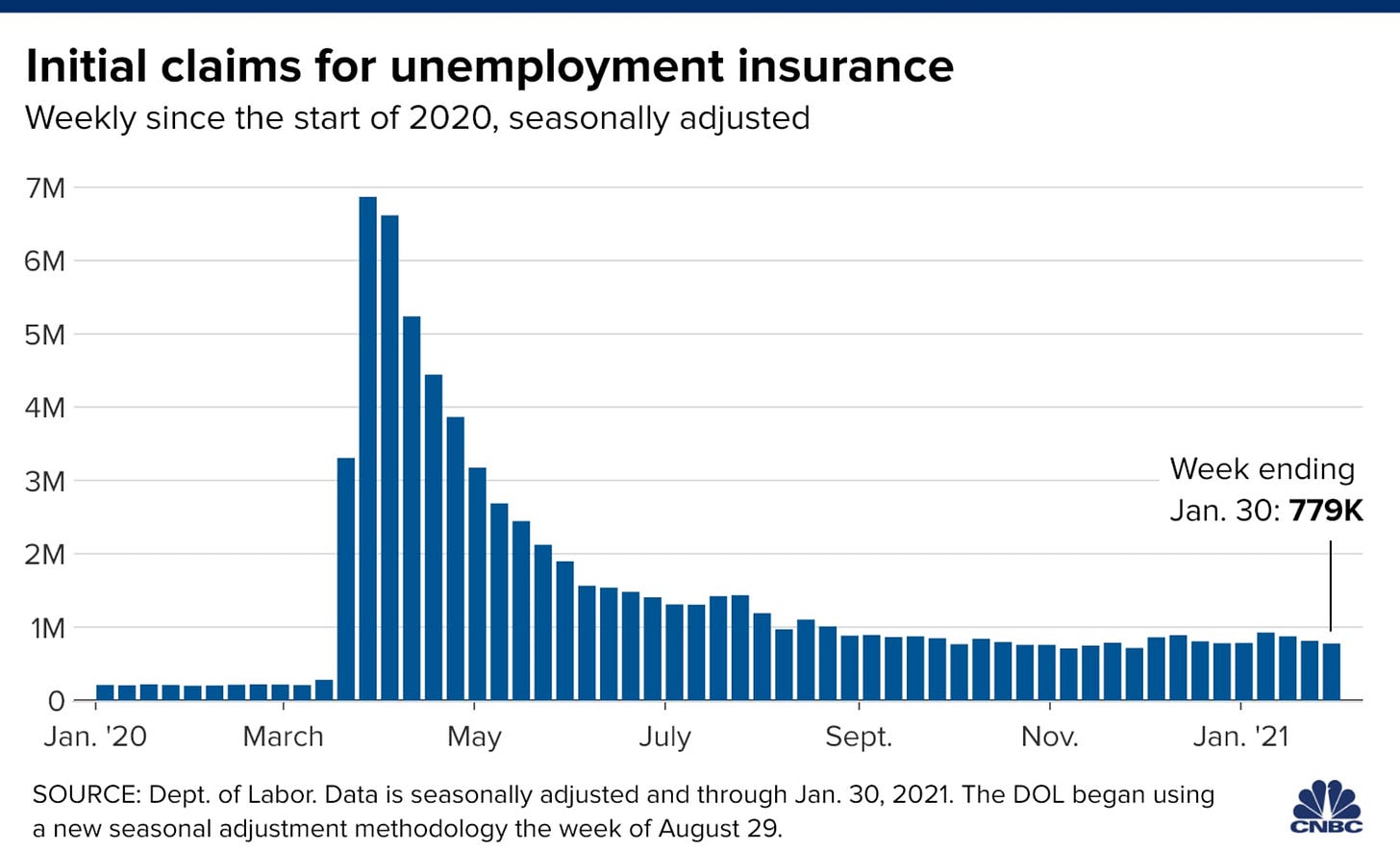

U.S. weekly jobless claims fall more than expected: The number of Americans filing new applications for unemployment benefits decreased last week, suggesting that the labor market was stabilizing as authorities started to loosen pandemic-related restrictions on businesses. Initial claims for state unemployment benefits totaled a seasonally adjusted 779,000 for the week ended Jan. 30, compared to 812,000 in the prior week, the Labor Department said on Thursday. Economists polled by Reuters had forecast 830,000 applications in the latest week. Jobless claims remain above their 665,000 peak from during the 2007-09 Great Recession, but well below a record 6.867 million in last March when the pandemic hit the United States’ shores. Read More.

VP Take: One week of better than expected jobless claims, but still 779,000 (which have been adjusted - marked down). This is only 33k less jobless claims…nothing suggests job market is stabilizing.

Bank of England keeps rates and bond-buying program unchanged: The Bank of England kept its stimulus program unchanged on Thursday. The BoE maintained its Bank Rate at 0.1% and left the size of its total asset purchase program at 895 billion pounds ($1.22 trillion). Read More.

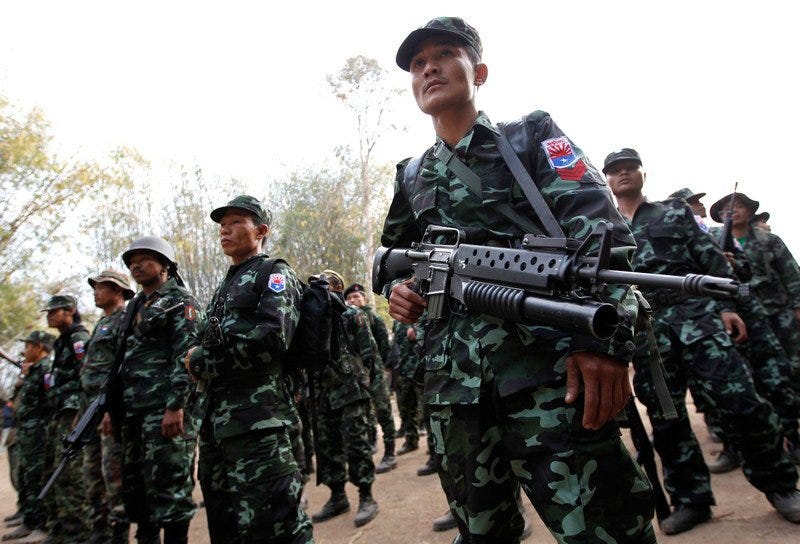

Myanmar Blocks Facebook Access After Online Protests of Military Coup: Myanmar blocked access to Facebook after some users in the country in recent days shared material challenging a Monday military coup that ousted the elected civilian government. People in the country had been posting to Facebook images of people banging pots and pans in a show of opposition to the coup. Some people were also shown making a three-fingered salute that was a symbol of resistance in “The Hunger Games” books and movies, and adopted by protesters after a 2014 military coup in neighboring Thailand. Some users in Myanmar also changed their Facebook profile photos in recent days to an image showing a white hand making the gesture, set against a black background. Read More.

“Telecom providers in Myanmar have been ordered to temporarily block Facebook,” a spokeswoman for Facebook Inc. said Thursday. “We urge authorities to restore connectivity so that people in Myanmar can communicate with family and friends and access important information.”

VP Take: Censorship across communication channels like social media platforms is becoming widely adopted as a means of control. This is only going to fuel decentralization across all industries.

German GDP downgrade and coronavirus worries hammer European stocks: European stocks tumbled on Wednesday as extended coronavirus lockdowns drove the German government to slash its growth forecast for 2021, while talk of further interest rate cuts by the European Central Bank hit banking stocks. After holding largely unchanged in morning trade, the pan-European STOXX 600 fell into the red and closed down 1.2% - its biggest single-day percentage fall in over five weeks. The global mood also soured as investors turned more cautious about mounting coronavirus cases around the world and about stretched stock valuations after retail investors piled into some niche U.S. stocks, causing an eye-popping surge in their market value within just days. Read More.

Bitcoin

Visa Signals Further Crypto Ambitions With API Pilot for Bank Customers to Buy Bitcoin: Visa (V) is piloting a suite of application programming interfaces (APIs) that will allow banks to offer bitcoin services. The Visa Crypto APIs pilot program will let clients “easily connect into the infrastructure provided by Visa’s partner, Anchorage, a federally chartered digital asset bank, to allow their customers to buy and sell digital assets such as bitcoin as an investment within their existing consumer experiences,” Visa said in a press statement. Visa envisions a product set that extends to other cryptocurrencies and stablecoins as well as other crypto services such as trading. Digital bank First Boulevard is the first bank involved in the pilot; Visa has issued a wait list for other banks. Read More.

“This is shifting to the next phase of Visa’s strategy where we’re looking at how Visa can also be a bridge between the thousands of financial institutions … and help them tap into the growing world of crypto assets and blockchain networks,” Sheffield told CoinDesk in an interview. “We’re excited to see what early tests and consumer engagement look like for things like dollar-cost averaging to buy bitcoin or for things like earning bitcoin back as rewards.”

Saylor, MicroStrategy Offer Playbook for Corporate Bitcoin Adoption at Annual Summit: Michael Saylor, the MicroStrategy CEO-turned-king of bitcoin treasuries, called upon fellow business executives Wednesday to avoid the path of financial “serfdom” at his virtual WORLD.NOW bitcoin-themed conference. In his solo address, Saylor detailed the cryptocurrency playbook that propelled his three-decade-old data firm to newfound relevance in less than a year. Largely eschewing the near-mystical rhetoric that has punctuated his public crypto musings since August, Saylor focused on hardline business strategies, procedures and dollar-sense language in a calibrated appeal to corporations. Read More.

“There’s a macroeconomic wind blowing – big – it’s gonna impact $400 trillion of capital. That capital is sitting in fiat instruments that are being debased. That capital is going to want to convert into strong money…Every company has to make one of two choices” when faced with a world of belligerent money printing, Saylor said. “You either have to decapitalize, which is kind of like self destruct… or you have to recapitalize with an asset which is going to appreciate faster than the rate of monetary supply expansion. This is where bitcoin comes in,” said Saylor.

Dan Tapiero Launches $200M Fund to Invest in Crypto Companies: Investor and entrepreneur Dan Tapiero is launching a $200 million fund called 10T Holdings to invest in cryptocurrency startups. The long-time bitcoin advocate filed to launch the new fund Tuesday, per documents from the U.S. Securities and Exchange Commission. Tapiero's filing comes amid a stampede of other institutional interest in investing and building in the cryptocurrency industry as bitcoin has returned gains near 300% in the past year. In addition to Tapiero, the filing lists as investors longtime investor Michael Dubilier and Stan Miroshnik, former CEO of crypto-focused advisory firm Argon Group. Read More.

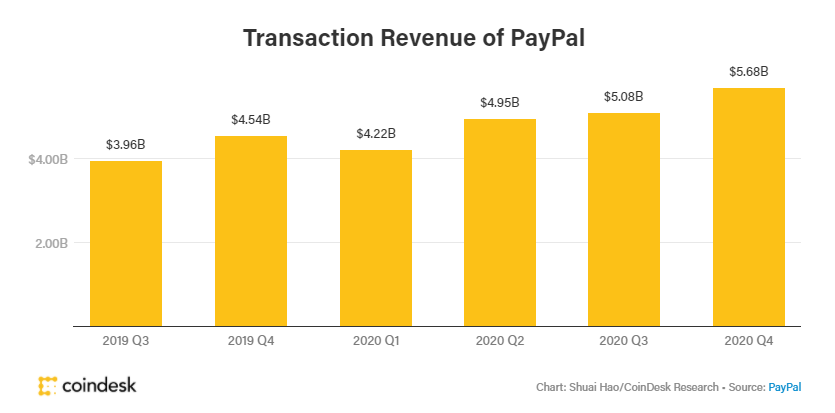

PayPal Q4 Transaction Revenue Rose 11.8% in 1st Quarterly Report Since Adding Crypto: In the final quarter of 2020, PayPal gained 16 million in net new active accounts and handled $277 billion in total payment volume. The earnings are the payment giant’s first since rolling out crypto buying and selling late last year. It removed the waitlist for BTC, ETH, LTC and BCH to all of its 350 million users on Nov. 12, 2020. Customers who purchased crypto through the platform have been logging into PayPal twice as much as they were before buying crypto. Read More.

Bitcoin an ‘Emerging Competitor’ to Gold, Says CME’s Chief Economist: Bluford Putnam, chief economist and managing director of CME Group, believes bitcoin is an “emerging competitor” to gold. Putnam said the yellow metal’s ongoing production, likely to increase in 2021, contrasts with bitcoin‘s fixed supply. The World Gold Council estimates roughly 217,790 tons of the shiny metal have been mined throughout history with an additional 2,756-3,306 tons added to stock levels each year. By contrast, bitcoin is designed to have a fixed supply of 21 million units – the maximum that can ever be created as “block rewards” obtained via proof-of-work mining. To date, 18.62 million BTC have already been mined. Read More.

NYDIG Expects to Hold $25B in Bitcoin for Institutional Clients by Year End: Stone Ridge Asset Management’s bitcoin spinoff firm – NYDIG – already has enough institutional buy orders lined up to push its bitcoin holdings over $25 billion by the end of 2021, according to CEO Ross Stevens. Read More.

"I am confident we'll have over $25 billion of bitcoin by the end of 2021. I just got this order book. I'm not guessing, I see what's happening," Stevens told MicroStrategy CEO Michael Saylor Tuesday.

Crypto

Elon Musk Is Back Tweeting About Dogecoin as Price Rises 50%: Dogecoin (DOGE) surged more than 50% on Thursday morning to trade around $0.059 per coin. The news was apparently welcomed by Elon Musk who made several tweets about the cryptocurrency, despite a pledge two days ago to stay off Twitter for “a while.” In one, Musk shared a Lion King-inspired Meme featuring a photoshopped image of himself raising the iconic DOGE (+62.8%) shiba inu dog to the sky. Read More.

VP Take: DO NOT PARTICIPATE IN THIS MADNESS. DOGECOIN IS A MEME COIN WITH NO VALUE. WE HIGHLY RECOMMEND NOT INVESTING IN DOGECOIN.

Grayscale Now Has 3 Million Ethereum under Management: The asset manager accumulated 70,791 ETH in the last 7 days. Grayscale, the world’s largest crypto asset management firm, has accelerated its accumulation of the world’s second-largest cryptocurrency. The firm now has more than 3 million Ethereum with a total value of $4.9 billion. Grayscale added 47,000 ETH in the last 24 hours. Read More.

“Between the enormous amount of activity on Ethereum, the economic improvements to Ether, and the promise of increased scalability with ETH 2.0, there is a lot for the Ethereum community to be excited about. We can observe from the data that the price of Ether tends to move with underlying activity on the network. As noted throughout this report, multiple metrics are reaching new highs, including active addresses, hash rate and network fees, a positive sign for investors,” Grayscale mentioned in the report.

Rare Hashmasks Digital Artwork Sells for $650K in Ether: A demonic digital artwork on the Ethereum blockchain has been sold for a small fortune via peer-to-peer marketplace OpenSea. Selling for 420 ETH (roughly $650,000), the collectible non-fungible token (NFT)-based artwork is known as a Hashmask. Read More.

SUSHI price surges 73% in four days - Why investors say it's still undervalued: SUSHI, the native token of SushiSwap, rallied by 73% in the past four days. However, some investors believe the DeFi token may still have a lot more room to run. SushiSwap is an automated market maker (AMM) that allows users to trade cryptocurrencies in a decentralized manner on the Ethereum blockchain. The market cap of SUSHI achieved $2 billion as its price surpassed $16. But, there are three key reasons why it could still be undervalued. First, Uniswap, its direct competitor, is hovering at around $6 billion market cap, despite decreasing gap in metrics. Second, compared to traditional companies, SushiSwap has an appealing revenue to price ratio. Third, the DeFi market, in general, is performing strongly with the total value locked (TVL) now surpassing $30 billion. SushiSwap's TVL, specifically, is approaching $3 billion, currently sitting between Curve Finance and Synthetix as the sixth most popular DeFi platform. Read More.

Media

2-3-2021 MicroStrategy Bitcoin for Corporations conference, Ross Stevens with Michael Saylor

BTC011: Bitcoin & our Financial Advisor w/ Andy Edstrom

Bitcoin and Government | Senator Lummis | Pomp Podcast #482

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.